10 Most Influential Cloud Computing Vendors

Leaders Of The Pack

Their every move can shake the foundation of the industry. Their strategy becomes the topic of discussion among partners and competitors. And their top executives have all eyes on them as they break new ground in the IT landscape. These are the 10 most influential vendors in cloud computing right now. These are the ones to watch as this emerging market continues to take the shape of a multi-billion dollar transition and becomes a pie from which everyone wants a piece.

Oracle

Leave it to oft outspoken Oracle CEO Larry Ellison to call cloud computing little more than fluff -- its "everything we already do," he's said -- and then turnaround with a full-on cloud computing platform just months later. At the company's OracleWorld conference in San Francisco this month, Ellison and his crew plotted Oracle's cloud attack: an offensive mounted on all fronts that includes the recently unveiled Oracle Exalogic Elastic Cloud server, a system designed to serve as a cloud computing platform or what Ellison called a "cloud in a box."

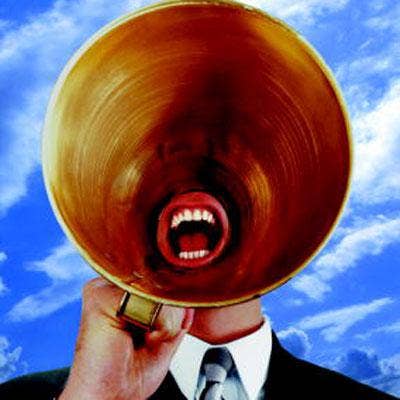

Following Ellison's cloud mega-phoning, Oracle Executive Vice President Thomas Kurian took the stage, noting that Oracle offers "a number of unique capabilities through our products [and] we also offer a number unique capabilities through our cloud services."

While Oracle may be a little late to pick up the cloud torch, with Ellison's brains, cash flow, ego and gumption at the helm Oracle is sure to shape the decisions other major cloud players make.

Google dove into cloud computing head first and didn't look back. With Google Apps, it's collaboration and communications suite of cloud tools; Google Docs, its cloud-based productivity apps; its Google Apps Marketplace, where users can buy and developers can sell their cloud wares; its Google AppEngine development platform; and it's cadre of VARs and solution providers, Google has stormed the market and is proving that it means business when it comes to the cloud.

Google constantly innovates, forcing the competition to keep guessing and play catch up on the features and function fronts. And its ability to keep costs low -- Google Apps typically runs $50 per user per year -- Google is leading the charge in the continuing price per performance cloud computing war.

Amazon Web Services

For all intents and purposes, Amazon Web Services is the granddaddy of cloud computing. Amazon launched its EC2 cloud platform in 2006 and has since continued to offer new and interesting cloud offerings like cloud storage, messaging, networking, database, e-commerce, content delivery and others. Amazon's cloud arsenal continues to grow, offering everything from high performance computing capabilities and the ability to spin up and tear down servers in the matter of seconds with little more than a web connection and a credit card.

Some estimates indicate that Amazon's revenue just from the cloud could exceed $500 million in 2010. That same report, from UBS, indicated that Amazon's cloud revenue could reach $750 million in 2011 and hit a jaw-dropping $2.5 billion come 2014.

Amazon has managed to continue to grow despite the emergence of massive competitors like Google, IBM and Microsoft. But the company has continued innovating, updating its portfolio of cloud offerings and cutting prices.

CA

It wasn't only the name that has changed about CA. The company has managed to reinvent itself into a major cloud computing player and it's done so through not only its own internal R&D, but CA has made several high-profile cloud computing acquisitions to inject some much-needed innovation.

CA has been the one to beat when it comes to scooping up the top talent in the cloud. Over the past 14 months, CA has acquired a small army of cloud computing companies to help bulk up its cloud strategy. It's estimated that CA has plunked down roughly $1 billion on cloud-focused acquisitions that include Arcot Systems, a cloud and on-premise authentication and fraud prevention player; Cassatt, which makes software for operating data centers like cloud computing utilities; 3Tera, a platform for building and deploying cloud services; Oblicore, which offers service-level management applications; Nimsoft, which has a line of cloud application performance and monitoring tools; and 4Base Technologies, a cloud consulting and integration firm.

Salesforce.com

If Amazon is cloud computing's granddaddy, Salesforce.com is the cloud's godfather. Salesforce is credited with making a SaaS deployment model mainstream, playing Peter Piper to many a follower. Salesforce has grown beyond just CRM, incorporating mobility, social media, communications, and myriad other capabilities that have become a linchpin for success for businesses. Salesforce does it all with its real-time, multi-tenant cloud architecture, its platform and its CRM apps. All told, it offers various inroads into the cloud with the Sales Cloud for sales force automation and contact management; the Service Clouds, for customer service and support; Chatter for social collaboration; the Force.com platform for custom cloud application development; and the AppExchange, a marketplace for cloud apps.

