10 Things IBM Business Partners Learned At IBM Think Digital

New IBM leaders CEO Arvind Krishna and President James Whitehurst introduced themselves to partners at the company’s flagship conference—turned virtual due to the coronavirus crisis—and shared their vision for Big Blue’s growth in the years ahead.

Propelling Its Position In Emerging Technologies

IBM’s flagship conference took place online under the Think Digital branding as the in-person event originally slated to be held in San Francisco had to be called off due to the coronavirus crisis.

The virtual format limited the extent to which new IBM leaders CEO Arvind Krishna and President James Whitehurst could introduce themselves to Big Blue’s customer and partner communities. But the two used their online keynotes and sessions to share their vision for Big Blue’s growth in the years ahead.

Some 85,000 registered for the online conference, which took place a week after the virtual Red Hat Summit.

Throughout the week, IBM’s leaders emphasized a grand vision of leveraging its $34 billion acquisition of Red Hat, the company that Whitehurst led since 2007, to propel its market position in crucial emerging technologies: cloud, artificial intelligence and 5G network enablement.

Here’s what IBM Business Partners learned at Think Digital.

New Build Track Highlights Partners’ Unique IP

Build isn’t just a new track in the IBM PartnerWorld program, but a major strategic emphasis for partners.

IBM wants its channel writing code, creating applications, packaging them with Red Hat OpenShift and integrating their unique IP across the solution portfolio, General Manager for Partner Ecosystem David La Rose told CRN.

“Traditional partner roles are blurring,” Michael Fino, COO of IBM Partner Ecosystem, said during a partner session Wednesday.

IBM is seeing 58 percent of partner revenue generated by their own IP—a lucrative profit driver for the channel, Fino said.

The new track supports and incentivizes those efforts to build solutions on the IBM Cloud, Fino said.

Timothy Kreytak, CEO of Ironside, a Boston-based data analytics specialist, said IBM is providing to partners “the Legos, the pieces we can use to build solutions and take them to market.”

Accordingly, IBM has modified its channel program to deliver financial benefits to partners who are doing more than selling IBM’s technology. Moving away from a fulfillment-based model is important as IBM shifts focus to integrations with Red Hat platforms, Kreytak said.

“You’re deploying a platform, and the more applications that get built on that platform, the more relevant that platform is,” Kreytak said.

Expanding the financial incentives for partners to “build something that’s going to drive consumption” will create new ways to monetize IBM products.

Ramping Partner Expertise In Professional Services

The channel has a vital role to play in delivering professional services to enterprises adopting cloud. IBM is looking to ramp partner expertise and innovation in that department.

In addition to Build, IBM added a Services track to its PartnerWorld program that incents partners to invest in developing unique implementation and managed services practices.

Fino said during a partner session Wednesday that IBM has heard from 86 percent of its customers that migrating to cloud is their top priority—and they need help in doing it.

“Service capabilities continue to be in high demand,” Fino said.

The Services track supports service-based offerings built with IBM technologies in mind, he said.

Hybrid Cloud Market Exploding

“When we look at the size of this market going forward, it’s billions and billions,” Whitehurst (pictured) told IBM Business Partners of the hybrid cloud market.

And the company Whitehurst led until recently, Red Hat, which IBM bought for $34 billion, is the key to unlocking that exploding market. Red Hat OpenShift is the platform that will deliver IBM a unique hybrid position.

IBM is the only company working to deliver hybrid cloud with a single architecture that allows applications to run anywhere—from the data center to any public cloud to edge computing environments, Whitehurst said.

A cohesive hybrid platform frees enterprises from locking themselves into any public cloud provider’s innovation cycles, said Krishna is his opening keynote.

IBM’s strategy hinges on allowing enterprises to choose their infrastructure through Red Hat’s consistent and cloud-agnostic platforms, as customers never start their digital transformation journeys from scratch.

“Hybrid cloud is about meeting you where you’re at in terms of the infrastructure choices you made,” Krishna said. That approach supports existing systems—and whatever transformation road map lies ahead.

A new product will advance IBM’s hybrid reach. IBM Cloud Satellite, soon to be released in beta, offers a control plane that eases extending workloads running on IBM’s public cloud into on-premises and edge environments. That solution will also be delivered through OpenShift.

“It’s a very shrewd move from a marketplace perspective, viewing OpenShift as an operating system that goes across cloud providers, essentially turning public cloud into commodity,” said Ironside’s Kreytak.

“You can build capabilities on OpenShift, they can be deployed anywhere,” he said. “It prevents vendor lock-in.”

Red Hat Platforms ‘Define Generations Of Computing’

Red Hat unlocks IBM’s potential to become a dominant player in the hybrid cloud market, and propel its own public cloud, AI and edge computing solutions.

A portfolio that includes Red Hat Enterprise Linux, the OpenShift Kubernetes platform, OpenStack cloud-building technology, and Ansible for DevOps configuration enables IBM partners to deliver versatile and agnostic solutions that reach deep into enterprise operations.

