The Biggest Losing Tech Stocks In The Coronavirus Sell-off

Every one of the 40 technology companies on our stock watch list has seen the value of its shares tumble since the coronavirus – now a global pandemic – emerged in China early this year.

Coronavirus Fallout

On Jan. 7 Chinese authorities reported to the World Health Organization that a virus that had been causing illnesses in the Wuhan area since late December was a previously unknown coronavirus. In the two months since, the coronavirus pandemic – officially COVID-19 – has wreaked havoc on the global economy, the IT industry and the stock markets.

Thursday saw the Dow Jones Industrial Average fall 9.99 percent (2,352 points) and the Nasdaq lose 9.43 percent (750.25 points). The Dow Jones plunge was the worst one-day percentage loss for that index since the Oct. 19, 1987 stock market crash.

Here's a look at how much the share price of the biggest IT vendors has dropped between Jan. 7 and the close of trading yesterday. Much of those losses have come just this week – the worst for stock indexes since the financial crisis of 2008.

The list begins with the companies whose stock prices declined the least on a percentage basis during that time span, working down to those companies that have recorded the biggest price percentage declines – including two that have lost more than half of their share value in that time.

Citrix Systems

CEO: David Henshall

Jan. 7, 2020 Close: $112.41

March 12, 2020 Close: $105.06

Change: -6.54%

Digital workspaces and networking software developer Citrix was the only company on our watch list whose stock price has not fallen by double digits since Jan. 7.

ServiceNow

CEO: Bill McDermott

Jan. 7, 2020 Close: $292.91

March 12, 2020 Close: $262.12

Change: -10.51%

ServiceNow is operating under new management this year after former SAP CEO Bill McDermott became ServiceNow’s CEO on Nov. 18, 2019. He replaced John Donohoe who left to become the CEO of athletic apparel company Nike.

Microsoft

CEO: Satya Nadella

Jan. 7, 2020 Close: $157.58

March 12, 2020 Close: $139.06

Change: -11.75%

In February, Microsoft said that it no longer expected to achieve its revenue guidance for the current quarter. This week the company said it is shifting its Build 2020 developer conference to a digital event.

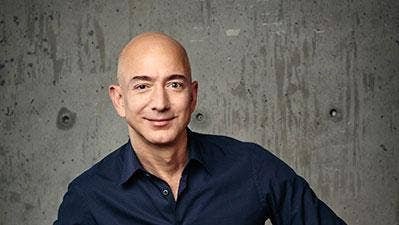

Amazon

CEO: Jeff Bezos

Jan. 7, 2020 Close: $1,906.86

March 12, 2020 Close: $1,676.61

Change: -12.07%

Amazon’s market capitalization, which previously broke the $1 trillion barrier and stood at $916 billion at the start of this year, dropped to $835 billion at the close of trading Thursday.

Verizon Communications

CEO: Hans Vestberg

Jan. 7, 2020 Close: $59.60

March 12, 2020 Close: $51.20

Change: -14.09%

Verizon, which reported operating revenue of $131.87 billion for all of 2019, sees 5G networks as its most promising growth area.

HP Inc.

CEO: Enrique Lores

Jan. 7, 2020 Close: $20.66

March 12, 2020 Close: $17.50

Change: -15.30%

HP has been the target of an unsolicited takeover bid by Xerox, which is offering $24 per share for the PC and printer maker.

But Xerox’s offer to HP shareholders is partially made up of Xerox stock – which has lost more than 33 percent of its value since Jan. 7. Friday Xerox said it was putting the HP takeover bid on hold while it focuses on the safety of its employees, customers, partners and affiliates amidst the coronavirus pandemic.

Apple

CEO: Tim Cook

Jan. 7, 2020 Close: $298.39

March 12, 2020 Close: $248.23

Change: -16.81%

Apple’s sales and operations have been particularly hard hit by the coronavirus outbreak. China, where the pandemic began and parts of the country are shut down, is a big market for Apple iPhones and it’s also where a lot of Apple products are manufactured.

