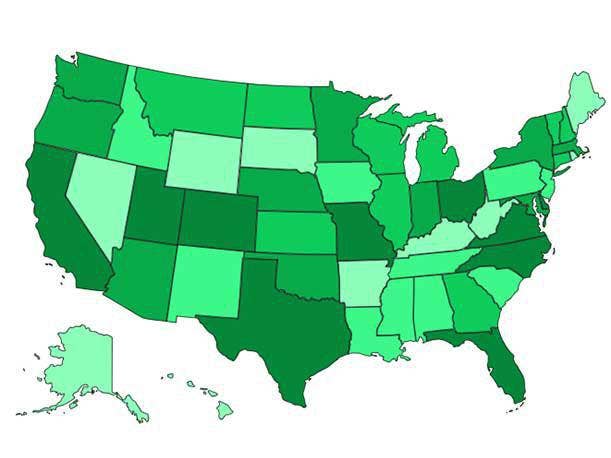

Top States For Business In 2018: Starting A Solution Provider Company

Worst To First: What Does Your State Have To Offer?

With the economy humming along and the demand for IT services continuing to grow, more people who work in the IT industry–either on the business or the technical side – may be getting the entrepreneurial bug and considering striking out on their own to start a solution provider business.

Such entrepreneurs face a lot of challenges. Where can they find the talented employees they'll need to make their startup vision a reality? How abundant are the business opportunities needed to ensure success? And what kind of hurdles will the new business face in terms of costs, taxes and regulations?

The answers to those questions can vary widely based on where in the U.S. an entrepreneur starts his or her business. The following ranks all 50 states, starting with the worst (No. 50) to the best (No. 1) for starting and growing a solution provider business.

The findings are based on a CRN Research analysis of a broad range of data, including the education and experience level of each state's workforce, labor and business operating costs, and tax and regulatory burdens. States are also ranked for their potential for fostering innovation, spurring growth and generating business opportunities.

We've also cross-referenced the results with CRN's 2018 Solution Provider 500, noting how many of the biggest solution providers call each state home.

Take a look. The results might surprise you.

No. 50: West Virginia (No. 50 in 2017)

Number Of Solution Provider 500 Companies: Zero

West Virginia ranked No. 50 in this year's Best States study–the fourth year in a row the Mountain State has come in last among the states.

Finding technical talent in West Virginia is tough: It ranked No. 48 in the education and experience levels of its workforce (behind only Louisiana and Mississippi). More than 73 percent of Louisiana's labor force lacks a four-year degree and the state ranked No. 49 in a WalletHub study of the most and least educated states in America.

The tech industry employed 30,311 people in the state in 2017, down 265 from the year before –one of only 13 states whose technology industry lost employees last year.

West Virginia's GDP grew 2.6 percent in 2017. Nevertheless, the state was ranked No. 50 in entrepreneurship and innovation–the state was No. 45 in the WalletHub 2018 Best States to Start a Business ranking and No. 50 in the CNBC Technology and Innovation Rank.

West Virginia was No. 25 for taxes and regulations in our research. The Tax Foundation ranked the state No. 19 on its 2018 State Business Tax Climate Index, which calculates the overall tax burden on businesses from a state's corporate, individual income, sales/local, property and unemployment insurance taxes.

No. 49: Nevada (No. 41 in 2017)

Number Of Solution Provider 500 Companies: One

Nevada's ranking in this year's Best States study suffered from its No. 49 rank in state infrastructure, No. 48 in personal cost of living and quality of life (the state was No. 48 for violent crimes), and No. 46 in workforce education and experience. On the latter, CNBC scored the Silver State last among all states for education in its America's Top States for Business 2018 and nearly 73.9 percent of its workforce lacks a four-year college degree.

On the tax and regulation front, Nevada was ranked a relatively poor No. 39 in this study: While Nevada has no personal or corporate income tax (it does impose a "gross receipts" tax on businesses), high sales/local and unemployment taxes hurt the state's ranking.

Nevada was ranked No. 33 for entrepreneurship and innovation and No. 31 for business climate and competitive environment– the latter despite robust 3.5 percent GDP growth in 2017.

No. 48: Kentucky (No. 40 in 2017)

Number Of Solution Provider 500 Companies: Four

Kentucky's overall ranking is pulled down by its low scores for entrepreneurship (No. 47) and taxes/regulations (No. 48). The technology sector accounts for only 4 percent of the state's total gross state product and employed 94,021 in 2017, down by 55 from one year earlier.

The Bluegrass State is ranked No. 33 on the Tax Foundation's 2018 State Business Tax Climate Index because of its high unemployment insurance and property taxes.

Kentucky ranked No. 43 for the overall education and experience of its workforce: 70.9 percent of the workforce doesn't have a four-year college degree.

Kentucky did rank No. 9 for personal cost of living/quality of life, largely due to its low median monthly housing costs (at $675, third lowest among the states) and median rental costs (fourth lowest at $769 for a two-bedroom apartment). But the state is also ranked No. 47 for median household income ($45,369).

No. 47: Arkansas (No. 43 in 2017)

Number Of Solution Provider 500 Companies: One

Arkansas was ranked a poor No. 49 for entrepreneurship and innovation and a mediocre No. 36 for business climate/competitive environment–the latter pulled down by the state's anemic 1.1 percent GDP growth in 2017.

The Natural State ranked No. 45 in workforce education and experience: 72.6 percent of the workforce doesn't have a four-year college degree. Its total technology employment (59,428) in 2017 represented a gain of 510.

The state's No. 34 rank for taxes and regulations is pulled down by its 6.5 percent sales tax and 6.5 percent corporate income tax.

