The Best Tech Stocks of 2018 (And The Worst)

Only 21 of the 44 technology companies on our watch list managed to record gains in the price of their publicly traded shares during the stock market turbulence of 2018. Twenty-three recorded price declines—many by significant double-digit percentages. Take a look at who were the winners and who were the losers.

Hit By The Stock Market's Dive Late In The Year, Many Tech Companies Suffer Share Price Declines In 2018

Overall, the markets had their worst year since the financial crisis of 2008 with most of the losses coming in the fourth quarter. The Dow Jones closed the year at 23,327.46, down 5.63 percent from its 2017 close. The tech-heavy Nasdaq fared a bit better, closing at 6,635.28, down 3.88 percent from its 2017 close.

Twenty-three of the 44 technology companies on our watch list recorded declines in their stock prices in 2018, many by hefty double-digit percentages. Only 21 managed to increase the value of their stocks in 2018. (And a couple of those were due to acquisitions in which the acquiring company paid an above-market premium.)

And going forward our watch list will include Dell Technologies, which went public on the New York Stock Exchange on Dec. 28 at $46.00 per share and closed out the year at $48.87, up 6 percent.

Here's a look at who was up and who was down in 2018, starting with companies with the biggest gains in share price, based on stock closing prices on Dec. 29, 2017, and Dec. 31, 2018.

Advanced Micro Devices

CEO: Lisa Su

Dec. 29, 2017 Close: $10.28

Dec. 31, 2018 Close: $18.46

Change: +79.57%

A resurgent AMD topped this year's list of companies with the biggest increases in stock price.

With its Ryzen CPU processors and Radeon graphics cards, AMD has been giving rival Intel a competitive run for its money. And AMD is readying its next-generation 7-nanometer chips for 2019 even while Intel struggles with delays with its 10nm processors.

For the first nine months (ended Sept. 29) of 2018, AMD reported revenue of $5.06 billion, up 29 percent from $3.91 billion in the same period in 2017. The company reported net income of $299 million for the first nine months of 2018 compared with a $14 million loss in the same period one year before.

In December AMD was added to the Nasdaq 100 index—the 100 largest non-financial companies listed on the Nasdaq stock market.

Tableau Software

CEO: Adam Selipsky

Dec. 29, 2017 Close: $69.20

Dec. 31, 2018 Close: $120.00

Change: +73.41%

Tableau Software has become one of the clear leaders in the crowded market for business analytics and data visualization software.

For the first nine months (ended Sept. 30) of 2018, Tableau reported revenue of $819.1 million, up 30 percent from $627.7 million in the first nine months of 2017. The company also nearly halved its loss for the nine-month period, reporting a $79.9 million loss during the 2018 period compared with a $143.7 million loss one year earlier.

Fortinet

CEO: Ken Xie

Dec. 29, 2017 Close: $43.69

Dec. 31, 2018 Close: $70.43

Change: +61.20%

Security technology developer Fortinet is another company that rebounded in 2018 after hitting rough patches in recent years. The company staked out a leadership position in the rough-and-tumble cybersecurity arena with its Fortinet Security Fabric architecture.

In October Fortinet acquired ZoneFox, a developer of cloud-based threat analytics technology, in a move that expanded the company's offerings for protecting against insider threats.

For the first nine months (ended Sept. 30) of 2018, Fortinet reported revenue of $1.29 billion, up 20 percent from $1.08 billion in the same period in 2017. The company reported net income of $149.6 million for the 2018 period, more than double the $60.4 million in net income reported for the same period a year earlier.

Red Hat

CEO: James Whitehurst

Dec. 29, 2017 Close: $120.10

Dec. 31, 2018 Close: $175.64

Change: +46.24%

On Oct. 28 open-source software developer Red Hat struck a deal to be acquired by IBM for $34 billion, an acquisition the two companies expect to complete in the second half of 2019.

IBM is buying Red Hat at $190 per share, a significant premium above the $116.68 closing price of Red Hat's shares the Friday before the deal was announced. Red Hat shares soared to $170 following the announcement and have fluctuated between $170 and $180 per share since.

For the first three quarters (ended Nov. 30) of its fiscal 2019, Red Hat reported revenue of $2.48 billion, up nearly 16 percent from $2.15 billion in the first three quarters of fiscal 2018. The company reported net income of $294.5 million for the three quarters, up 7.5 percent from $274.0 million in the same period in fiscal 2018.

Salesforce.com

CEOs: Marc Benioff (pictured) and Keith Block

Dec. 29, 2017 Close: $102.23

Dec. 31, 2018 Close: $136.97

Change: +33.98%

After cracking the $10 billion revenue threshold in its fiscal 2018, Salesforce has forecast that revenue in fiscal 2019 (ending Jan. 31, 2019) will be between $13.23 billion and $13.24 billion, representing 26 percent year-over-year growth.

