The Top 10 Tech Stocks Of 2020 (And The 10 Worst)

Check out which IT company stocks recorded the biggest gains in 2020 and which ones suffered the biggest declines.

Tech Stocks Hit By Pandemic And Recession, But Many End 2020 With Gains

Stock markets were riding high for the first weeks of 2020 before plunging in late February and March as the COVID-19 pandemic hit and many segments of the U.S. economy shut down. From there stock markets began a generally steady climb through the end of 2020.

The Dow Jones ended trading on Dec. 31 at 30,606.48, up 7.25 percent from its 28,538.44 close on Dec. 31, 2019. The tech-heavy Nasdaq fared even better in 2020, closing at 12,888.28 on Dec. 31, up 43.64 percent from its 8,972.60 close on Dec. 31, 2019.

Among the IT company stocks followed by CRN, many recorded double-digit gains in their stock price in 2020. But others watched as the value of their publicly traded stock dropped during the year—some plunging by double digits.

Here‘s a look at the biggest stock price winners and losers in 2020. We start with the 10 biggest winners, counting down to the IT vendor with the biggest stock price gain during the year. Then we list the 10 companies whose stock price declined the most, concluding with the IT vendor with the biggest loss. The rankings are based on stock closing prices on Dec. 31, 2019 and Dec. 31, 2020.

No. 10: FireEye

CEO: Kevin Mandia

Dec. 31, 2019 Close: $16.53

Dec. 31, 2020 Close: $23.06

Change: +39.50%

On Dec. 11 FireEye closed a $400 million strategic investment led by Blackstone Tactical Opportunities with ClearSky, a cybersecurity-focused investment firm, as a co-investor.

Also in December FireEye was very much in the news as it was the first to report the state-sponsored cyberattack that targeted multiple IT companies and U.S. government agencies, including the Department of State and the U.S. Treasury.

For the first three quarters of 2020 ended Sept. 30, FireEye reported revenue of $693.1 million, up 6 percent from $654.1 million in the first three quarters of 2019. The company reported a loss of $168.7 million for the three quarters compared with a $208.2 million loss one year before.

FireEye ended 2020 with a market cap of $5.41 billion, up 51.06 percent from $3.58 billion at the end of 2019.

No. 9: Lenovo Group

CEO: Yang Yuanqing

Dec. 31, 2019 Close: $13.38

Dec. 31, 2020 Close: $18.69

Change: +39.69%

Lenovo enjoyed surging demand for its PCs amid the shift to work-from-home because of the COVID-19 pandemic.

For the first six months ended Sept. 30 of its fiscal 2021, Lenovo reported revenue of $27.87 billion, up 7 percent from $26.03 billion in the first half of fiscal 2020. Profit for the six-month period was $596 million, up 37 percent from $436 million one year before.

While the pandemic and economic slowdown took a toll on Data Center Group sales earlier in calendar 2020, sales rebounded later in the year with the company reporting 11.1 percent growth in Data Center sales in the fiscal second quarter.

Lenovo Group ended 2020 with a market cap of $11.27 billion, up 39.53 percent from $8.08 billion at the end of 2019.

No. 8: Microsoft

CEO: Satya Nadella

Dec. 31, 2019 Close: $157.70

Dec. 31, 2020 Close: $222.42

Change: +41.04%

Microsoft benefited from the pandemic-induced move to work from home when use of the company’s Teams collaboration software grew nearly six-fold from 20 million active daily users in November 2019 to 115 million in October 2020.

In May Microsoft disclosed an agreement to buy U.K.-based Metaswitch Networks in a move that will help the software giant build out the capabilities of its Azure Cloud platform for the coming 5G era. In September Microsoft struck a deal to acquire video game developer ZeniMax Media and its publisher Bethesda Game Studios for $7.5 billion

On June 28 Microsoft announced that it planned to close all 83 of its retail stores and would take a $450 million pre-tax charge against earnings.

For all of fiscal 2020 ended June 30, Microsoft reported revenue of $143.02 billion, up nearly 14 percent from $125.84 billion in fiscal 2019. Net income for the fiscal year was $44.28 billion, up nearly 13 percent from $39.24 billion one year before.

