10 Signs The AWS Cloud Juggernaut Is Unstoppable

King Of The Cloud

One rule in the tech industry that mostly holds true is this: Wait long enough and you'll see today's giants cut down to size by tomorrow's upstarts.

For almost a decade now, conventional wisdom has dictated that at some point, some rival, somehow, is going to chip into the overwhelming first-mover advantage Amazon Web Services established for itself in the public cloud market.

But Amazon just has a funny way of brushing contenders off, innovating with the attitude of a startup while operating with the swagger of a multinational conglomerate.

Amazon's fourth annual re:Invent conference and its more-recent third-quarter earnings call leave the impression that AWS is simply unready and unwilling to even slightly relinquish its massive lead in the market.

We Never Just Add A Lone Data Center

Amazon Web Services never just builds a data center, Andy Jassy (pictured), senior vice president of AWS, told reporters during a Q&A at the AWS re:Invent conference in Las Vegas.

Instead, when the world's largest cloud chooses to expand capacity across regions or launch new ones, it adds clusters of data centers all at once, Jassy explained, like the mere idea of building just one massive facility at a time is beneath the cloud computing giant.

Amazon is currently adding clusters in India, Germany, and in a new Beijing region right on Ali Baba's home turf.

The footprint is growing faster than you can say "total global dominance. "

530 Features

That's how many "significant new features" Amazon CFO Brian Olsavsky said Amazon Web Services has added over the last year.

"We believe we're adding new services and features at a rate faster than any others," he told investors during Amazon's third-quarter earnings call.

A striking trend in the public cloud landscape is the move from IaaS to PaaS. AWS is no longer a raw infrastructure provider, but a cloud platform stocked full of hundreds of tools and services that help partners architect grand solutions for customers.

Some of those 530 new features are giving AWS partners whole new lines of business to win.

Aurora's First Four

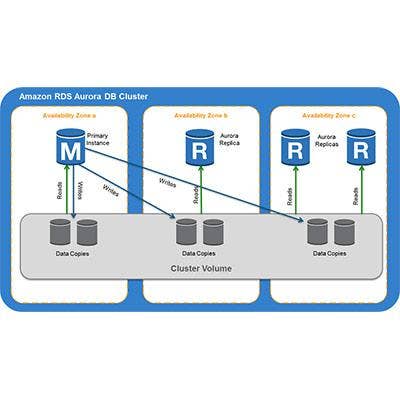

One new feature unveiled at re:Invent in 2014 was Aurora, a MySQL-compatible database engine.

Four months since its general availability launch in July, AWS Aurora has become the fastest-growing service in the cloud's history, dethroning previous top dog AWS RedShift, Jassy said at re:Invent.

Not only is AWS introducing features at a breakneck pace, but its global network of system integrators are eagerly leveraging the new functionality to create agile new solutions for customers.

Margins Up

We still don't know how profitable its competitors are, but AWS -- until recently also a black box as far as revenues and expenses -- is making money. Serious money.

Not only is Amazon's cloud looking at a run rate of $6 billion, but in its earnings call, Olsavsky revealed the AWS operating margin increased to a very respectable 25 percent in the quarter, up from a not-too-shabby 21.4 percent in the second quarter.

On $2.09 billion in quarterly revenue, that's more than half a billion in profit over three months.

QuickSight Insights

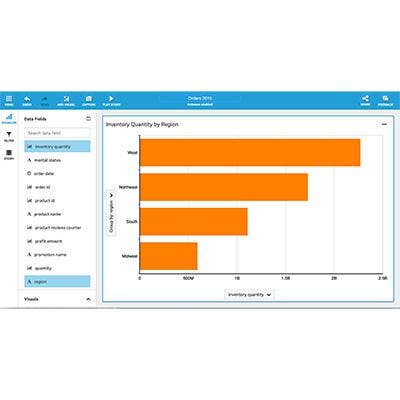

Amazon's nearest rival, Microsoft, has been aggressively developing and pushing its business intelligence capabilities, which it sees as a possible differentiator for its cloud. To that end, Microsoft recently released Power BI, a visualization suite poised to compete with established vendors like Tableau.

If there was any suspicion that BI might be a weakness in the AWS front lines, well, it looks like Amazon isn't willing to leave any front open to attack.

At re:Invent, AWS unveiled QuickSight, a business intelligence service for creating visualizations and deriving analytic insights without complex data modeling.

The service is powered by the Super-fast, Parallel, In-memory Calculation Engine (SPICE), which allows partners to plug in through an API and aggregate data for feeding business intelligence tools from across Amazon data stores.

Accenture's New Business Group

It never hurt anyone to have one of the world's largest IT consulting companies open a unique business division to focus exclusively on deploying their product.

Accenture's AWS Business Group, introduced during a keynote at re:Invent 2015, will focus on helping large organizations migrate and run their businesses in Amazon's cloud. To facilitate that process, Accenture is developing a suite of cloud services and technologies that integrate business processes, application migration, architecture design and application development.

The new Accenture division also will focus on analytics and big data solutions while exploring expansion into emerging fields like Internet of Things.

The Accenture AWS Business Group is another indicator that enterprise adoption of Amazon's public cloud will only accelerate in the coming years.

Bye Bye, Helion

More than a year ago, HP's acquisition of Eucalyptus caused some heads to get a good scratching.

After all, HP was pushing its own Helion public cloud as a competitor to AWS. And HP had squarely committed itself to the OpenStack ecosystem.

Eucalyptus, on the other hand, was an open-source IaaS technology compatible with AWS -- one positioned to rival OpenStack.

Whatever the motivation was behind that acquisition, it seems to carry a different significance in light of HP's recent announcement that HP's Helion public cloud offering is headed to the great cloud heaven in the sky.

HP's new public cloud strategy is to partner with other public clouds.

Suddenly Eucalyptus -- and the opportunities it creates to build hybrid environments with Amazon Web Services -- potentially could be a factor in tipping HP cloud customers to Amazon's infrastructure.

Fanatical Amazon

Rackspace, unlike HP, hasn't thrown in the towel on its public cloud.

And while the hosting giant no longer holds the kind of prominence in the market it did a few short years ago, when it was considered one of AWS' strongest challengers, Rackspace still insists that its popular brand of technical support -- Fanatical Support -- is a key differentiator for its cloud.

But Rackspace also recently struck a deal with Amazon (like it did with Microsoft Azure), and has officially become an AWS Managed Service Provider.

Through the partnership, AWS offers its customers Fanatical Support, and everyone wins. Especially AWS.

Driving DevOps

Enterprise IT is rapidly moving to a DevOps model where building applications, deploying applications, and managing applications is an integrated and cohesive set of processes.

AWS has been effectively ingratiating itself with this community.

Many partners had been doing DevOps on the AWS cloud for years. But Amazon's new DevOps competency formalizes the process and gives system integrators a common language to talk to customers with.

With the addition to its channel program, Amazon is breeding an army of partners with serious DevOps chops who will make sure its cloud will be a platform of choice for businesses that want automated and agile IT environments.

AWS IoT

One of the great business opportunities for public clouds in the coming years will be to become the platforms on which the exploding number of interconnected sensors and devices out in "the world" communicate with the applications that monitor them.

Amazon Web Services, simply due to its position in the market, was already popular with developers building these Internet-of-Things solutions, but much of the heavy lifting was still done downstream of AWS-enabled services.

But at re:Invent 2015, Amazon took a deep dive into the world of IoT, first announcing a new competency for partners, and then culminating the conference by unveiling a comprehensive platform, AWS IoT, that will make it much easier to connect, manage and secure devices sending data to Amazon's cloud.