Arkansas does have the lowest labor and electricity costs among the 50 states and is ranked No. 2 in cost of living by CNBC America's Top States For Business 2018: A two-bedroom apartment rents for $722 a month, lowest in the U.S.

No. 46: Hawaii (No. 47 in 2017)

Number Of Solution Provider 500 Companies: Zero

Hawaii is often ranked in the bottom five of our study because of its high costs. The state ranked No. 49 in personal cost of living and quality of life due to its highest-in-the-nation median monthly housing costs ($1,438), high rental costs, and high personal income tax (11 percent, second only to California's 13.3 percent personal income tax).

The Aloha State is ranked a low No. 42 in entrepreneurship and innovation and a low No. 41 in business climate and competitive environment. The state's GDP grew a lackluster 1.7 percent in 2017 and the tech sector represents only 3.8 percent of total gross state product–among the lowest 10 states.

Hawaii was No. 50 in the WalletHub 2018 Best States to Start a Business ranking.

Hawaii is ranked No. 28 for workforce education and experience: 68.0 percent of its workforce doesn't have a four-year degree.

No. 45: Alaska (No. 48 in 2017)

Number Of Solution Provider 500 Companies: One

Like Hawaii, Alaska is an expensive place to run a business: It is ranked No. 50 for overall labor and operating costs.

The Last Frontier state is No. 50 in business climate/competitive environment, not surprising given that state GDP grew only 0.2 percent in 2017. Contributing to the state's No. 41 rank in entrepreneurship and innovation was the fact Alaska has only 929 tech business establishments (No. 50).

In July the state's unemployment rate was 6.1 percent–highest in the nation–and its tech industry employment declined by 194 in 2017 to 18,684.

Alaska is ranked a respectable No. 20 in the taxes and regulations department. The state has no individual income or sales tax, although it does have a 9.4 percent corporate income tax. Alaska, nevertheless, is a business-friendly No. 3 on the Tax Foundation's State Business Tax Climate Index.

No. 44: South Dakota (No. 38 in 2017)

Number Of Solution Provider 500 Companies: One

South Dakota's mediocre ranking in workforce education/experience (No. 34) isn't enough to compensate for its poor rankings in entrepreneurship and innovation (No. 46) and business climate and competitive environment (No. 47).

The Mount Rushmore State is ranked No. 50–dead last–on the 2017 Kauffman Rate of Startup Growth Index. Its GDP grew only 0.3 percent in 2017. And the state is No. 48 for tech industry employment, according to the 2018 CompTIA Cyberstates report.

On the plus side, South Dakota has no individual or corporate income tax and its 4.5 percent sales tax is on the low side. (But it does have a high unemployment insurance tax.) And the state boasts a No. 11 rank for low labor and operating costs.

No. 43: Maine (No. 46 in 2017)

Number Of Solution Provider 500 Companies: One

Maine is ranked No. 47 in taxes and regulations. The Pine Tree State's corporate income tax is a high 8.93 percent and its individual income tax is 7.15 percent. Toss in its high property taxes and the state's overall rank on the Tax Foundation's 2018 State Business Tax Climate Index is a middling No. 28.

The state also fares poorly in business climate/competitive environment with a No. 44 ranking. WalletHub ranks Maine's economy at No. 45 and the state's GDP growth in 2017 was a mediocre 1.4 percent.

Maine is a respectable No. 18 in personal cost of living and quality of life, a ranking boosted by its No. 1 rank for the having the lowest rate of violent crime.

No. 42: Wyoming (No. 44 in 2017)

Number Of Solution Provider 500 Companies: One

Wyoming is No. 49 in business climate and competitive environment. The least populous state in the nation also has the fewest number of small and midsize businesses (under $1 billion in revenue) that make for potential customers for a solution provider. On the plus side, the Cowboy State has the smallest number of solution providers per capita, meaning a startup solution provider will have less competition.

Wyoming fares much better in the taxes and regulations arena. With no corporate or individual income tax and a 4 percent sales tax, the Tax Foundation ranks the state No. 1 on its 2018 State Business Tax Climate Index. (The state is ranked No. 26 in our study because of high state unemployment insurance and property taxes.)

The share of the state's workforce without a four-year college degree is 74.5 percent, second highest behind only Mississippi.

No. 41: Rhode Island (No. 49 in 2017)

Number Of Solution Provider 500 Companies: Two

Rhode Island has long battled a reputation as a "business-unfriendly" state and some of the Ocean State's rankings in this year's study, including No. 47 in labor and operating costs and No. 42 in business climate/competitive environment, show it still has a ways to go.

On the plus side, Rhode Island is ranked No. 12 in state infrastructure and a respectable No. 21 in workforce education and experience–the state is in the top 10 states with the percentage of people 25 or older with an advanced degree (13.4 percent).

Rhode Island is No. 27 in taxes and regulations: The state's individual income tax is 5.99 percent while its corporate income and sales taxes are set at 7 percent.

No. 40: New Mexico (No. 36 in 2017)

Number Of Solution Provider 500 Companies: One

New Mexico's overall ranking is pulled down by its poor scores in labor and operating costs (No. 44) and workforce education and experience (No. 42). The state's share of the labor force without a four-year college degree, a high 72.9 percent, is No. 46 among all states.

The tech sector accounts for 10 percent of New Mexico's total gross state product and the state's tech sector employed 66,997 in 2017, down 318 from the year before.

The Land of Enchantment State does rank a relatively favorable No. 17 in taxes and regulations. The Tax Foundation ranks it No. 1 for low property taxes.

New Mexico's GDP grew only 0.8 percent in 2017, bringing down its business climate and competitive environment ranking to No. 38. WalletHub ranked the state only No. 43 in its Best States to Start a Business.

