Top States For Business In 2019: Starting A Solution Provider Company

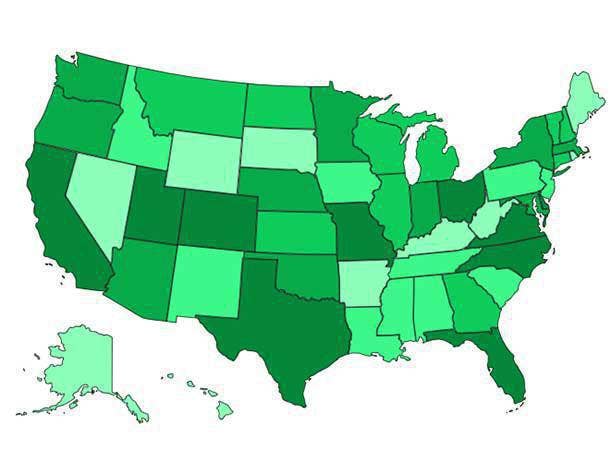

Which states offer the most business opportunities, have an entrepreneurial culture or provide the most educated workforce for a solution provider startup? See how your state ranks in providing the resources needed—or hinders growth with taxes, high costs and other obstacles.

Worst To First: What Does Your State Have To Offer?

The economy is as strong as it has been in years and demand for IT services and products continues to grow. While there may be some uncertainty about how long the current economic expansion (now the longest in U.S. history) can continue, some people who work in the IT industry—either on the business or the technical side—may be thinking this is the best time to act on their dream of starting a solution provider business.

But entrepreneurs face a lot of challenges—and a lot of questions. Where can they find the talented employees they'll need to staff their startup? How abundant are the business opportunities needed to ensure success? And what kind of hurdles will the new business face in terms of costs, taxes and regulations?

The answers to those questions can vary widely based on where in the U.S. an entrepreneur starts his or her business. The following ranks all 50 states, starting with the worst (No. 50) to the best (No. 1) for starting and growing a solution provider business.

The findings are based on a CRN Research analysis of a broad range of data, including the education and experience level of each state's workforce, labor and business operating costs, and tax and regulatory burdens. States are also ranked for their potential for fostering innovation, spurring growth and generating business opportunities.

We've also cross-referenced the results with the CRN Solution Provider 500, noting how many of the industry’s biggest solution providers call each state home.

Take a look. The results might surprise you.

No. 50: Arkansas (No. 47 in 2018)

Solution Provider 500: 0

Arkansas, No. 47 on last year’s Best States list, dropped to last place in this year’s ranking.

Arkansas was ranked a poor No. 48 for entrepreneurship and innovation and a mediocre No. 38 for business climate/competitive environment—the latter pulled down by the state's anemic 0.9 percent GDP growth in 2018 (No. 45 among all states).

The Natural State ranked No. 47 in workforce education and experience, down two spots from last year, and only 4.7 percent of the state’s workforce is in technology. But Arkansas was No. 11 in labor and other operating costs and its 3.5 percent unemployment rate (in June 2019) was in the middle (No. 23) among all states.

The state's No. 38 rank for taxes and regulations (a drop from No. 34 last year) is pulled down by its relatively high 6.5 percent sales tax and 6.5 percent corporate income tax. The Tax Foundation lists Arkansas a poor No. 46 on its 2019 State Business Tax Climate Index, which calculates the overall tax burden on businesses from a state's corporate, individual income, sales/local, property and unemployment insurance taxes.

No. 49: West Virginia (No. 50 in 2018)

Solution Provider 500: 0

West Virginia, which has been No. 50 on the Best States list for the last four years, moved up one space in this year’s ranking. Still, the Mountain State has a long way to go to become an attractive place to start a tech business.

Finding technical talent in West Virginia remains a challenge. The state ranked No. 50 in workforce education and experience and only 4.3 percent of the workforce is in technology—it was one of the few states that saw a decline in tech workers in 2018, according to the 2019 CompTIA Cyberstates report.

West Virginia was also No. 50 in entrepreneurship and innovation and No. 50 in state infrastructure: The state was ranked last in innovation potential by WalletHub and last in technology and innovation in the CNBC America’s Top States for Business 2019. And it was a poor No. 39 in business climate/competitive environment, despite fairly healthy 2.4 percent GDP growth in 2018.

Nevertheless, West Virginia is No. 5 in solution provider saturation (the ratio of businesses in a state for every solution provider).

The state was ranked a middle-of-the-road No. 29 for taxes and regulations. The Tax Foundation ranked the state No. 19 on its 2019 State Business Tax Climate Index: West Virginia has a relatively high 6.5 percent corporate income tax and 6.0 percent sales tax.

No. 48: Alaska (No. 45 in 2018)

Solution Provider 500: 1

Alaska has dropped down a fee spots in the Best States ranking. The Last Frontier State is an expensive place to do business—it is No. 50 in overall labor and operating costs.

The state is also ranked No. 50 in business climate/competitive environment—the latter taking a hit from the relatively few numbers of private sector firms there, especially small businesses, and the 0.3 percent decline in its 2018 GDP. WalletHub ranked Alaska No. 50 for economic health and U.S. News & World Report ranked it No. 48 for economic growth. And the state’s 6.4 percent unemployment rate in June was the highest among all 50 states.

Alaska ranked No. 45 for entrepreneurship and innovation. The state generally ranks high for opportunity— the Kauffman Indicators of Entrepreneurship ranked it No. 3 for best place to launch a startup—and the state is No. 6 in solution provider saturation. But the state is No. 49 in tech industry employment and No. 50 in tech business establishments, according to CompTIA Cyberstates.

Alaska is No. 32 in taxes and regulations. The Tax Foundation ranked the state an enviable No. 2 on its 2019 State Business Tax Climate Index, largely due to the state’s lack of a personal income tax and sales taxes. But its corporate income tax rate soars to 9.4 percent for corporate income above $222,000.