For the fiscal 2021 first quarter ended Sept. 30, 2020, Microsoft reported revenue of $37.15 billion, up more than 12 percent from $33.06 billion one year before. Net income for the quarter was $13.89 billion, up more than 30 percent from $10.68 billion one year before.

Microsoft ended 2020 with a market cap of $1.68 trillion, up 40.17 percent from $1.20 trillion at the end of 2019.

No. 7: Dell Technologies

CEO: Michael Dell

Dec. 31, 2019 Close: $51.39

Dec. 31, 2020 Close: $73.29

Change: +42.62%

Dell Technologies disclosed in July that the company is mulling a plan to spin off VMware, the virtualization technology leader in which Dell owns an 81 percent stake. Dell’s acknowledgement confirmed reports about a possible spin-off that had been circulating for several weeks.

In a filing with the U.S. Securities and Exchange Commission and in a company statement, Dell said such a move would benefit shareholders of both companies, as well as employees, customers and partners, “by simplifying capital structures and creating additional long-term enterprise value.”

For the first three quarters ended Oct. 30, 2020 of the company’s fiscal 2021, Dell reported revenue of $68.11 billion, essentially flat with the $68.12 billion reported in the first three quarters of fiscal 2020. Net income for the three-quarter period was $2.16 billion, down 58 percent from $5.11 billion one year before.

Dell Technologies ended 2020 with a market cap of $54.95 billion, up 44.99 percent from $37.90 billion at the end of 2019.

No. 6: Palo Alto Networks

CEO: Nikesh Arora

Dec. 31, 2019 Close: $231.25

Dec. 31, 2020 Close: $355.39

Change: +53.68%

Palo Alto Networks unveiled a deal on March 31 to acquire SD-WAN player CloudGenix for $420 million. (The acquisition was completed April 21.) In September the company acquired risk management and digital forensics consulting firm The Crypsis Group for $265 million. And in November Palo Alto Networks inked a deal to buy attack surface management tech developer Expanse for $800 million. (That acquisition was completed Dec. 15.)

For all of fiscal 2020 ended July 31, Palo Alto Networks reported revenue of $3.41 billion, up 17.5 percent from $2.90 billion in fiscal 2019. The company reported a $267.0 million loss for the fiscal year compared with an $81.9 million loss one year earlier.

For the fiscal 2021 first quarter ended Oct. 31, Palo Alto networks reported revenue of $946.0 million, up 23 percent from $771.9 million in the first quarter of fiscal 2020. The company’s loss for the quarter was $92.2 million compared with the $59.6 million loss one year earlier.

Palo Alto Networks ended 2020 with a market cap of $34.41 billion, up 51.92 percent from $22.65 billion at the end of 2019.

No. 5: Netgear

CEO: Patrick Lo

Dec. 31, 2019 Close: $24.51

Dec. 31, 2020 Close: $40.63

Change: +65.77%

Networking equipment manufacturer Netgear had the biggest stock price decline among the companies on our watch list in 2019, with shares losing more than half their value during the year. But the company’s stock rebounded in 2020 to record one of the biggest gains among the companies on our watch list.

With the sudden work-from-home move spurred by the COVID-19 pandemic, Netgear saw demand for its Wi-Fi routers surge in 2020.

For the first three quarters of 2020 ended Sept. 27, Netgear reported revenue of $881.1 million, up 19 percent from $745.8 million in the first three quarters of 2019. The company reported net income of $27.3 million for the three-quarter period, up more than 4 percent from $26.2 million one year earlier.

Netgear ended 2020 with a market cap of $1.23 billion, up 66.46 percent from $738.92 million at the end of 2019.

No. 4: Amazon

CEO: Jeff Bezos

Dec. 31, 2019 Close: $1,847.84

Dec. 31, 2020 Close: $3,256.93

Change: +76.26%

With so many people staying at home because of the pandemic, online shopping surged in 2020. For the nine months ended Sept. 30, Amazon reported sales of $260.51 billion, up 35 percent from $193.09 billion in the first nine months of 2019. Net income for the nine-month period surged nearly 70 percent to $14.11 billion from $8.32 billion one year before.

And Amazon continued to grow its presence in the IT industry with Amazon Web Services. For the nine-month period ended Sept. 30, AWS sales were $32.63 billion, up 30 percent from $25.07 billion one year before. Earlier in the year the company said that AWS revenue for all of 2020 was expected to exceed $40 billion.