As Whitehurst told partners during a PartnerWorld session, the company he previously led was in the “ecosystem-building business.”

Red Hat developed platforms “that define generations of computing,” Whitehurst told IBM partners. And “one of the things we recognize at IBM is when there’s such a massive, rapid amount of change, how computing architectures develop is important.”

While IBM’s success depends on a large portfolio of on-premises hardware and public cloud services, its strategy hinges on allowing enterprises to choose their infrastructure through Red Hat’s consistent and cloud-agnostic platforms, Krishna said in his opening keynote.

“We have joined forces with Red Hat to give you the capability to build mission-critical apps once and run them anywhere,” Krishna said.

Cloud Paks: ‘The Heart Of Any Solution’

The melding of IBM and Red Hat technology comes in the form of Cloud Paks.

Those offerings wrap IBM middleware in containers managed by Red Hat’s OpenShift platform. The integration eases deploying IBM solutions in any environment—a significant advantage in an increasingly hybrid and multi-cloud world.

Cloud Paks are envisioned “to be at the heart of any solution IBM or a partner is providing to clients,” La Rose told CRN. As such, IBM wants to reward partners for putting them at the center of their go-to-market strategies, even if they don’t have a direct relationship with Red Hat.

IBM also hopes the deployment flexibility of Cloud Paks encourages partners to pursue deals downmarket from the large enterprises that constitute much of IBM’s customer base.

Ironside’s Kreytak said Cloud Paks go far to simplify what can be a complicated process of installing and configuring components of the IBM portfolio.

“They’ve made adoption of their technology easier,” Kreytak said. “Cloud Paks have all the pieces in them already preconfigured and scalable. It takes a lot of the manual effort around platform integration off the table.”

Differentiating IBM Cloud

Red Hat platforms give IBM a powerful hybrid and multi-cloud story—build an app once and run it anywhere you’d like.

As such, Big Blue works with other public clouds “in this horizontal infrastructure,” Whitehurst told IBM Business Partners.

But IBM still has its own public cloud, and it wants that infrastructure service to be in the discussion, if not a necessary component, of cloud transformation initiatives based on Red Hat-enabled IBM Cloud Paks.

Red Hat will remain independent, and the OpenShift platform agnostic to ensure portability and no lock-in to any one cloud provider. But IBM will also work to “differentiate the IBM Cloud significantly from the others” based on synergies with its subsidiary, La Rose told CRN.

Partners could benefit from more clarity from IBM on its “relentless push to have customers consider the IBM Cloud as a possible public cloud option,” Darrin Nelson, vice president of software sales at Sirius Computer Solutions, told CRN.

The market still perceives IBM’s public cloud as the old SoftLayer offering, or the Bluemix platform.

Bluemix in particular had “tremendous function, simplifying access to extraordinary services,” Nelson said. But it was a proprietary solution, and most customers weren’t willing to refactor applications to work on the platform.

They typically ended up adopting the options perceived to be more open: Microsoft Azure, Amazon Web Services or Google Cloud Platform.

Now, as IBM’s key selling point is an open, hybrid platform, partners want to know how IBM plans to inspire customers to consider IBM Cloud rather than those three market leaders, Nelson said.

The ‘Critical Role’ Of AI

Krishna (pictured) in his opening keynote said artificial intelligence is one of the “powerful core technologies all of you will use to translate how business operates.”

IBM has staked much of its future on a cognitive computing vision and has built out the core technology of the Watson platform to solve varied use cases spanning industries.

This week, that cognitive portfolio expanded with Watson AIOps, an automated incident response solution, and Watson Assistant for call center automation.

Watson AIOps automates how enterprises self-detect, diagnose and respond to IT anomalies in real time, reducing the number of costly outages, Krishna said in his Tuesday keynote. The solution is built on Red Hat’s OpenShift Kubernetes platform to allow deployment in any hybrid cloud environment. It also integrates with ServiceNow and can plug into Slack and Box.

Intelligent incident detection is especially important during the current crisis, as employees around the world, including IT professionals, are restricted from their work environments due to the coronavirus pandemic.

“I strongly believe AI can play a critical role in assisting clients in this uncertain time,” Krishna said.

Ironside’s Kreytak said he’s impressed by how complete IBM has made the Watson platform, and that “they continue to improve it.”

Broader integrations with Watson Knowledge Catalog, InfoSphere Information Governance Catalog and data movement tools will go far in making AI and machine learning even easier to build and deploy on the platform.

Sirius Computer Solutions’ Nelson said he would have like to have heard Krishna talk more about the critical role of data, and IBM investments to support AI selling motions.

“AI without meaningful data is irrelevant,” Nelson said. “IBM can and should play a meaningful role there. After all, their repositories house large portions of the world’s transactional and operational data.”

IBM needs to keep evolving how that data is not only operationalized, but also visualized, Nelson said.

Winning In The 5G And Edge Era

“The 5G and edge computing generation is coming quickly,” Krishna said in his keynote.