No. 47: Kentucky (No. 48 in 2018)

Solution Provider 500: 3

Kentucky moved up one spot in the 2019 Best States ranking.

The Bluegrass State is a solid No. 16 for its relatively low labor and operating costs.

Kentucky is ranked a poor No. 49 on taxes and regulations. The Tax Foundation ranked the state No. 23 on its 2019 State Business Tax Climate Index, largely due to the state’s high unemployment insurance and property taxes. Its 5 percent corporate income tax rate is in the middle of the pack while its sales tax and personal income tax are relatively low.

Kentucky is also an unenviable No. 46 in the education and experience of its workforce and No. 44 in entrepreneurship and innovation—the technology sector accounts for only 4.1 percent of the state's total gross state product (No. 43). It was No. 34 in business climate/competitive environment—the state’s 1.4 percent GDP growth in 2018 was No. 37 among the states.

No. 46: South Dakota (No. 44 in 2018)

Solution Provider 500: 1

Dropping two places this year, South Dakota suffers from low rankings in business climate and competitive environment (No. 43) and in entrepreneurship and innovation (No. 47). The Mount Rushmore State is ranked No. 48 in tech industry employment and No. 47 in tech industry establishments.

GDP growth in 2018 was a relatively low 1.3 percent. CNBC America’s Best States for Business 2019 ranked South Dakota No. 47.

While South Dakota is No. 16 for its relatively low labor and operating costs, it’s a poor No. 34 for the education and experience levels of its workforce.

South Dakota has no individual or corporate income tax and its moderate 4.5 percent sales tax is on the low side, ranking the state No. 3 on the Tax Foundation’s 2019 State Business Tax Climate Index. But its ranking in the Best States results takes a hit from high property and unemployment insurance taxes.

No. 45: Hawaii (No. 46 in 2018)

Solution Provider 500: 0

Hawaii is often near the bottom of the Best States rankings given its high business and living costs and limited business opportunities.

The Aloha State is No. 47 for labor and operating costs, behind only Connecticut, New York and Alaska. It’s No. 50 with the most expensive electricity costs.

Hawaii is in the middle of the pack in educated and experienced workers (No. 25) and in taxes and regulations (No. 27)—despite a 6.4 percent corporate income tax on income over $100,000 and a relatively heavy personal income tax burden.

Hawaii ranks only No. 43 in entrepreneurship and innovation and a dismal No. 48 in business climate and competitive environment. The tech sector is only 3.9 of total gross state product (No. 44) and WalletHub ranks the state No. 47 in innovation potential. Hawaii’s GDP grew an anemic 1.0 percent in 2018 (No. 42 among the states) and U.S. News & World Report ranked it No. 47 for business environment.

Hawaii has the highest cost of living among all 50 states, according to CNBC America’s Top States for Business, including having the highest median list price for a home ($632,500) and the highest average state gas price.

No. 44: Wyoming (No. 42 in 2018)

Solution Provider 500: 0

Wyoming has generally scored low in the Best States analysis because, having the smallest population among all 50 states, it offers limited business opportunities.

Indeed, the Cowboy State is ranked No. 49 in business climate/competitive environment. The state is No. 48 in the number of private sector firms and No. 50 in the number of small businesses. Its GDP ($39.4 billion, only Vermont is smaller) grew only 0.3 percent in 2018—tied with Delaware and behind only Alaska. On the plus side, Wyoming is No. 1 in solution provider competitive saturation with so few VARs and IT service providers in the state.

Wyoming is No. 39 in entrepreneurship and innovation. It is No. 50 in tech industry employment, according to CompTIA Cyberstates, and No. 50 in the tech sector as a percent of total gross state product (2.9 percent).

Wyoming ranks No. 25 in both the labor/operating costs and workforce education/experience categories. It’s No. 31 in taxes and regulations: It has no corporate income tax and it is No. 2 on the Tax Foundation’s 2019 State Business Tax Climate Index. But its ranking in the Best States suffers from high property and unemployment insurance taxes.

The state is No. 5 in personal cost of living/quality of life: That’s because it has no personal income tax and its 4 percent sales tax is among the lowest.

No. 43: Rhode Island (No. 41 in 2018)

Solution Provider 500: 2

Rhode Island has a reputation for being the state that’s first into a recession and the last to exit. Earlier this year the total number of employed workers in the Ocean State finally surpassed the peak it hit prior to the 2007-2009 recession. The state’s 3.8 percent unemployment rate ranks it No. 33. Overall the state was No. 44 with high labor and operating costs.

Rhode Island is No. 37 in entrepreneurship and innovation and No. 44 in business climate and competitive environment. WalletHub ranked Rhode Island No. 50, at the bottom, in its 2019 ranking of best states in which to start a business.

The state’s GDP grew only 0.6 percent in 2018—No. 47 among all states. WalletHub and CNBC America’s Top States for Business 2019 rank the state’s economy at No. 50 and No. 48, respectively.

The state is No. 30 in taxes and regulations: The Tax Foundation ranks Rhode Island No. 37 on its 2019 State Business Tax Climate Index with its 7 percent corporate income tax and 7 percent sales tax.

No. 42: Maine (No. 43 in 2018)

Solution Provider 500: 3

Maine’s spot in this year’s Best States gets a boost from its No. 11 ranking in personal cost of living and quality of life. It has the lowest violent crime rate, according to FBI statistics from 2017, a low cost of living and a moderate (5.5 percent) sales tax.

But the Pine Tree State doesn’t score so well in most of the other criteria including entrepreneurship and innovation (No. 41) and business climate/competitive environment (No. 40). WalletHub ranked Maine No. 48 for its innovation environment and the state is No. 40 for both technology industry employment and technology business establishments.

Maine is ranked a mediocre No. 32 for the education and experience level of its workforce and a middle-of-the-road No. 23 for taxes and regulatory environment. Its sales tax is 5.5 percent while its corporate income tax rate tiers range from 3.50 percent to 8.93 percent.