No. 39: Mississippi (No. 42 in 2017)

Number Of Solution Provider 500 Companies: Three

Mississippi is ranked last, No. 50, in workforce education and experience. It has the highest percentage of the labor force without a four-year college degree (75.7).

The tech sector accounts for only 3.0 percent of Mississippi's total gross state product, ranking it No. 48. And the state's GDP grew only 0.3 percent in 2017.

The Magnolia State is ranked a favorable No. 7 for taxes and regulations, due to its low unemployment insurance tax and relatively low (5.0 percent) corporate income tax.

Mississippi is ranked No. 1 in cost of living. But the state's overall rank on the personal cost of living/quality of life criteria (No. 20) takes a hit from having the lowest median household income ($41,099) in the country.

No. 38: Idaho (No. 34 in 2017)

Number Of Solution Provider 500 Companies: Two

Idaho is ranked No. 2 for its low labor and operating costs, including low energy costs. But the Gem State ranks a surprisingly poor No. 44 in taxes and regulations. Despite low property taxes, Idaho has a 7.4 percent corporate income tax and a 6.0 percent sales tax.

Idaho also fares poorly in workforce education and experience, where it's ranked No. 41.

Idaho was ranked a middling No. 28 for entrepreneurship and innovation and No. 32 for business climate/competitive environment. Idaho's GDP, however, grew a healthy 2.7 percent in 2017.

The state's overall rank gets a boost from its No. 2 rank in personal cost of living/quality of life.

No. 37: Alabama (No. 30 in 2017)

Number Of Solution Provider 500 Companies: Three

Alabama is ranked a solid No. 11 in taxes and regulatory environment, despite having some high local taxes that bring the Yellowhammer State's rank down to No. 35 on the Tax Foundation's State Business Tax Climate Index. Alabama has a relatively low 4.0 percent sales tax and middling corporate income tax rate of 6.5 percent.

Alabama doesn't fare as well with the education and experience level of its workforce, where it's ranked No. 44. Likewise, it’s No. 43 rank for entrepreneurship and innovation: The Information Technology & Innovation Foundation's Center for Data Innovation ranked Alabama a poor No. 47 in its ability to attract and grow data-driven companies.

Alabama does do better in business climate and competitive environment, where it's No. 29, despite the state's lackluster 1.2 percent GDP growth in 2017.

No. 36 Louisiana (No. 45 in 2017)

Number Of Solution Provider 500 Companies: Four

Finding technical talent in the Pelican State is tough: It ranked No. 49 in the education and experience levels of its workforce (behind only Mississippi). Nearly 73 percent of Louisiana's labor force lacks a four-year degree and the state is ranked No. 48 in a WalletHub study of the most and least educated states in America.

The state's tech industry employed 81,531 people in 2017, down 1,256 from the year before– the biggest decline among all states. And the tech sector accounted for only 3.0 percent of the state's total gross state product in 2017, ranking it No. 49.

On the plus side, Louisiana is No. 9 in taxes and regulations. That's despite having an 8.0 percent corporate income tax and a poor ranking (No. 42) on the Tax Foundation's 2018 State Business Tax Climate Index.

The state ranked a respectable No. 19 in state infrastructure, but a middling No. 30 in business climate and competitive environment–the state's GDP declined 0.2 percent in 2017 over 2016– and a low No. 44 for entrepreneurship and innovation. WalletHub did rank Louisiana No. 18 on its Best States to Start a Business because of its lower costs.

No. 35: Pennsylvania (No. 23 in 2017)

Number Of Solution Provider 500 Companies: 12

Pennsylvania took a serious dip in this year's Best States analysis and the Keystone State's No. 50 ranking in taxes and regulatory environment (No. 46 last year) is the main reason it fares so poorly. Pennsylvania's 9.99 percent corporate tax rate is second only to Iowa's 12.0 percent and this year the state is ranked No. 50 by the Tax Foundation with the highest unemployment insurance taxes.

Pennsylvania ranks No. 13 for the education and experience level of its workforce, No. 10 for business climate and competitive environment (although its 1.8 percent GDP growth in 2017 was below the national 2.3 percent), and No. 19 for entrepreneurship and innovation.

Employment in the state's tech sector was 425,161 in 2017 (No. 7 among all states), up 4,526 from 2016.

No. 34: South Carolina (No. 32 in 2017)

Number Of Solution Provider 500 Companies: Three

South Carolina is generally known as being one of the most business-friendly states: It has the lowest percentage (2.6 in 2017) of unionized employed wage and salary workers, for example, according to the Bureau of Labor Statistics.

The Palmetto State is generally ranked toward the middle or the lower end of most of the Best States criteria. It's a rather poor No. 36 in workforce education and experience and No. 38 in entrepreneurship and innovation.

The state fares somewhat better in business climate and competitive environment (No. 24). Its 2.3 percent GDP growth in 2017 was in line with the national rate.

But South Carolina is a surprisingly low No. 31 in taxes and regulations. While its corporate income tax rate is only 5.0 percent, among the five lowest states that have such a tax, its individual income tax is 5.499 percent and its sales tax is 6.0 percent.

No. 33: New Jersey (No. 26 in 2017)

Number Of Solution Provider 500 Companies: 29

Like Pennsylvania, New Jersey has slipped in this year's Best States rankings. The state is No. 43 for its high labor and operating costs (No. 37 last year). CNBC America's Top States for Business ranks it No. 50 for labor costs.

Even worse is the Garden State's No. 46 ranking in taxes and regulatory environment: Its high corporate and individual income taxes and sales/local taxes earned New Jersey the No. 50 spot on the Tax Foundation's 2018 State Business Tax Climate Index.

New Jersey is ranked No. 7 in workforce education and experience: 43.9 percent of the labor force has a four-year college degree, ranked No. 3 in the nation (only Massachusetts and Maryland have higher rates of college graduates.)