“The winners in the 5G and edge era will be those who embrace a hybrid cloud approach based on open technologies and standards,” he added. IBM’s expanding edge portfolio incorporates Red Hat OpenStack, a cloud-building technology, and Red Hat’s OpenShift Kubernetes platform.

In touting its edge strategy, IBM primarily highlighted relationships with telecoms. With Red Hat under its wing, IBM is delivering to customers including Verizon a consistent platform to build out high-bandwidth 5G networks spanning on-premises data centers, public clouds and edge infrastructure.

The latest offerings include IBM Edge Application Manager for remote management of IoT workloads, and the IBM Telco Network Cloud Manager to orchestrate virtual and containerized network functions.

IBM’s edge strategy will gain relevance as the Internet of Things goes more mainstream, said Sirius Computer Solutions’ Nelson.

“The ability to put AI and compute resources in a distributed edge cloud, closer to instrumented assets, will speed response times and reduce latency,” Nelson told CRN.

Edge Application Manager, Telco Network Cloud Manager and the new Cloud Satellite hybrid management plane are enabling telecoms to build robust edge compute options that could ultimately offer meaningful competition to the public cloud giants, Nelson said.

To advance the strategy, IBM has also created an IBM Edge Ecosystem consisting of ISVs and global systems integrators that can help enterprises deploy edge infrastructure. Another Telco Network Cloud Ecosystem is designed to partner with telecom industry and networking giants including Cisco Systems, Dell Technologies, Juniper Networks and Intel.

New Certification, Enablement Opportunities

The changes to the IBM PartnerWorld channel program didn’t stop with new Build and Service tracks.

Fino said during a partner session Wednesday that IBM is adding certifications and enablement opportunities to help its channel capitalize on market trends.

Of the new tracks to incent those practices, as well as the existing Sell track, any Business Partner can participate in one, or all, at no cost, and without even needing to register.

IBM also introduced six new competencies to showcase technical proficiency and client success for the new Build and Services track partners.

Four of those are focused on strategic industries with regulated workloads, including banking and manufacturing. The Services track will also have an application modernization competency, Fino said.

“Achieving these will unlock additional valuable benefits,” he told partners, including priority promotion in IBM’s Business Partner directory.

To further simplify achieving benefits, IBM has removed client reference and client satisfaction criteria for the Gold or Platinum tiers, and the sales success requirement previously needed to achieve Silver. The entry-level Registered tier is being renamed Member.

IBM is also offering IBM Partner Packages at no charge from July 1 to the end of the year for all PartnerWorld members. Those include access to all IBM software, including Cloud Paks; IBM Cloud Lite credits; and remote development and test support to help accelerate partner initiatives.

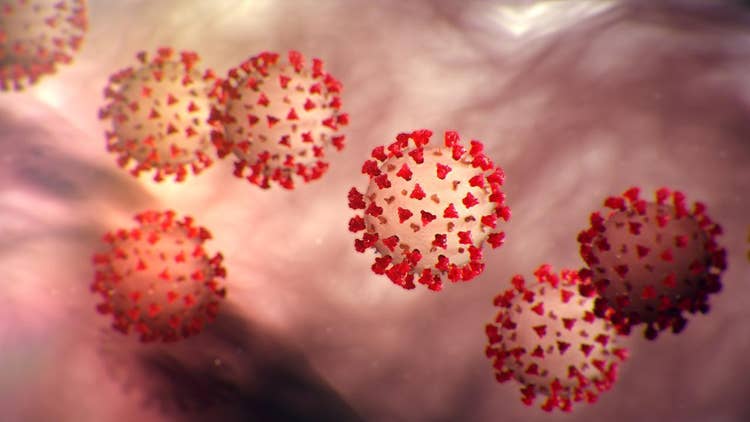

The Role Of Tech Companies During The Coronavirus Crisis

Krishna began his first address as CEO to the broad IBM community by saying his heart went out to all the families dealing with loss from the deadly COVID-19 outbreak.

While IBM is pained to see the devastation caused by the pandemic, he said, the crisis has highlighted the important role technology companies have to play in society.

“I’ve seen powerful new partnerships between government, academia and the private sector form overnight,” Krishna said. “We’ve all seen a massive mobilization of corporate capability to join the fight.”

As the world grapples with a global public health crisis, “IBM continues to be an important player, not just watching from the sidelines,” Krishna said.

He told customers that in navigating the unprecedented crisis, “we’re carefully thinking about how and when we all return to the workplace. We should do this together in a consistent manner.”

In his PartnerWorld keynote, La Rose noted that he should have been on a stage in San Francisco addressing partners in his first such event as Big Blue’s channel chief.

Instead, La Rose had to rely on an online medium to share programs designed to help partners weather the pandemic, including extending revalidation deadlines, preserving all partner loyalty levels through 2020, aggressive short-term incentives, digital seminars, virtual tools, deferred terms on contracts, credits for on-boarding to the partner platform, and support for digital marketing campaigns.

Whitehurst, who participated in La Rose’s virtual PartnerWorld keynote, told channel partners that as soon as possible, he looked forward to starting the process of meeting as many of them as possible in-person.