Amazon ended 2020 with a market cap of $1.63 trillion, up 78.36 percent from $916.15 billion at the end of 2019.

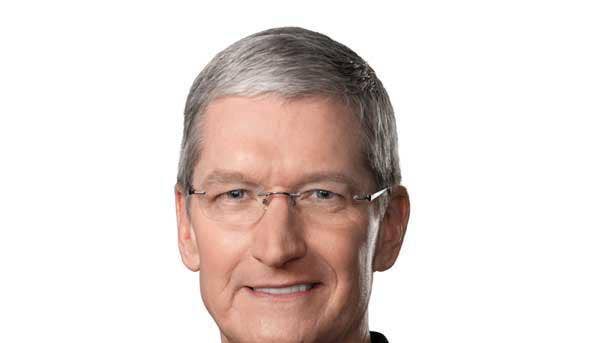

No. 3: Apple

CEO: Tim Cook

Dec. 31, 2019 Close: $75.09

Dec. 31, 2020 Close: $132.69

Change: +76.76%

Apple executed a 4-for-1 stock split on Aug. 31 and the share prices used in this analysis reflect that change.

Apple closed out 2020 with an astounding market capitalization of $2.26 trillion.

On June 22 Apple provided details of its long-reported plans to develop its own Arm-based processors for its Mac computers, displacing the Intel chips that now power the devices. On Nov. 10 the company debuted the M1, the company’s first chip specifically designed for Mac computers, along with introducing new MacBook Air, 13-inch MacBook Pro and Mac Mini systems with the new processor. The launch of the new system-on-a-chip (SoC) marks the start of a two-year transition period to Apple-designed chips.

For all of its fiscal 2020 ended Sept. 26, Apple reported revenue of $274.52 billion, up 5.5 percent from $260.17 billion in fiscal 2019. Net income for the fiscal year was $57.41 billion, up 3.9 percent from $55.26 billion one year earlier.

Apple ended 2020 with a market cap of $2.26 trillion, up 73.54 percent from $1.30 trillion at the end of 2019.

No. 2: ServiceNow

CEO: Bill McDermott

Dec. 31, 2019 Close: $282.32

Dec. 31, 2020 Close: $550.43

Change: +94.97%

ServiceNow began 2020 under new management after Bill McDermott, previously CEO of software giant SAP, took over as ServiceNow CEO on Nov. 18, 2019. He replaced John Donahoe, who left to become the CEO of athletic apparel company Nike.

On June 22 ServiceNow struck a deal to acquire configuration data management pioneer Sweagle. On Nov. 30 the company signed an agreement to buy artificial intelligence tech developer Element AI.

For the first nine months ended Sept. 30 of 2020, ServiceNow reported revenue of $3.27 billion, up more than 30 percent from $2.51 billion in the first nine months of 2019. Net income for the nine-month period was $101.9 million compared with $28.0 million one year earlier.

ServiceNow ended 2020 with a market cap of $107.39 billion, up 101.75 percent from $53.23 billion at the end of 2019.

No. 1: Advanced Micro Devices

CEO: Lisa Su

Dec. 31, 2019 Close: $45.86

Dec. 31, 2020 Close: $91.71

Change: +99.98%

Of all the IT companies on the CRN watch list, chipmaker AMD recorded the biggest stock price gain in 2020.

AMD more than doubled the value of its stock price in 2019 in a year when the chipmaker debuted a stream of innovative products, including its Ryzen and EPYC processors. That momentum continued into 2020 where the company’s stock price was just 1 cent short of doubling its value for a second year.

In May AMD launched new Ryzen Pro 4000 laptop CPUs to compete with Intel’s vPro processors and moved aggressively into the integrated graphics arena with its new Ryzen 4000 G-Series and Pro Series APUs for desktop PCs. In October AMD unveiled its next-generation, 7-nanometer, Zen 3 architecture and the first product line it powers, the Ryzen 5000 desktop processors.

Also in October the chipmaker struck a deal to buy programmable chip developer Xilinx for $35 billion, an acquisition that is expected to strengthen AMD’s competitive position in high-performance computing systems and, according to CEO Lisa Su, position AMD as a stronger strategic force for next-generation data centers.