No. 41: Nevada (No. 49 in 2018)

Solution Provider 500: 1

Nevada was hard hit by the Great Recession, but its economy has been on the mend and the state moved up eight places in this year’s Best States list.

But the state still has work to do. It ranks only No. 39 in workforce education and experience, a middling No. 26 in entrepreneurship and innovation and No. 22 in business climate/competitive environment.

On the plus side, the Silver State’s GDP grew 3.2 percent in 2018, putting it in the top 10 for economic growth.

Nevada has no individual or corporate income tax, although its 6.85 percent sales tax is relatively high, good enough for the state to reach No. 9 on the Tax Foundation’s 2019 State Business Tax Climate Index. But its ranking in the Best States results takes a hit from high property and unemployment insurance taxes.

Nevada has low labor and operating costs. It was No. 1 among the states in the number of new jobs added (43,400) between July 2018 and July 2019. It also ranked No. 1 for the lowest energy costs.

No. 40: Iowa (No. 32 in 2018)

Solution Provider 500: 3

Iowa ranks a poor No. 42 in entrepreneurship and innovation: FitSmallBusiness.com ranks the state a low No. 48 for best places for a business startup and WalletHub ranks it No. 46 for a not-so innovative environment. Iowa fares better in business climate/competitive environment at No. 30.

The Hawkeye State’s attractiveness for startups always takes a hit due to its high tax burden. Iowa’s poor No. 45 rank on the Tax Foundation’s 2019 State Business Tax Climate Index is due to its high corporate income taxes (which start at 6 percent and rise to 12 percent—among the nation’s highest) and high personal income taxes.

Iowa ranks No. 30 in business climate/competitive environment. U.S. News & World Report, however, ranks the state No. 2 for opportunity based on its affordability, economic opportunity and equality.

Iowa ranks No. 15 on personal cost of living/quality of life thanks to its low housing (median home price $184,000) and rental prices.

No. 39: Louisiana (No. 36 in 2018)

Solution Provider 500: 3

Louisiana is ranked near the bottom of all states (No. 48) for personal cost of living/quality of life. That’s due to its relatively high personal income, state and local taxes. The state also has the second lowest median household income ($43,903)—only Mississippi is lower.

The Pelican State was No. 41 in business climate/competitive environment. The state’s GDP grew only 1.1 percent in 2018, No. 41 among the states. It was No. 50 in job creation as the state lost 1,000 jobs between July 2018 and July 2019. Comptia Cyberstates ranked Louisiana No. 48 in tech jobs as a percent of the total workforce.

Louisiana was ranked at or near the bottom in a number of studies and surveys for the state of its economy, economic climate and potential for economic growth and opportunity.

Louisiana is ranked in the bottom 10 in the 2019 State Business Tax Climate Index by the Tax Foundation.

No. 38: Pennsylvania (No. 35 in 2018)

Solution Provider 500: 14

Pennsylvania is ranked No. 48 in taxes and regulations largely due to its 9.99 percent corporate income tax— among the nation’s highest—and its high unemployment insurance tax.

The Keystone State is ranked a relatively low No. 35 in workforce education and experience: U.S. News ranked the state No. 50 for the education attainment levels of its available labor force, although WalletHub ranked the state No. 29 for the same thing.

The state is a respectable No. 15 in business climate/competitive environment, given the size of its economy. But there are already a lot of solution providers in the state: It is No. 43 in the competitive saturation index. And several studies (FitSmallBusiness.com and WalletHub) scored Pennsylvania at or near the bottom of all states as a place to start a business.

No. 37: Idaho (No. 38 in 2018)

Solution Provider 500: 2

Idaho had the lowest labor and operating costs among all states in this year’s Best States study.

The Gem State offers entrepreneurs a robust economy: It’s 4.1 percent GDP growth in 2018 was No. 3 among the states and several surveys (CNBC America’s Best States for Business 2019 and WalletHub’s Best and Worst State Economies) both ranked Idaho No. 2. And the tech sector accounts for a surprising 10.1 percent of total gross state product—No. 13 among the states.

Idaho, however, is only ranked No. 41 for workforce education and experience and the Best States analysis ranks it a poor No. 47 in taxes and regulations for its high unemployment insurance taxes and relatively high corporate income tax.

No. 36: South Carolina (No. 34 in 2018)

Solution Provider 500: 3

South Carolina’s overall ranking suffers from its No. 43 position in workforce education and experience with low scores for the education attainment levels of the state’s workforce.

The Palmetto State otherwise receives mediocre rankings in most Best States criteria including No. 35 in entrepreneurship and innovation and No. 28 in business climate and competitive environment.

South Carolina is No. 24 in taxes and regulations. The Tax Foundation ranks it No. 34 on its 2019 State Business Tax Climate Index given its relatively high personal income tax (7.0 percent on income above $12,250).

For entrepreneurs seeking a state with the lowest percentage of unionized workers, South Carolina is No. 1 in that criteria.

No. 35: Mississippi (No. 39 in 2018)

Solution Provider 500: 4

Mississippi is No. 48 in workforce education and experience: It is No. 47 in the numer of people 25 years and older with an advanced degree (8.0 percent) and it is No. 49 in tech jobs as a percentage of the total workforce.

The Magnolia State is No. 49 in entrepreneurship and innovation and No. 47 in business climate and competitive environment. The tech sector accounts for only 3.7 percent of total gross state product (No. 46) and the state is No. 50 in the number of patents issued to private sector workers. The state’s 1.0 percent GDP growth in 2018 was No. 42 among the states.

Mississippi, however, is No. 1 in low cost of living. But the flip side of that is the state has the lowest median household income ($43,441) of any state.

Mississippi is No. 7 in taxes and regulations, with relatively low corporate and individual income taxes (but a high 7.0 percent sales tax rate). The low taxes could also explain the state’s No. 49 ranking in state infrastructure.

