IT Leaders: What Is Driving Cloud Adoption?

Understanding The Cloud Shift

Cloud apps and services are proliferating across the business world with adoption accelerating in both the enterprise and SMB markets.

But the increasing sophistication of cloud apps and services does not mean IT leaders have no concerns about migrating workloads to IaaS and SaaS providers.

They want to leverage the substantial benefits of the cloud to support and drive mission-critical operations, but they are still highly cautious.

Exoprise, a Boston-based vendor of cloud-based performance monitoring software that compares data on various cloud services from across its network of customers, recently surveyed over 200 business executives and IT managers in North America to better understand this shift.

Who Uses IaaS And Who Will Soon?

It might not be long before the majority of North American businesses have an Infrastructure-as-a-Service provider. Exoprise found that 35 percent of respondents currently subscribe to an IaaS host, and another 22 percent plan to soon. Only 43 percent of the companies surveyed said they have no interest in cloud-based infrastructure.

Companies already in the cloud predominantly use Amazon Web Services -- thirty-two percent of respondents were customers of the industry leader. The next 23 percent were on Microsoft's Azure Cloud. Google Compute trailed its rivals with 14 percent, and other providers claimed the final 31 percent of respondents.

Exoprise concludes that while IaaS is a mature market, there exists a large pool of smaller companies that are more likely to adopt SaaS offerings.

So How About SaaS?

Nearly three-quarters of respondents indicated that their organizations use, or plan to use, Software-as-a-Service. Twenty percent use SaaS throughout the organization, 35 percent only in specific departments and 16 percent expect to adopt cloud-based software soon.

SaaS is more popular than IaaS, with current and pending users, among those taking the survey, edging out the more bare-bones offering 71 percent to 57 percent.

That's an indicator that IT teams are looking not only to leverage cloud for hosting apps they manage, but also to leverage apps hosted and fully managed by the service providers when possible, Exoprise concluded.

What SaaS Apps Do New Adopters Plan To Use?

If the survey is representative of new adopters, Microsoft Office 365 will get almost 40 percent of new SaaS business, and Google Apps will get just over 20 percent.

Document storage providers should also do well. Thirty percent of new adopters, companies that want a standalone storage solution, will buy Dropbox.

CRM is another major driver to the cloud. Twenty-four percent of respondents planning migrations will be buying Salesforce.com, and 10 percent will go with Microsoft Dynamics. Business app providers Workday and ServiceNow are both below 10 percent, but "will continue to provide an onramp to the cloud."

"IT organizations are moving more mission-critical applications and services to the cloud -- a clear sign that cloud is becoming a core part of enterprise IT operations."

What Role Will These Cloud Offerings Play?

More than 80 percent of respondents confirmed that cloud-based apps have at least some role in their IT plans going forward.

But when presented four descriptions of that role -- strategic, opportunistic, experimental or tactical -- all options polled at roughly 20 percent

"As the major business software providers, like Microsoft, develop and promote SaaS offerings, it is validating the model for business IT. However, some organizations may still wait for forcing events, like this past year’s end of support milestone for Windows XP and Exchange Server 2003, before they make a major move to the cloud," Exoprise wrote.

What's Driving Cloud Adoption?

The survey's respondents indicated that enhanced agility and features offered by cloud apps and services are more important than capital and operational cost reduction in motivating migrations.

" Cost has been the primary driver behind the use of datacenter co-location and remote application hosting, but that is clearly changing. The major cloud players have added value to their IaaS offerings, and cost is no longer the primary factor," Exoprise concluded.

Almost half said improved agility was driving adoption, with cloud features polling at just over 40 percent, about five points higher than costs.

Is The Cloud Changing How IT Administrators Work?

More than two-thirds of respondents said yes, even though most were in early transitional stages in the adoption of cloud-based software and only making incremental changes. But 15 percent of that group was comprised of IT and business leaders who said the cloud is drastically altering how they do their jobs.

Freed from much of the low-level datacenter management tasks, these IT teams are now looking to solve the problems of application management across multiple service providers.

" We see this as a trend that will grow with cloud adoption, and one [that] presents great opportunities for IT teams to elevate their value to the business," the Exoprise team wrote.

What's Holding Them Back?

In a word: security.

More than 70 percent of respondents, the vast majority, said data security remains their primary concern.

In distant second, about 35 percent, came app performance and availability, followed by about 25 percent who cited lack of tools, visibility and control. Costs, migration difficulty, churn and lack of features all account for some resistance to cloud adoption as well.

"Although the major cloud service providers implement security measures that are more sophisticated than those in place within most business datacenters, businesses remain wary of the risks of storing their sensitive data in the cloud," Exoprise concluded.

What Tools Do Administrator Use To Monitor And Manage Their Clouds?

The majority have none.

More than 40 percent of respondents answered nada, and almost 25 percent just use the dashboards offered from their service provider.

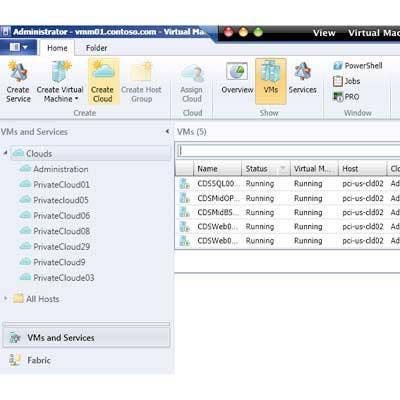

The highest ranked tool, one used by 20 percent of respondents, was Microsoft's System Center, a product integrated into the Azure public cloud. Solar Winds followed with less than 15 percent. Traditional leaders like CA, BMC and HP were all polling under 10 percent.

"We think that this data demonstrates the significant gap that exists in the systems management market. Traditional systems management tools, which have relied on direct access to servers, network equipment, log files and API’s are unable to effectively support cloud apps and services that do not expose those interfaces," the Exoprise team wrote.

Are Those Tools Pretty Good?

Not if you ask the respondents.

Only 17 percent said the management and monitoring tools they use work "very well." More than 60 percent said they're just "okay", 15 percent said they work "poorly" and 6 percent think they're just terrible.

That means more than three-quarters of the respondents felt, at best, ambivalent about the tools they currently use to manage their cloud.

"It is clear that for businesses to fully embrace the cloud they will need management tools that are designed from the ground up to support the remote, distributed nature of cloud apps and services," wrote the Exoprise team.

What Kinds Of Performance Comparisons Will Benefit Businesses?

More than 40 percent want to see what the performance differences are between various cloud service providers, according to the Exoprise survey.

That's a reflection of the market being in an early stage, and customers wanting to shop and compare between different offerings.

More than 35 percent also want to compare performance across different locations on their network, and more than 25 percent want that comparison presented to them between different office locations. This makes sense, Exoprise noted, because businesses like to provide uniform access across their locations.

All of which confirms that application monitoring "is really a big data problem" that requires a platform enabling subscribers to collectively aggregate performance data across customers to effectively monitor services, according to Exoprise.