George Hope: 5 Keys To HPE Channel Sales Growth

HPE Worldwide Channel Chief George Hope says among the keys to the company’s channel sales growth in the first fiscal quarter was a 116 percent increase in GreenLake cloud service indirect orders.

Partner Sales Up $69 Million In First Fiscal Quarter

Hewlett Packard Enterprises’ indirect sales were up $69 million or two percent year over year with triple-digit channel sales growth for both HPE GreenLake’s on premises cloud service and HPE’s Primera storage business, said HPE Worldwide Channel Chief George Hope.

Overall, HPE’s channel partners contributed $2.9 billion in indirect sales, said Hope, who hosted a post earnings conference call for partners with HPE CEO Antonio Neri.

HPE’s hardware indirect mix accounted for 65 percent of sales, said Hope.

Neri, for his part, thanked channel partners for helping to deliver a strong quarter for HPE with earnings and sales that were above expectations.

Overall, HPE posted non-GAAP earnings of 52 cents per share on sales of $6.83 billion for its first fiscal quarter ended Jan. 31. That was well above the Zacks Wall Street earnings consensus of 40 cents per share on sales of $6.80 billion.

The considerable earnings increase is higher than pre-pandemic levels, said Neri. “That is pretty remarkable if you think about it,” he said.

HPE reported record breaking free cash flow for the quarter of $563 million, up $748 million from the year ago period. “We never had positive free cash flow in Q1,” said Neri.

“Congratulations,” Neri said to channel partners, commenting on the strong quarterly results. “Our results are a reflection of what you do. Without you we can not deliver this kind of performance. Q1 was clearly marked by strong profitability and cash flow. This was a very solid quarter for us and I am pleased with these results because it gives us a very good platform to build on for the rest of 2021.”

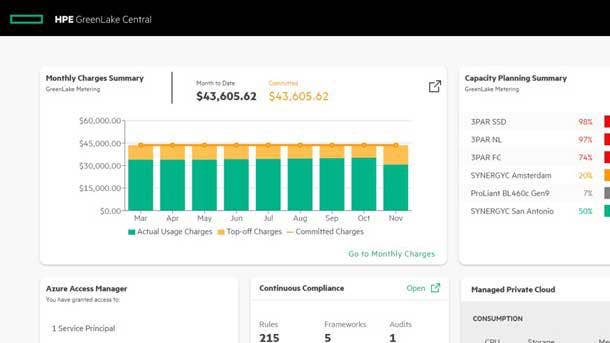

A Banner Quarter For HPE GreenLake

HPE’s GreenLake on premises cloud service was up 116 percent year over year in the channel with the number of active partners up 62 percent, said Hope.

The GreenLake indirect mix – which was in the single digit range several years ago – is now at 29 percent, up 11 points year over year, said Hope.

“The number of partners who sell GreenLake keeps growing as we make it easier and more profitable for you to sell consumption offerings,” he said.

To fuel the GreenLake sales charge, HPE has maintained its 17 percent robust up-front rebate for GreenLake channel deals and has added GreenLake business planning workshops aimed at helping partners move to the pay-per-use, consumption-based GreenLake sales model.

Storage as a service offerings now represent 30 percent of overall GreenLake sales, said Hope. “We expect that to continue to grow,” he said.

With aggressive plans to ramp up GreenLake data management offerings, Hope said he sees a “huge” opportunity for growth in 2021 and beyond.

Primera And Nimble Storage Sales On Rise

HPE’s high availability Primera storage platform- which guarantees customers 100 percent uptime- was up 105 percent in the channel with an 83 percent increase in the number of active partners selling the product, said Hope.

“I’m glad to see that the Primera value proposition continues to resonate with our customers,” said Hope. “With the built in agility of cloud and powered by the intelligence of InfoSight Primera gives us instant access to data with storage that sets up in minutes, upgrades transparently and can be delivered as a service.”