For the first nine months ended Sept. 26 of 2020, AMD reported revenue of $6.52 billion, up 41.6 percent from $4.60 billion in the first nine months of 2019. Net income for the nine-month period was $709 million, up more than 4X from $171 million one year earlier.

AMD ended 2020 with a market cap of $110.43 billion, up 106.32 percent from $53.52 billion at the end of 2019.

No. 10: Cisco Systems

CEO: Chuck Robbins

Dec. 31, 2019 Close: $47.96

Dec. 31, 2020 Close: $44.75

Change: -6.69%

Cisco Systems is the first on our list of companies with the biggest stock price declines in 2020, coming in at No. 10.

In March Cisco unveiled a number of executive changes and a corporate restructuring that included the creation of a new security and applications group, a future tech business unit, a new mass-scale infrastructure group, and the merger of the company’s silicon group with its hardware platform and optics team. In December the company confirmed that it had cut its workforce by 3,500 since the start of the pandemic.

On May 28 Cisco unveiled a deal to acquire network monitoring company ThousandEyes for nearly $1 billion. Other acquisition deals during the year included cloud security startup Portshift, cloud transformation startup Banzai Cloud, and logs and events analytics tech startup Dashbase.

In October Cisco was ordered by a U.S. District Court judge to pay $1.9 billion for infringing four patents held by cybersecurity startup Centripetal Networks.

For all of fiscal 2020 ended July 25, 2020, Cisco reported sales of $49.30 billion, down 5.3 percent from $51.90 billion in fiscal 2019. Net income for fiscal 2020 was $11.21 billion, down 3.6 percent from $11.62 billion one year earlier.

For its fiscal 2021 first quarter ended Oct. 24, Cisco reported revenue of $11.93 billion, down 9 percent from $13.16 billion in the first quarter of fiscal 2020. Net income for the quarter was $2.17 billion, down nearly 35 percent from $2.93 billion one year earlier.

Cisco ended 2020 with a market cap of $189.09 billion, down 7.06 percent from $203.46 billion at the end of 2019.

No. 9: VMware

CEO: Pat Gelsinger

Dec. 31, 2019 Close: $151.79

Dec. 31, 2020 Close: $140.26

Change: -7.60%

Dell Technologies disclosed in July that the company is mulling a plan to spin off VMware, the virtualization technology leader in which Dell owns an 81 percent stake. Dell’s acknowledgement confirmed reports about a possible spin-off that had been circulating for several weeks.

In a filing with the U.S. Securities and Exchange Commission and in a company statement, Dell said such a move would benefit shareholders of both companies, as well as employees, customers and partners, “by simplifying capital structures and creating additional long-term enterprise value.”

In January VMware reached an agreement to buy network analytics specialist Nyansa in a move to expand its SD-WAN capabilities. In May VMware struck a deal to acquire early stage Kubernetes security startup Octarine. In July the company inked an agreement to buy Datrium in a move to bolster its cloud disaster recovery capabilities. And in September VMware acquired software automation specialist SaltStack.

In December VMware COO Rajiv Ramaswami left the company to become CEO of rival Nutanix, prompting a lawsuit from VMware against the executive.

For the first nine months ended Oct. 30 of the company’s fiscal 2021, VMware reported revenue of $8.47 billion, up 9.5 percent from $7.74 billion in the first nine months of fiscal 2020. Net income for the nine months totaled $1.27 billion compared with $6.04 billion (including an $4.84 billion tax benefit) one year earlier.

VMware ended 2020 with a market cap of $58.88 billion, down 5.37 percent from $62.22 billion at the end of 2019.

No. 8: Juniper Networks

CEO: Rami Rahim

Dec. 31, 2019 Close: $24.63

Dec. 31, 2020 Close: $22.51

Change: -8.61%

In October Juniper Networks struck a deal to buy networking startup 128 Technology in a move to boost its enterprise artificial intelligence and edge computing technology portfolio. And in December it agreed to buy intent-based network startup Apstra.

For the first nine months ended Sept. 30 of 2020, Juniper Networks reported revenue of $3.22 billion, down 0.5 percent from $3.24 billion in the first nine months of 2019. Net income for the nine months grew 28.5 percent to $227.0 million from $176.6 million in the same period one year before.

The company will announce its 2020 fourth quarter and full year results on Jan. 28.

Juniper Networks ended 2020 with a market cap of $7.42 billion, down 9.93 percent from $8.24 billion at the end of 2019.