On Friday the company said that its WWDC developer conference, scheduled for June, would become a virtual event instead because of the pandemic.

This week, the company also said it may have to delay the launch of its highly anticipated 5G iPhones because Apple engineers cannot travel to China.

Advanced Micro Devices

CEO: Lisa Su

Jan. 7, 2020 Close: $48.25

March 12, 2020 Close: $39.01

Change: -19.15%

AMD CEO Lisa Su said earlier this month that outside of China, demand for the chip maker’s products have held relatively steady and the company expects the coronavirus crisis to have only a “modest” impact on revenue.

Eaton

CEO: Craig Arnold

Jan. 7, 2020 Close: $94.84

March 12, 2020 Close: $75.92

Change: -19.95%

Eaton postponed its partner summit, originally scheduled for March 16-18, until November because of the coronavirus pandemic.

Alphabet

CEO: Sundar Pichai

Jan. 7, 2020 Close: $1,393.34

March 12, 2020 Close: $1,114.91

Change: -19.98%

Google parent company Alphabet achieved a $1 trillion market cap on Jan. 16 when the internet giant’s share price hit $1,450.16, shortly after news of the coronavirus outbreak began to emerge from China. But as of the close of trading Thursday of this week Alphabet’s market cap was down to $765 billion.

Salesforce

CEO: Marc Benioff

Jan. 7, 2020 Close: $176.00

March 12, 2020 Close: $140.55

Change: -20.14%

Salesforce co-CEO Keith Block announced on Feb. 25 that he was stepping down, leaving company founder Marc Benioff as the sole CEO.

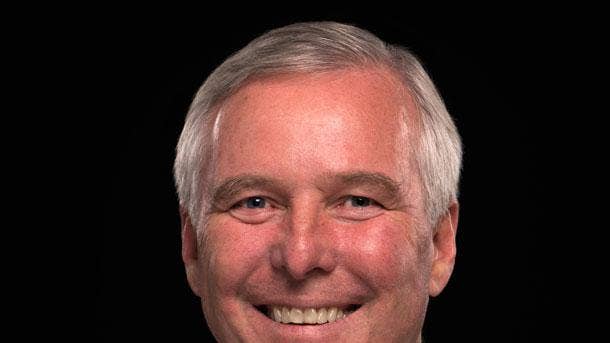

AT&T

CEO: Randall Stephenson

Jan. 7, 2020 Close: $39.25

March 12, 2020 Close: $31.32

Change: -20.20%

In September activist investment firm Elliott Management revealed that it had acquired a $3.2 billion stake in AT&T and called for changes to boost the company’s stock price. In October AT&T said it would work with the investor to shed non-strategic assets to boost profits by $14 billion this year.

Juniper Networks

CEO: Rami Rahim

Jan. 7, 2020 Close: $24.19

March 12, 2020 Close: $19.21

Change: -20.59%

For all of 2019 Juniper Networks reported revenue of $4.45 billion, down 4.3 percent from $4.65 billion in 2018. Net income for the year was $345.0 million, down 39 percent from $566.9 million one year before.

Intel

CEO: Bob Swan

Jan. 7, 2020 Close: $58.93

March 12, 2020 Close: $45.54

Change: -22.72%

This week Intel announced that it has canceled the on-site portion of the Intel Partner Connect conference for the Americas, scheduled for May 19-21, because of the coronavirus pandemic and will hold a digital event instead.

Lenovo Group

CEO: Yang Yuanqing

Jan. 7, 2020 Close: $13.68

March 12, 2020 Close: $10.54

Change: -22.95%

Based in China, Lenovo potentially faces a significant impact from the coronavirus epidemic. One of the company’s largest factories is in the city of Wuhan where the epidemic began and was shut down. The company said it is facing “short-term constraints and delays” in its supply chain.