New Jersey is ranked No. 14 in both entrepreneurship/innovation and business climate/competitive environment, the latter despite GDP growth of just 0.9 percent last year.

And the state takes a big hit from its poor No. 47 rank for cost of living and quality of life, the result of its high income and sales/local taxes, and high housing and rental costs.

No. 32: Iowa (No. 28 in 2017)

Number Of Solution Provider 500 Companies: Eight

Iowa's overall ranking was helped by its No. 3 rank in having low labor and operating costs. It scored well (ranked No. 14) in cost of living/quality of life, helped by its low housing and rental costs.

The Hawkeye State's overall showing wasn't helped by its relatively poor rank (No. 37) in taxes and regulatory environment. Iowa's 12.0 percent corporate income tax rate is the highest in the nation while its 8.98 percent individual income tax rate is fourth highest (behind California, Oregon and Minnesota).

Iowa otherwise ranks in the middle of the pack or lower when it comes to other Best States criteria including workforce education and experience (No. 31), entrepreneurship and innovation (No. 39) and business climate/competitive environment (No. 28).

No. 31: Tennessee (No. 24 in 2017)

Number Of Solution Provider 500 Companies: Five

Tennessee has a mixed bag of rankings across the Best States criteria. The Volunteer State, for example, is ranked a favorable No. 12 in labor and operating costs and a not-so-favorable No. 45 in entrepreneurship and innovation. (The tech sector accounts for just 5 percent of total gross state product, No. 37 among all states.)

The state ranks No. 21 in taxes and regulatory environment and is a relatively attractive No. 14 on the Tax Foundation's 2018 State Business Tax Climate Index. Its corporate income tax rate is a middling 6.5 percent, but its sales tax is a high 7.0 percent.

Tennessee is ranked No. 37 in workforce education and expertise, but fares better in business climate/competitive environment, where it's ranked No. 22.

No. 30: Connecticut (No. 35 in 2017)

Number Of Solution Provider 500 Companies: Eight

Connecticut has a highly educated and experienced workforce, according to the state's No. 5 ranking. The share of the state's labor force with a four-year college degree is 41.9 percent, among the highest (ranked No. 5). And 16.7 percent of the state's residents 25 or older have an advanced degree, No. 3 in the country.

But there's a price there as the Constitution State has some of the highest labor and operating costs in the nation (ranked No. 49), including a high cost of electricity (No. 48).

Connecticut scores a middling No. 22 on entrepreneurship and innovation and No. 26 in business climate/competitive environment–its GDP actually dropped 0.2 percent in 2017, one of only three states whose GDP declined. The state is No. 24 in taxes and regulations, despite having high property taxes and a corporate income tax rate of 8.25 percent. At least some of that tax money is spent on state infrastructure, where Connecticut is ranked No. 10.

Connecticut has the second highest median household income ($75,923) in the U.S., but that isn't enough to overcome other criteria such as high housing and rental costs that bring down the state's personal cost of living/quality of life ranking to No. 44.

No. 29: Michigan (No. 16 in 2017)

Number Of Solution Provider 500 Companies: 14

Like Connecticut, Michigan's overall Best States performance is hurt by the state's high labor and operating costs (No. 45, a big drop in rank from last year). But the Great Lakes State also takes a hit from its poor (No. 42) taxes and regulation ranking, which includes high unemployment insurance taxes.

Michigan does score well in both entrepreneurship and innovation and in business climate/competitive environment, ranking No. 12 in both sets of criteria. CNBC America's Top States for Business 2018 ranked Michigan No. 3 for technology and innovation. The state added 13,161 tech jobs in 2017, third only to California and Texas.

No. 28: Montana (No. 37 in 2017)

Number Of Solution Provider 500 Companies: Zero

Montana moved up in this year's Best States analysis thanks to better showings in workforce education and experience (No. 23) and in entrepreneurship and innovation (No. 31)–the latter despite that tech accounts for only 4 percent of the Treasure State's total gross state product.

Montana is ranked No. 15 in taxes and regulations: The Tax Foundation ranks the state a favorable No. 6 on its State Business Tax Climate Index. The state has no sales tax while its corporate income tax is set at 6.75 percent.

The state's business climate and competitive environment ranking (No. 43) reflects its lackluster 0.6 percent GDP growth in 2017.

Montana is ranked No. 3 in personal cost of living/quality of life, given its low taxes and low housing costs.

No. 27: Illinois (No. 18 in 2017)

Number Of Solution Provider 500 Companies: 28

Illinois takes the No. 1 ranking in state infrastructure, earning high scores for its airports, public transportation, cellphone coverage and other criteria.

Illinois also placed well in workforce education and experience (No. 12) and even better in business climate/competitive environment (No. 9)–the latter boosted by the state's large number of businesses, including small and midsize businesses, that make up much of a solution provider's prospective customer base.

But Illinois is a dismal No. 45 in taxes and regulations. The Prairie State has a high corporate income tax (9.5 percent) and high property and unemployment insurance taxes. And Illinois is No. 43 in personal cost of living/quality of life.

No. 26: New Hampshire (No. 21 in 2017)

Number Of Solution Provider 500 Companies: Four

New Hampshire was ranked No. 1 for the personal cost of living/quality of life criteria in this year's Best States review. The Granite State has no sales tax or personal income tax (it does tax interest and dividends at 5.0 percent). It also has the highest median household income ($76,260) in the U.S. and the third lowest violent crime rate.

The state is ranked No. 6 for its educated and experienced workforce: CNBC America's Top States for Business 2018 ranked the state No. 2 in education.

The tech sector accounts for 13 percent of New Hampshire's total gross state product, No. 6 among all states.