For fiscal 2020 Salesforce is forecasting that revenue will be in the range of $15.90 billion to $16.00 billion, representing growth of 20 percent to 21 percent.

On Aug. 7 Salesforce announced that president and COO Keith Block had been promoted to co-CEO.

CA Technologies

CEO: Michael Gregoire

Dec. 29, 2017 Close: $33.28

Nov. 5, 2018 Close: $44.44

Change: +33.53%

In one of the most surprising news events of the year, CA Technologies struck a deal in July to be acquired by chipmaker Broadcom for $18.9 billion, or $44.50 per share. Broadcom touted the acquisition as a marriage of its hardware products with CA's infrastructure software portfolio.

The acquisition price represented approximately a 20 percent premium to the July 11 closing price of CA's shares. The price of CA's shares hovered around $44 until Broadcom completed the acquisition on Nov. 5.

Palo Alto Networks

CEO: Nikesh Arora

Dec. 29, 2017 Close: $144.94

Dec. 31, 2018 Close: $188.35

Change: +29.95%

On June 1 security technology vendor Palo Alto Networks announced that Nikesh Arora would take over as the company's CEO, succeeding CEO Mark McLaughlin, who became vice chairman.

Arora worked for nearly a decade at Google, helping grow the company's search business from $2 billion to more than $60 billion. More recently he served as president and COO of Tokyo-based SoftBank Group.

For its fiscal 2019 first quarter (ended Oct. 31), Palo Alto Networks reported revenue of $656.0 million, up 31 percent from $501.8 million in the first quarter of fiscal 2018. The company reported a loss of $38.3 million for the quarter compared with a $63.2 million loss one year earlier.

Amazon

CEO: Jeff Bezos

Dec. 29, 2017 Close: $1,169.47

Dec. 31, 2018 Close: $1,501.97

Change: +28.43%

On Sept. 4 Amazon's total market cap hit $1 trillion, joining Apple as the only publicly traded companies to reach that benchmark. But Amazon was unable to hold onto the $2050 per-share price it needed to maintain that total market value. Amazon, not immune to the slumping stock markets, ended the year with a $735 billion market cap.

Amazon, nevertheless, continued its astounding growth in 2018. For the first three quarters (ended Sept. 30) of the year, the company reported revenue of $160.50 billion, up nearly 37 percent from $117.41 billion in the first three quarters of 2017. Net income for the first three quarters of 2018 grew six-fold to $7.05 billion from $1.18 billion in the first three quarters of 2017.

While the online retail giant reported growth across all its businesses, Amazon Web Services CEO Andy Jassy said in May that AWS could one day be bigger than Amazon's core e-commerce business. AWS had a projected $22 billion revenue run rate for 2018.

Splunk

CEO: Doug Merritt

Dec. 29, 2017 Close: $82.84

Dec. 31, 2018 Close: $104.85

Change: +26.57%

Splunk has enjoyed rapid sales growth for its software used to collect, process and analyze machine data. The company's growth has been most pronounced in software sales for IT operational analytics, IT operations management, and security and vulnerability management applications.

For the first three quarters (ended Oct. 31) of its fiscal 2019, Splunk reported revenue of $1.18 billion, up 39 percent from $849.5 million in the first three quarters of fiscal 2018. The company reported a $277.7 million loss for the most recent nine months compared with a $223.4 million loss in the same period one year earlier.

F5 Networks

CEO: Francois Locoh-Donou

Dec. 29, 2017 Close: $131.22

Dec. 31, 2018 Close: $162.03

Change: +23.48%

For its fiscal 2018 (ended Sept. 30), F5 Networks reported revenue of $2.16 billion, up 3.4 percent from $2.09 billion in fiscal 2017. The company said that growth was fueled by its software solutions and services business.

Net income for the year was $453.7 million, up nearly 8 percent from $420.8 million one year earlier.

Lenovo Group

CEO: Yang Yuanqing

Dec. 29, 2017 Close: $11.24

Dec. 31, 2018 Close: $13.40

Change: +19.22%

Lenovo's stock rebounded from a decline in the first half of 2018 to a gain in the third quarter and then managed to hang onto some of that gain.

On Sept. 13 Lenovo unveiled a strategic alliance with storage system and service provider NetApp, co-developing all-flash arrays and hybrid flash systems to compete against Hewlett Packard Enterprise and Dell EMC in the data storage arena.

