D&H Co-Presidents On Standing Out Amid The Tech Data-Synnex Merger: ‘We Are Like Evolution Versus Revolution’

‘When you have big mergers, a lot of times there are big revolutions. There’s a lot of major changes that have to occur. We like to have lots and lots of little tweaks, survey our customers monthly about what’s important to them, about how we can serve them better and lean in on service,’ says Dan Schwab who, along with his brother Michael, speak to CRN about the merger and a host of other topics.

D&H Co-Presidents See Nothing But Opportunity

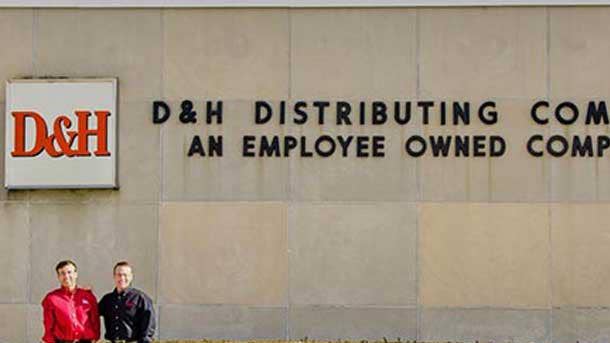

D&H Co-Presidents Dan (pictured left) and Michael Schwab (pictured right), who are the third generation of Schwabs to run the family-owned 104-year-old distributor, told CRN they see nothing but opportunity in the wake of the upcoming merger between Tech Data and Synnex. This opportunity comes in large part because, unlike the upcoming distribution juggernaut’s $57 billion in revenue from SMB to enterprise partners around the globe, D&H’s $5 billion in revenue comes almost exclusively from SMB and midmarket partners in North America.

With Tech Data and Synnex’s plan to merge the two companies into a distribution powerhouse, it will be able to leapfrog rival Ingram Micro, which is undergoing an acquisition by a private equity company, to some time this year become the world’s largest distributor.

And while Tech Data/Synnex and Ingram Micro will dominate distribution from a revenue standpoint and their global reach, the current fourth-largest and soon-to-be third-largest broadline distributor D&H has an ace up its sleeve, according to its co-presidents: The $5 billion company’s focus on the North American market, and in particular the North American midmarket and SMB channel business, give it the ability to continue its growth even in the face of its huge competitors.

Here is what Dan and Michael Schwab had to say about how distribution is changing as private equity money comes in and how distributors are changing their business to better meet the needs of solution providers.

This is an interesting time for distribution, with mergers and acquisitions by private equity. How is that impacting the distribution business?

Michael Schwab: Inevitably, through attrition and mergers, the remaining distributors have gotten stronger. And, I would argue, with barriers to entry today so high, getting the vendor agreements and customer relationships in place, getting the IT systems in place, setting up a whole distribution network and having all that run at very low-single-digit operating costs, it’s a monumental undertaking that takes decades to build out.

So I think we‘re at a point in time here where the distributors that are left are resilient. They’ve proven their merits in the marketplace, that they have value-added structures that resellers aspire to have strong relationships with. And distributors perhaps have become even more relevant to the marketplace than ever before.

But one of the things that could change is how vendors now look at their distribution partners. Do they perhaps now through consolidation have too much of their business going through one or two sources into the marketplace? And the theme of, ‘too many eggs in one basket’ might prove out here as business consolidation continues.

What does that mean for D&H?

Michael Schwab: From D&H’s perspective, we play a pretty good role in helping to diversify the go-to-market strategy for a number of the vendors that we work with. From that perspective, we’re happy to be here, one of the survivors. I’ve been at this 30 years, Dan’s been at it 25 years. We’ve seen a lot of mergers. And inevitably, when you get to the other side, D&H has found itself to be both resilient and even perhaps more relevant to the customer base than we were before the mergers. ...