Where New Hampshire stumbles is in the taxes it charges businesses: Its 8.2 percent corporate income tax rate is among the dozen highest and the state has high property and unemployment insurance taxes. All that earns the state a poor No. 41 in the taxes and regulations.

No. 25: Vermont (No. 39 in 2017)

Number Of Solution Provider 500 Companies: Zero

Vermont, New Hampshire's neighbor, shares some of its attributes (Vermont has the second lowest rate of violent crime to New Hampshire's No. 3 ranking), for example, and both states boast highly educated workforces (Vermont is No. 11). But there are differences.

On the tax and regulation front, Vermont is No. 22 in our ranking, even though Vermont's corporate income tax is a bit higher (8.5 percent) than in New Hampshire. The Green Mountain State also has high property taxes, but lower unemployment insurance taxes. Vermont has a high 8.95 percent individual income tax rate, which gives the state an unfavorable No. 47 rank on the Tax Foundation's State Business Tax Climate Index. (Our Best States research factors individual tax rates into the personal cost of living/quality of life category of criteria.)

Vermont, however, ranks almost at the bottom (No. 48) for business climate and competitive environment. The rural state's GDP is the smallest of all 50 states, it has the second-fewest number of small and midsize businesses (behind only Wyoming), and it has the second-fewest number of private businesses overall (behind only Alaska). So it's not surprising that WalletHub ranked Vermont a poor No. 46 among the states for starting a new business.

No. 24: Georgia (No. 12 in 2017)

Number Of Solution Provider 500 Companies: 19

Fueled by its thriving economy, Georgia is ranked No. 7 in business climate and competitive environment. The Peach State recorded 2.7 percent GDP growth in 2017, outpacing the nation's 2.3 percent growth. The state also has a solid base of businesses that provide a potential customer base for a solution provider: It's No. 6 in the number of small and midsize businesses and No. 3 in fast-growing firms.

Georgia is also ranked a respectable No. 16 in entrepreneurship and innovation. The tech sector accounted for 10 percent of Georgia's total gross state product (No. 11) and the state is ranked No. 7 for the number of tech establishments (17,989). In 2017 Georgia added 7,292 tech jobs, No. 9 in tech jobs growth.

But Georgia is ranked a relatively poor No. 36 in taxes and regulations. Its individual and corporate income tax rates are a middling 6.0 percent and it has high unemployment insurance taxes.

No. 23: North Dakota (No. 29 in 2017)

Number Of Solution Provider 500 Companies: One

North Dakota's economy, which exploded five years ago with the oil and gas fracking boom, has returned to earth in recent years.

On the plus side, North Dakota is ranked No. 5 for its low labor and operating costs. And the Peace Garden State is a favorable No. 12 in taxes and regulations: Its corporate income tax is a low 4.31 percent and its individual income tax is 2.9 percent.

But North Dakota is ranked a dismal No. 45 in business climate and competitive environment. The state's GDP grew just 1.0 percent in 2017 and the sparsely populated state means there are few business establishments (it's No. 47 in the number of small and midsize businesses) for a solution provider's customer base.

North Dakota is ranked No. 32 in workforce education and experience: It has the lowest rate (7.7 percent) of people over 25 who have an advanced degree.

No. 22: Wisconsin (No. 25 in 2017)

Number Of Solution Provider 500 Companies: 13

Wisconsin ranks No. 2 in state infrastructure with good grades in such criteria as internet speeds and airport availability. And the Badger State is No. 11 in quality of life, a ranking driven by a relatively low (5.0 percent) sales tax, moderate housing costs and a decent $59,817 median household income. (That quality of life ranking would be higher, however, if not for the state's individual income tax rate of 7.65 percent, among the 10 highest in the country.)

The state is ranked a favorable No. 8 in labor and operating costs and No. 17 in workforce education and experience. But Wisconsin's No. 40 rank in taxes and regulations is hurt by the state's relatively high 7.9 percent corporate income tax and high unemployment insurance taxes.

No. 21: Kansas (No. 27 in 2017)

Number Of Solution Provider 500 Companies: Five

Kansas' overall rank is pulled up by its No. 13 ranking in taxes and regulations: Most of its taxes are in the middle of the pack (corporate income tax is 7.0 percent and the individual income tax is 5.7 percent) while its unemployment insurance taxes are low.

The Sunflower State's rankings are low in entrepreneurship and innovation (No. 36) and business climate/competitive environment (No. 37). In 2017 the state's GDP dropped by 0.1 percent (one of only three states to record a decline) and its tech employment ranks shrank by 271 to 96,062.

WalletHub ranks Kansas No. 2 for traffic and roadway infrastructure, boosting the state's overall Infrastructure ranking to No. 17.

No. 20: Arizona (No. 20 in 2017)

Number Of Solution Provider 500 Companies: 10

Arizona's low corporate and individual income tax rates (4.90 and 4.54 percent, respectively) are among the lowest while its 5.60 percent sales tax is about average. The result is a favorable No. 14 ranking in taxes and regulations.

The Grand Canyon State also scores well in entrepreneurship and innovation (No. 15) and business climate/competitive environment (No. 18). Arizona's economy is booming–GDP growth was a robust 3.2 percent in 2017. The tech sector accounted for 10 percent of the state's total gross state product and last year the state grew its tech workforce by 4,292.

Arizona stumbles in workforce education and experience, however, where it's ranked No. 40 in our Best States study. (CNBC America's Best States for Business ranks it No. 48 in education.) Only 30.6 percent of the labor force has a four-year college degree, No. 34 among all states.

No. 19: Oklahoma (No. 33 in 2017)

Number Of Solution Provider 500 Companies: Four

Oklahoma is ranked No. 3 in taxes and regulations, with low property and unemployment insurance taxes, a 6.0 percent corporate income tax rate and 5.0 percent individual income tax.