IBM

CEO: Virginia Rometty

Jan. 7, 2020 Close: $134.19

March 12, 2020 Close: $102.81

Change: -23.38%

On Jan. 30 IBM announced that Ginny Rometty would step down as CEO, effective April 6, and senior vice president for cloud and cognitive software Arvind Krishna taking over as CEO.

SAP

Co-CEOs: Christian Klein and Jennifer Morgan

Jan. 7, 2020 Close: $133.62

March 12, 2020 Close: $101.41

Change: -24.11%

In January SAP reported that for all of 2019 total revenue reached 27.55 billion euros ($30.32 billion), up 12 percent from 24.71 billion euros ($27.19 billion) in 2018. After-tax profit for the year was 3.39 billion euros ($3.73 billion), down 17 percent from 4.09 billion euros ($4.50 billion) one year before.

Seagate Technologies

CEO: Dave Mosely

Jan. 7, 2020 Close: $58.91

March 12, 2020 Close: $44.55

Change: -24.38%

For the first six months (ended Jan. 3) of its fiscal 2020, storage technology manufacturer Seagate reported revenue of $5.27 billion, down 7.6 percent from $5.71 billion in the first half of fiscal 2019. Net income for the period was $518 million, down 38 percent from $834 million one year earlier.

Oracle

CEO: Safra Catz

Jan. 7, 2020 Close: $54.16

March 12, 2020 Close: $39.79

Change: -26.53%

Oracle this week reported strong financial results for its fiscal 2020 third quarter (ended Feb. 29). But CEO Safra Catz said that projecting future sales and earnings was tricky because of the uncertain impact of the coronavirus epidemic on customer spending and supply chains.

Check Point Software Technologies

CEO: Gil Shwed

Jan. 7, 2020 Close: $112.03

March 12, 2020 Close: $82.05

Change: -26.76%

In February, Check Point reported revenue of $1.99 billion for all of 2019, up 4 percent from $1.92 billion in 2018. Net income for the year was $825.7 million, up 0.5 percent from $821.3 million one year before.

CenturyLink

CEO: Jeff Storey

Jan. 7, 2020 Close: $12.73

March 12, 2020 Close: $9.28

Change: - 27.10%

In February CenturyLink reported that operating revenue for all of 2019 was $22.40 billion, down 4 percent from $23.44 billion in 2018. The communications service provider reported a net loss of $5.27 billion for the year (largely due to a first-quarter $6.51 billion goodwill impairment charge) compared to a $1.73 billion net loss in 2018.

F5 Networks

CEO: Francois Locoh-Donou

Jan. 7, 2020 Close: $136.99

March 12, 2020 Close: $98.33

Change: -28.22%

In January F5 Networks reported that revenue in its fiscal 2020 first quarter (ended Dec. 31, 2019) grew 5 percent to $569.3 million. But net income for the quarter was down nearly 25 percent to $98.5 million.

Netgear

CEO: Patrick Lo

Jan. 7, 2020 Close: $25.49

March 12, 2020 Close: $18.15

Change: -28.80%

In February, Netgear reported that for all of 2019 revenue was $998.8 million, down nearly 6 percent from $1.06 billion in 2018. But the company reported net income of $25.8 million for the year, compared to a net loss of $9.2 million one year earlier.

Cisco Systems

CEO: Chuck Robbins

Jan. 7, 2020 Close: $47.49

March 12, 2020 Close: $33.20

Change: -30.09%

Cisco was among the communications and networking tech companies that dropped out of last month’s Mobile World Congress event because of the coronavirus epidemic. MWC was ultimately canceled.

This week Cisco instituted a mandatory work from home policy because of the pandemic and has canceled partner events.

Commvault Systems

CEO: Sanjay Mirchandan

Jan. 7, 2020 Close: $45.93

March 12, 2020 Close: $31.81

Change: -30.74%

In January Commvault reported revenue for the first nine months (ended Dec. 31) of fiscal 2020 of $506.1 million, down 4.4 percent from $529.5 million in the first nine months of fiscal 2019. The company reported a net loss of $14.6 million for the nine-month period compared to net income of $5.7 million one year earlier.

