Broadcom’s VMware Acquisition: 5 Key Customer And Cost Figures To Know

From what each company spends on sales, marketing and administrative costs to R&D spending, here’s five comparable figures that all channel partners, investors and customers should know as Broadcom seeks to buy VMware for $61 billion.

Broadcom’s $61 Billion Acquisition Of VMware: 5 Customer, R&D And Sales Figures

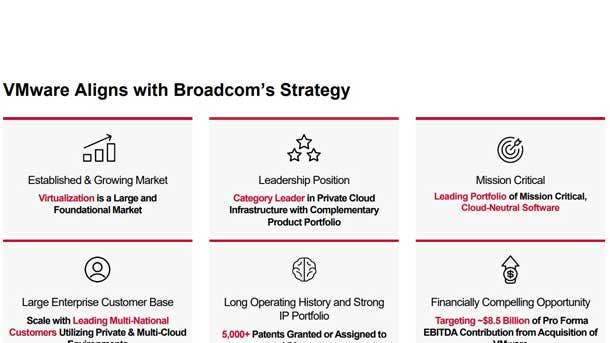

VMware and Broadcom operate very differently in terms of marketing, sales and administrative costs, as well as how much spending goes towards research and development.

While VMware spends roughly two-thirds of its total revenue on R&D, marketing, sales and administrative costs, Broadcom spends only a fraction of that on those operational expenses. This is leading many to speculate that operational cost cut measures will occur at VMware if Broadcom completes its blockbuster $61 billion acquisition of VMware later this year.

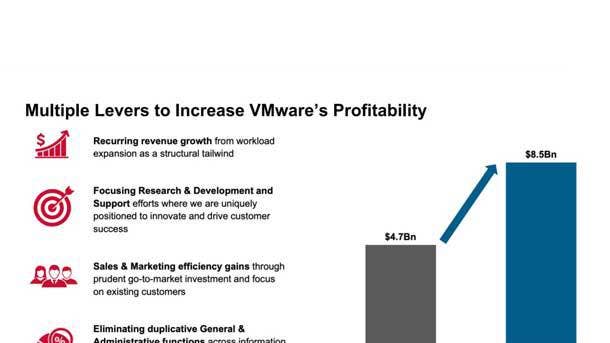

In fact, Broadcom said it hopes to increase VMware’s profitability from $4.7 billion in fiscal year 2022 to $8.5 billion within the next few years, in part, by “eliminating duplicative general and administration functions across human resources, finance, legal, facilities and information technology.”

However, in a letter sent to VMware employees from Broadcom CEO Hock Tan and Tom Krause, president of Broadcom’s software group, the executives touted VMware’s software leadership.

“By bringing an iconic pioneer like VMware into the Broadcom family, we will be able to reimagine what we can deliver to our customers,” said Tan and Krause in a May 26 letter to VMware employees. “We’ve long admired VMware for your enterprise software leadership. In fact, one of the reasons why we became interested in this transaction was because of your world-class team, known for engineering prowess and strong customer and partner relationships. Like VMware, Broadcom has an engineering-first, innovation-centric culture.”

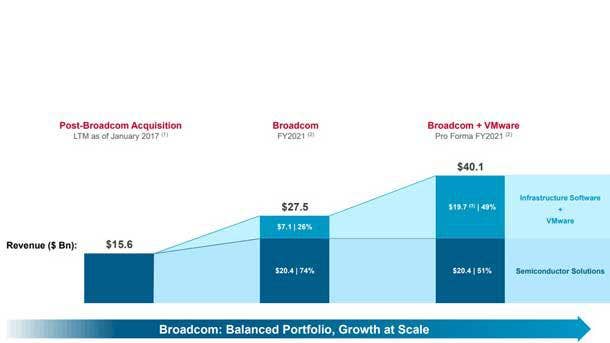

San Jose, Calif.-based Broadcom shook up the software world last week when it announced its intent to acquire VMware, based in Palo Alto, Calif., for $61 billion.

Broadcom has approximately 20,000 employees worldwide, while VMware has over 35,000 employees. If completed, Broadcom’s software group will rebrand and operate as VMware, which will incorporate Broadcom’s existing infrastructure and security software solutions.

CRN takes a look at VMware and Broadcom’s most recent financial earnings reports and other figures to see the difference between how both companies operate from a sales, customer and operational standpoint. VMware’s first fiscal quarter 2023 ended April 29, 2022, while Broadcom’s second fiscal quarter 2022 ended May 1, 2022.

Here are five key data points and figures that customers, investors and channel partners should know.

Sales, Marketing, Administrative Costs: VMware’s 42% Compared To Broadcom’s 4.5%

The amount of money spent on sales, marketing and general administrative is vastly different between VMware and Broadcom.

Looking at both companies’ most recent fiscal quarter financial results, VMware spends a much larger percentage of its total revenue on sales, marketing and general administrative costs compared to Broadcom.

For its first fiscal quarter, VMware spent $1.053 billion on marketing and sales with total revenue of $3.088 billion for the quarter. Additionally, general administrative costs for VMware were $251 million.

This means VMware spent roughly 42 percent of its total revenue on marketing, sales and general administrative costs.

Meanwhile, in Broadcom’s recent second fiscal quarter, the company spent $368 million on “selling, general and administrative” costs, generating a total of $8.103 billion in revenue, according to its financial earnings report.

This means Broadcom’s selling, general and administrative costs represented about 4.5 percent of the company’s total sales—significantly less than VMware’s spending 42 percent of its total revenue on these operational costs.

Key takeaway: Broadcom plans to increase VMware’s annual profitability from $4.7 billion to $8.5 billion within the first three years of closing the deal. Broadcom said it will achieve this, in part, by

“eliminating duplicative general and administration functions across human resources, finance, legal, facilities and information technology.” It appears there could be some employee layoffs ahead for VMware.

