The CDW-Sirius Merger: 8 Big Profit And Sales Stats To Know

From gross profit margins to hardware versus services sales, here are eight key data points and figures from CDW and Sirius Computer Solutions’ upcoming merger.

8 Things To Know About CDW’s ‘Home Run’ Acquisition Of Sirius

The news this week that $20 billion solution provider powerhouse CDW is buying Sirius Computer Solutions is making waves across the channel partner community.

CDW’s CEO Christine Leahy said its $2.5 billion acquisition of Sirius is a “home run.”

“Sirius further balances our portfolio. It’s expected to be immediately accretive and strengthened our financial profile. And it’s expected to have strong cash flow to support our capital allocation priority,” said Leahy, during a recent call with financial analysts.

Leahy went on to say that “most importantly,” Sirius is “going to help us serve our customers better than anyone and be that trusted advisor that has the breadth, the depth, the skill, and the expertise to deliver customer-centric outcomes and speed to return-on-investment.”

Vernon Hills, Ill.-based CDW is expected to close on its all-cash acquisition of San Antonio-based Sirius in December.

Here are eight important data points and sales figures from the deal that channel partners, investors and customers should know.

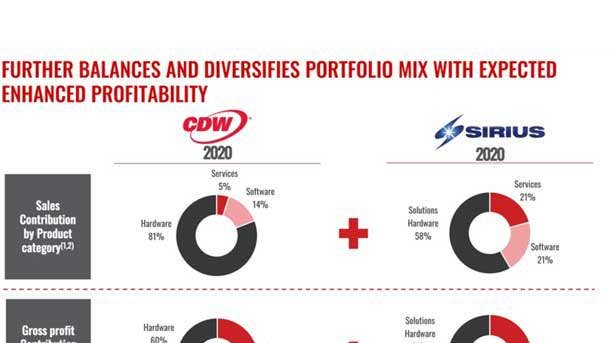

64% Of Sirius Profit Comes From Services & Software, More Than CDW’s Share

Only 40 percent of CDW’s profit comes from services and software when looking at gross profit contribution by product category last year.

Comparatively, 64 percent of Sirius’ total gross profit in 2020 came from services and software.

The majority, 60 percent, of CDW’s gross profit came via hardware, while hardware solutions only accounted for 36 percent of Sirius’ gross profit.

Sirius Computer Solutions President and CEO Joe Mertens told CRN this week that his company is bringing “greater services volume and capabilities” and “stronger data center capacities around managed services” to CDW.

“Services is a fast-growing area of the market. And we would expect to grow at least as fast as a market, if not more quickly to take share,” Leahy said.

81% Of CDW’s Revenue Comes Via Hardware

Out of CDW’s $18.5 billion in sales last year, 81 percent came via hardware revenue. This means CDW sold roughly $15 billion in IT hardware in 2020. Interestingly, only 5 percent of sales came from services, which would be around $900 million.

Looking at Sirius’ portfolio mix, 21 percent of its $2 billion in sales last year came from services, while another 21 percent came from software revenue. This means services and software sales hit $840 million for Sirius in 2020. The remaining 58 percent of total sales came from IT hardware, which would be roughly $1.16 billion.

Sirius’ Mertens told CRN that his company will gain new capabilities and opportunities around client devices such as PCs.

“By this combination, we gain some capability around client-side computing that we haven’t had. I think the combination of the two will create some pretty attractive offerings for clients,” said Mertens.

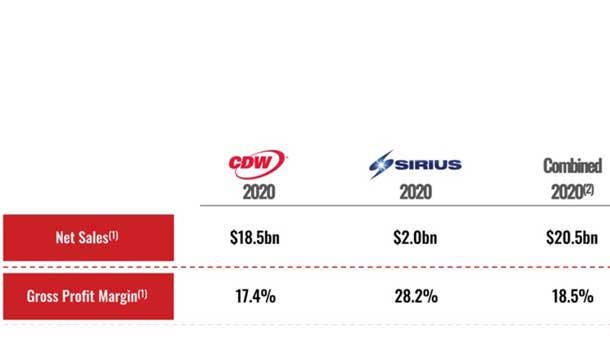

Sirius’ Gross Profit Margin Is 11% Higher Than CDW

One of biggest reasons CDW is acquiring Sirius is due to its services and software-led business model that reaps larger profit margins compared to traditional hardware sales.

In 2020, Sirius generated a gross profit margin of 28.2 percent. Comparatively, CDW reported 17.4 percent gross profit margin last year.

“Sirius’ financial profile is attractive and meaningful,” said CDW’s Leahy.

She said the acquisition is expected to immediately increase its gross margin by approximately 110 basis points.

CDW’s Sales Are $16.5 Billion Greater Than Sirius

CDW’s total revenue dwarfs Sirius by a whopping $16.5 billion.