On the flip side, the Sooner State is No. 47 in workforce education and experience and 70.0 percent of the labor force lacks a four-year college degree. Oklahoma lost 787 tech jobs in 2017, second only to Louisiana's 1,256.

Oklahoma is No. 16 in labor and operating costs: The oil-rich state has the second-lowest electricity costs, behind only Arkansas.

No. 18: Oregon (No. 9 in 2017)

Number Of Solution Provider 500 Companies: Four

Oregon was No. 11 in entrepreneurship and innovation, not so surprising given that the tech sector accounts for 13 percent of the state's total gross state product (No. 6 among all states). But the Beaver State is ranked a middling No. 20 in business climate and competitive environment: While its 2.5 percent GDP growth last year beat the national average, it was below the GDP growth generated by neighbors like Washington (4.4 percent) and California (3.0 percent).

Oregon's overall showing in this year's Best States got a big boost from its No. 5 ranking in personal cost of living/quality of life criteria where Oregon's lack of a statewide sales tax was a significant factor.

The lack of any sales tax also helped with Oregon's tax and regulation rank (No. 30) where the corporate income tax rate is 7.6 percent and the individual income tax rate is 9.9 percent– behind only California and Hawaii.

No. 17: New York (No. 17 in 2017)

Number Of Solution Provider 500 Companies: 41

New York is No. 2 in workforce education and experience, behind only Massachusetts: 42.6 percent of the state's labor force has a four-year college degree (No. 4) and 15 percent of people 25 or older have an advanced degree (No. 5). The Empire State added 10,368 tech jobs in 2017, bringing its total tech employment to 639,491, behind only Texas and California.

The state ranks No. 5 for entrepreneurship and innovation and No. 3 for business climate/competitive environment. The latter, despite anemic GDP growth of 1.1 percent last year, is largely due to such factors as access to capital and the large number of businesses that make up a solution provider's potential customer base.

Thanks to its extensive public transportation systems, New York ranks No. 5 in state infrastructure.

Not surprisingly, New York is an expensive place to start and operate a business. It's No. 46 in labor and operating costs. And high housing costs (the monthly median is $1,132) and 8.82 percent individual income tax rate bring down the state's personal cost of living/quality of life ranking to No. 38.

No. 16: Minnesota (No. 15 in 2017)

Number Of Solution Provider 500 Companies: 15

Minnesota ranks high in entrepreneurship and innovation (No. 10). The North Star State added 3,505 tech jobs in 2017 and is No. 17 in both the number of technology business establishments (9,506) and in tech employment. The state is No. 16 in business climate and competitive environment, a ranking that might have been hurt by its 1.9 percent GDP growth in 2017.

Minnesota is ranked No. 10 in workforce education and experience and No. 12 in personal cost of living/quality of life.

But the state is ranked No. 43 in taxes and regulations. Its 9.8 percent corporate income is third highest in the nation while its 9.85 percent individual income tax is fourth highest. The Tax Foundation ranks Minnesota No. 46 overall on its 2018 State Business Tax Climate Index.

No. 15: Maryland (No. 14 in 2017)

Number Of Solution Provider 500 Companies: 22

Maryland is ranked No. 7 in entrepreneurship and innovation. The Information Technology & Innovation Foundation's Center for Data Innovation ranked the Old Line State No. 3 in its Best States for Data Innovation report. And the tech sector accounts for 11 percent of total gross state product, No. 8 among the states.

Maryland also shined in the workforce education and experience realm, where it ranked No. 9. It had the second highest share of the workforce with a four-year college degree (44.6 percent) and was No. 2 in the percent of people over 25 with an advanced degree (17.7 percent).

While the state is ranked No. 28 in taxes and regulations (its corporate income tax rate is set at 8.25 percent), it is a poor No. 39 in labor and operating costs. It's also No. 34 in personal cost of living/quality of life: It has the third highest monthly housing costs ($1,230) in the country.

On the plus side, its public transportation systems push its state infrastructure ranking to No. 8, despite a No. 48 ranking for traffic and infrastructure by WalletHub.

No. 14: Indiana (No. 19 in 2017)

Number Of Solution Provider 500 Companies: Seven

Indiana rises in our Best States rankings because of its No. 5 rank in taxes and regulations. The Hoosier State has a middle-of-the-road corporate income tax rate (6.0 percent) and low individual income tax (3.23 percent), plus low property and unemployment insurance taxes. The Tax Foundation ranks Indiana No. 9 overall on its 2018 State Business Tax Climate Index.

The state generates relatively favorable rankings in labor and operating costs (No. 17) and business climate/competitive environment (No.19): Its GDP grew at 2.1 percent in 2017, just below the national average.

But the state's No. 38 ranking in workforce education and experience is rather poor.

No. 13: Massachusetts (No. 7 in 2017)

Number Of Solution Provider 500 Companies: 18

Massachusetts is tops in workforce education and experience. It has the largest share of the workforce (49.0 percent) with a four-year college degree and is No. 1 in having the most people 25 or older with an advanced degree (18.4 percent).

Massachusetts is also No. 1 in entrepreneurship and innovation: The Bay State's tech sector accounts for 16 percent of total gross state product (No. 3) and the state is second only to California in the amount of venture capital invested as a share of gross state product.

The state is No. 8 in business climate/competitive environment: Its GDP grew 2.6 percent in 2017, fastest in the Northeast. And it is No. 4 in state infrastructure, with high rankings for cellphone coverage and internet speeds. (But WalletHub ranks Massachusetts dead last for traffic and infrastructure.)