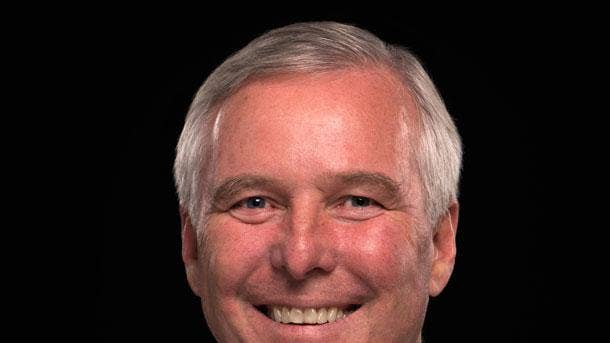

No. 7: Western Digital Corp.

CEO: David Goeckeler

Dec. 31, 2019 Close: $63.47

Dec. 31, 2020 Close: $55.39

Change: -12.73%

On March 5 Western Digital announced the appointment of David Goeckeler as the company’s CEO, replacing Steve Milligan who had previously announced his retirement. Goeckeler joined Western Digital from Cisco Systems where he was executive vice president and general manager of the company’s $34 billion networking and security business.

For the fiscal 2021 first quarter ended Oct. 2, Western Digital reported revenue of $3.92 billion, down 3 percent from $4.04 billion in the first quarter of fiscal 2020. The company reported a $60 million loss for the quarter compared with a $276 million loss one year earlier.

Western Digital ended 2020 with a market cap of $16.85 billion, down 10.74 percent from $18.88 billion at the end of 2019.

No. 6: Intel

CEO: Robert Swan

Dec. 31, 2019 Close: $59.85

Dec. 31, 2020 Close: $49.82

Change: -16.76%

In April Intel reported a surge in demand for its laptop processors due in large part to the abrupt shift of people working from home because of the COVID-19 pandemic.

The year saw a number of key product announcements from Intel including its third-generation Xeon Scalable CPUs, its 10th-generation Intel Core S-Series processors for desktop PCs, and new 10th-generation, enterprise-grade vPro processors for laptops and desktop PCs.

But Intel suffered setbacks in 2020. During the company’s second-quarter earnings call July 23 CEO Bob Swan acknowledged that its 7-nanometer products had been delayed by six months because of slower-than-expected progress with the company’s next-generation manufacturing process—meaning the first 7nm products won’t arrive until late 2022 or early 2023.

On the personnel side Jim Keller, Intel’s top chip design executive, abruptly resigned on June 11 for personal reasons. And on July 27 Intel said that Chief Engineering Officer Venkata Murthy Renduchintala, whose responsibilities included 7nm and manufacturing operations, was leaving the company.

For the first nine months of 2020 ended Sept. 26, Intel reported revenue of $57.89 billion, up nearly 12 percent from $51.76 billion in the first nine months of 2019. Net income for the nine months was $15.04 billion, up 6 percent from $14.14 billion one year before.

Intel ended 2020 with a market cap of $204.16 billion, down 21.58 percent from $260.35 billion at the end of 2019.

No. 5: NortonLifeLock

CEO: Vincent Pilette

Dec. 31, 2019 Close: $25.52

Dec. 31, 2020 Close: $20.78

Change: -18.57%

After chip manufacturer Broadcom acquired Symantec's $2.5 billion enterprise security business in late 2019, Symantec’s consumer business, renamed NortonLifeLock, was spun off as an independent, publicly traded entity and continued to trade on the Nasdaq exchange.

In December NortonLifeLock struck a deal to buy Avira, a Germany-based developer of consumer-focused cybersecurity and privacy software marketed in Europe and key emerging markets.

For the first six months ended Oct. 2 of its fiscal 2021, NortonLifeLock reported revenue of $1.24 billion, down 1.4 percent from $1.26 billion in the first six months of fiscal 2020. Net income for the six-month period was $182 million compared with $811 million (including $735 million from discontinued operations) one year before.

NortonLifeLock ended 2020 with a market cap of $12.30 billion, down 22.70 percent from $15.91 billion at the end of 2019.