In 2020, CDW generated a total of $18.5 billion in net sales, while Sirius captured total revenues of $2 billion.

The deal brings together one of the world’s top providers of IT products in CDW, No. 5 on the CRN 2021 SP500 with nationally recognized solution provider powerhouse Sirius, No. 21 on the SP500. CDW made its bones selling IT products with a direct sales catalogue with a legendary telemarketing sales organization. Sirius has diversified from its roots as an IBM solution provider specialist into a broad and deep services organization. Sirius now delivers 400 professional services engagements a year with top notch engineering talent and 50 technology enablement centers.

“Sirius has grown to be one of the largest and most well-regarded IT solution integrators in North America,” said Leahy. “They focus on four IT key growth areas: hybrid infrastructure, security, digital and data innovation, and cloud managed services. They are a consultative solution provider across the full ecosystem of leading and emerging vendors.”

$2.5 Billion Purchase Price Is A Multiple Of 10.4X

CDW’s purchase price of $2.5 billion amounted to a multiple of 10.4 times the 2021 adjusted earnings of Sirius Computer Solutions before interest, taxes, depreciation and amortization (EBITDA).

“You can never pay too much for a great asset,” Martin Wolf, president of martinwolf M&A Advisors of Scottsdale, Arizona, one of the top technology services investment advisory dealmakers, told CRN. “Price is what you pay. Value is what you get and CDW will get great value from this deal.”

CDW’s Leahy said the acquisition is a “home run” for both companies.

“This transaction is expected to create value for all of our stakeholders, our customers, coworkers, partners, communities, and investors,” she said

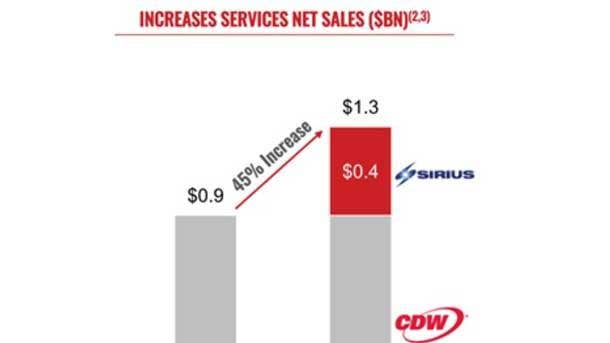

Sirius Increases CDW’s Services Portfolio By 45%

The deal expands CDW’s services portfolio by approximately 45 percent from $900 million in 2020 to approximately $1.3 billion.

“An increase of 45 percent is a meaningful increase that will impact our portfolio,” said CDW’s Leahy. “At CDW, it always begins with the customer: where they are, where they’re going, and what they need to get there. Today, organizations are dramatically accelerating the digital transformation initiatives. This acceleration requires greater service capabilities be integrated into their IP ecosystem.”

Wolf said a CDW with Sirius will be “less willing to sell service packs of other vendors”.

“They will sell their own services,” said Wolf. “Then the question is who really controls the customer over the next five years: the vendor or the solution provider?”

Sirius’ 2,600 Workforce With 1,500 Technical Experts

Sirius has more than 2,600 employees across 40 offices in North America set to join CDW’s 10,500-person workforce.

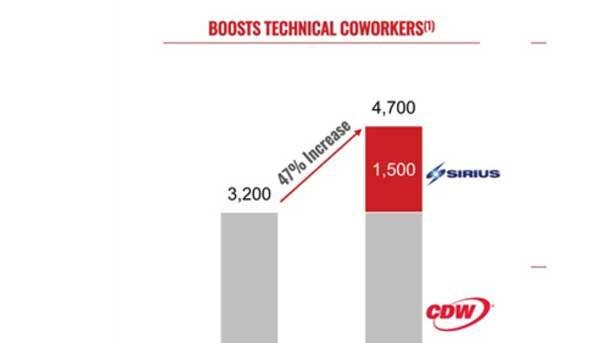

“Specifically, Sirius brings 1,500 highly certified technical coworkers with deep technical expertise,” she said. “This would increase CDW’s total technical coworkers by over 45 percent to 4,700 strong—a meaningful increase in today’s competitive market for IT talent.”

Sirius holds more than 5,500 technical certifications with specialties in security, cloud, digital infrastructure and managed services.

Sirius’ Has 3,900 Customers Compared With CDW’s 250,000

Sirius Computer Solutions has a total of 3,900 active customers mostly in North America. The average tenure for its top 200 customers is more than 9 years.

Sirius‘ overall customers satisfaction rating currently stands at 9.3 out of 10.

“Like CWD, Sirius has a culture of putting the customer-first,” said Leahy.

“Currently, [Sirius customer] mix includes corporate, healthcare, and government and education, which matches well with our profile. These 3,900 customers represent excellent potential for cross sell,” she said Leahy. “We see Sirius’ portfolio of customers is very complementary.”