For the first six months (ended Sept. 30) of its fiscal 2019, Lenovo reported revenue of $25.29 billion, up 16 percent from $21.77 billion in the first half of fiscal 2018. Net income for the first six months of fiscal 2019 was $258.8 million, up 160 percent from $99.3 million in the same period one year earlier.

Microsoft

CEO: Satya Nadella

Dec. 29, 2017 Close: $85.54

Dec. 31, 2018 Close: $101.57

Change: +18.74%

On June 4 Microsoft unveiled a deal to buy source code repository GitHub in a deal valued at $7.5 billion. The companies completed the acquisition Oct. 26.

For its fiscal 2019 first quarter (ended Sept. 30), Microsoft reported revenue of $29.08 billion, up 19 percent from $24.54 billion in the first quarter of fiscal 2018. Net income for the quarter was $8.82 billion, up 34 percent from $6.58 billion one year earlier.

For all of fiscal 2018 (ended June 30), Microsoft reported revenue of $110.36 billion, up 14 percent from $96.57 billion in fiscal 2017. Net income for the year was $16.57 billion, down 35 percent from $25.49 billion in fiscal 2017.

Nutanix

CEO: Dheeraj Pandey

Dec. 29, 2017 Close: $35.28

Dec. 31, 2018 Close: $41.59

Change: +17.89%

Nutanix has become a pivotal player in the market for hyper-converged infrastructure systems, competing with Dell EMC, Cisco, Pivot3 and Hewlett Packard Enterprise.

On Aug. 1, president Sudheesh Nair announced that he was leaving to become CEO of big data startup ThoughtSpot.

For its fiscal 2019 first quarter (ended Oct. 31), Nutanix reported revenue of $313.3 million, up nearly 14 percent from $275.6 million in the same quarter one year before. But the company's loss increased to $94.3 million from $61.5 million one year earlier. The company continued its transition to a recurring revenue model with 51 percent of billings in the quarter coming from subscriptions.

For all of fiscal 2018 (ended July 31), Nutanix reported revenue of $1.16 billion, up 36.6 percent from $845.9 million in fiscal 2017. The company reported a $297.2 million loss for the year compared with the $379.6 million loss reported for fiscal 2017.

Citrix Systems

CEO: David Henshall

Dec. 29, 2017 Close: $88.00

Dec. 31, 2018 Close: $102.46

Change: +16.43%

Citrix, a developer of software that optimizes application performance and content delivery across hybrid and multi-cloud environments, in the last year has undertaken a major overhaul of its product portfolio, reorganized its business units, and continued its transition to a subscription model.

For the first nine months (ended Sept. 30) of 2018, Citrix reported revenue of $2.17 billion, up 6 percent from $2.05 billion in the first nine months of 2017. Net income for the nine months in 2018 was $409.9 million, up 56 percent from $263.2 million one year before.

FireEye

CEO: Kevin Mandia

Dec. 29, 2017 Close: $14.20

Dec. 31, 2018 Close: $16.21

Change: +14.15%

For the first nine months (ended Sept. 30) of 2018, FireEye reported revenue of $613.4 million, up nearly 7 percent from $573.8 million in the first nine months of 2017. The company reported a $194.7 million loss for the nine-month period compared with a $214.8 million loss in the same period of 2017.

Cisco Systems

CEO: Chuck Robbins

Dec. 29, 2017 Close: $38.30

Dec. 31, 2018 Close: $43.33

Change: +13.13%

Cisco Systems has been transforming itself from a networking hardware manufacturer to a supplier of software for communications, security and other IT, and transitioning to a subscription-based revenue model.

On Oct. 1 Cisco acquired Duo Security, a provider of unified access security and multi-factor authentication technology, in a move Cisco said would strengthen its intent-based networking strategy. In December Cisco unveiled a deal to buy optical chip maker Luxtera for $660 million in cash.

For its fiscal 2019 first quarter (ended Oct. 27), Cisco reported revenue of $13.07 billion, up nearly 8 percent from $12.14 billion in the first quarter of fiscal 2018. Net income for the quarter was $3.55 billion, up 48 percent from $2.39 billion one year earlier.

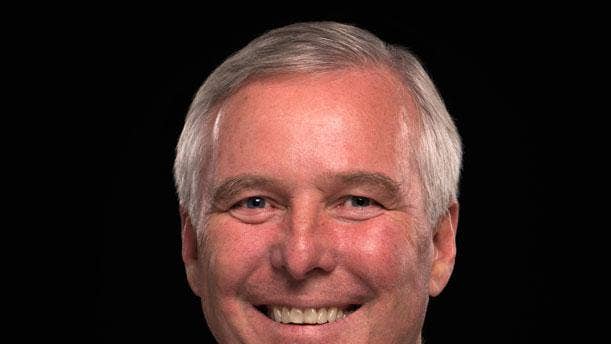

Commvault Systems

CEO: N. Robert Hammer

Dec. 29, 2017 Close: $52.50

Dec. 31, 2018 Close: $59.09

Change: +12.55%

On May 1 Commvault reported disappointing fiscal 2018 fourth-quarter results and the company announced that it was searching for a successor to president and CEO N. Robert Hammer as part of a broader "strategic transformation plan." Hammer, who was still CEO at year's end, will remain as chairman once a successor is hired.

