AWS-Slack Deal Ups Ante Vs. Microsoft, Zoom, Google

Slack and AWS are promising new solutions to improve enterprise workforce collaboration, the importance of which has heightened amid the increase in remote workers.

A new multi-year deal will see Slack Technologies leaning more heavily on Amazon Web Services and Amazon Chime for the operations of its cloud-based, workplace messaging and collaboration platform as they take on Microsoft Teams, Zoom Video Communications and Google Meet for more share of the enterprise market.

Under the extended partnership announced yesterday, San Francisco-based Slack and Seattle’s AWS – already Slack’s preferred cloud provider -- are promising new solutions to improve enterprise workforce collaboration, the importance of which has heightened amid the increase in remote workers resulting from stay-at-home advisories and non-essential business closures forced by the coronavirus (COVID-19) pandemic.

Slack, which yesterday said it added a record 90,000 new free and paid customers in the first quarter for a total of 750,000, will migrate its Slack Calls capability for voice and video calling to Amazon Chime, AWS’ unified communications service that allows users to meet, chat and place business calls.

Slack and AWS are expanding their product integrations to help developer teams more easily communicate and manage their AWS resources in Slack channels and Amazon Chime chat rooms. The deal also will allow Slack to use AWS’ cloud infrastructure to offer data residence flexibility to its enterprise customers, letting them choose which country or region their data is stored.

AWS, meanwhile, will use Slack to help its teams better communicate and collaborate.

“The future of enterprise software will be driven by the combination of cloud services and workstream collaboration tools,” Stewart Butterfield, Slack’s cofounder and CEO, said in a statement. “Strategically partnering with AWS allows both companies to scale to meet demand and deliver enterprise-grade offerings to our customers. By integrating AWS services with Slack’s channel-based messaging platform, we’re helping teams easily and seamlessly manage their cloud infrastructure projects and launch cloud-based services without ever leaving Slack.”

AWS customers will get a “powerful new means of managing their AWS resources that will help teams collaborate and build more applications using the broadest and deepest set of cloud services,” AWS CEO Andy Jassy said in a statement.

“Together, AWS and Slack are giving developer teams the ability to collaborate and innovate faster on the front end with applications, while giving them the ability to efficiently manage their backend cloud infrastructure,” he said.

Here’s a look at the top things to know about the deal, including the AWS-Slack integrations, reaction from AWS and Microsoft partners, and a new agreement that outlines how much Slack has committed to paying AWS annually.

Integration of Amazon Chime Infrastructure With Slack Calls

Audio, video and screen-sharing capabilities in native Slack Calls soon will be powered by Amazon Chime SDK (software development kit), a set of real-time communications components that developers can use to quickly add audio calling, video calling and screen-sharing capabilities to their web or mobile applications.

By using Amazon Chime to power its real-time communications, Slack will “leverage AWS’s proven infrastructure to deliver high-quality and reliable user experiences while eliminating the cost and complexity of maintaining its own unified communications (UC) infrastructure, the two companies said.

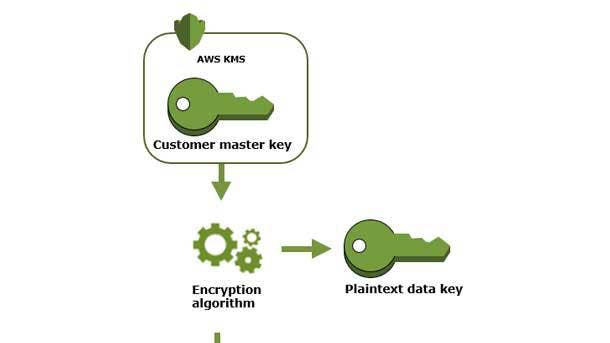

AWS Key Management Service

Slack uses AWS’ security services -- including AWS Key Management Service for the distribution and control of cryptographic keys -- for its enterprise key management (EKM).

“Designed for security-conscious or regulated enterprise customers who seek increased visibility and control over their data in Slack, over 90 companies are now using the solution to manage their own encryption keys,” the companies said.

Slack added features, including EKM for Slack’s Workflow Builder automation tool, last month.

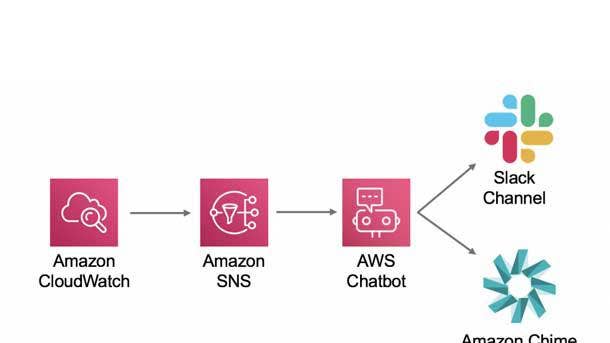

AWS Chatbot Integration With Slack

AWS Chatbot, which became generally available on April 22, now is integrated with Slack.