No. 34: Alabama (No. 37 in 2018)

Solution Provider 500: 3

Like its neighbor Mississippi, Alabama’s overall ranking takes a hit from low scores for workforce education and experience (No. 45) and entrepreneurship and innovation (No. 40).

The technology industry accounts for 6.8 percent of Alabama’s total gross state product, No. 28 among the states, while its 2.0 GDP growth in 2018 was No. 26.

The Yellowhammer State is No. 49 in personal cost of living/quality of life, given its high state and average local sales taxes and high gas prices. But Alabama is ranked No. 14 overall in taxes and regulations for moderate personal and corporate income tax rates.

No. 33: New Hampshire (No. 26 in 2018)

Solution Provider 500: 4

New Hampshire is No. 1 in cost of living and quality of life thanks to its lack of a personal income tax or sales tax. It also boasts a median household income of $74,801—No. 3 among all the states.

But while the Granite State likes to boast about the lack of those taxes, its corporate income tax is a high 7.7 percent. The Tax Foundation, nevertheless, ranks New Hampshire an enviable No. 6 on its 2019 State Business Tax Climate Index. New Hampshire is ranked No. 14 in taxes and regulations overall in this Best States analysis.

New Hampshire is No. 14 in workforce education and experience and the state’s entrepreneurship and innovation ranking (No. 20) gets a boost from the fact that the tech sector accounts for 13.8 percent of total gross state product (No. 5).

No. 32: Montana (No. 28 in 2018)

Solution Provider 500: 0

Montana is ranked near the bottom (No. 46) in business climate/competitive environment. That’s due, in part, to the state’s sparse population and the relatively small number of private sector firms and small businesses that provide a potential customer base for a solution provider. But the Treasure State’s slow GDP growth in 2018 (0.9 percent, No. 45 among the states) is also a factor.

Montana is ranked No. 28 in both labor/operating costs and workforce education/experience.

The state gets a boost from its No. 18 ranking in both taxes/regulations and in personal cost of living/quality of life. The state has no sales tax and the Tax Foundation ranks Montana No. 6 on its 2019 State Business Tax Climate Index.

No. 31: Connecticut (No. 30 in 2018)

Solution Provider 500: 7

Connecticut can be an expensive place to do business with its No. 46 ranking in labor and operating costs.

The Constitution State is No. 25 in taxes and regulations, but that includes a No. 50 ranking for its high property taxes that push the state (at No. 47) onto the Tax Foundation’s list of the 10 states with the worst business tax climates. The state’s corporate income tax is a middle-of-the-road 7.5 percent.

Connecticut is No. 19 in workforce education and experience—it’s No. 3 in the percentage of people 25 or older (17.0 percent) with an advanced degree.

Connecticut’s economy isn’t great: Its GDP grew by just 1.0 percent in 2018, No. 42 among the states. And the state was a poor No. 46 in economic stability, according to a U.S. News ranking.

No. 30: Vermont (No. 25 in 2018)

Solution Provider 500: 0

Vermont is a rural state with relatively few businesses (No. 49 in private sector firms, No. 49 in the number of new businesses and No. 47 in the number of small businesses) and a slow-growing economy (1.2 percent GDP growth in 2018, No. 40 among the states). All that adds up to a poor No. 45 rank in business climate/competitive environment.

The Green Mountain State’s overall ranking is also pulled down by its high property taxes (No. 49) and relatively high corporate income tax (8.5 percent on income greater than $25,000), putting the state onto the Tax Foundation’s list of the 10 states with the worst business tax climates.

While the state is only No. 23 in workforce education and experience, it is No. 6 in the percent of its workforce 25 and older with an advanced degree (15.0 percent).

No. 29: Illinois (No. 27 in 2018)

Solution Provider 500: 28

Illinois is ranked No. 14 for business climate and competitive environment with its large number of business of all sizes. It is No. 4 in tech business establishments and No. 5 in tech industry employment. And the Prairie State is No. 15 in workforce education and experience.

But there are economic problems in Illinois. WalletHub ranks the state No. 48 in economic health, despite 2.1 percent GDP growth in 2018 (No. 23). Illinois has been wrestling with wildly out-of-balance state budgets and big deficits for years and U.S. News ranks the state dead last among the states for “economic stability.”

Illinois is also No. 46 in taxes and regulatory burden with high property and unemployment insurance taxes and a 9.5 percent corporate income tax, one of the highest in the nation.

No. 28: Michigan (No. 29 in 2018)

Solution Provider 500: 14

Michigan is ranked a respectable No. 13 in both entrepreneurship/innovation and business climate/competitive environment. The tech sector accounts for 7.8 percent of the Great Lakes State’s total gross state product (No. 22) and more than 409,000 people are employed in the tech industry in the state (No. 9).

Michigan has plenty of private companies (ranked No. 11) and small businesses (No. 10) that provide a potential customer base for a solution provider startup.

Where Michigan stumbles is in taxes and regulations where its very high unemployment insurance tax pulls the state’s ranking down to a dismal No. 45. The state’s personal income tax is a relatively low 4.25 percent (which helps boost the state’s personal cost of living rank to No. 10) and the corporate income tax is 6.00 percent.

No. 27: New Mexico (No. 40 in 2018)

Solution Provider 500: 1

New Mexico has moved up significantly in the Best States analysis thanks to gains in its rankings in labor/operating costs, workforce education and experience, and labor and operating costs.

New Mexico does well in entrepreneurship and innovation (No. 21), thanks, in part, to the tech sector accounting for 10.4 percent of total gross state product (No. 11).

The Land of Enchantment state, however, is ranked a poor No. 42 in business climate and competitive environment. That despite 2018 GDP growth of 1.8 percent (No. 31 among the states), an improvement from the 0.8 percent GDP gain in 2017.

On the tax and regulations front New Mexico is a respectable No. 13. It has the lowest property taxes of all states, according to the Tax Foundation, and relatively moderate personal and corporate income tax rates.