The "Commvault Advance" plan and its governance initiatives were part of an agreement between the company and hedge fund investment firm Elliott Management, which owns 10.3 percent of the company's stock. In October the company said it was making progress on executing the plan, which is designed to simplify the business, drive improved and sustainable revenue growth, and improve profitability through increasing operating leverage.

For the first six months (ended Sept. 30) of fiscal 2019, Commvault reported revenue of $345.3 million, up 3 percent from $334.1 million in the first half of fiscal 2018. But the company's loss for the six-month period was $7.7 million, far bigger than the $1.3 million loss in the same period one year earlier.

VMware

CEO: Pat Gelsinger

Dec. 29, 2017 Close: $125.32

Dec. 31, 2018 Close: $137.13

Change: +9.42%

On July 2 Dell Technologies, which owns a majority of VMware's shares following its 2016 acquisition of EMC, announced a plan to go public as part of a share swap with its VMware tracking stock. The announcement ended months of speculation about VMware's future under Dell. Dell executed the deal on Dec. 28 and became a public company once again, but it remains the majority shareholder in VMware.

For the first nine months (ended Nov. 2) of its fiscal 2019, VMware reported revenue of $6.38 billion, up more than 13 percent from $5.64 billion in the first nine months of fiscal 2018. Net income for the nine-month period surged to $1.92 billion, up 84 percent from $1.05 billion one year earlier.

NetApp

CEO: George Kurian

Dec. 29, 2017 Close: $55.32

Dec. 31, 2018 Close: $59.67

Change: +7.86%

For the first six months (ended Oct. 26) of its fiscal 2019, NetApp reported revenue of $2.99 billion, up more than 9 percent from $2.74 billion in the first half of fiscal 2018. Net income for the six-month period was $524 million, up nearly 72 percent from $305 million in the same period one year earlier.

NetApp, a supplier of hybrid cloud data storage and management services, said that sales of its all-flash array products are running at a $2.2 billion annual run rate.

On Sept. 18 NetApp acquired StackPointCloud, a developer of multi-cloud Kubernetes-as-a-Service and a contributor to the Kubernetes project.

Verizon Communications

CEO: Hans Vestberg

Dec. 29, 2017 Close: $52.93

Dec. 31, 2018 Close: $56.22

Change: +6.22%

In June Verizon announced the retirement of CEO Lowell McAdam and the appointment of chief technology officer Hans Vestberg as his successor, effective Aug. 1.

In September published reports said Verizon planned to cut its costs by about $10 billion over the next four years and is offering early retirement buyouts to thousands of employees, including managers.

In December Verizon said it will take a $4.6 billion goodwill impairment charge for the diminished value of its Oath media subsidiary.

For the first three quarters (ended Sept. 30) of 2018, Verizon reported operating revenue of $96.58 billion, up 5 percent from $92.08 billion in the first three quarters of 2017. Net income for the nine-month period was $13.97 billion, up 19 percent from $11.77 billion in the same period one year before.

Intel

CEO: Robert Swan

Dec. 29, 2017 Close: $46.16

Dec. 31, 2018 Close: $46.93

Change: +1.67%

Intel continues to search for a permanent replacement for CEO Brian Krzanich, who resigned June 21 after the company learned that he had a consensual relationship with an employee in violation of company policy. Chief financial officer Robert Swan continues to serve as interim CEO.

During the second half of 2018 Intel was dealing with a shortage of the company's CPU processors.

On Nov. 15 Intel's board authorized a $15 billion increase in its authorized stock repurchase program, in addition to the $4.7 billion remaining under an earlier repurchase authorization.

For the first nine months (ended Sept. 29) of 2018, Intel reported revenue of $52.19 billion, up 14 percent from $45.71 billion in the first nine months of 2017. Net income for the most recent nine months was $15.86 billion, up 54 percent from $10.29 billion in the same period one year earlier.

Carbonite

CEO: Mohamad Ali

Dec. 29, 2017 Close: $25.10

Dec. 31, 2018 Close: $25.26

Change: +0.64%

In March Carbonite, a developer of cloud-based data backup and recovery services, completed its acquisition of rival Mozy from Dell Technologies for $145.8 million. The acquisition, announced in February, is expected to increase Carbonite's roster of both customers and channel partners.