Where Massachusetts falls down is in taxes and regulation, where it's ranked No. 49. Its corporate income tax rate is 8.0 percent and it has some of the highest property and unemployment insurance rates in the country. The state's individual income tax rate, however, is a more moderate 5.1 percent.

No. 12: Nebraska (No. 22 in 2017)

Number Of Solution Provider 500 Companies: Three

Nebraska offers low labor and operating costs for a startup (No. 4). And the Cornhusker State has low unemployment insurance taxes, which help offset its somewhat high 7.81 percent corporate income tax for a No. 10 ranking in that criteria.

Nebraska's scores for workforce education and experience have improved, boosting its ranking there to No. 14 and improving its overall ranking.

But the state remains ranked low for entrepreneurship and innovation (No. 37) and business climate/competitive environment (No. 35): Nebraska's GDP grew only 0.6 percent in 2017.

Nebraska can brag about its No. 7 ranking for personal cost of living/quality of life, thanks to relatively low housing and rental costs.

No. 11: Washington (No. 5 in 2017)

Number Of Solution Provider 500 Companies: Seven

As the home state of such tech giants as Microsoft and Amazon, you'd expect Washington to rank high in our Best States review.

Washington is ranked No. 4 in entrepreneurship and innovation and No. 6 in business climate/competitive environment. The Evergreen State's GDP grew 4.4 percent in 2017–the most of any state and nearly twice the national average. The tech sector accounts for 17 percent of the state's total gross state product–No. 1 among all states. And the Information Technology & Innovation Foundation's Center for Data Innovation ranked the state No. 2 in its Best States for Data Innovation report.

Washington is ranked No. 8 for its educated and experienced workforce.

But the state can be an expensive place to set up shop, as evidenced by its No. 41 ranking in labor and operating costs. That's also true in the personal cost of living/quality of life criteria, where Washington ranks a poor No. 41 due to high sales/local taxes (although it has no individual income tax), and high housing and rental costs.

The fact that Washington has no corporate income tax (along with no individual income tax) ranks the state at No. 18 in taxes and regulations. (The state does impose a "gross receipts" tax on businesses).

No. 10: Virginia (No. 8 in 2017)

Number Of Solution Provider 500 Companies: 42

The Washington,, D.C. region has become one of the tech hubs of the U.S. with many IT companies calling the region home.

And that means Virginia is home to a lot of tech talent: The Old Dominion State is No. 4 in workforce education and experience. The state is No. 7 for the share of the labor force (41.6 percent) with a four-year college degree and No. 4 in the percentage of people 25 and older with an advanced degree (15.7 percent).

Virginia is No. 8 in entrepreneurship and innovation: The tech sector accounts for 13 percent of total gross state product (No. 5) and it is No. 6 in both tech industry establishments and tech industry employment. The state is No. 15 in business climate and competitive environment.

Virginia, however, ranks a relatively unfavorable No. 38 in taxes and regulations. The state's individual income tax is set at 5.75 percent and its corporate income tax at 6.0 percent, in addition to having high unemployment insurance taxes.

No. 9: Delaware (No. 31 in 2017)

Number Of Solution Provider 500 Companies: Zero

Delaware made some big jumps in our Best States rankings this year. Delaware, "The First State," benefited from the introduction of new criteria: Its state infrastructure ranking, for example, jumped due to its No. 1 rank as the state with the fewest number of natural disasters, according to the World Atlas. In other cases the boost came from new data, such as the improvement in the state's unemployment numbers this year.

Delaware was ranked No. 2 in taxes and regulations. While the state has a relatively high corporate income tax (8.7 percent), it has no sales tax and a low unemployment insurance burden.

The tech sector accounts for 7 percent of Delaware's total gross state product (No. 20), leading to a respectable No. 21 for entrepreneurship and innovation. But its poor No. 39 rank for business climate and competitive environment is partly size related–Delaware is No. 48 in the number of private sector companies–and a mediocre economy as evidenced by its 1.6 percent GDP growth last year.

Delaware was No. 20 in workforce education and experience. But it was ranked No. 1 for average peak internet speeds.

No. 8: Ohio (No. 11 in 2017)

Number Of Solution Provider 500 Companies: 11

Ohio has been evolving into a more business-friendly state in recent years. While it's still a fairly expensive place to run a business, from a labor and operating cost perspective (No. 34), the Buckeye State's ranking in taxes and regulations (No. 8) gets a boost from its lack of a sales tax and corporate income tax (although it does impose a "gross receipts" tax on businesses).

Ohio ranked a favorable No. 11 in business climate and competitive environment and a middle-of-the-road No. 20 for entrepreneurship and innovation. The tech sector accounted for only 5 percent of Ohio's total gross state product in 2017 (No. 31), but the state did add 5,505 tech jobs last year.

The state was ranked No. 26 in workforce education and experience.

No. 7: California (No. 4 in 2017)

Number Of Solution Provider 500 Companies: 60

California, of course, is in many ways the center of the nation's information technology industry and naturally ranks high in some of our Best States criteria. But the Golden State is very diverse and also has its downsides.

California ranked No. 1 in business climate and competitive environment in this year's Best States review. Much of that is a function of size: California has the biggest GDP (which grew 3.0 percent in 2017) of all states, the biggest population, the most small and midsize businesses, and so on.

And it is No. 2 in entrepreneurship and innovation. The tech sector accounts for 16 percent of total gross state product (No. 2 behind Washington) and the state added 43,601 tech jobs in 2017 (No. 1 among all states). WalletHub ranked California No. 2 in its Best States to Start a Business (behind No. 1 Texas).

But California is an expensive place to do business, as seen in its No. 38 rank for labor and operating costs: The average wage for a tech industry worker in California is $161,897.