[Resellers may be] trapped in some ways where they don’t have the ability to scale and grow their business because of credit lines and credit facilities being consolidated. We look at that and take it quite seriously. In fact, in just this past year, even before any mergers were announced, we deployed over $160 million in new credit downstream to our reseller community, which has created growth opportunities not only for ourselves but for our vendors and for our reseller partners as well. That, from my perspective, is the No. 1 thing that’s top of mind. Change creates uncertainty. I think if the pandemic has taught us anything, it’s if you have built strong relationships, partner in this environment, you can really have a synergy with those accounts and customers that perhaps can’t be matched by somebody offering at a dollar or two lower. It really does become meaningful, particularly as our business has evolved where it’s not just products anymore. It’s services, it’s solutions, it’s cloud solutions. So there’s a much more integrated sales motion that transpires, particularly as we think about as-a-service and all the intricacies of the business today.

Dan Schwab: Our ability to bring technology products that help our SMB resellers move upstream is one of those critical components in our investment in presales tech support and all the iterations of what makes a distributor sticky and relevant in the marketplace today. Our runway continues to be strong, and these consolidations or mergers will continue to happen around us. But being 104 years in the making, being privately owned, being employee-owned, allows us to think very long term.

You talked about moving upstream product-wise. Tech Data and Synnex on the analyst conference call announcing the merger talked about a big focus on cloud, business analytics, security and IoT going forward. They have a lot more resources to invest in these areas than D&H does. How does that impact your investments in these areas?

Dan Schwab: All those areas are part and parcel of our business today, and those are the high-growth areas. When you think about [Tech Data and Synnex together] now being a $57 billion global company, they continue to move upmarket and upstream into the enterprise and help global companies from a services standpoint. From our standpoint, if anything, we’ve actually had a lot of midmarket resellers come to D&H because they’re looking to improve service. We used to just help SMB partners move upstream into the midmarket. Now those midmarket partners look at us as a destination for them. And it’s because, although they’re interested in those cloud and security and other solutions, there’s still a lot of day-in-day-out selling servers and notebooks and updating networks, getting them ready for 5G and Wi-Fi 6, and everything that distributors do.

And one of the other outcomes to be thinking about: There were four major distributors in North America. When you go to three, that also likely means there’s less inventory throughout the distribution centers. I think one benefit D&H has there is that we try and have a 45-plus-day supply. We try to have the deepest inventory of any distributor.

There’s no doubt that they’re going to put their efforts in some strategic areas. And those are the areas where they probably see growth within the Fortune 100 companies and the global 100 companies. So that’s not surprising at all. But from our standpoint, that’s not where we‘re concerned. Those are important solutions. But we care about solutions that are right for the SMB resellers, the midmarket resellers and the end users they support.

D&H is a $5 billion distributor. What part of that revenue is from North America?

Dan Schwab: One hundred percent. In the North American market, for many vendor partners, we’re the same size as or larger than other distributors. And we really had great growth in the last decade. We‘ve been growing at two to three times the rate of overall distribution for a decade. This year our fiscal year finishes up in April. And we’ll be up over 15 percent [over last year.]

It’s a little bit like the tortoise and the hare. We are like evolution versus revolution. When you have big mergers, a lot of times there are big revolutions. There’s a lot of major changes that have to occur. We like to have lots and lots of little tweaks, survey our customers monthly about what’s important to them, about how can we serve them better and lean in on service. So our service model really stands out. We’re nimble and we’re flexible. And because we have been growing, we’ve actually made some huge investments in the channel around our supply chain services where we can do third-party logistics, where we help our vendors with their logistics.

Going forward, Ingram Micro, Tech Data-Synnex and D&H will all be privately owned. How significant is that?

Michael Schwab: The one thing that’s interesting in distribution: The return on invested capital normally doesn’t meet the expectations of the public market. But I think as of late, security is a top-of-mind conversation as is cloud and other solutions, so the landscape has changed a bit. So whether it is private equity or being public or, in our case, remaining private, it shows that there is an inherent value in distribution of IT technology. If you think about the work-from-home initiative that’s transpired, the remote learning initiatives, the remote health care and telehealth, and now as we go back to even more of hybrid work approach, IT infrastructure continues to be top of mind. So historically you could argue that distribution should be a private undertaking. I think in today’s environment, the market has dictated that [customers are] going to pay a premium, and that this is a good place to invest resources and see that return on invested capital.