R&D Percentage Of Revenue: Broadcom 15% Versus VMware 25%

VMware spends a larger percentage of its revenue on research and development compared to Broadcom.

For its most recent first quarter, VMware spent $774 million on research and development (R&D). This R&D cost represented about 25 percent of VMware’s total $3.09 billion in revenue.

Comparatively, Broadcom spent $1.26 billion on R&D to achieve its $8.103 billion in total sales for its recent second quarter. Broadcom’s R&D costs represent approximately 15 percent of the company’s total revenue.

It is key to note, that Broadcom CEO Hock Tan and Tom Krause, President of Broadcom’s Software group, sent a letter to VMware staff expressing admiration for VMware’s “engineering-first, innovative-centric culture.”

“Over the last several years, we’ve been executing on our strategy to build the world’s leading infrastructure technology company, by both investing in R&D and integrating established, mission-critical platforms, like Symantec, CA Technologies and now VMware, into our company,” said the letter. “We’ve long admired VMware for your enterprise software leadership. In fact, one of the reasons why we became interested in this transaction was because of your world-class team, known for engineering prowess and strong customer and partner relationships. Like VMware, Broadcom has an engineering-first, innovation-centric culture.”

Key takeaway: There have been fears among channel partners that Broadcom’s takeover of VMware will cause VMware’s innovative-driven market strategy to be cut down in order to increase profitability. It appears that Broadcom will, in fact, focus its investment on VMware’s core, mature product lines.

“In terms of R&D, we’re going to reinvest back in the core business, the core franchises,” said Broadcom’s Krause during a call with media and analyst last week. “If you think about the three different pillars of this business, it’s really the core infrastructure business—vSAN, vSphere, vRealize—these are the businesses that are core to driving the bulk of the revenues. And that’s where the reinvestment is going to occur.”

Broadcom Focus On 600 Large Customers Compared To VMware’s Vast Customer-Based

Broadcom focuses very heavily on several hundred of its largest clients, while VMware has thousands of enterprise customer and hundreds of thousands of commercial clients who depend on VMware.

During Broadcom’s Investor Day in late 2021, the company said 70 percent of its total annual recurring revenue came from roughly 600 accounts.

Of those 600 customer accounts, roughly 100 clients spend over $10 million in annual recurring revenue on Broadcom.

“We are totally focused on the priorities of these 600 strategic accounts,” said Krause during Investor Day in November, adding that these large customers operate in mostly hybrid cloud environments.

For Broadcom’s smaller commercial side of the business, approximately 100,000 clients accounted for only roughly 6 percent of Broadcom’s total annual recurring revenue as of November 2021.

Comparatively, VMware focuses on serving its more than 300,000 vSphere clients and over 400,000 total customer-base.

VMware also touts that 100 percent of all the Fortune 500 companies use its products.

Key takeaway: With Broadcom focusing so heavily on its largest 600 customers, VMware’s channel partner community will become the critical to the majority of its 400,000-plus strong customer-based.

Broadcom To Increase VMware Subscriptions From 29% To 100%

Broadcom plans to rapidly transition VMware customer contracts from perpetual software licenses to subscriptions and software-as-a-service once the acquisition is complete.

Subscription and SaaS accounted for 29 percent of VMware’s total $3.09 billion in revenue during its recent first fiscal quarter. Once acquired, Broadcom hopes to make all VMware software licensing agreements into SaaS subscription.

“We are going to focus on going through a transition, and a rapid transition, from [VMware] perpetual licensing to subscription,” said Krause in a recent call with media and analysts. “With the software business, we’ve been totally focused on pretty much 100 percent recurring revenue.”

Broadcom’s CEO said his company plans to “convert” VMware’s on-premises licensing model to subscriptions over the next couple of years, which will likely slow revenue growth for VMware in the near term.

“From an economics point of view, whether it’s perpetual or subscription, frankly, it’s the same. But we want to make it very consistent with the way we run the model. Based on this, we are in a sense, restructuring the contracts from perpetual to subscription,” said Tan during the call with media and analysts. “That’s why, depending on where you see it, you’ll see a slower growth at the beginning—if any—followed by a more rapid growth as we convert more to subscription.”

Key takeaway: Although VMware has been striving to make more of its total revenue come via SaaS and subscription in recent years, many of its customers still buy its enterprise software licenses. It will be interesting to see just how much Broadcom will push VMware to turn these accounts into solely recurring revenue customers.

Revenue Growth: Broadcom 23% Versus VMware’s 3%

VMware typically grows quarterly sales at around 9 percent year over year. For example, for its fiscal year 2022, which ended in January, VMware generated $12.8 billion in revenue, an increase of 9 percent compared to fiscal year 2021.

However, VMware reported sales growth of only 3 percent year over year to $3.09 billion in its most recent first fiscal quarter.

Additionally, due to the pending Broadcom acquisition deal, VMware said it will not be providing financial guidance for its current second quarter and is suspending its financial guidance for the full fiscal year 2023. So there is no insight into how much VMware expects to grow over the next few quarters.

Comparatively, Broadcom increased sales by 23 percent year over year for its most recent second quarter to $8.1 billion.

Broadcom also shared that it expects current third quarter revenue of approximately $8.4 billion, which would represent a 24 percent year over year increase.

Broadcom’s market capitalization currently stands at $229.7 billion. VMware’s market cap is now at $54.5 billion.

Key takeaway: Broadcom is growing sales at a faster rate than VMware as VMware’s growth rate slowed down significantly in its most recent quarter. It is also interesting that VMware will no longer provide financial earnings guidance for the foreseeable future.