For the first nine months (ended Sept. 30) of 2018, Carbonite reported revenue of $219.4 million, up 23 percent from $177.8 million in the first nine months of 2017. The company reported net income of $6.8 million for the nine-month period, compared with a $2.4 million loss in the first nine months of 2017.

Check Point Software Technologies

CEO: Gil Shwed

Dec. 29, 2017 Close: $103.62

Dec. 31, 2018 Close: $102.65

Change: -0.94%

In October Check Point acquired Tel Aviv, Israel-based Dome9, whose technology is used to secure IT operations across multiple public clouds.

For the first nine months (ended Sept. 30) of 2018, Check Point reported revenue of $1.39 billion, up 3 percent from $1.35 billion in the first nine months of 2017. Net income for the nine-month period was $583.1 million, up more than 3 percent from $563.6 million in the same period one year ago.

Alphabet

CEO: Larry Page

Dec. 29, 2017 Close: $1,046.40

Dec. 31, 2018 Close: $1,035.61

Change: -1.03%

In July the European Commission hit Alphabet with a $5.05 billion fine for alleged antitrust behavior that included imposing "illegal restrictions" on Android device makers and mobile network operators, allegedly aimed at bolstering Google's search engine.

For the first nine months of 2018, Alphabet, Google's parent company, reported revenue of $97.54 billion, up 24 percent from $78.53 billion in the first nine months of 2017. Net income for the nine-month period was $21.79 billion, up 39 percent from $15.68 billion in the same period one year ago.

HP Inc.

CEO: Dion Weisler

Dec. 29, 2017 Close: $21.01

Dec. 31, 2018 Close: $20.46

Change: -2.62%

For its fiscal 2018 (ended Oct. 31), HP reported revenue of $58.47 billion, up more than 12 percent from $52.06 billion in fiscal 2017. Net earnings for fiscal 2018 were $5.33 billion, more than double the $2.53 billion net earnings reported for fiscal 2017.

On Aug. 23 HP Inc. named Vikrant Batra as the company's new chief marketing officer, succeeding Antonio Lucio, who left the company Aug. 31 to become head of marketing at Facebook. Batra was most recently global head of marketing for HP's $19 billion Imaging and Printing group.

Oracle

CEOs: Safra Catz and Mark Hurd

Dec. 29, 2017 Close: $47.28

Dec. 31, 2018 Close: $45.15

Change: -4.51%

In early September Thomas Kurian, the top-level executive who oversaw all of Oracle's software development operations and played a critical role in the company's move to the cloud, announced that he was temporarily stepping down from the job. On Sept. 28 it was disclosed that he had resigned and wouldn't be returning to the company. In November Google announced that he had been named the new CEO of Google Cloud.

For the first six months (ended Nov. 30) of its fiscal 2019, Oracle reported revenue of $18.76 billion, essentially flat with the $18.69 billion in revenue reported for the first six months of fiscal 2018. Net income for the most recent six-month period was $4.60 billion, up 6 percent from $4.36 billion in net income in the first six months of fiscal 2018.

Juniper Networks

CEO: Rami Rahim

Dec. 29, 2017 Close: $28.50

Dec. 31, 2018 Close: $26.91

Change: -5.58%

For the first nine months (ended Sept. 30) of 2018, Juniper Networks reported revenue of $3.47 billion, down 8.5 percent from $3.79 billion in the first nine months of 2017. Net income for the nine-month period was $374.7 million, down 17.5 percent from $454.3 million one year earlier.

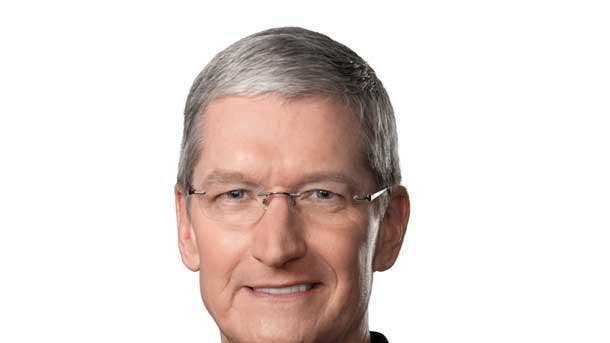

Apple

CEO: Tim Cook

Dec. 29, 2017 Close: $169.23

Dec. 31, 2018 Close: $157.74

Change: -6.79%

On Aug. 2 Apple became the world's first company to achieve a $1 trillion market capitalization after the company's stock price reached an all-time high of $206.46. But by year's end its market cap had fallen to $749 billion.