Dan Schwab: We’re private. We’re owned by the employees. We’re a family business. We’ve had the same ownership for 100 years. In different cases, when private equity acquires a company, that’s often a means to an end because in five to seven years later they plan to sell it, take it public, do something different with it. I can’t speak specifically to this deal, but that’s the general practice of private equity and what they typically do. They want an exit strategy. We’re not looking for an exit strategy. We’re looking to help our partners win. It’s a different objective.

With Tech Data and Synnex soon to become the world's largest distributor with more resources for developing and broadening markets, how does that impact a smaller distributor like D&H?

Dan Schwab: I think vendors realize that customers want choices, and that different distributors have different strengths. I also think they believe sometimes the fact that smaller companies are typically more nimble and flexible and have a faster go-to-market, and I think D&H has proven that over time. And on a relative basis, we may be somewhat smaller, but from a North American standpoint, we‘re still $5 billion. So our economies of scale and capabilities are equal to any North American distributor from that standpoint.

As D&H’s channel partners digest the news about the merger, what is your message to them?

Dan Schwab: That D&H isn’t going anywhere. There’s no changes. For any of them that are unfamiliar with us, this is a great opportunity to learn our value. Our goal is to earn their business and help them grow and win and add value. So from that standpoint, you’ll see a lot of investment. You’ll see more credit coming from D&H. You’ll see more training and education. More support. And we’re increasing the number of salespeople. Often in mergers there’s fewer people. We’re increasing the support we have for our vendors and customers to help grow. So from that standpoint, they’ll be able to see great consistency and really great people who want to work with them.

Michael Schwab: Change creates uncertainty and perhaps some risk. And in our organization, we’re in this in perpetuity. When you transact with D&H, we’re going to be here next week and next month and next year to support you.

D&H hasn’t done any mergers or acquisitions, right?

Michael Schwab: It has all been organic growth. Even when we opened up in Canada 14 years ago, we started from scratch. It’s been our own internal resources and execution to get us to our growth goals.

Dan Schwab: We’re not using the public’s money to grow. We’re using our own money. And we’re really careful about where we invest. Historically, we’ve found that investing in our customers and vendors internally is better than acquiring something to get big fast.

So acquisition is not on the horizon for a way for D&H to grow?

Dan Schwab: It’s not something that we’re looking at today. We’re always open to it. But our bar is set pretty high on what the return on investment would need to be. It has to have tremendous value for our partners. It’s not about what’s in it for is. It’s about what’s in it for our customers and our vendors.

Anyone ever call D&H about acquiring you?

Dan Schwab: Michael has used this phrase: We’re kind of the Rock of Gibraltar for the channel. We’re not going anywhere. It’s been the same ownership for 104 years. The employees have owned over a third of the company for over 20 years. We don’t see that changing in our lifetime. It’s been very consistent. And I think that’s a big part of why we’ve been successful. We have a proven model, and we’re sticking to it.

Have you started grooming any others in the Schwab family to take over the business in the future?

Michael Schwab: We are in our fourth generation of Schwabs now. So that’s actually good to see. I think it adds consistency and credibility here as the clocks continue to move forward with these types of changes in the distribution landscape.

Dan Schwab: We’re lucky that we have great leaders in our company. We’re more of a bottoms-up-driven company, being employee-owned. And I think that really has been a strength for us. So we’re lucky that we’ve got so many great leaders in the company. Michael and I just get the credit.

Michael, when you said ‘fourth generation’ are you referring to you and Dan, or are you guys the third generation?

Michael Schwab: We have a couple folks that are earning their stripes that have been with the company now for a couple of years from the next generation.