The state is dead last in personal cost of living/quality of life because of high housing and rental costs (No. 49 in both), high individual income taxes (13.3 percent, the nation's highest), and other factors. And a solution provider startup in California will face the most competition, based on the number of solution providers doing business today (22,346) balanced against the number of potential business customers.

California ranked No. 16 in workforce education and experience and No. 19 in taxes and regulations.

No. 6: Colorado (No. 6 in 2017)

Number Of Solution Provider 500M Companies: 13

Colorado has had a booming economy since The Great Recession (its 3.6 GDP growth in 2017 was second only to Washington) and consistently has been in our Top 10 Best States.

The Centennial State is No. 3 for its highly educated and experienced workforce: It's No. 6 for the share of its labor force (41.8 percent) that has a four-year college degree. That goes hand-in-hand with its No. 3 rank in entrepreneurship and innovation, with the tech sector accounting for 14 percent of total gross state product (No. 4).

Colorado even has relatively low labor and operating costs (No. 7). And the state is an enviable No. 8 in personal cost/quality of life.

But Colorado is No. 32 in taxes and regulations, given its high unemployment insurance and local taxes (although its corporate income tax rate is a relatively low 4.63 percent).

No. 5: Texas (No. 3 in 2017)

Number Of Solution Provider 500 Companies: 22

Texas is another state that's been booming in recent years and has become one of the country's technology hubs.

The Lone Star State is ranked No. 6 for entrepreneurship and innovation in this year's Best States: WalletHub ranked Texas No. 1 in its Best States to Start a Business. And the state is No. 2 in business climate/competitive environment with its robust economy (2.6 percent GDP growth in 2017). And low labor and operating costs (No. 9) add to the state's allure.

Texas is No. 23 in taxes and regulations. While it doesn't have individual or corporate income taxes, the state does charge businesses a gross receipts tax, and has high local and property taxes.

Texas is ranked No. 33 in the education and experience of its workforce.

No. 4: Utah (No. 10 in 2017)

Number Of Solution Provider 500 Companies: 2

Utah is another state that regularly scores well on our Best States list. This year the Beehive State is No. 1 for labor and operating costs and No. 16 in taxes and regulations, the latter the result of its low (5.0 percent) corporate tax rate and No. 8 ranking on the Tax Foundation's 2018 State Business Tax Climate Index.

Utah is No. 18 in workforce education and experience and No. 13 in entrepreneurship and experience. The tech sector accounts for 10 percent of Utah's total gross state product (No. 9) and WalletHub ranked the state No. 3 in its Best States to Start a Business review.

The state was ranked No. 25 in business climate/competitive environment: While its economy is strong (2017 GDP growth was 3.1 percent), the state has a relatively sparse number of businesses compared with more populous states.

Still, the state is ranked No. 2 for the number of fast-growing companies that call Utah home, according to the Information Technology & Innovation Foundation's 2017 State New Economy Index.

No. 3: Missouri (No. 13 in 2017)

Number Of Solution Provider 500 Companies: Seven

Missouri's third-place showing in this year's Best States ranking marks a significant gain for the Show Me state.

Missouri moved up in the rankings to No. 4 in personal cost of living/quality of life based on improvements in the Show Me State's cost of living criteria

Missouri also made less dramatic gains across other Best States criteria, such as moving up to No. 27 from No. 31 in entrepreneurship and innovation, and to No. 23 from No. 25 in business climate/competitive environment. But its showing in workforce education dipped this year to No. 25 from No. 19.

Missouri's strength remains its business-friendly environment including a relatively low tax burden (No. 6) and low labor and operating costs (No. 15).

No. 2: North Carolina (No. 2 in 2017)

Number Of Solution Provider 500 Companies: Four

North Carolina, of course, has been in the news as Hurricane Florence causes damage throughout the state. And the potential for such dangers is certainly something for businesses to consider. (The Best States analysis includes criteria about how prone states are for natural disasters and their preparedness for them.)

Nevertheless, the Tar Heel State is making a repeat performance in the No. 2 spot in our Best States analysis.

To start, North Carolina gets a boost from its low taxes (including a 3.0 corporate income tax and 4.75 percent sales tax) that results in a No. 4 ranking in taxes and regulations. The state's solid growth (GDP was up 2.3 percent in 2017) and other favorable factors lead to the state's No. 5 ranking in business climate/competitive environment.

Perhaps more surprising is North Carolina's No. 3 rank in state infrastructure–although damage from Florence could reduce that rank in the future.

North Carolina ranked No. 30 for the education and experience level of its workforce.

No. 1: Florida (No. 1 in 2017)

Number Of Solution Provider 500 Companies: Nine

For the third year in a row Florida has captured the No. 1 spot in our Best States analysis.

The Sunshine State, as it was last year, was ranked No. 1 in taxes and regulations. The state's corporate income tax is a moderate 5.5 percent, its sales tax is 6.0 percent, unemployment insurance taxes are low and there is no individual income tax. For its overall tax burden Florida is No. 4 on the Tax Foundation's 2018 State Business Tax Climate Index.

Florida's other strength is its business climate/competitive environment, where it ranked No. 4 (compared with No. 2 in 2017). It's No. 2 in both the number of private sector firms and in the number of small and midsize companies that provide solution providers with potential customers. And it had the fourth largest state GDP in 2017—$984.1 billion.

Florida is No. 9 in entrepreneurship and innovation: The state is home to 31,835 tech business establishments (No. 3) and the state's tech employment ranks grew by 12,022 last year. And the state has relatively low labor and operating costs (No. 10).

The state, however, is No. 29 in workforce education and experience: 67.0 percent of the workforce doesn't have a four-year college degree. And the state is ranked No. 37 in personal cost of living/quality of life, given its rising housing and rental costs and its No. 41 rank in median household income ($51,176).