For fiscal 2018 (ended Sept. 29), Apple reported revenue of $265.60 billion, up nearly 16 percent from $229.23 billion in fiscal 2017. Net income in fiscal 2018 was $59.53 billion, up 23 percent from $48.35 billion in fiscal 2017.

In its biggest product debut of the year, Apple launched three new models of its popular iPhone on Sept. 12: the iPhone XS, XS Max and XR. The company also debuted the fourth generation of its Apple Watch.

On Jan. 2, 2019, after the period covered in this analysis, CEO Tim Cook warned that revenue for the fiscal 2019 first quarter (ended Dec. 29) would be around $84 billion, far below the earlier guidance of revenue in the range of $89 billion to $93 billion. That sent the price of Apple shares plummeting.

Seagate Technology

CEO: Dave Mosley

Dec. 29, 2017 Close: $41.84

Dec. 31, 2018 Close: $38.59

Change: -7.77%

For its fiscal 2019 first quarter (ended Sept. 28), Seagate Technology reported revenue of $2.99 billion, up nearly 14 percent from $2.63 billion in the first quarter of fiscal 2018. Net income for the quarter was $450 million, up 149 percent from $181 million one year before.

On Nov. 2 Seagate announced that its board had authorized the company to repurchase up to $2.3 billion of its outstanding ordinary shares.

Hewlett Packard Enterprise

CEO: Antonio Neri

Dec. 29, 2017 Close: $14.36

Dec. 31, 2018 Close: $13.21

Change: -8.01%

For fiscal 2018 (ended Oct. 31), Hewlett Packard Enterprise reported revenue of $30.85 billion, up nearly 7 percent from $28.87 billion in fiscal 2017. The company's net earnings soared to $1.91 billion compared with $344 million one year earlier.

On Aug. 28 HPE named Tarek Robbiati as the company's chief financial officer, replacing Tim Stonesifer, who stepped down in October. Robbiati was most recently CFO at Sprint Corp.

CenturyLink

CEO: Jeff Storey

Dec. 29, 2017 Close: $16.68

Dec. 31, 2018 Close: $15.15

Change: -9.17%

In 2018 CenturyLink was focused on integrating its operations with those of Level 3 Communications, the global network services company CenturyLink acquired Nov. 1, 2017, for about $34 billion in cash and stock.

In May longtime CEO Glen Post retired with president and chief operating officer Jeff Storey, previously Level 3's CEO, taking over as CenturyLink CEO.

For the first nine months (ended Sept. 30) of 2018, CenturyLink reported operating revenue of $17.67 billion, up 43 percent from $12.33 billion in the first nine months of 2017. Net income for the nine-month period was $679 million, up 150 percent from $272 million in the first nine months of 2017.

SAP

CEO: Bill McDermott

Dec. 29, 2017 Close: $112.36

Dec. 31, 2018 Close: $99.55

Change: -11.40%

SAP has been transitioning itself and its customers to cloud software. The company has set itself the goal of having revenue from cloud subscriptions and software support account for 70 percent to 75 percent of its sales in 2020.

In November SAP struck a deal to acquire experience management application developer Qualtrics International for $8 billion. The companies expect to complete the deal in the first half of 2019.

For the first three quarters (ended Sept. 30) of 2018, SAP reported that total revenue was 17.28 billion euros, ($19.70 billion), up 4 percent from 16.66 billion euros ($18.99 billion) in the first three quarters of 2017. After-tax profit was 2.40 billion euros ($2.74 billion) for the most recent three quarters, up 10 percent from 2.19 billion euros ($2.49 billion) one year ago.

The company plans to announce its 2018 fourth-quarter and full-year results Jan. 29.

Netgear

CEO: Patrick Lo

Dec. 29, 2017 Close: $58.75

Dec. 31, 2018 Close: $52.03

Change: -11.44%

In August Netgear spun off its Arlo smart home security technology business with an initial public offering that created Arlo Technologies Inc. Netgear retained 84.2 percent of the common stock, which it is distributing to its shareholders.

For the first nine months (ended Sept. 30) of 2018, Netgear reported revenue of $1.11 billion, up 10 percent from $1.01 billion in the first nine months of 2017. But the company reported net income of $10.3 million for the nine months, due in part to separation expenses of $18.8 million related to the Arlo spinoff, compared with net income of $51.4 million in the first nine months of 2017.

Eaton

CEO: Craig Arnold

Dec. 29, 2017 Close: $79.01

Dec. 31, 2018 Close: $68.66

Change: -13.10%

For the first nine months (ended Sept. 30) of 2018, Eaton reported sales of $16.15 billion, up more than 6 percent from $15.19 billion in the first nine months of 2017. Net income for the first nine months of 2018 was $1.51 billion, down nearly 36 percent from $2.35 billion in the same period in 2017.