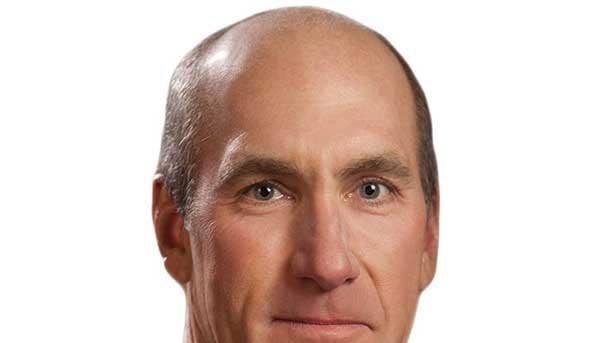

No. 4: Hewlett Packard Enterprise

CEO: Antonio Neri

Dec. 31, 2019 Close: $15.86

Dec. 31, 2020 Close: $11.85

Change: -25.28%

On Dec. 1 Hewlett Packard Enterprise said that it is moving its headquarters to Houston.

In July HPE unveiled a deal to acquire SD-WAN tech vendor Silver Peak for $925 million in a move to bolster the SD-WAN offerings of its HPE Aruba business. The acquisition was completed in September.

For all of fiscal 2020 ended Oct. 31, HPE reported revenue of $26.98 billion, down more than 7 percent from $29.14 billion in fiscal 2019. The company reported a $322 million loss for the fiscal year compared with net income of $1.05 billion one year before.

HPE ended 2020 with a market cap of $15.33 billion, down 25.27 percent from $20.51 billion at the end of 2019.

No. 3: Lumen Technologies

CEO: Jeff Storey

Dec. 31, 2019 Close: $13.21

Dec. 31, 2020 Close: $9.75

Change: -26.19%

In September communications service provider CenturyLink changed its name to Lumen Technologies.

For the first nine months ended Sept. 30 of 2020, Lumen Technologies reported operating revenue of $15.59 billion, down 3 percent from $16.15 billion in the first nine months of 2019. Net income for the nine-month period was $1.06 billion compared with a $5.49 billion loss one year before.

Lumen Technologies ended 2020 with a market cap of $10.70 billion, down 19.02 percent from $13.21 billion at the end of 2019.

No. 2: AT&T

CEO: John Stankey

Dec. 31, 2019 Close: $39.08

Dec. 31, 2020 Close: $28.76

Change: -26.41%

In April AT&T said that CEO Randall Stephenson would retire as of July 1. AT&T President and Chief Operating Officer John Stankey was named the new CEO.

On June 16 AT&T said it would cut more than 3,400 jobs and shutter more than 250 retail stores as a direct result of the pandemic-induced recession.

For the first nine months of 2020 ended Sept. 30, AT&T reported operating revenue of $126.07 billion, down 6.2 percent from $134.37 billion in the first nine months of 2019. Net income for the nine-month period was $9.69 billion, down 21 percent from $12.27 billion one year before.

AT&T will release its fourth-quarter financial results on Jan. 27.

AT&T ended 2020 with a market cap of $204.94 billion, down 28.21 percent from $285.48 billion at the end of 2019.

No. 1: Xerox

CEO: John Visentin

Dec. 31, 2019 Close: $36.87

Dec. 31, 2020 Close: $23.19

Change: -37.10%

Xerox began 2020 pursuing an unsolicited bid to take over HP Inc., its leading competitor in the printer market.

HP had rejected the Xerox proposal and on Nov. 26, 2019, Xerox launched a direct appeal to HP stockholders, asking them to sell their shares to Xerox. The maneuvering and posturing continued into the new year and Xerox at one point upped its offer from $22 per share to $24 per share for a total of $34.9 billion.

But Xerox’s efforts were ultimately stymied by the COVID-19 pandemic. Xerox dropped its buyout effort on March 31, citing the pandemic and the “resulting macroeconomic and market turmoil.”

On Dec. 11 Xerox named company veteran Xavier Heiss to be the company’s CFO, replacing William Osbourn, who left in September for personal reasons.

For the first nine months ended Sept. 30 of 2020, Xerox reported revenue of $5.09 billion, down 23 percent from $6.62 billion in the first nine months of 2019. The company reported net income of $115 million for the nine-month period, down 78.5 percent from $535 million in net income one year earlier.

Xerox ended 2020 with a market cap of $4.60 billion, down 42.27 percent from $7.97 billion at the end of 2019.