The 10 Biggest Cloud Stories Of 2014

A Tipping-Point Year

It's been a transformative year for the cloud. Many experts believe one day we will look back at 2014 and recognize a tipping point -- the year businesses big and small finally accepted the inevitability of cloud-based IT, and started planning for that future.

It seems concerns about security, privacy, and compliance are finally easing. Or at least they're being overwhelmed by the desire to achieve benefits in agility, scalability and cost.

But the cloud landscape only grows more complex, with legacy vendors in turmoil, new technologies taking off, service providers engaged in price wars and the savvy solution providers who got ahead of the curve enjoying phenomenal business growth.

Here are the biggest cloud stories of the year. Also, check out the rest of CRN's biggest and best of 2014.

10. Equinix Launches Cloud Exchange

Equinix operates more than 100 top-tier data centers around the globe, providing the computing infrastructure on which many a cloud is built.

In April, the network-neutral collocation provider leveraged its unique capacity, connectivity and performance attributes to create a cloud exchange through which customers could seamlessly connect to multiple public and private clouds, all on a private connection if they wanted.

Since then, the Equinix Cloud Exchange has caught the eye of just about all of the major public cloud service providers, forging partnerships that provide secure, high-throughput portals to Microsoft Azure, AWS, Google Cloud Platform , GoGrid, and most recently IBM SoftLayer.

The channel is hoping next year it will see a greater piece of the action.

9. IBM SoftLayer Succeeds

Last year ended with IBM making a major cloud play with the acquisition of SoftLayer for $2 billion. It was a gutsy move into the market, one uncertain to prove successful.

Today, IBM's cloud business might be the company's fastest-growing asset.

SoftLayer now represents roughly seven percent of the public cloud market -- in third place and ahead of the Google Cloud Platform.

But IBM has made clear it has no interest in participating in a commodity price war.

Channel partners are thrilled to hear that Big Blue instead seeks to differentiate itself as the premier enterprise platform through performance, reliability and security. That's a recipe for healthy margins.

8. Microsoft Azure Ascending

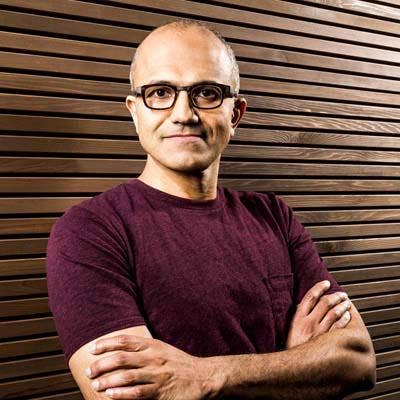

In February, Satya Nadella (pictured) emerged from Microsoft's Cloud and Enterprise group as the company's new CEO, telegraphing the direction of the world's largest software company.

Nadella's ascension was interpreted as a big bet on the cloud, and Microsoft didn't disappoint. The Redmond, Wash.-based company redoubled its commitment to Office 365 and Azure, and Microsoft's cloud is now growing faster than any other in the land.

Sure, AWS still dominates the market. But Synergy Research Group estimated that Microsoft is growing its cloud business almost 2.5 times faster than its hometown rival.

Thanks to an estimated 136 percent growth in the third-quarter, Microsoft now controls 10 percent of the public cloud market, having broken out of the pack to stand unchallenged in second place.

7. Cisco Weaves Intercloud

While a latecomer to the cloud party, Cisco made a big splash this year by leveraging its connectivity credentials to bring to market a unique offering called Intercloud.

Cisco's cloud strategy revolves around a technology called Intercloud Fabric that weaves together many federated public and private clouds, allowing workloads to seamlessly flow between them.

Cisco's Intercloud already connects to hundreds of data centers, linking a diverse ecosystem of distributors, MSPs and cloud service providers that compliment Cisco's own hosting infrastructure.

6. Embracing OpenStack

OpenStack is proving itself to be the transformative technology many had hoped for. But the biggest development regarding OpenStack in 2014, a few years after it was developed by NASA and introduced by Rackspace, is its widespread acceptance and adoption.

Which creates another unique challenge for many vendors, partners and enterprise customers: finding engineers with the skills to build, deploy and manage OpenStack clouds.

Red Hat announced in June its intent to purchase French managed service provider eNovance, a major contributor to the OpenStack community, for 70 million Euros in cash and stock.

The acqui-hire intended to help Red Hat deliver its OpenStack distribution to customers illustrates this dearth of talent that may jeopardize the open-source project.

5. HP Buys Eucalyptus

Talk about bold and unexpected moves, HP got heads scratching in the tech world in September by announcing a deal to acquire startup software vendor Eucalyptus, a close ally of Amazon Web Services and competitor of OpenStack.

Eucalyptus makes open-source cloud operating software that leverages Amazon's APIs and has been marketed as a means to build hybrid cloud environments compatible with AWS. HP, a competitor of Amazon, is now the largest contributor to the OpenStack project, a cloud operating system partly created to provide an alternative to Eucalyptus.

It remains to be seen how HP will try to make the two competing open-source cloud platforms coexist, or how Amazon will respond to the encroachment.

4. Rackspace on the Market, Maybe?

In May, Rackspace surprised the tech world by disclosing to the SEC it had hired Morgan Stanley to evaluate "inbound strategic proposals."

That revelation released a flood of predictions as to who would acquire the San Antonio-based cloud and server hosting giant.

After months of speculation, and an embarrassing number of media reports that proved false, Rackspace put all acquisition rumors to rest in September by announcing it would remain an independent company. Rackspace concurrently appointed Taylor Rhodes as CEO to oversee the company's managed cloud strategy going forward.

The company later assuaged shareholders by announcing a stock buyback.

3. Everybody Loves Docker

It's been a watershed year for Docker, the open-source Linux container technology that has disrupted the process by which distributed applications are developed, deployed and managed across disparate computing environments.

In June, Docker Inc., the commercial entity behind the project, released its first enterprise-grade offering. Since then, suitors have been stumbling over each other to hold Docker's hand.

Partnerships with Microsoft Azure, Amazon Web Services, Google Cloud Platform and IBM SoftLayer have all come to fruition in recent months.

2. Google's Enterprise Push

What's in a rebranding?

From Google, the latest and perhaps most-significant signal yet that the Mountain View search giant is really, really serious about the enterprise market.

Google let the world know in early September that henceforth and forever its enterprise cloud business went by the name Google For Work, and the company hasn't been shy about insisting the media observe the new moniker.

While a rebranding typically isn't a major story in itself, Google's transformation into a vendor of business products, and an even-more-heated Microsoft competitor, certainly is a game-changing development.

And Google's turn to the enterprise space has come with a far greater commitment to building out its channel.

1. AWS Can't Be Ignored

It seems almost a rule these days that every name-brand computing giant, nimble upstart and open-source community that enters the cloud fray needs to declare its intention to knock Amazon off its perch. And yet, despite the big target on its back and all those gunning for it, AWS still does more business than its four largest competitors combined.

Amazon's partner network has grown 75 percent over the last year, and AWS will soon offer more than 500 unique services through its platform.

While not growing as fast as its competitors, AWS's lead is so substantial that it's hard to imagine anyone catching up without a major disruption.

The thinking among some solution providers is that AWS has become so large and so diverse that they have no choice but to find a way to work with it.