IBM

CEO: Virginia Rometty

Dec. 29, 2017 Close: $153.42

Dec. 31, 2018 Close: $113.67

Change: -25.91%

After several years of steadily shrinking revenue, IBM's sales began growing again in late 2017 and early 2018, but it declined again year-over-year in the third quarter. For the first three quarters (ended Sept. 30) of 2018, IBM reported revenue of $57.83 billion, up just over 2 percent from $56.60 billion in the first three quarters of 2017. Net income for the most recent three quarters was $6.78 billion, down less than 1 percent from $6.81 billion one year earlier.

On Oct. 28 IBM announced a deal to acquire open-source software giant Red Hat for $34 billion. The companies expect to complete the acquisition later this year.

AT&T

CEO: Randall Stephenson

Dec. 29, 2017 Close: $38.88

Dec. 31, 2018 Close: $28.54

Change: -26.59%

AT&T completed its $85.4 billion acquisition of global entertainment and media powerhouse Time Warner in late June, just days after U.S. District Court Judge Richard Leon ruled on June 12 that the acquisition could proceed without any restrictions or conditions. But the U.S. Justice Department is appealing Judge Leon's ruling. Now the case will continue in court and AT&T has asked the court to let the acquisition stand.

For the first nine months of 2018, AT&T reported operating revenue of $122.76 billion, up 3.3 percent from $118.87 billion in the first three quarters of 2017. Net income for the most recent three quarters was $14.82 billion, up 38.4 percent from $10.71 billion in the same three quarters one year earlier.

Hortonworks

CEO: Rob Bearden

Dec. 29, 2017 Close: $20.11

Dec. 31, 2018 Close: $14.42

Change: -28.29%

On Oct. 3, Hortonworks unveiled a deal to merge with rival Cloudera and create a big data platform giant under the Cloudera name. The new Cloudera, which faces a complex task of rationalizing and integrating the two companies' product portfolios, is expected to have annual sales of $720 million.

Hortonworks' shares rose to $25.58 immediately following the announcement of the acquisition, but steadily declined through the rest of the year. The acquisition was completed on Jan. 3, just after the period covered by this analysis.

For the first nine months of 2018, Hortonworks reported revenue of $252.6 million, up 35 percent from $186.8 million in the first nine months of 2017. The company reported a $114.8 million loss for the first nine months of 2018, down from the $156.3 million loss in the same period one year before.

Xerox

CEO: John Visentin

Dec. 29, 2017 Close: $29.15

Dec. 31, 2018 Close: $19.76

Change: -32.21%

Xerox had a turbulent first half of 2018. After Xerox announced in January a deal for Fujifilm Holdings to acquire a majority stake in the printer and copier manufacturer, activist investor Carl Icahn and major shareholder Darwin Deason filed suit to stop the plan. That triggered a months-long battle in court, on Xerox's board and in the public domain about the company's future.

CEO Jeff Jacobson and a number of Xerox board members resigned in May to avoid a prolonged proxy fight and Xerox's newly reconstituted board killed the Fujifilm deal. Fujifilm has filed a $1 billion lawsuit seeking damages for alleged breach of contract.

For the first nine months (ended Sept. 30), of 2018 Xerox reported revenue of $7.30 billion, down nearly 3 percent from $7.52 billion in the first nine months of 2017. Net income for the nine months was $224 million, down nearly 42 percent from $385 million in the same period one year earlier. The company reported progress in its efforts to drive business improvement, increase cash flow and improve operating margins.

Symantec

CEO: Greg Clark

Dec. 29, 2017 Close: $28.06

Dec. 31, 2018 Close: $18.90

Change: -32.64%

In May Symantec began an internal investigation of the company's reporting of some non-GAAP financial measures, including those that could impact executive compensation programs. The investigation, triggered by concerns raised by a former employee, also looked at commentary around historical financial results and stock trading plans.

On Sept. 24 the company announced that of $13 million in revenue recognized from a customer transaction in the fourth quarter ended March 30, 2018, only $1 million should have been recognized and the company would defer $12 million that had been improperly recognized.

In August activist investor Starboard Value disclosed that it had acquired a 5.8 percent stake in Symantec and had nominated five candidates for the company's board as part of its campaign to get Symantec to make operational changes and improve its profit margins. In September Symantec reached an agreement with Starboard and named three new directors to its board from Starboard's list of nominees.

On Nov. 29 Symantec announced that president and COO Michael Fey had resigned, effective immediately, as part of a leadership shuffle.