No. 26: Wisconsin (No. 22 in 2018)

Solution Provider 500: 13

Wisconsin is ranked No. 3 in personal cost of living and quality of life. That’s due, in part, to the state’s relatively high median household income ($63,451) and relatively low costs (the median home price is $224,900).

The Badger State is No. 13 for workforce education and experience while its business climate/economic environment is ranked No. 19—its 2.5 percent GDP growth in 2018 was No. 17 among all states.

Where Wisconsin loses some of its luster is in taxes and regulations (No. 41). Its 7.9 percent corporate income tax is on the high side, as is the state’s unemployment insurance taxes. Overall the Tax Foundation ranks Wisconsin No. 32 on its 2019 State Business Tax Climate Index.

No. 25: New Jersey (No. 33 in 2018)

Solution Provider 500: 25

While New Jersey has moved up in the Best States overall rankings, it still remains a very expensive place to do business.

The Garden State is No. 40 in taxes and regulations. Its corporate income tax rates reach as high as 9.0 percent for income over $100,000 and 11.5 percent for income over $1 million. Its personal income tax and property taxes are high, as is the 6.625 percent sales tax.

Overall the Tax Foundation ranks New Jersey No. 50—dead last—on its 2019 State Business Tax Climate Index. The Small Business & Entrepreneurship Council ranked the state No. 49 in its Small Business Tax Index. And U.S. News ranked New Jersey No. 49 in fiscal stability.

Taxes aside, New Jersey ranks a fairly healthy No. 16 in workforce education and experience, No. 4 in entrepreneurship and innovation, and No. 18 in business climate/competitive environment.

No. 24: North Dakota (No. 23 in 2018)

Solution Provider 500: 1

North Dakota was once high up on the Best States list when the oil boom of 2010 to 2015 caused the state’s economy to explode. As oil prices have declined, so has North Dakota’s Best States ranking.

While the Peace Garden State recorded GDP growth of 2.5 percent in 2018, the state was only No. 47 in the number of jobs added between July 2018 and July 2019. North Dakota is ranked No. 38 in entrepreneurship and innovation and No. 35 in business climate/competitive environment. But with so few solution providers in the state, it’s No. 2 in terms of solution provider saturation.

North Dakota does score well on the tax and regulations front (No. 12) with its low personal income, corporate income, property and unemployment insurance taxes.

No. 23: New York (No. 17 in 2018)

Solution Provider 500: 41

New York, long the country’s financial capital, has also become a tech hub in recent years. CompTIA’s 2019 Cyberstates report ranks the Empire State as No. 3 in tech industry employment (663,295), No. 5 in tech business establishments (24,471) and No. 18 for the tech sector component of total gross state product (8.1 percent). All that fueled the state’s No. 7 rank in entrepreneurship and innovation.

Adding to the attraction are the state’s $1.68 trillion economy (third behind only Texas and California) and economic expansion and access to capital (No. 2 behind California, according to CNBC America’s Top States for Business 2019)—giving New York a No. 17 business climate/competitive environment ranking.

But oh, the costs! New York is No. 48 in labor and operating costs and No. 48 in personal cost of living, including No. 45 in median housing prices and No. 50 for rentals.

And New York is No. 35 in taxes and regulations. While the state’s corporate income tax is a middling 6.5 percent, other high taxes push the state to No. 48 on the Tax Foundation’s 2019 State Business Tax Climate Index, joining the list of the 10 states with the worst business tax climates.

No. 22: Massachusetts (No. 13 in 2018)

Solution Provider 500: 21

Massachusetts has long been a tech hub with its highly educated workforce. The Bay State is No. 4 for workforce education and experience in this year’s Best States, including No. 1 in the percentage of tech jobs as a percentage of the total workforce and No. 1 in the percentage of people 25 years and over with an advanced degree.

Massachusetts is No. 3 in entrepreneurship and innovation (behind only California and Colorado) and No. 7 in business climate/competitive environment.

But Massachusetts has become an increasingly expensive place to live and work—it’s No. 42 in labor and operating costs in this year’s Best States, No. 47 in cost of living and No. 48 in median home price ($479,900).

And Massachusetts is dead last—No. 50—in the taxes and regulations criteria. High property and unemployment insurance taxes are largely to blame, along with a fairly high 8.0 percent corporate income tax.

No. 21: Oklahoma (No. 19 in 2018)

Solution Provider 500: 3

Oklahoma has the lowest labor costs, according to WalletHub, and the second lowest energy costs of all states. The Sooner State is No. 3 in taxes and regulations in this year’s Best States review, including a 6.0 percent corporate income tax and low unemployment insurance taxes.

But the state is No. 44 in workforce education and experience—its tech workforce actually declined by 264 workers from 2017 to 2018.

Oklahoma is No. 34 in entrepreneurship and innovation and No. 31 in business climate/competitive environment. The state’s 1.8 percent GDP growth in 2018 was No. 31 among the states.

No. 20: Oregon (No. 18 in 2018)

Solution Provider 500: 4

Oregon is No. 10 in entrepreneurship and innovation: The tech sector accounts for 12.4 percent of total gross state product, according to the CompTIA 2019 Cyberstates report, No. 7 among all states. While the Beaver State is ranked a middling No. 23 for business climate/competitive environment, its 3.4 percent GDP growth in 2018 was No. 8.

Oregon is No. 11 in workforce education and experience and No. 6 in personal cost of living/quality of life— the latter despite relatively high personal income taxes, but no sales tax.

The state is ranked No. 36 for taxes and regulations: It’s corporate income tax rate is 6.6 percent up to $1 million and 7.6 percent above that.

No. 19: Tennessee (No. 31 in 2018)

Solution Provider 500: 6

Tennessee, which dropped in last year’s Best States rankings, has moved back up in 2019.

The Volunteer State is No. 12 in business climate/competitive environment—a big jump from No. 22 last year—fueled by its 3.0 percent GDP growth in 2018 (No. 11 among all states). But the state is less of a hub for entrepreneurial activity and tech innovation, ranked only No. 32 in that criteria.

