The 10 Biggest AWS Stories Of 2016

Amazon Web Services – Unstoppable!

Even with hyper-scale competitors Microsoft and Google Cloud Platform growing their revenue with triple-digit speed, Amazon maintained a blowout lead in the market, while at the same time strengthening its vaunted position as the fast-paced innovator beating any and all comers.

AWS prepared to close out 2016 owning more than one- third of the world's cloud spend, more than the next three competitors -- Microsoft, IBM and Google -- combined.

To maintain that dominance, AWS continued to build out its infrastructure globally, added new features at an accelerated clip, introduced surprising partnerships, and promoted its longtime leader to the formal position of CEO.

(For more of our 2016 retrospective, check out 'CRN's 2016 Tech Year In Review.')

10. Amazon, Eh?

In January, Amazon Web Services pleased its partners north of the border with news that Canada would soon get its first AWS cloud data centers.

While details regarding the number and scale of those facilities weren't disclosed, and they still hadn't come online by November, AWS said its Montreal region would be carbon-neutral, powered almost exclusively by renewable hydro-electric sources.

9. Cloud Services Keep On Rolling

Many have argued that the public cloud is a race to zero, with commodity prices driving ever-smaller margins and scale ultimately being the prime differentiator. However, AWS has long made the case that innovation will always be a major factor in the customer's decision-making process.

That doesn't mean that Amazon hasn't mastered the economics of scale. But despite its massive footprint and technological efficiency, the public cloud pioneer has maintained its focus on developing innovative cloud products to differentiate itself in a hyper-competitive market.

In 2015, AWS rolled out 722 significant new services and features -- 40 percent more than it had the previous year.

In October, Amazon execs said during a third-quarter earnings call that they had already surpassed that number for 2016, and more releases were slated in the final months of the year.

8. A Bite Out Of Its Apple

When CRN in March broke the story that Apple had shifted roughly half its cloud spend with AWS to Google Cloud Platform, which those with knowledge of the deal estimated somewhere between $400 million and $600 million, it was seen as a big coup for Google's budding enterprise ambitions.

Amazon told CRN that Apple's adoption of a new cloud provider didn't signify "competitive defection."

While the Apple deal drove a spike in Google's market share, losing those hundreds of millions of dollars of revenue didn't cause any perceptible shift in Amazon's dominant position in the market.

7. P2 Power

As the race to offer artificial intelligence solutions in the cloud dramatically heated up in 2016, AWS wasn't to be outdone in providing a platform to power state-of-the-art processes like machine learning and deep learning.

The P2 instance type, introduced in September, offered AWS customers a configuration of compute, memory and network resources geared for AI workloads.

P2s leverage banks of Nvidia graphics processors to ramp compute power along with advanced memory features to keep those cores humming. The instances run an AWS-specific version of Intel's Broadwell processors.

6. International Expansion

AWS launched a massive buildout of infrastructure around the globe in 2016, preparing to add nine availability zones in four regions of the world.

The coming facilities, like one added in June in Mumbai, India, will make it easier for customers to run workloads on AWS, especially where they have latency or regulatory concerns.

New regions in the works include Montreal, London, Paris, and Ningxia, China.

5. Jassy-land

Andy Jassy, senior vice president of Amazon Web Services since its launch in 2006, in April was given the formal title of CEO for AWS.

Jassy's promotion came after Amazon CEO Jeff Bezos revealed in his annual letter to shareholders earlier that week that AWS was on track to reach $10 billion in sales for the fiscal year. Bezos said AWS was growing faster in its first decade of business than Amazon had.

Jassy founded AWS in 2003 with a team of 57 people.

4. Salesforce Preferred

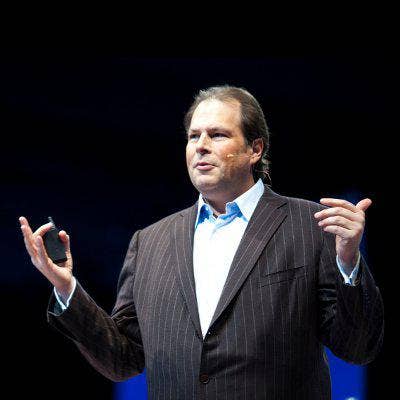

The world's largest Software-as-a-Service company, a customer of several major cloud providers, surprised even its partners in May by declaring AWS its "preferred public cloud."

Salesforce CEO Marc Benioff (pictured) disclosed the arrangement in an earnings call, telling investors his CRM company would be expanding its core services into international markets on the backbone of Amazon's public cloud.

The international expansion plan represents the first time Salesforce will host its core Software-as-a-Service portfolio -- Sales Cloud, Service Cloud, App Cloud, Community Cloud, Analytics Cloud -- on AWS' infrastructure, the companies said in separate blog posts.

3. The Lonely $3 Billion Club

The financials Amazon reported for the third quarter, representing the three months ending in September, disappointed investors overall.

But the bright spot of that earnings report was AWS, a segment of the sprawling business that notched more than $3.2 billion in sales, compared with just more than $2 billion a year earlier.

As it blew past the $3 billion mark, the world's largest public cloud doubled its profitability year over year, with more than $1 billion in operating income in the third quarter driven with 31 percent margins.

On a trailing nine-month basis, cloud sales were up to $8.6 billion from $5.4 billion in the first three quarters of 2015.

2. Partner Sales Growth Off The Charts

The AWS Managed Service Program saw steady growth in 2016 even as the high-flying cloud provider introduced stricter auditing requirements.

AWS Channel Chief Terry Wise (pictured) told the 18,0000-plus attendees at the company's AWS re:Invent conference in Las Vegas that AWS managed service providers grew by more than 130 percent, while consulting partners by more than 110 percent. The AWS ecosystem, meanwhile, added more than 10,000 partners in the last year, he said.

Partner-driven engagements are growing faster than the overall business, and the largest partners are growing the fastest – Premier Tier partners in the last year increased revenue four times faster than Advanced Tier partners, Wise said.

In January, AWS raised its auditing requirements for partners in areas like application migration and monitoring services, as well as continuous optimization.

Even with the stricter auditing requirements, as of May, AWS had 66 partners in the program, compared with 11 partners at the same point in the previous year.

1. VMware Cloud For AWS

Three years ago, VMware CEO Pat Gelsinger (pictured, left) declared war on Amazon Web Services, rallying partners to own the corporate workload with the battle cry – "If a workload goes to Amazon, you lose and we have lost forever."

In October, Gelsinger stood side by side with AWS CEO Andy Jassy announcing a strategic partnership under which VMware's complete software-defined data center offering would run on the AWS public cloud. The announcement was a tacit acknowledgement that AWS has forever changed the corporate computing landscape.

Under the partnership, the two companies will collaborate on a new platform called VMware Cloud on AWS that their top executives said takes away the binary decision of whether to run a private or a public cloud.

"We see that we could bring together the best of both worlds," Gelsinger said. "The best of public cloud and the best of private cloud are coming together."