10 Factors Driving VMware's Sale Of vCloud Air To OVH

Behind The Deal

VMware's sale of its vCloud Air business to French hosting giant OVH is set to close in the second quarter, and it'll allow VMware to break away from the business of owning and operating clouds while fueling OVH's ambitions to be a global cloud player.

Not long ago, the official VMware line was that Amazon Web Services was the enemy. But late last year, the company inked a partnership deal with AWS. That relationship followed closely behind parent company EMC's $1.2 billion acquisition of high-performance cloud services firm Virtustream, a deal that was perhaps the first sign that vCloud Air wasn't long for this world.

Tuesday, VMware and OVH executives took questions from journalists and analysts by phone, and offered a little more detail about how the companies will handle the acquisition and the motivations driving it. Here are 10 key points.

OVH's Expansion Into The U.S. Is Fueled By Huge Private Equity Investment

Last October, private equity giants KKR and TowerBrook Capital Partners pumped 250 million euro into OVH in exchange for a minority stake in the company. The funding was specifically aimed at expanding OVH's global footprint with deals like the vCloud Air acquisition, which will serve as OVH's introduction to the U.S. market. OVH was founded in 1999 by Octave Klaba. He and his family retain a majority stake in the company and lead the company's strategy and operations.

OVH Will Use The Channel To Spur U.S. Growth

Russ Reeder, CEO of OVH U.S., said the channel is a key part of OVM's global growth strategy. "The indirect sales channel with OVH has been a huge global success, and we're going to continue that," he said. "We're going to bring that model to the U.S. We do have a number of other hosting companies that white label our tech as well, [we're] going to continue that as well."

vCloud Air Network Of Providers 'Won't Change'

vCloud Air built up a network of more than 4,400 global cloud provider partners, and Raghu Raghuram, COO of VMware, said nothing will change for them. Currently, customers can use the network to choose either VMware Services on IBM Cloud, or beginning midyear, VMware Cloud on AWS. "There will be no change to that network," Raghuram said. "It's growing very nicely for us, and we'll continue to invest in it."

Execs See OVH As An Alternative For VMware Customers That Don't Want To Use AWS

Asked if OVH is positioning itself as an alternative for VMware customers that don't want to go to AWS, Reeder said, "That's exactly the opportunity we're giving to customers." Furthermore, Raghuram said VMware will support and service vCloud Air software "forever," adding "that's the beauty of this model."

vCloud Air Employees Will Go To OVH

OVH intends to continue to invest in vCloud Air technology as part of a larger commitment to moving that business, including its customers and employees, into its new U.S. operation. "We're going to continue to invest in the partnership, in the technology; it's a significant amount," Reeder said. "We're excited for customers and employees to come over."

vCloud Air Data Centers Will Change Hands

Most of the vCloud Air data centers are in the U.S., including locations in Northern California, Nevada, Arizona, Virginia, New Jersey and multiple locations in Texas. Globally, the service operates data centers in the U.K., Germany, Japan and Australia. All of the data centers will be moving over to OVH when the transaction closes.

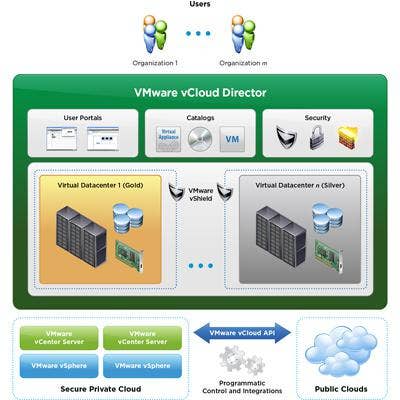

VMware Supplies The Tech, OVH Runs The Show

OVH will operate the service, and VMware will be the tech supplier to OVH. OVH will build, service, operate vCloud Air service going forward. VMware is transitioning vCloud Air U.S. and European data centers, customer operations, and customer success teams to OVH. After the close of the acquisition, OVH will operate the service as vCloud Air Powered by OVH, will continue to leverage VMware's hybrid cloud technology, and will closely partner with VMware on go-to-market and customer support around the three proven vCloud Air use cases: data center extension, data center consolidation and data center recovery.

OVH Wants To Be A Global Cloud Player, VMware Wants Out

The big investment KKR and TowerBrook made in OVH fuel the company's global ambitions while VMware is more interested in getting out of the business of owning and operating clouds. "It made imminent sense to find a partner," Raghuram said. "This fits into their strategy of being a global provider and allows to rapidly build out a North America footprint. We will continue to partner with OVH on go-to-market and customer support. For them, there will be almost literally no change."

OVH Says It Can Beat AWS, Azure, Google On Price, But Not By How Much

Calling OVH a "disrupter in enterprise and SMB," Reeder said the company can offer prices that undercut public cloud powerhouses like AWS, Microsoft Azure, Google and others, all while providing customers with clear SLAs. "There's going to be an impact on pricing for U.S. customers," Reeder said. "Pricing is an incentive to migrate to OVH infrastructure." However, Reeder wouldn't elaborate on OVH's pricing specifically and wouldn't give estimates for how much better its prices are than North America's current public cloud chieftains. "We're going to offer the best product at the best value. That's the strategy we're focusing on," he said.

Different APIs For Different Folks

vCloud Air and OVH each have their own APIs, and that's how things will stay. They won't be brought together. Raghuram said the companies' APIs, "are targeted at different purposes. VMware APIs are aimed at operators and ISVs to build infrastructure value propositions, rather than developers." Reeder said OVH builds its APIs mostly around automation for the scaling of infrastructure."