Tennessee is ranked a relatively poor No. 36 in workforce education and experience. On the flip side, the state is No. 20 in taxes and regulations: The state’s low 2 percent personal tax applies only to interest and dividend income and it’s corporate income tax rate is set at 6.5 percent. (But the 7.0 percent sales tax is on the high side.)

U.S. News ranked Tennessee No. 1 for its fiscal stability.

No. 18: Kansas (No. 21 in 2018)

Solution Provider 500: 4

The Sunflower State moved up three spots on this year’s Best States ranking.

Kansas' overall rank is pulled up by its No. 17 ranking in taxes and regulations. Most of its taxes are in the middle of the pack: Corporate income tax is 7.0 percent for income above $50,000 and the individual income tax is 5.7 percent for income above $30,000). Unemployment insurance taxes are low and Kansas also boasts low labor and operating costs (ranked No. 9).

The Sunflower State is No. 29 in business climate/competitive environment—up from No. 37 last year when that ranking took a hit from a 2017 GDP decline. (GDP in 2018 was up a moderate 1.9 percent.) The state is ranked No. 31 in entrepreneurship and innovation.

Kansas is ranked No. 21 in workforce education and experience—that despite a decline in the number of tech jobs in the state in 2018.

No. 17: Virginia (No. 10 in 2018)

Solution Provider 500: 43

Virginia got a lot of attention earlier this year when Amazon announced that it was building its second headquarters in Arlington, Va. And with the exception of some tax issues, the Old Dominion State has a lot going for it.

Virginia is No. 3 in the education and experience of its workforce, behind only Washington and Colorado. The state is No. 2 in tech jobs as a percentage of the total workforce, according to the CompTIA 2019 Cyberstates report.

The state is No. 9 in business climate and competitive environment. Part of the fast-growing Washington D.C. area, Virginia’s GDP grew 2.8 percent in 2018 (No. 13 among the states). But the state is already crowded with solution providers—ranked No. 46 for solution provider competitive saturation. And the state is No. 17 in entrepreneurship and innovation: The technology sector accounts for 13.5 percent of total gross state product (No. 6).

But Virginia has issues. The state is No. 32 in cost of living, according to the CNBC America’s Top States for Business 2019. And it is No. 42 in taxes and regulations in the best states research – largely due to its high unemployment insurance and property taxes. The Tax Foundation rates Virginia No. 22 overall on its 2019 State Business Tax Climate Index.

No. 16: Indiana (No. 14 in 2018)

Solution Provider 500: 4

In contrast to Virginia, Indiana gets a boost from its low tax burden, No. 6 for taxes and regulations. The personal income tax is only 3.23 percent and the corporate income tax is a moderate 5.75 percent. The Tax Foundation rates Indiana No. 10 overall on its 2019 State Business Tax Climate Index, just making the organization’s 10 best business tax climate list.

But Indiana stumbles in other areas. The Hoosier State is a poor No. 42 in workforce education and experience. Its rankings for business climate and competitive environment (No. 26) and entrepreneurship and innovation (No. 33) are in the middle of the pack. GDP grew 1.9 percent in 2018 (No. 28).

The state is No. 41 in overall labor and operating costs.

No. 15: Georgia (No. 24 in 2018)

Solution Provider 500: 17

Georgia, with its fast-growing Atlanta metro area, has been moving up in the Best States rankings. The Peach State is No. 6 in business climate and competitive environment with its 2.6 percent GDP growth in 2018 (No. 16). Georgia also ranks high in the number of small businesses (No. 6) and new establishments that make up a prospective customer base for a solution provider.

Georgia is No. 15 in entrepreneurship and innovation: The state is No. 12 in tech industry employment and No. 12 in the tech sector’s share of the total gross state product (10.2 percent).

Georgia is No. 7 for its low labor and operating costs. But it’s No. 20 in the overall education and experience level of its workforce.

No. 14: Minnesota (No. 16 in 2018)

Solution Provider 500: 14

Minnesota is No. 6 in entrepreneurship and innovation on this year’s Best States list. The North Star state is No. 17 in both the number of tech industry establishments and tech industry employment. The tech sector accounts for 9.3 percent of total gross state product and Minnesota was No. 16 in business climate and competitive environment.

Minnesota is No. 9 in workforce education and experience: The state is No. 10 in the number of tech jobs as a percentage of the total workforce, according to the CompTIA 2019 Cyberstates report.

But Minnesota is No. 49 in labor and operating costs, behind only Alaska. The state added only 800 jobs in 2018 (No. 48) and a high percentage of workers are unionized (No. 44). Its relatively high 4.2 percent unemployment rate as of June 2019 ranked it No. 41 among all states.

Minnesota has a 9.8 percent corporate income tax rate, among the nation’s highest, and a relatively high 6.875 percent sales tax—all of which lands the state on the Tax Foundation’s list of the 10 states with the worst business tax climates.

No. 13: Maryland (No. 15 in 2018)

Solution Provider 500: 19

Maryland has one of the most educated workforces in the U.S. (No. 5) with 18.0 percent of people over 25 holding an advanced degree (No. 2). WalletHub ranked the Old Line State No. 2 in its Most Educated States in America.

The state is No. 6 in entrepreneurship and innovation: The tech sector accounts for 11.7 percent of total gross state product (No. 8). But the state is only No. 25 in business climate and competitive environment: It’s GDP grew only 1.6 percent in 2018 (No. 34) and it’s a dismal No. 42 on the solution provider saturation rank.

Maryland is No. 28 in taxes and regulations. While the cost of living is high (No. 46), the state is No. 1 in median household income ($81,084). And Maryland is No. 1 in state infrastructure.

No. 12: Nebraska (No. 12 in 2018)

Solution Provider 500: 1

Nebraska held its No. 12 position in this year’s Best States ranking.

