HPE Is ‘Years Ahead’ Of Competitors In Everything- As-A-Service Channel Battle: HPE GreenLake GM Keith White

‘I have huge expectations for the channel in fiscal year 2021, but I am also going to put our money where our mouth is and make sure they have the resources, tools, enablement, incentives and people to help them be successful,’ says White.

Hewlett Packard Enterprise is “sprinting forward” with an Everything-as-a-Service channel model that is “years ahead” of competitors like Dell Technologies and Cisco Systems, which recently signaled their intent to move lock, stock and barrel into the Everything-as-a-Service channel game, said HPE Senior Vice President and GreenLake Cloud Services General Manager Keith White.

“We are years ahead,” said White in an interview with CRN in which he pledged to triple HPE’s GreenLake channel investment for the new HPE fiscal year, which starts Nov. 1. “We have worked through a lot of the kinks. It’s easy to just say you are going to be an as-a-service company but [HPE President and CEO] Antonio [Neri] put the stake in the ground a couple of years ago [to move the complete HPE portfolio to as a service by 2022], and we are aggressively moving toward that.”

Dell Technologies CEO Michael Dell told CRN in September that Dell is in the process of rolling out as-a-service consumption-based models for its massive portfolio of PCs, servers, storage, networking, end-user computing and hyperconverged infrastructure solutions.

Cisco CEO Chuck Robbins has also signaled an Everything-as-a-Service shift, telling analysts in August that the tech giant wants to move its entire portfolio to a consumption-based model in the wake of the COVID-19 pandemic.

HPE, for its part, has been honing the channel model for GreenLake—which started out as HPE Flex Capacity in 2016 and morphed into the much-heralded GreenLake 2.0 release in 2018 with a robust 17 percent up-front rebate for partners.

HPE’s partner profitability on the GreenLake pay-per-use model is unmatched, according to partners.

White, for his part, said HPE is committed to delivering the best profitability for the channel for Everything as a Service. “I am committed to making sure our partners are the most profitable,” he said. “Our whole mindset is how do we go through and with our partner ecosystem to deliver these to our customers. To do that, we have to not only provide them with the most profitability we have to provide them with the tools and resources required to be successful.”

White said competitors provide lower commissions but also do not pay out the 17 percent commission rebate up front. “We give it based on the order that partners receive,” he said. “This isn’t happening later when it gets installed, delivered or when the customer starts to use something.”

White said HPE is making an all-out GreenLake partner sales blitz in the new fiscal year backed up with new GreenLake sales specialists including a call center team charged with driving new logo wins with partners.

“I have huge expectations for the channel in fiscal year 2021, but I am also going to put our money where our mouth is and make sure they have the resources, tools, enablement, incentives and people to help them be successful,” said White.

How committed are you to profitability leadership versus the competitors?

I am committed to making sure our partners are the most profitable. Our whole mindset is how do we go through and with our partner ecosystem to deliver these to our customers. To do that, we have to not only provide them with the most profitability, we have to provide them with the tools and resources required to be successful. That is why I am talking about workshops, QuickQuote tools and SWIFT programs. We also have to make sure that we are continuously listening to our partners. We have our Partner Advisory Council that educates us on a regular basis on what are the top challenges and issues facing them.

How big is the GreenLake channel investment for the new fiscal year?

We are tripling our channel investments and going from zero to a large number of inside sales resources at a worldwide level.

I expect us to pay out even more of the [GreenLake 17 percent up-front rebate] incentive that we talked about. As more and more of our business flows through the channel, that will increase as well.

So we’re making a significant investment in the channel both with incentives and resources on the GreenLake front.

How big an impact do you expect those investments to have on the channel?

It’s massive. What we are learning is that as we move to the as-a-service world the customer expectations go up dramatically. We have talked about the cloud expectations that customers have from the public cloud. But at the end of the day what they want are solutions that provide business outcomes for them to be even more successful.