AWS Chatbot is an interactive agent for “ChatOps” that’s designed to make it easier to monitor and interact with AWS resources in Slack channels and Amazon Chime chat rooms. It uses an interactive agent to help development teams remain updated, collaborate and respond more quickly to operational events, security findings, workflows and other alerts for applications running in AWS accounts.

“Going forward, the AWS Chatbot service will incorporate AWS’ more than 175 services to give developers the ability to collaborate with their teams to manage all of their cloud-based services without leaving Slack,” the companies said.

Amazon AppFlow Integration With Slack

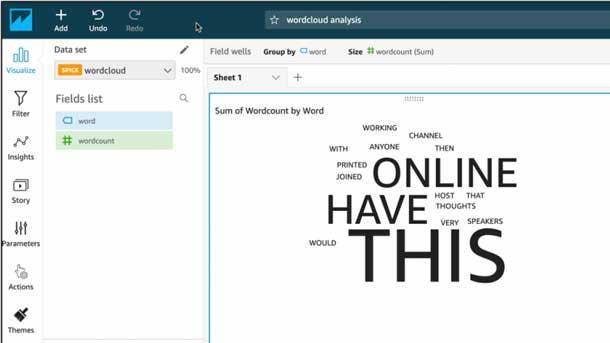

AWS’ new Amazon AppFlow is now integrated with Slack. Unveiled late last month, Amazon AppFlow is a fully managed integration service that allows customers to build and execute secure data flows between AWS services such as Amazon S3 and Amazon Redshift and SaaS applications such as Slack in minutes.

The integration simplifies tasks including analyzing trends in customer engagement from helpdesk requests and measuring sentiment data.

AWS and Slack plan to enhance that capability in the coming months to allow customers to transfer data bi-directionally between multiple Slack channels and AWS services in a single flow.

Partner Reaction

The extended AWS-Slack partnership is a smart move for both companies, according toEthan Simmons, managing partner at Pinnacle Technology Partners, a Norwood, Mass.-based AWS Advanced Consulting Partner.

“Slack is a very popular service within the AWS community, and AWS is looking grow the adoption of their Chime collaboration platform,” Simmons said. “Based on the recent rumors around Slack and Fuze, it appears that Slack is actively looking to enhance their calling and video conferencing capabilities to compete with Microsoft Teams.”

Simmons was referring to unconfirmed reports that Slack is in talks to buy UC-as-a-service vendor Fuze, a Boston-based cloud communications and collaboration software platform designed for enterprises.

The AWS deal positions Slack to be “fighting more broadly with Microsoft by helping Amazon,” according to Reed Wiedower, chief technology officer of Washington, D.C.-based New Signature, a Microsoft partner. But, he said, Slack’s declining per-share stock price yesterday and today “speaks louder than any words about where analysts think this is going.”

“The core integration component that popped out at me was using Chime as the calling platform of choice,” Wiedower said. “I don’t know any enterprises that have standardized on Chime, although plenty have been using Slack in the past. We just don’t see many organizations deciding to use (Amazon) WorkDocs or WorkMail versus Microsoft 365.”

“I just feel like Slack’s moment in the sun has passed and by working closely with Amazon, they may be setting themselves up for a future acquisition,” he said.

Slack’s stock price dropped after the company yesterday also announced during a first-quarter earnings calls that it was withdrawing its billings guidance. Slack reported a 50 percent increase in year-over-year revenue to $201.7 million for the first quarter that ended April 30, one of its strongest ever, and a net loss of $74.4 million. Slack said it added a record 12,000 new paid customers and a record 90,000-plus new organizations that are using Slack for free or through a paid subscription, to bring the total to more than 750,000.

“We have also continued to see stronger than normal top online activity in April and May,” Slack chief financial officer Allen Shim said during the earnings call.

But Shim pointed to “potential headwinds” for Slack’s business, including less visibility into how information technology spending will trend for the remainder of the year, particularly if the economic effects of the coronavius pandemic persist or worsen.

“When we guided for the full year in early March, we accounted for some of these headwinds,” Shim said. “Thus far, in the first half, the tailwinds have outweighed the headwinds. However, we believe that macroeconomic uncertainty is significantly greater today than it was then. Taking into account the puts and takes of the above, we continue to have visibility to guide to quarterly and full-year revenue, but our withdrawing our calculated billings guidance.”

Slack’s New AWS Spending Commitments

Slack has used AWS’ cloud infrastructure to operate its service since its 2014 launch.

The new deal between the companies was negotiated separately from Slack’s cloud contract, CNBC reported yesterday. AWS declined to comment on deal terms.

Slack last week amended its existing agreement with AWS, according to a quarterly report filed yesterday with the U.S. Securities and Exchange Commission.

Under the amended agreement, Slack committed to paying at least $425 million to AWS over the five-year period that runs from May 1, 2020 through April 30, 2020, with minimum annual commitments of $75 million that will increase by $5 million annually.

Slack previously had an agreement to pay AWS a minimum of $50 million per year from May 2018 through July 2023 for cloud services -- for a total minimum commitment of $250 million under a five-year deal disclosed in a regulatory filing last April, in advance of an initial public offering.