The Cornhusker State has its relatively business friendly tax and regulatory environment (No. 9), including low sales and unemployment insurance taxes, to thank for its ranking. Nebraska is also a respectable No. 17 in workforce education and experience.

Nebraska doesn’t score as well in business climate/competitive environment (No. 32) or entrepreneurship/innovation (No. 36). Its GDP grew 1.5 percent in 2018 (No. 36 among all states) and the tech sector accounts for only 6.4 percent of the total economy (No. 30).

Nebraska is No. 12 in personal cost of living/quality of life.

No. 11: Colorado (No. 6 in 2018)

Solution Provider 500: 12

Colorado has been near the top of every Best States list, but it has slipped in recent years. Perhaps its rapidly growing popularity has made the Centennial State a more expensive place to do business?

Colorado is No. 2 with its highly educated and experienced workforce, behind only Washington. And the state is No. 4 in technology jobs as a percentage of the total workforce.

Those workers are apparently very creative given Colorado’s No. 2 rank in entrepreneurship and innovation. And many must work in the technology industry as the tech sector accounts for 14.5 percent of total gross state product (No. 4). The state is No. 5 in business climate and competitive environment: Its 3.5 percent GDP growth in 2018 was No. 5 among the states.

Colorado, however, is No. 39 in taxes and regulations, given its high unemployment insurance and local taxes (although its corporate income tax rate is a relatively low 4.63 percent).

No. 10: California (No. 7 in 2018)

Solution Provider 500: 58

California is generally considered the hub of the U.S. tech industry. The Golden State is No. 1 in tech business establishments (51,356). No. 1 in tech industry employment (1,782,499) and No. 1 in the tech sector as a percentage of total gross state product (18.9 percent) – all of which gives California the No. 1 spot in entrepreneurship and innovation, up from No. 2 last year.

California is No. 4 in business climate/competitive environment (down from No. 1 last year) with its GDP ($2.97 trillion) and 2018 GDP growth (3.5 percent, tied for No. 5 among the states). The state also has the biggest population, the most small and midsize businesses, and so on. And the state is No. 7 in workforce education and experience.

But there are downsides to California. The state is No. 50 in solution provider saturation. And it’s No. 43 in labor and operating costs—the median tech occupation wage is $96,237.

The state is No. 50 in personal cost of living/quality of life—the median price for a house is $550,000 (No. 49) —and the personal income tax schedule is ranked second-to-highest (behind only New Jersey).

Speaking of taxes, Best States ranks California No. 22 with a relatively high 8.84 percent corporate income tax. The state makes the Tax Foundation’s list of the 10 worst business tax climates.

No. 9: Arizona (No. 20 in 2018)

Solution Provider 500: 10

Arizona has been moving up in the Best States rankings, gaining 11 spots this year.

The Grand Canyon State is No. 9 in entrepreneurship and innovation. Surveys (FitSmallBusiness.com and WalletHub) score the state in the top 10 as a place to start a business and the tech sector accounts for 10.5 percent of total gross state product (No. 10). And the state is No. 10 in business climate/competitive environment – its 4.0 percent GDP growth in 2018 was No. 4 among all states.

Arizona is ranked a relatively favorable No. 15 in taxes and regulations (its corporate income tax is a low 4.9 percent) and a middle-of-the-road No. 24 for workforce education and experience (an improvement from previous years). But it’s No. 33 in labor and operating costs.

No. 8: Missouri (No. 3 in 2018)

Solution Provider 500: 7

Missouri ranks high in Best States largely due to its business-friendly taxes, including a relatively low corporate income tax (6.25 percent) and middling personal income tax (5.4 percent for income over $8,424). Overall the Tax Foundation ranks the Show Me State No. 14 on its 2019 State Business Tax Climate Index.

Most of Missouri’s other rankings are fairly middle-of-the-road. It is No. 21 for business climate and competitive environment—GDP grew 2.3 percent in 2018 (No. 20). And the state is No. 25 in entrepreneurship and innovation: It is No. 19 in the number of tech business establishments (8,330), No. 20 in tech industry employment (209,250) and No. 24 as the tech sector’s percentage of total gross state product (7.6 percent).

Missouri is No. 39 in labor and operating costs: The state’s 5.0 unemployment rate in June 2019 was second only to Alaska.

No. 7: Ohio (No. 8 in 2018)

Solution Provider 500: 11

Ohio is another state that benefits from its favorable tax and regulatory environment—No. 8 on this year’s Best States ranking. The state has no corporate income tax and the state’s low property and unemployment insurance taxes.

Many of the Buckeye State’s other rankings, like Missouri, are fairly unremarkable. It is No. 20 in business climate/competitive environment, down from No. 11 last year—likely the result of its relatively slow 1.8 percent GDP growth (No. 31) in 2018. And it is No. 28 in entrepreneurship and innovation: The tech sector accounted for only 5.8 percent of Ohio's total gross state product in 2018 (No. 34).

And it’s a relatively poor No. 33 for workforce education and experience. But it does have an edge with its relatively low labor and operating costs (No. 15)—despite having the second lowest unemployment rate (2.3 percent) in the country.

No. 6: Delaware (No. 9 in 2018)

Solution Provider 500: 0

Delaware is another state that owes its favorable ranking to its business-friendly tax and regulatory environment—No. 2 in this year’s Best States survey, behind only No. 1 Florida. Delaware, the First State, is ranked No. 11 on the Tax Foundation’s 2019 State Business Tax Climate Index with its low unemployment insurance taxes and property taxes and lack of any sales tax. (Its 8.7 percent corporate income tax is high, however.)

Delaware gets a boost from its No. 4 rank in personal cost of living/quality of life, helped again by its low property taxes and lack of a sales tax.

But Delaware’s scores are otherwise unremarkable. It’s a rather poor No. 37 in business climate and competitive environment, in fact, with its 0.3 percent GDP growth in 2018, No. 48 among all states. Delaware is No. 22 in entrepreneurship and innovation, a ranking inflated by its No. 1 ranking in awarded patents (many corporations are registered in Delaware).

