HP Finally Takes Lead From Cisco In Cloud Infrastructure Equipment Market

We've Got A New Leader

Hewlett-Packard is the new market leader for cloud infrastructure equipment, pulling ahead of Cisco after years of lagging behind in second place, according to new second quarter 2015 data from Synergy Research Group.

Synergy's latest quarterly research on the hardware and software cloud infrastructure equipment market shows HP now leading the market, with 13 percent market share, following by Cisco -- which dropped half a percentage point sequentially -- at 12.5 percent.

Total cloud infrastructure equipment revenue accounted for $16 billion per quarter, with a growth rate of 25 percent year over year, according to Synergy. Nearly 90 percent of the cloud infrastructure market is made up of servers, storage, operating systems and networking, while the remaining 10 percent consists of cloud security, cloud management and virtualization applications.

CRN spoke with John Dinsdale, Synergy's chief analyst, about the market leaders and why HP is winning market share from Cisco.

HP Pulls Ahead

HP has been closely trailing Cisco over the past two years before becoming neck and neck in the first quarter of 2015. Palo Alto, Calif.-based HP has now surpassed the networking giant by capturing 13 percent of the market after achieving stronger sequential revenue growth. HP has a clear lead in the private cloud, is a main challenger in storage and is winning the cloud server segment, according to Dinsdale.

"At this stage of the game, HP has one big thing in its favor -- it has a huge base of business selling gear into the data center market, much of which has not yet transitioned over to cloud," said Dinsdale. "So there is an underlying numbers game that now favors HP. Cisco does not have that base of data center business, at least not at anything like the scale of HP, so it needs to rely on further growth of the networking segments and on more aggressively pushing its server business. … Servers account for a huge chunk of cloud infrastructure and HP is now the king of the server market."

Dinsdale said Cisco server revenues are currently about a quarter the size of HP's.

HP Partner Take

"Cisco entered the market aggressively, but I think HP made some really great decisions in altering their technology to compete more aggressively with Cisco," said David Cote, president of Versatile Communications, a Marlboro, Mass.-based solution provider and HP partner.

Cote pointed at HP's Gen9 servers as better provisioned for a cloud consumption environment, compared with its Gen8 servers. HP also gives customers choice, he said, such as with its enhanced Cloudline servers and "high-performance" Apollo products.

"These are products that give the customers a choice, and that's why we're excited," said Cote. "Cisco is going to have a hard time coming up with an answer to all of that -- not to mention largely because they're worried about losing market share on their networking side as well."

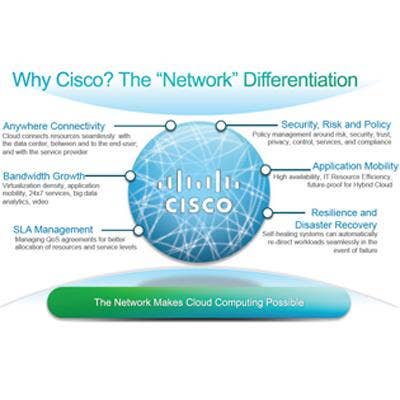

Cisco Drops To 12.5%

Cisco has owned between 13 percent and 14 percent market share for the past two years, but dropped half a percentage point to 12.5 percent for the second quarter. The San Jose, Calif.-based networking giant continues to hold a commanding lead in the public cloud infrastructure space, but its cloud server business is lagging behind HP's in scale, according to the report.

Cisco's position is mainly because of its networking dominance while it is also rapidly growing its positon in servers. Dinsdale said Cisco can "undoubtedly" bounce back into the leadership positon.

"Cisco should work to maintain its grip on the networking part of the cloud infrastructure market," said Dinsdale. "It needs to keep its foot on the gas growing its presence in servers. It might consider some [mergers and acquisitions] activity to penetrate some software and hardware segments where it is not present."

Cisco Partner Take

An executive solution provider who is a Cisco Gold and HP Platinum partner said his company just had a record quarter for Cisco in the space, compared with moderate growth with HP.

"We're continuing to see net new customers adopt Cisco technologies in the cloud arena," said the executive, who declined to be named. "While we don't see a lot of net new HP customers -- customers moving away from a competing vendor to HP -- we do see continued loyalty and spending from existing HP customers."

The executive said Cisco's hardware products are excelling in the space and the company continues to invest heavily to "beef up their capabilities" on the software front. He said he feels more confident with Cisco's portfolio and cloud direction compared with HP's.

Microsoft Takes Bronze

Redmond, Wash.-based Microsoft sits in third place, with just over 8 percent market share. Microsoft is a leader because of its position in server OS and virtualization applications, according to Dinsdale, but it's going to be hard to continue to stay ahead of its competitors in this space because it's a software company. Software accounts for only 18 percent of the cloud infrastructure market, Dinsdale said.

" It already has a 45 percent share of the software segments of the cloud infrastructure market," said Dinsdale. "Possibly Microsoft can grow that further, but it won’t be easy. … It is probably doing as much as it can already."

Dell Steady In Fourth

Round Rock, Texas-based Dell owns about 7 percent market share, which it has continued to hold for the past two years. Dinsdale described Dell as "a bit of a mini-HP" -- active in similar segments but just doesn't have the same scale.

" We're seeing excellent growth with Dell, albeit off of a far smaller base number," said the solution provider who partners with Cisco and HP. "Dell continues to surprise us in this space, with a much more friendly channel program than before they went private. They are winning more than their fair share … in the server arena in particular."

IBM Still Hurting From x86 Server Sale

Armonk, N.Y.-based IBM dropped from owning the top spot of around 13 percent market share during the fourth quarter of fiscal year 2013, to now fifth place, hovering around 6.5 percent, because of its selling its x86 server product to Lenovo.

"It made a huge hole in its cloud infrastructure revenues," said Dinsdale. "That is a tough hole to fill, but IBM has plenty of good technology under its belt and is doing well in non-x86 servers. … IBM has a strong corporate focus on cloud, both on the services side and on the infrastructure side, which will help it."