In a COVID-19 world, customers don’t have as much revenue coming in. They need to conserve their cash flow and make sure they are not overspending up front for the [business] outcome at the end. So there is a really a key focus on cash flow, ROI and [business] impact. .

What that means is with these services we have to do this with our partner ecosystem—the people delivering these services for us. With respect to the channel, this is how we scale GreenLake to more and more customers.

And remember, this is not a one-time sell to these customers. Once partners have landed GreenLake within an account, then they expand it with the next project, the next solution and the next capability that is required.

That is where we are seeing the excitement from partners. They are seeing that once they get a customer in with GreenLake, there is more and more on top of that.

I have huge expectations for the channel in fiscal year 2021, but I am also going to put our money where our mouth is and make sure they have the resources, tools, enablement, incentives and people to help them be successful.

What’s the channel plan for account expansion for the channel in the new fiscal year?

We are opening up a lot more of the customer base to the channel as we head into the next fiscal year. We are realizing they have the tools, resources and capabilities to really serve a much broader set of our customer base. I expect there to be a significant uptake with these customers going forward.

So how are you looking at the market differently and how will the account structure change in terms of what accounts are going to be partner-led?

As we think about the direct scenario we have a core set of customers—mostly at the very high end who we do a significant amount of business with. I don’t want to indicate that we are not going to engage and co-sell with our partner ecosystem to those folks as well. It is sort of a law of diminishing returns, if you will. It is also who is best set up for us to be able to manage and engage with that customer for their best business outcome.

What we are finding is that as we sort of consolidate our direct engagement at top-tier customers, it means we then get to provide more channel-led opportunities for a much larger base of our customer set.

I want to make sure that people realize this is about joint go-to-market. We are doing this together. We are providing the tools and resources but at the same time we are co-selling, doing joint account calls, doing joint account planning, being thoughtful and strategic about what the customer needs. But in essence, we are really enabling the channel to have a much broader surface area to really be fully channel-led.

How big an investment are you making as you expand that broader channel-led focus?

We are adding a set of GreenLake specialists into our inside sales organization to engage directly with the channel to help bring them into deals on top of that. Today we sort of had a broad inside sales rep that was managing a few things. We now have GreenLake specialists that connect out to the channel partners.

The second thing we are doing is we are dramatically increasing our worldwide channel resources to help engage and co-sell with those channel partners as well. We are making significant investments to make sure there are GreenLake-specific specialists to help get these deals closed and to help with the enablement and co-selling.

How is HPE going to continue to incent the channel and make sure they are profitable?

We provide a 17 percent rebate up front based on orders. We don’t wait for it to get installed or be utilized. This is all up front for our partners, and we are going to continue to drive that profitability model.

One plus one equals three for our customer set and we have to be the most profitable for our channel partners as they are delivering these solutions to their customers.

How important are the workshops that HPE is doing to help partners move from a Capex to an Opex model?

We have a set of workshops we have done with a variety of KPMG-like folks to help them really go in and scrutinize their business model and all the things they are doing to help them with this transition. We have a number of channel partners that we have taken through that workshop.

How does HPE profitability stack up against what Dell and Cisco are offering partners?

Often times what we are seeing from the competitors is not just a lower percentage. It is also when do they get those dollars. We are planning on again [for the new fiscal year] the 17 percent (up-front rebate). Secondly, we give it based on the order that partners receive. This isn’t happening later when it gets installed, delivered or when the customer starts to use something. This is about today as they are making this transition.

We have also taken and created this tool called QuickQuote. The idea is partners can go in and quickly get a quote through the tool for an offering to their customer. That outputs the full statement of work and the amount. We are really trying to narrow down the pricing scenario. This new Swift offering plugs right into our QuickQuote tool and these then deliver the standardized offerings we can get to the customer in as little as 14 days. We are really trying to speed up and simplify the whole process and make it super easy so we can all do what we want to do, which is serve our customers in the most effective way possible.

How big a factor is the 14-day quote-to-delivery model compared to what was there before?