For the first six months (ended Sept. 28) of fiscal 2019, Symantec reported revenue of $2.33 billion, down 3.5 percent from $2.42 billion in the first six months of fiscal 2018. For the six-month period Symantec reported a loss of $68 million compared with a $145 million loss one year before.

Cloudera

CEO: Tom Reilly

Dec. 29, 2017 Close: $16.52

Dec. 31, 2018 Close: $11.06

Change: -33.05%

On Oct. 3, Cloudera announced a deal to merge with rival Hortonworks and create a big data platform giant under the Cloudera name. The new Cloudera, which faces a complex task of rationalizing and integrating the two companies' product portfolios, is expected to have annual sales of $720 million.

Cloudera's shares rose to $19.05 immediately following the announcement of the acquisition, but steadily declined through the rest of the year. The acquisition was completed on Jan. 3, just after the period covered by this analysis.

For the first three quarters (ended Oct. 31) of fiscal 2019, Cloudera reported revenue of $331.2 million, up more than 25 percent from $264.0 million in the first three quarters of fiscal 2018. The company reported a $111.0 million loss for the most recent three quarters compared with the $341.9 million loss in the same three quarters one year earlier.

BlackBerry

CEO: John Chen

Dec. 29, 2017 Close: $11.77

Dec. 31, 2018 Close: $7.11

Change: -39.59%

In November BlackBerry struck a deal to acquire cybersecurity company Cylance for $1.4 billion in a move to add security and AI capabilities to its platform.

For the first nine months (ended Nov. 30) of its fiscal 2019, BlackBerry reported revenue of $649 million, down 7 percent from $699 million in the first nine months of fiscal 2018. Net income for the nine months was $42 million, down almost 90 percent from $415 million one year earlier.

Extreme Networks

CEO: Ed Meyercord

Dec. 29, 2017 Close: $12.52

Dec. 31, 2018 Close: $6.10

Change: -51.28%

For its fiscal 2019 first quarter (ended Sept. 30), Extreme Networks reported revenue of $239.9 million, up 13 percent from $211.7 million in the first quarter of fiscal 2018. The company reported a $9.1 million loss for the quarter compared with net income of $4.4 million one year earlier.

For all of fiscal 2018 (ended June 30), Extreme Networks reported revenue of $983.1 million, up 62 percent from $607.1 million in fiscal 2017. The company reported a loss of $46.8 million compared with the $1.7 million loss in fiscal 2017.

Western Digital Corp.

CEO: Stephen Milligan

Dec. 29, 2017 Close: $79.53

Dec. 31, 2018 Close: $36.97

Change: -53.51%

For its fiscal 2019 first quarter (ended Sept. 28), Western Digital reported revenue of $5.03 billion, down 3 percent from the $5.18 billion reported in the same quarter one year before. Net income for the quarter was $511 million, down 25 percent from $681 million one year earlier.

For all of fiscal 2018 (ended June 29), Western Digital reported revenue of $20.65 billion, up 8 percent from $19.09 billion in fiscal 2017. Net income for the year was $675 million, up 70 percent from $397 million in fiscal 2017.

Quantum

CEO: Jamie Lerner

Dec. 29, 2017 Close: $5.63

Dec. 31, 2018 Close: $2.00

Change: -64.48%

After losing more than 60 percent of its value in the first half of this year, Quantum's stock price more or less stabilized in the second half of the year in the $1.50 to $2.50 per share range.

In January Quantum received a subpoena from the U.S. Securities and Exchange Commission regarding the company's accounting practices and internal controls relating to revenue recognition. The company began an internal investigation and has delayed issuing financial results for fiscal 2018 (ended March 31) or for the fiscal 2019 quarters since.

On Sept. 14 Quantum said the Special Committee of its Board of Directors had "substantially completed its internal investigation" and concluded that "there were misstatements in the company's previously consolidated financial statements and other financial information relating to the recognition of revenue for certain transactions."

Quantum said annual financial reports for fiscal years 2015, 2016 and 2017, as well quarterly reports for those years and for the fiscal 2018 quarters ended June 30, 2017, and Sept. 30, 2017, "should no longer be relied upon and will be restated."

Because Quantum has yet to file its 10-K form for fiscal 2018 or 10-Q forms for fiscal 2019, the company has faced delisting on the New York Stock Exchange. But on Aug. 15 it was given until Jan. 15, 2019, to file its earnings reports. And on Dec. 28 the company said it had secured $210 million in long-term financing to repay debts and "provide a foundation for growth."

Quantum has also experienced turmoil in its executive ranks. On June 26 the company named former Cisco and Seagate executive Jamie Lerner to be its third CEO this year.