Splunk

CEO: Doug Merritt

Jan. 7, 2020 Close: $153.41

March 12, 2020 Close: $105.01

Change: -31.55%

Earlier this month Splunk reported that revenue in its fiscal 2020 (ended Jan. 31) was $2.36 billion, up nearly 31 percent from $1.80 billion in fiscal 2019.

Fortinet

CEO: Ken Xie

Jan. 7, 2020 Close: $111.89

March 12, 2020 Close: $75.81

Change: -32.25%

In February Fortinet reported revenue of $2.16 billion for all of 2019, up nearly 20 percent from $1.80 billion in 2018. The company reported net income of $326.5 million for the year, down 1.7 percent from $332.2 million in 2018.

Xerox

CEO: John Visentin

Jan. 7, 2020 Close: $35.95

March 12, 2020 Close: $23.90

Change: -33.52%

Xerox launched an unsolicited takeover of HP Inc. last year and recently increased its tender offer to HP shareholders to $24 per share, including cash and Xerox stock.

Xerox’s stock has lost more than 33 percent of its value since Jan. 7. Friday Xerox said it was putting the HP takeover bid on hold while it focuses on the safety of its employees, customers, partners and affiliates amidst the coronavirus pandemic.

Dell Technologies

CEO: Michael Dell

Jan. 7, 2020 Close: $49.80

March 12, 2020 Close: $32.73

Change: -34.28%

This week Dell said that Dell Technologies World 2020, the company’s biggest annual event, would become a virtual conference because of the coronavirus pandemic.

CEO Michael Dell told CRN that demand for laptop computers and other work-at-home systems and solutions is up because of the outbreak, which has led many businesses to order their employees to work from home. But he said the overall business impact of the coronavirus pandemic is still fluid and unknown.

VMware

CEO: Pat Gelsinger

Jan. 7, 2020 Close: $150.34

March 12, 2020 Close: $97.42

Change: - 35.20%

VMware wrapped up its fiscal 2020 on Jan. 31, reporting revenue of $10.81 billion for the year, up 12.5 percent from $9.61 billion in fiscal 2019. Net income for the year surged to $6.41 billion from $1.65 billion one year earlier.

NortonLifeLock

CEO: Vincent Pilette

Jan. 7, 2020 Close: $26.75

March 12, 2020 Close: $17.26

Change: -35.48%

NortonLifeLock is the consumer cybersecurity software and services company that was spun out of Symantec last year after chip manufacturer Broadcom acquired Symantec’s enterprise security business for $10.7 billion. NortonLifeLock began trading on the NASDAQ exchange.

In February NortonLifeLock reported revenue of $1.88 billion for the first nine months (ended Dec. 28) of its fiscal 2020, up 2 percent from $1.84 billion in the first nine months of fiscal 2019. Net income for the nine-month period was $3.66 billion (including $3.23 billion in income from discontinued operations) versus a $3 million loss one year before.

Cloudera

CEO: Martin Cole

Jan. 7, 2020 Close: $11.52

March 12, 2020 Close: $7.08

Change: -38.54%

Just this week big data platform developer Cloudera reported financial results for its fiscal 2020 (ended Jan. 31), including revenue of $794.2 million, up more than 65 percent from one year earlier.

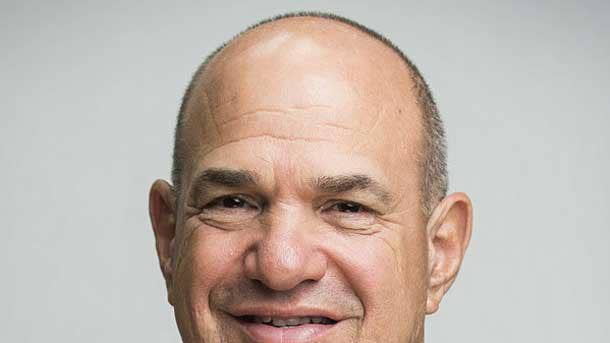

Hewlett Packard Enterprise

CEO: Antonio Neri

Jan. 7, 2020 Close: $15.64

March 12, 2020 Close: $9.14

Change: -41.56%

Earlier this month Hewlett Packard Enterprise confirmed that its annual Discover Las Vegas conference in June was still on. But the company said it was canceling most of its other events through April, including HPE-hosted, co-hosted and sponsored events, because of the coronavirus outbreak.