When I first came to HPE, the first thing I asked the team was to walk me through awareness to deployment, show me what that process looked like and how long it takes. There was a pretty big timeline with respect to getting to that. So what we did is we stepped back—we had nearly 1,000 customers and $4 billion of total contract value. As you saw, we had in Q3 82 percent year-over-year growth for GreenLake, which is super exciting. That is delivering on hundreds of deals around the world every quarter.

In essence what we did was take that experience and look at what were the most common set-ups, configurations and usage scenarios. That is how we came up with the 17 [standardized] configurations that we have. Then we went to our factories and we prebuilt those. So they are basically ready to go for the customer with some slight tweaks based on what the customer wants. We are doing that in the Americas, EMEA and across Asia. That allows us basically to get an order and to get it out to the customer very quickly.

Customers want their stuff, and they want to be able to execute on it right away. That has been a key piece of it. Now with the QuickQuote tool and the Swift offering we have narrowed down the time it takes to quote, deliver and the cost associated with that so that we can get to a broader group of customers.

So if I want to GreenLake my hospital because I need more medical records and X-rays to be stored because of COVID, I can quickly go up, do a quick quote that goes through the channel partner and then that gets delivered to me in as little as 14 days.

The 14 days is from order to delivery. We have dramatically decreased the time for these standard configurations.

How important is the reduced time from quote to delivery?

It is all about cloud experience, making sure that you can provision things very quickly, self-serve, automated. It is cloud economics, you want to pay for what you use and not pay for some big chunk up front. And it is cloud management. On all of these deals we are managing all of it for the customer. We are delivering it, running it, looking at capacity and making sure it is the highest performance. You put all these things together and you can’t beat it.

What is the competitive differentiation with VMware on Containers as a Service with VMware Tanzu versus HPE Ezmeral?

We are going to make sure that Ezmeral is just a fantastic experience for our customer set. We are delivering Containers as a Service through GreenLake. It is pay for what you use. It is not a leasing scenario that you typically see with the Dells of the world.

At the same time, we also have an open platform. So if a customer chooses Red Hat OpenShift, we are going to make sure we do a fantastic job of running that as well. We are really taking a customer-in approach looking what at what is the customer is trying to accomplish.

We are going to make sure that the HPE container platform is the best of the best and that we enable it to be easy for our customers as they move to these container-type scenarios. At the same time we want to be open. So we have signed deals with Google Anthos, OpenShift. VMware is a partner of ours as well. A lot of customers are still doing virtualization and virtual machines. We just did a huge [$27 million] deal with LyondellBasell [one of the world’s largest producers of plastic resins] as they migrate and modernize their data center. A lot of customers are looking to modernize their data centers and they still have VMware.

We are also partnering closely with Nutanix and we are seeing a significant uptick and interest in Nutanix from our customer base in partnership with GreenLake. In fact they even mentioned GreenLake as part of their last earnings call. They are seeing a ton of momentum in that as well.

So we want to partner across the board. At the same time, we are going to make sure we are going to deliver the best experience for the customer regardless of what they want.

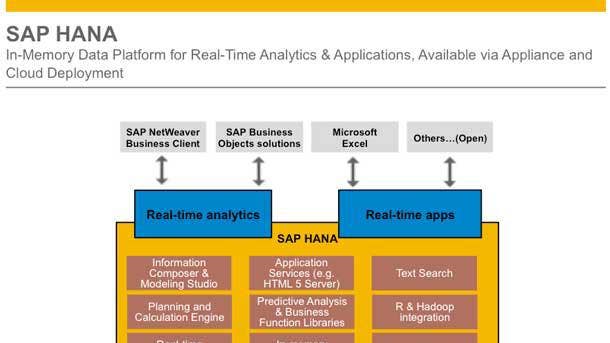

How are you moving to provide service provider offerings like you did with the GreenLake SAP HANA Enterprise Cloud?

We are now the provider for SAP HEC [HANA Enterprise Cloud] on-prem for all their customers. That has allowed us to create for service providers —the next channel, if you will, for us—the ability to provide GreenLake capabilities with their services out to their customer base as well. We are excited about the momentum there.