HPE’s Nimble storage indirect business, meanwhile, was up 19 percent to $129 million with active partners up by 14 percent, said Hope.

HPE is mounting a massive 3Par to Nimble and Primera upgrade initiative for the fiscal year. That opportunity amounts to a $1.5 to $3 billion in sales, said Hope.

“When it comes to storage our opportunity is massive this year,” said Hope. “Data has gravity and it continue to grow exponentially. In a mostly flat or declining storage market there are still very high growth areas that have huge TAMs (total addressable markets) like all flash arrays which are growing at a 13 percent CAGR (compound annual growth rate) and HCI which is growing at a 13 percent CAGR.”

Midmarket/SMB Growth

The midmarket channel busines was up nine percent from the year ago quarter, said Hope.

HPE’s Silver medallion and proximity partners grew their share of the GreenLake business by 29 percent compared to the year ago quarter, said Hope.

“As we continue to focus GreenLake on some of the workloads that are attractive to the midmarket partners, there is even more opportunity for our partner community there,” he said.

HPE is putting significant investments in driving midmarket/SMB growth, said Hope.

“The pandemic has forced most SMBs to radically alter their technology priorities for 2021 and beyond,” said Hope. “The digitally determined SMBs are more likely to report revenue increases than those who haven’t embarked on their digital transformation journey.”

To that end, HPE has brought new Flex Offers to the SMB market with a distributor tool that allows partners to go to a distributor’s website to get special SMB built-to-order Flex Offers and promotions.

HPE has built the new CTO capability into its HPE iQuote tool, a streamlined quoting tool that provides partners with preapproved discounts and promotional prices in real time.

HPE’s CloudPhysics Partner Game Changer

HPE’s acquisition of CloudPhysics last month provides partners with a powerful AI-based sales proposal platform, said Hope.

“Now we can offer a breakthrough hybrid cloud assessment tool with our new CloudPhysics tool,” said Hope. “CloudPhysics is a SaaS based tool that analyzes on premise IT environment and then provides quick ROI recommendations for cloud migrations, app modernization and infrastructure.”

The CloudPhysics data lake—which includes more than 200 trillion data samples from more than 1 million virtual machines—provides a one-two AI sales punch when teamed with HPE’s InfoSight AI-based predictive analytics data engine, said Hope.

InfoSight—which collects information from HPE’s massive installed base to automatically remediate infrastructure issues—has 1,250 trillion data points in a data lake that has been built up over more than a decade, said Hope. “This one two punch is phenomenal,” he said.

HPE has combined the CloudPhysics and InfoSight data lake as part of a massive AI-based Software Defined Opportunity Engine (SDOE) that provides customized sales proposals

The SDOE—which was launched in tandem with the CloudPhysics acquisition—slashes the time it takes for partners to do custom sales proposals from as much as 45 days to just 45 seconds, said Hope. “This is better positioning us to seize margin rich opportunities,” he told partners.

Coming Soon- HPE High Performance Compute As A Service For Partners

With artificial intelligence reshaping the competitive landscape, HPE is poised to offer high performance compute (HPC) as a service for channel partners, said Hope.

“We are in the process of building out our three year strategy with HPC and MCS (Mission Critical Systems) to focus more on the channel,” said Hope. “So stay tuned for that. We are looking for some of you to step up and help us with that.”

HPE’s HPC channel business was up 11 percent year over year in the channel, said Hope.

HPE unveiled its GreenLake HPC cloud service aimed at bringing affordable supercomputing power to midsize and even small business in December.

The new cloud service—which comes in small, medium and large options—allows customers and partners to order HPC as a service through a self-service portal with delivery from configuration to rollout in as few as 14 days.

HPE expects the service to slash by 40 percent the big-ticket, capital expenditure price for HPC systems that previously cost hundreds of thousands and even millions of dollars. What’s more, HPE said the new service will speed up the deployment of HPC rollouts by 75 percent.