Delaware is No. 18 in workforce education and experience and No. 29 in labor and operating costs.

No. 5: Washington (No. 11 in 2018)

Solution Provider 500: 8

Washington, of course, is home to Microsoft, Amazon and other leading tech companies. The Evergreen State is No. 1 in business climate and competitive environment: Its 5.7 percent GDP growth in 2018 was No. 1 among the states and WalletHub ranks it No. 1 for economic development efforts.

Washington is No. 4 in entrepreneurship and innovation. It is No. 1 in tech sector as a percentage of total gross state product (20.1 percent). WalletHub ranks the state No. 2 in innovation potential (behind only Massachusetts) while CNBC America’s Best States for Business 2019 ranks it No. 2 for technology and innovation (behind only California).

And with the state No. 3 in technology jobs as a percentage of the total workforce, Washington is ranked No. 1 overall in workforce education and experience.

Washington is No. 19 in taxes and regulations. It has no corporate income tax (but it does have a gross receipts tax). The state’s ranking takes a hit from its high state and local sales tax rates, however: The Tax Foundation ranks the state No. 20 overall on its 2019 State Business Tax Climate Index.

And Washington is only No. 40 in personal cost of living and quality of life: Those state and local sales taxes hurt here, as does the $425,000 median list price for a home (No. 46, behind only Colorado, Massachusetts, California and Hawaii).

No. 4: Texas (No. 5 in 2018)

Solution Provider 500: 24

With its robust economy and low tax burden, it’s no surprise Texas has been in the top 5 in the Best States survey for several years now, including No. 5 last year and No. 3 in 2017.

The Lone Star State is No. 3 in business climate and competitive environment (behind only Washington and Florida), recording 3.2 percent GDP growth in 2018 (No. 9). And it added 323,300 jobs to its economy in 2018, No. 1 among the states. But with a solution provider saturation rank of No. 49, it might be a tough place for a startup to squeeze in.

Texas is No. 5 in entrepreneurship and innovation. It’s No. 2 to California in both the number of technology establishments and tech industry employment, although only No. 17 in the technology sector as a percent of total gross state product (8.7 percent). The WalletHub 2019 Best States to Start a Business survey ranked Texas No. 1 for its business environment.

The state is No. 3 for low labor costs. And it is No. 16 in taxes and regulations—although there is no personal or corporate income tax, the state does charge businesses a gross receipts tax.

Texas is ranked No. 31 in the education and experience of its workforce, up from No. 33 in 2018.

No. 3: Utah (No. 4 in 2018)

Solution Provider 500: 1

Utah was at top of the first Best States survey seven years ago and has consistently been in the top ranks of the states that are most attractive for starting a solution provider business.

The Beehive State has some impressive statistics. It’s No. 11 in business climate, thanks to 4.3 percent GDP growth in 2018—No. 2 behind only Washington. WalletHub ranked Utah No. 1 for economic health in its Best and Worst State Economies survey. And the state isn’t overrun with solution providers, according to its No. 25 placement in the Best States solution provider saturation index.

Utah is No. 12 in entrepreneurship and innovation: While it’s only No. 26 in tech industry establishments and No. 25 in tech industry employment, the tech sector accounts for 11.4 percent of total gross state product (No. 9).

Utah has a highly educated and experienced workforce (No. 6), low labor and operating costs (No. 4), and a business-friendly No. 11 ranking in taxes and regulations, thanks to a relatively low 4.95 percent corporate income tax.

No. 2: North Carolina (No. 2 in 2018)

Solution Provider 500: 8

North Carolina is No. 2 for the third year running, scoring well almost across the board on the Best States criteria, including a low tax burden, educated workforce and favorable business environment.

The Tar Heel State was No. 8 in business climate and competitive environment. Its GDP grew a healthy 2.9 percent in 2018 (No. 12 among the states) and CNBC America’s Top States for Business 2019 ranked it No. 1 for its growth prospects.

North Carolina was No. 16 in entrepreneurship and innovation. It’s growing tech sector accounts for 9.3 percent of total gross state product (No. 15) and the state is No. 8 and No. 13, respectively, in the number of tech industry establishments and tech industry employment.

The state is No. 12 for workforce education and experience: It was No. 4 among the states in new technology job gains between 2017 and 2018, according to the CompTIA 2019 Cyberstates report.

But North Carolina really shines in its low taxes, No. 4 overall, with a 2.5 percent corporate income tax. The Tax Foundation ranks the state No. 12 in its 2019 State Business Tax Climate Index. The state is also No. 11 with relatively low labor and operating costs.

No. 1: Florida (No. 1 in 2018)

Solution Provider 500: 12

For the fourth year in a row Florida has captured the No. 1 spot in our Best States analysis.

The Sunshine State, as it has been for several years, was ranked No. 1 in taxes and regulations. The state's corporate income tax is a moderate 5.5 percent, its sales tax is 6.0 percent, unemployment insurance taxes are low and there is no individual income tax. For its overall tax burden Florida is No. 4 on the Tax Foundation's 2019 State Business Tax Climate Index.

Florida's other strength is its booming business climate where it ranked No. 4 (compared to No. 4 in 2018 and No. 2 in 2017). Its 3.5 percent GDP growth in 2018 was No. 5 among the states. But beware, the state already has 10,418 solution providers, ranking it No. 48 in solution provider competitive saturation, behind only California and Texas.

The state also has the lowest unemployment rate (2.1) and was No. 3 in the total number of jobs added (227,200) in 2018.Florida is No. 11 in entrepreneurship and innovation: The state is No. 3 in tech business establishments and No. 4 in tech industry employment—a sign of just how big and diverse Florida’s economy is given how much of the state’s economy is driven by tourism. (The tech sector accounts for 7.9 percent of total gross state product, No. 20 among the states.

Florida continues to offer low labor and operating costs (No. 2) and has even improved its ranking in workforce education and experience to No. 10.