5 Things To Know About Citrix’s Acquisition Of Wrike

Citrix Systems is paying $2.25 billion to buy work management application vendor Wrike.

Diving Into The Deal

Citrix Systems struck a definitive agreement Tuesday to acquire Wrike, a developer of work management and collaborative workspace software, for $2.25 billion.

Citrix said the acquisition will expand its portfolio of unified digital workspace technology that already includes application and desktop virtualization tools, content collaboration software and other products.

Here’s a look at the five major points of the Wrike acquisition deal, which Citrix says has the potential to greatly impact “the future of work.”

Acquisition Agreement Details

Citrix entered into a definitive agreement to buy Wrike for $2.25 billion in cash from Vista Equity Partners, which acquired the company in 2018.

The transaction has been unanimously approved by each companies’ board of directors and the acquisition is expected to close in the first half of 2021, subject to regulatory approvals and other customary closing conditions.

Citrix, based in Ft. Lauderdale, Fla., expects to fund the deal with a combination of new debt and existing cash and investments and has obtained a commitment from JPMorgan Chase Bank, N.A. for $1.45 billion in a senior unsecured bridge loan.

Wrike founder and CEO Andrew Filev will continue to lead the Wrike operations once the acquisition is completed. He will report to Arlen Shenkman, Citrix executive vice president and chief financial officer.

Who Is Wrike?

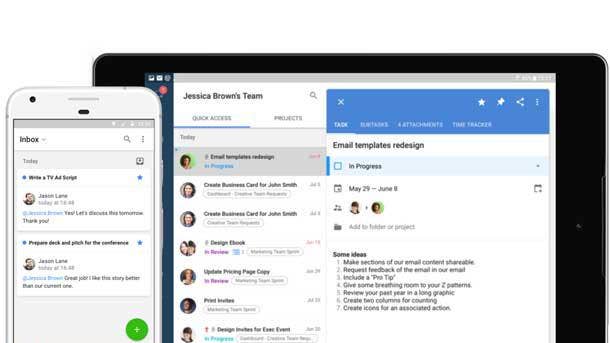

Wrike develops SaaS-based collaborative work and project management software that help work teams streamline their collaboration and work execution and improve their digital workflows

The company’s software provides dashboards and shared calendars, collaboration tools, project templates, project visibility, file management functionality, request and approval capabilities, and additional functionality.

Founded in 2006, Wrike is based in San Jose, Calif. The company has more than 1,000 employees and some 18,000 customers including Walmart, Nickelodeon, Dish and Mars.

Wrike ended calendar 2020 with more than $140 million in unaudited annual recurring revenue, reflecting a more than 30 percent CAGR over the two prior years.

Wrike was named a leader in the IDC MarketScape for Worldwide Work Management and Project and Portfolio Management 2020 report, and a leader in the IDC Marketscape for Worldwide Cloud Project and Portfolio Management 2019-2020 Vendor Assessment report.

Company And Product Synergies

Citrix said the acquisition of Wrike will allow it to provide a comprehensive, cloud-delivered digital workspace that allows employees to securely access, collaborate on and execute work, enabling structured and unstructured operations, team collaboration, and document-based workflows, according to the company.

Citrix said it will provide more details on its plans to integrate the two companies’ product portfolios when the acquisition closes.

The addition of Wrike’s cloud-native capabilities will accelerate Citrix’s efforts to shift its business model to the cloud, the company said, and build on its strategy to offer a complete SaaS-based work platform that addresses the needs of various functional groups across the enterprise.

Combining Wrike and Citrix will unlock new revenue opportunities both within the existing installed bases of the two companies and within new line-of business buying centers including marketing, professional services and human resource management, Citrix said.

The combined company will have 400,000 customers across 140 countries.

The Citrix And Wrike Partner Ecosystems

The acquisition will provide Wrike with access to the Citrix partner ecosystem and create new opportunities for Citrix partners, Citrix said.

The Citrix Partner Network program encompasses solution providers and advisors, systems integrators, service providers, MSPs, ISVs and technology partners.

The Wrike Partner Program includes channel partners (VARs, systems integrators, agencies and consultants) and technology partners who integrate their products with Wrike.

The Financial Impact

As of the close of trading Tuesday, the day the acquisition was announced, Citrix shares were trading at $135.36, up $3.36 per share or 2.55 percent for the day.

Citrix said it expects Wrike to generate approximately 30 percent stand-alone growth in 2021 to between $180 million and $190 million in annual recurring revenue.

Citrix said the acquisition’s financing and purchase accounting impacts to deferred revenue will affect 2021 non-GAAP earnings per share. Integration and other costs related to the acquisition are expected to be modestly dilutive to non-GAAP earnings per share in 2021. The transaction is expected to be neutral to Citrix’s fiscal year 2022 non-GAAP earnings per share and free cash flow, and accretive thereafter.

The announcement of the Wrike acquisition came the same day Citrix announced its 2020 fourth-quarter and full-year (ended Dec. 31) results.

For the quarter Citrix reported revenue of $809.7 million (essentially flat with $809.8 million one year before) and net income of $112.1 million (down nearly 46 percent from $207.1 million one year earlier).

For all of 2020 Citrix reported revenue of $3.24 billion, up 7.5 percent from $3.01 billion in 2019.