10 Hot DevOps Companies To Watch In 2022

Startups and IT giants alike are among CRN’s 10 hottest companies offering tools for DevOps.

Startups – including Solo.io, Honeycomb and Cast AI – and giants such as Amazon Web Services and Microsoft are some of the companies CRN is watching for new innovative tools to help organizations adopt DevOps.

DevOps – or development operations, the combination of software development and IT operations for the purpose of shortening the development lifecycle, continues to grow in importance for businesses and organizations with a large amount of remote workers.

Businesses and organizations seek tools to improve agility and cut development time and skill requirements, making the market for platforms that support DevOps and low-code, no-code attractive, according to Gartner.

[RELATED: The 10 Hottest DevOps Company Startups Of 2021]

Here are 10 hot DevOps companies to watch in 2022.

Amazon Web Services

The No. 1 cloud infrastructure by market share, Amazon Web Services continues to innovate around the DevOps tools it offers.

In May, the Seattle-based company announced general availability of DevOps Guru, which uses machine learning to help developers with application availability and operational issues detection. DevOps Guru analyzes application metrics, logs, events and traces for anomalous behavior, according to the company.

DevOps Guru gained an enhanced analysis for Aurora databases and support for AWS tags in December.

In November, the company announced AWS Mainframe Modernization to help customers migrate legacy workloads to the cloud. The tool provides continuous integration and continuous delivery capabilities for application development and deployment.

That same month, AWS updated its CodeGuru code quality and review automation tool with a secrets detector capability to make sure new code doesn’t have secrets before merger and deployment. And the company launched CloudWatch RUM for real-user monitoring and reducing resolution time.

In December, AWS announced Amplify Studio, a visual development environment for web application user interfaces with minimal coding and full customization with JavaScript, TypeScript and other programming languages.

Cast AI

Cast AI offers a platform for users to connect existing clusters and get a savings report and improve performance of users’ cloud environments. The platform’s autonomous Kubernetes optimization capabilities supports AWS, Google Cloud and Microsoft Azure.

Miami-based Cast promises DevOps engineers more time for higher-level challenges while taking care of lower-level tasks, according to the company. In November, the company announced it had achieved SOC 2 Type II compliance and added an instant rebalancing feature to rightsize Kubernetes cluster configurations.

In October, Cast AI raised $10 million in a Series A round to help with development of its platform. It was founded in 2018 and has raised $18 million in total funding, according to Crunchbase.

CloudBees

CloudBees, which provides a software delivery platform, closed a $150 million Series F financing round and a $95 million debt facility in December, giving the company new money to accelerate product innovation and expand internationally.

The San Jose-based company’s CloudBees Compliance real-time compliance and risk analysis capability for software delivery from commit through production becomes available during this quarter. The technology comes from Neuralprints, which CloudBees acquired in September, according to the company.

CloudBees also recently made full visibility and control of feature flags throughout development and release pipelines available.

Copado

Chicago-based Copado is clearly in growth mode. This DevOps platform provider announced a $140 million Series C round in September, bringing its total funds raised to $257 million.

The company plans to use those funds to expand DevOps and artificial intelligence-enabled testing services and to grow internationally, according to Copado.

Copado bought Qentinel in the summer to add its robotic software testing services to Copado’s suite.The company originally designed its platform for Salesforce and has expanded into other Heroku, MuleSoft, Veeva and other cloud platforms.

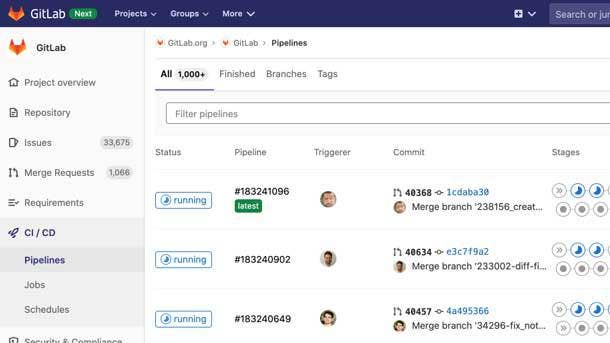

GitLab

Following its initial public offering in October that raised about $800 million – according to multiple media reports – San Francisco-based GitLab stands to make some promising investments in its DevOps tools.