How important is the service provider channel with broad support from many vendors?

That is really critical. Customers today want solutions. They are not just buying a disk array here or a processor here. They want a full solution. The service providers are going to be very complementary to our existing channel folks. In essence, it is an ability to take GreenLake and deliver those services, whether that is backup and disaster recovery, VDI virtual desktop solution or SAP for the customer. That is super critical.

That is key to scaling and growing out the business. We are deeply engaged with those service providers. What you are seeing is the channel sort of merge into that delivery as well. You have seen the Insights of the world purchase consulting and service provider capability. You are seeing the CDWs do the same thing. You talk to [CPP Associates Director] Paul O’Dell and the CPP team and they talk about servicing customers in a very different way. GreenLake provides them with that capability. Our whole goal is to make them profitable and to serve our joint customers —not my customer, not their customer. They are our joint customers. And partners are on the front end.

Where are you seeing the greatest traction in the standardized 17 building blocks?

The standardized building blocks have had a significant impact. I mentioned QuickQuote. We are seeing hundreds of quotes pop up on a regular basis.

Now what we are starting to see is the pipeline build pretty dramatically. I am not going to share specific numbers but it is in the hundreds in terms of pipeline opportunities for these standardized building blocks. Now that we have rolled those out in the July-August time frame, we are now seeing the momentum as customers make the decision on what they want to do. That is why I think the channel is going to have a huge impact for us in fiscal year 2021, which starts in November.

Is fiscal year 2021 going to be the ‘Year of GreenLake?’

We have laid the foundation this last fiscal year. We really took a look at how do we simplify and deliver all the things we just talked about.

We now have this foundation. With these [17 standardized] cloud services—compute, storage, networking, VMs and containers—that is the foundation with which to build out these solutions like SAP, VDI with Citrix and Nutanix, HPC [high-performance compute]. In essence, we are able to deliver because of the foundational components and how we have addressed the value chain, and because of all the incentives and resources we are now putting into the channel to really help partners be successful. We think this is a take-off year for us. We are really excited to see the momentum build.

How big a lead do you have versus competitors who are moving now into Everything as a Service?

We are sprinting. We are years ahead. We have worked through a lot of the kinks. It’s easy to just say you are going to be an as-a-service company but Antonio put the stake in the ground a couple of years ago [to move the complete HPE portfolio to as a service by 2022] and we are aggressively moving toward that.

It always takes people a while to figure out what does that really mean and where does it go. We are now sprinting forward. We have come out of the slow jog and jumped over the hurdles a bit and now we are sprinting. We feel really good about not just the lead we have because it is not only about that. It is also about what the customers are saying about us.

We have an over 99 percent retention rate of GreenLake customers. We see a significant amount of new business flow through those existing customers. That tells us that we are doing the right things. Now that we have got the 17 configurations that can be delivered in as little as 14 days, the Swift offering, the incentives and the people, we feel like that lead is just going to increase. We are putting our foot on the gas.

How important is the new executive talent you are adding in terms of driving GreenLake momentum?

Paul Hunter is now our leader in North America. Having his strong understanding of the channel and how it works effectively is going to be key. Our partnership is important as we develop the next-generation partner ecosystem with GreenLake. Having him there to implement that is going to be fantastic.

I also brought in my own channel chief—[HPE Vice President Worldwide Channel Go To Market/Channel Sales] Greg Stafford —who has been leading our [worldwide] channel sales organization. To build out the ecosystem Greg is partnering with [HPE Vice President Partner Ecosystem for GreenLake] Maurice Martin, who came over from Microsoft. He was instrumental in building out the Azure business and the Azure ecosystem. We are excited to have that expertise to drive that from a worldwide standpoint.

We also added [HPE Vice President Worldwide Sales] Arwa Kaddoura, who leads up our go to market and sales organization worldwide. She also came from Microsoft. She is lighting the go-to- market model on fire.

Bringing together sales and the ecosystem is a one plus one equals three scenario.