In August, Salesforce.com reported record revenues of $394 million for the second fiscal quarter of 2011, a jump of 25 percent year over year, and cash flow was $76 million, a 66 percent bump.

IBM

Big Blue is also looking skyward, and has had great results in doing so. IBM has said that cloud computing will give it $3 billion in net revenue come 2015.

IBM has been strategically releasing cloud offerings over the past years, launching a test and development cloud, LotusLive cloud collaboration offerings, storage clouds and a host of consulting and design services targeted at the cloud. IBM has opened several cloud computing centers globally, has been tapped to build a secure cloud for the U.S. Air Force and has teamed up with Aetna for an on-demand cloud-based health care support system.

And IBM, like some of its other cloud competitors, has made key acquisitions to fuel its cloud flames including the 2007 purchase of business intelligence and performance management software maker Cognos and this May's scoop up of Cast Iron Systems to connect its cloud to legacy software.

Microsoft

Perhaps no one has been as vocal as Microsoft in its push for cloud computing dominance. With CEO Steve Ballmer screaming its "all in" mantra from the mountain tops, the Redmond software giant has made no secret of its intention to own the cloud.

The company just revealed it will build a $500 million data center in southern Virginia's Mecklenburg county to boost cloud computing capacity. That comes after Microsoft opened two other cloud-focused data centers in Chicago and Dublin, Ireland in July.

Along with diving headfirst into the cloud with its Windows Azure cloud platform, its BPOS suite of applications and the cloud-ready components of Office 2010, Microsoft is also bringing its partners along for the ride. Last month, Microsoft pulled the curtain off of the Cloud Champions Club, a cloud-specific channel program to on-board partners into the cloud with incentives and rewards. As of July, Microsoft had 10,000 paying Azure customers.

Rackspace

Rackspace has made the jump from being a pure-play hosting company to a cloud computing tour de force. And the San Antonio-based company shows no signs of slowing its cloud roll. In the second quarter of 2010, Rackspace added 8,510 customers into its cloud computing business, pushing its total number of cloud customers to 88,590 as of June 30, 2010, a massive increase from the 51,440 cloud customers it had a year prior. And Rackspace's cloud revenue rose to $23.2 million in the second quarter, up from $19.3 million in the first quarter.

Rackspace's Cloud Servers cloud computing play and Cloud Files cloud storage offering have been generating buzz, while its Cloud Sites development platform has attracted many developers. To accommodate its shift to the cloud, Rackspace launched a cloud-focused channel program earlier this year.

In July Rackspace also launched its OpenStack initiative, an open source cloud computing play.

NetSuite

NetSuite emerged from the shadows as a cloud computing dark horse and quickly made a name for itself in the burgeoning cloud computing market. And the fruits of its labor are paying off.

Under the eye of CEO Zach Nelson, NetSuite saw revenue rise 17 percent to $47.1 million for the second quarter and saw channel-driven new business sales rise 27 percent in the first half of 2010, year over year.

NetSuite has been aggressive in its pursuit of new partners and resellers for its SaaS-based ERP, CRM and e-commerce applications and went so far as to let partners keep 100 percent of first year margin to help them adjust to the new paradigm of a recurring revenue stream the cloud brings about.

NetSuite has also gained traction against SAP and Microsoft – its two key competitors – as they try to find footing in the cloud. NetSuite has an edge in that it was built from the ground up to be a cloud player.

VMware

At VMworld 2010, VMware openly embraced cloud computing, which uses virtualization as a key building block. In regards to cloud computing, VMware CEO Paul Maritz said: "This is going to happen with or without VMware. This is the tide coming in."

Maritz put it this way: IT infrastructure has to change to accommodate the cloud, and adopting the cloud will open the door for new applications that add scalability, security and flexibility. For VMware's part, the company plans to deliver the technology needed to move operations between private and public clouds as customers embrace the hybrid cloud model. And VMware already started its own transition into the cloud with last year's SpringSource acquisition.

And while VMware is forging its own cloud path with products like vCloud Director and vFabric, the company also knows it can't go it alone. For instance, it relies on the Virtual Computing Environment (VCE) coalition and its Vblock platform with partners Cisco and EMC for virtualization and cloud computing.