Palo Alto Networks

CEO: Nikesh Arora

Jan. 7, 2020 Close: $241.64

March 12, 2020 Close: $140.49

Change: -41.86%

For the first six months (ended Jan. 31) of its fiscal 2020 Palo Alto Networks reported revenue of $1.59 billion, up 16 percent from $1.37 billion in the first half of fiscal 2019. The company reported a $133.3 million net loss for the six-month period compared to the $40.9 million net loss reported one year earlier.

NetApp

CEO: George Kurian

Jan. 7, 2020 Close: $61.95

March 12, 2020 Close: $35.91

Change: -42.03%

For the first nine months (ended Jan. 24) of its fiscal 2020 NetApp reported revenue of $4.01 billion, down nearly 12 percent from $4.55 billion in the first nine months of fiscal 2019. Net income for the nine-month period was $623 million, down more than 19 percent from $773 million one year earlier.

Western Digital Corp.

CEO: David Goeckeler

Jan. 7, 2020 Close: $67.66

March 12, 2020 Close: $39.11

Change: -42.20%

For the first six months (ended Jan. 3) of the company’s fiscal 2020 Western Digital reported revenue of $8.27 billion, down nearly 11 percent from $9.26 billion in the first half of fiscal 2019. The company reported a net loss of $415 million for the six-month period compared to net income of $24 million one year earlier.

Earlier this month Western Digital named David Goeckeler the company’s new CEO. Goeckeler was previously executive vice president and general manager of Cisco Systems’ $34 billion networking and security business. He succeeds Steve Milligan, who previously announced his retirement.

BlackBerry

CEO: John Chen

Jan. 7, 2020 Close: $6.66

March 12, 2020 Close: $3.70

Change: -44.44%

For the first nine months (ended Nov. 30) of fiscal 2020, BlackBerry reported revenue of $758 million, up nearly 17 percent from $649 million in the first nine months of fiscal 2019. The company reported a $111 million net loss for the nine-month period compared to net income of $42 million one year earlier.

FireEye

CEO: Kevin Mandia

Jan. 7, 2020 Close: $18.16

March 12, 2020 Close: $10.04

Change: -44.71%

In February, FireEye reported that revenue for all of 2019 was $889.2 million, up 7 percent from $831.0 million in 2018. The company reported a net loss of $257.4 million for the year compared to a $243.1 million net loss in 2018.

Also in February there were reports that Cisco Systems was preparing to make an acquisition bid for FireEye.

Extreme Networks

CEO: Ed Meyercord

Jan. 7, 2020 Close: $7.32

March 12, 2020 Close: $3.15

Change: -56.97%

Extreme Networks is one of two companies on our watch list that has seen its shares lose more than half of their value since the onset of the coronavirus pandemic.

The enterprise networking equipment maker is working to integrate its August 2019 acquisition of Aerohive, the No. 2 company in cloud managed wireless LAN services.

Nutanix

CEO: Dheeraj Pandey

Jan. 7, 2020 Close: $32.90

March 12, 2020 Close: $13.34

Change: - 59.45%

It’s been a tough couple of months for hyperconverged system maker Nutanix, whose stock has declined almost 60 percent since the beginning days of the coronavirus pandemic.

But earlier this month CEO Dheeraj Pandey professed to be unfazed by the stock drop, stating his determination to build Nutanix into a $3 billion company regardless of any stock market speed bumps.