This month, the company released GitLab 14.7 with streaming audit events, group access tokens for authentication and project management and other features. The company also acquired open source observability distribution provider Opstrace with plans to expand its monitoring capabilities.

The company also recently extended continuous integration, continuous deployment minute usage quotas to certain GitLab.com public projects to cut down on abuse and added a new metadata database to Container Registry to improve visibility.

HashiCorp

HashiCorp, the company behind the multi-cloud provisioning and automation tool Terraform, announced general availability of version 1.1 of its tool in December.

Upgrades from the San Francisco-based company include improved refactoring and command-line interface for Terraform Cloud and Enterprise users.

HashiCorp also released Waypoint .7 with a user interface redesign, improved support for complex deployment workflows and more continuous integration integrations.

The company raised about $1.2 billion when it went public in December, according to multiple media reports.

Honeycomb

Honeycomb offers an observability platform for engineering teams to visualize, analyze and improve cloud application quality and performance.

Its tool uses machine analysis, a query engine and integrated distributed tracing to allow users the ability to compare billions of rows of data about their systems and find patterns, according to the company.

In October, the company closed a $50 million Series C round of funding, bringing the company’s total funding raised to $96.9 million.

The company will use the money toward international expansion and its partner ecosystem. Honeycomb is available on AWS and has partnerships with Cloudflare, CircleCI and other vendors. Customers include Fender, Intercom and Optimizely, according to the company.

Honeycomb was founded in 2016, according to Crunchbase.

IBM, Red Hat And Ansible

With IBM now focused on software following the spin off of Kyndryl – its managed infrastructure services business – developers may see some major updates not only for IBM Cloud, but from its Red Hat subsidiary and Red Hat’s automation and configuration management subsidiary, Ansible.

Examples of Armonk, N.Y.-based IBM and its subsidiaries investing in developers tools and DevOps include the recent announcement of a field trial of Red Hat OpenShift Data Science to support machine learning on the enterprise Kubernetes platform and making Red Hat Enterprise Linux 8.5 generally available, with new tools meant to simplify multi-cloud operations, bolster container innovation and simplify deployment.

Red Hat OpenShift 4.9 became generally available last year, adding the option for single node OpenShift for small enterprise Kubernetes clusters at edge sites, according to the company.

The Red Hat Ansible Automation Platform 2.1 became generally available in December, with new features including automation mesh for more control around execution and an updated set of automation environments in the Red Hat container registry. Ansible Platform 2 introduced new content tools and collections and a Red Hat Insights integration, among other tools.

IBM recently released IBM Symphony on IBM Cloud for end-to-end high performance computing with one or more schedulers and made Kubernetes version 1.22 available for IBM Cloud Kubernetes Service clusters.

IBM also bought DevOps startup BoxBoat in the summer.

Microsoft

Microsoft – the No. 2 cloud company by market share – has also invested in more DevOps tools across its products suite. It also owns the GitHub project management tool that provides open source tools for DevOps.

In November, the Redmond, Wash.-based tech giant launched a preview of Azure Load Testing for high-scale load with custom Apache JMeter scripts, allowing developers to fix performance bottlenecks at scale.

In September, Microsoft updated its Azure Pipelines tool to automate builds and deployments with support for Azure Database for MySQL and PostgreSQL to allow updates through command-line interface tasks.

In May, Microsoft expanded its Azure Synapse Link tool for Microsoft Davaverse to allow business applications data into analytics services.

Solo.io

Solo.io is the maker of Gloo tools to help businesses coordinate configurations, load balance and accomplish other advanced traffic management needs that come from complex hybrid and multi-cloud environments.

Founded in 2017, Solo.io offers tools that run in Amazon Web Services, Microsoft Azure and Google Cloud, among other cloud vendors’ offerings.

In October, Solo.io raised $135 million in Series C funding at a valuation of $1 billion, according to a company statement. The round brought the company’s total funding raised to $171.5 million.

The company also recently added GraphQL support to Gloo Mesh and Gloo Edge to help query microservices.