8 Reasons Why Google Believes It Can Still Dominate In The Cloud Market

Google Goes Greene

Google, despite years of trying to crack into the enterprise cloud computing market, is still way behind Amazon Web Services, Microsoft Azure and by some calculations, IBM SoftLayer. Until recently, Google's highest profile cloud customer was Snapchat, a photo-sharing service that's popular with the young folks, though not exactly synonymous with enterprise technology.

Now, with VMware co-founder and former CEO Diane Greene at the helm, Google's cloud business looks poised to start delivering on its vast promise. Greene leads Google's enterprise sales and engineering teams and is on a quest to attract large enterprises with a powerful yet economical set of cloud infrastructure services.

While Google still faces an uphill climb to catch AWS and Microsoft in the cloud infrastructure market, the Alphabet subsidiary believes it has a number of technological advantages over the competition. Following are eight reasons why Google believes it can leapfrog its competitors and eventually dominate the enterprise cloud market.

Machine Learning

At its first-ever cloud developer conference in late March, Google unveiled its new Cloud Machine Learning product line, which includes technology from Google’s open source Tensor framework.

Google is pitching Cloud Machine Learning as a way developers can build apps using the same technology that powers services like Google Now, Google Photos and Google Search voice recognition.

"Cloud Machine Learning makes it easy for you to build sophisticated, large scale machine learning models in a short amount of time," Fausto Ibarra, director of product management for Google Cloud Platform, said in a blog post.

Google also debuted a Cloud Speech API to go along with its existing Translate API and Cloud Vision API. "We're very excited to now offer a full set of APIs that help your applications see, hear and translate," said Ibarra in the blog post.

Amazon Web Services and Microsoft both offer cloud machine learning services and both vendors have armies of developers pushing the technology into ever more sophisticated apps. But Google is flexing its considerable technology muscles to give its developers tools that no other cloud players can match.

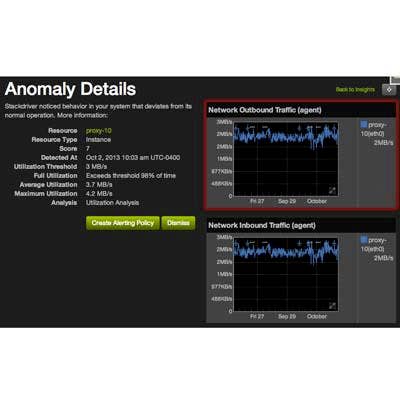

Stackdriver And Managing Amazon and Google Workloads

When Google acquired cloud monitoring and management startup Stackdriver in May 2014, some industry watchers expected it to end AWS support and focus exclusively on Google Cloud Platform.

Instead, Google maintained compatibility with AWS, and now it's pitching Stackdriver as a cloud monitoring and management tool that keeps track of networking, storage and compute on GCP and AWS, as well as customers' private clouds. Stackdriver, along with Google's open source container management technology Kubernetes, is a key part of the vendor's hybrid cloud story.

With Stackdriver, Google is acknowledging that it's OK with the fact that some of its customers are going to want to also use AWS. Plus, Google now has a way to show customers that it's not trying to lock them into its cloud.

And who knows? Maybe some AWS customers will like Google Cloud Platform so much that they'll decide to move more workloads out of AWS, as Apple has reportedly done.

Commitment To Open Source

Open source is the lingua franca of cloud computing, and everyone uses it in some form or another. But Google believes it's unique in this regard because it has created some of the open source technologies that are now widely used by other vendors.

At Google's Cloud Platform conference in March, the vendor touted its Dataflow and TensorFlow open source technologies as an unbeatable combo for machine learning.

Kubernetes, Google's open source container management technology, is a key part of its story for enterprise customers that want to move workloads around from private to public clouds. It's also part of the Google Container Engine (GKE) service.

All About The Fiber

Google's extensive fiber network linking its data centers just might be the vendor's biggest advantage in the cloud market, because it cuts down on networking bandwidth costs. When Google started buying up "dark" -- or unused -- fiber more than a decade ago, some industry watchers were puzzled as to its intentions, but that's no longer the case.

In a 2014 blog post, Randy Bias, CEO of Cloudscaling (now part of EMC), explained why dark fiber has enabled Google to build a nationwide network capable of terabit speeds that interconnects Google's data centers.

"What can Google do with this? Imagine the ability to have all Google Cloud Storage geo-replicated for free bandwidth costs. With so much bandwidth, moving huge VM images (100+ GB) across the network no longer sounds crazy," Bias said in the blog post.

While this gives Google an advantage on AWS, Microsoft has also been buying up lots of dark fiber, but this is still something that could end up being a competitive differentiator against other vendors.

Pricing And Performance

Selling public cloud infrastructure services is a natural offshoot of Google's technological expertise and vast experience operating data centers hosting global scale services like search and YouTube. Google's ability to optimize resource utilization is why Google's cloud leads in computing price-verses-performance ratio, CEO Sundar Pichai said on the vendor's quarterly earnings call in February.

In a January blog post, Miles Ward, global head of solutions for Google Cloud Platform, declared that Google's cloud offers the best price-performance ratio of any vendor in the public cloud market. Google's compute pricing is 15 percent to 41 percent cheaper than AWS, he said.

Google also offers automatic discounts for using its cloud services for an extended period of time, along with a slew of other pricing-related incentives.

"Our combination of lower list prices, sustained use discounting, no prepaid lock-in, per-minute billing, Preemptible VM's and Custom Machine Types offers a structural price advantage that's unmatched in the industry," Ward said in the blog post.

Load-Balancing Technology

In November, Google launched a service called HTTPS Load Balancing, which uses the vendor's private fiber network to ensure that apps are responsive no matter where they're accessed from.

At the Google Cloud Platform event in March, Urs Holzle (pictured), senior vice president of technical infrastructure, said startups can expand their businesses globally more easily with Google than with other vendors, thanks to its sophisticated load-balancing technology.

According to Holzle, Google's load-balancing technology solves the challenge of having an app deployed in multiple geographical regions, ensuring that latency isn't an issue. This, he said, is something neither AWS nor Microsoft Azure can match.

Super Secure And Efficient Data Centers

Google has spent billions of dollars on designing data centers that are high-performing and hyper-efficient, and run on renewable energy. It has also designed them with layers upon layers of physical and data security technologies.

On the physical security front, Google's data centers use electronic access cards, alarms, vehicle access barriers, perimeter fencing, metal detectors and biometrics. The guards Google hires to patrol these facilities must pass stringent background checks before being hired.

Google also pays lots of attention to securing data in transit. When data moves from a customer’s device and a Google data center, it's encrypted using HTTPS/TLS (Transport Layer Security) by default.

These security measures are designed to attract large enterprise customers that might have reservations about putting their data in its public cloud.

"We are dead serious about this business," Greene said in news conference at Google's Cloud Platform conference in March. "We've spent billions on data centers and are going to use them as much as we can. This is a long-term, forever event."

Diane Greene

Greene, the co-founder of VMware and its former CEO, joined Google's board of directors in 2012 but until recently had kept a low profile. That changed in November when Greene was tapped to lead Google's enterprise business, including the Google Cloud Platform and its Google For Work suite of productivity apps.

Google partners have told CRN they're encouraged by the attention Greene has paid to the channel since taking on this role. Not only does Greene understand why partners are key to helping Google expand its cloud business, she is also said to have changed the culture inside the company to pay closer attention to what enterprise customers want.

While Google still trails AWS and Microsoft by a country mile in the public cloud infrastructure market, partners say she has instilled an enterprise-focused culture at Google that hasn't previously been seen at the vendor.