UiPath Channel Chief On A Wide-Open Market For Partners: ‘Eighty Percent Of Processes Are Still Not Automated’

‘So if you’re a partner and you’re choosing not to participate, you’re now choosing to take automation off your offering for your customer ecosystem. And you’re opening up the door to your competition to fulfill that need. And if they fulfill that need, then the chances are they’ll fulfill other needs that you might be fulfilling today,’ UiPath’s Eddie O’Brien tells CRN.

Eddie O’Brien has grand plans for automation software company UiPath’s channel. Now that the company is past a successful initial public offering that netted $692.4 million in April, O’Brien has more resources to add more partners to the channel and build more relationships to grow revenue.

O’Brien is the company’s top channel executive and answers directly to Chief Revenue Officer Thomas Hansen. O’Brien’s resume includes roles as chief channel officer at UiPath competitor Automation Anywhere, global channel chief at cloud storage company Dropbox and more than 15 years with tech giant Microsoft. He joined UiPath in June 2020.

“The business is absolutely flying. We’re reported now to have 32 percent market share, with the two nearest competitors combined only having 22 percent share,” O’Brien told CRN in an interview.

“We have over 8,000 customers today,” he continued. “From my side of the house, one of the exciting things is we have over 4,000 partners who have joined our program. Now, to give you some relative context, at Dropbox we got up to 10,000 partners, probably after 10 years. My tenure would have been the back half of that 10 years. So it’s very early days in this industry to have UiPath have so many partners, and a lot of them are transacting regularly every quarter.”

He wants UiPath to have a channel to rival that of his old employer Microsoft.

“Let me quote Microsoft: 400,000 partners,” he said. “I ran the OEM channel when I was there. I know what it‘s like to have a world-class channel and the importance of it if you really want to be a global, corner-to-corner software and enterprise software company like we do and we are already.

Here’s how UiPath is investing in its partners.

What’s UiPath’s current standing in the automation market?

The entire automation space has really taken off in the last four or five years. UiPath only shipped their first enterprise software about five years ago.

The business is absolutely flying. We’re reported now to have 32 percent market share, with the two nearest competitors combined only having 22 percent share. So three players have 50 percent between them. And then there‘s a host of followers coming up. So we’re very excited about the market-share position.

The thing that makes us uniquely different is we’re, at this point, selling a platform. The original concept of RPA [robotic process automation] was creating a bot to automate a task or an activity or something in your workflow, whereas UiPath has come along and they’ve added task mining, document understanding, AI, other functionality that enables you to uncover the process that needs to be automated in the first place. Actually automate it, and then follow up with the reporting that’s on top of it.

Now an interesting statistic is 80 percent of processes are still not automated. If you think of all the software that’s been developed, we’re all still doing so much manual stuff. And the total addressable market of a fully automated enterprise, let’s say, is thought to be currently in and around $60 billion.

And that’s what makes us so attractive [to] all the Fortune 1000 and many different companies around the world.

So let me put some context around that then. We have over 8,000 customers today. But from my side of the house, one of the exciting things is we have over 4,000 partners who have joined our program.

Now, to give you some relative context, at Dropbox we got up to 10,000 partners, probably after 10 years. My tenure would have been the back half of that 10 years. So it’s very early days in this industry to have UiPath have so many partners, and a lot of them are transacting regularly every quarter.

So we’re very excited about certain metrics we don’t report publicly, but we call it ‘reach frequency and yield,’ which is the number of unique partners transacting each period, how often they transact, how much they transact.

What’s the strategy for growing UiPath’s partner ecosystem?

We have an omnichannel strategy, so we have both depth and breadth. So we’re in with all the large GSIs [global systems integrators] that you’d expect: Accenture, Deloitte, KPMG, Price Waterhouse, Ernst & Young, IBM, Cognizant, Capgemini, all the India-based SIs like Wipro and Infosys.

They’ve all started building automation practices, which is actually one of the really interesting and important telltale signs that these guys see this space as similar to large-scale ERP implementation like an SAP to build practices around. We’re in constant communication with them on how to help them scale their practices

So we have a depth part to our partner strategy, which is with all of these guys. And we have motions around that. We sell to them, as some of our best and biggest customers. We also sell with them into the marketplace. And then some of them, like Deloitte, actually resell our product in their own engagement with enterprise customers. The sell-to is interesting because two of our largest customers now are Ernst & Young and PwC. And they’re both big customer references for us.

And they’ve embraced that part of the strategy, which is also unique to UiPath, which is ‘a robot for every person.’ We call it ‘AREP.’ And [CEO] Daniel Dines likes to talk about this in the context of the infamous quote from Bill Gates—which was ‘a PC for every person’—that we all scoffed at a long time ago. But that ‘robot for every person’ is playing out among many customers, two of whom are big partners of ours, which makes my job even more exciting.

So, more than ‘AREP,’ a robot for every person, I want to introduce this concept of the fully automated enterprise. Because the endgame here is to be able to go to, you know, whether it‘s Ernst & Young or PwC or Coca-Cola, and really lead their digital transformation into the fully automated enterprise.

And as you know, so many companies talk today about intelligent automation and digital transformation. UiPath is the closest example I’ve seen of a company that can actually automate your workflows and deliver that dream of the fully automated enterprise.

And then we have other parts of the strategy. What we do is we have managed partner reps in each of the geographies around the world. So I have over 100 reps now globally and they all manage 10 to 12-ish partners themselves. They are high-touch, strategic, managed partners, below the layer of these global GSIs.

The global GSIs, I have a team that manage them globally, based here out of the U.S., a few out of India and a few out of APJ. But the global leaders are mainly out of the U.S.

And then in each of the geos we have this managed layer, which is the next layer down, and that usually has two to three flavors of it.

It has strategic partners who have betted on UiPath totally. There’ll be companies like Accelirate in North America. Ashling Partners is one. They’ve also dedicated themselves to a niche or a vertical in the marketplace that needs serving. So that’s a very important community to us.

Then we have our breadth players. So of the more than 4,400 partners, about 3,000 of them now are transacting through Ingram Micro.

So we recently built a global distribution program with Ingram Micro, which I had in the past at Dropbox, by the way. And Thomas Hansen, who’s CRO here, he used to run SMB at Microsoft. So one of his jobs was looking after the relationship with Ingram Micro, Tech Data, these big distribution players.

We’re excited about that relationship because, first of all, it’s very efficient for us. We don’t have to build big teams to manage the breadth. They have expertise and dedication that they can go drive that reach frequency and yield with that broader community. And then it gives us a reach into the midsize, smaller end of the market.

That’s the third tranche. We have our global GSIs, managed partners, the breadth players.

How about UiPath’s tech alliances?

We have over 300 tech alliances now. And why this is really important to my platform comment earlier is when a customer acquires UiPath, we want it to be able to work with everything.

And coming from Microsoft back in the day, that was a challenge for Microsoft when it was more closed. UiPath is wide open from the beginning in a very positive way. So things like Slack, Zoom. We have these 400 technologies, all of us, that we use to run our companies. And it’s getting even broader. We want to make sure all the big names there have a two-way integration into UiPath.

And we’re obviously looking at some deeper relationships with some of the bigger partners. Two of which are very interesting to mention actually are AWS and Microsoft. We’re on the Azure Marketplace. We’re on the AWS Marketplace. Their reps get paid on deals that they sell with UiPath.

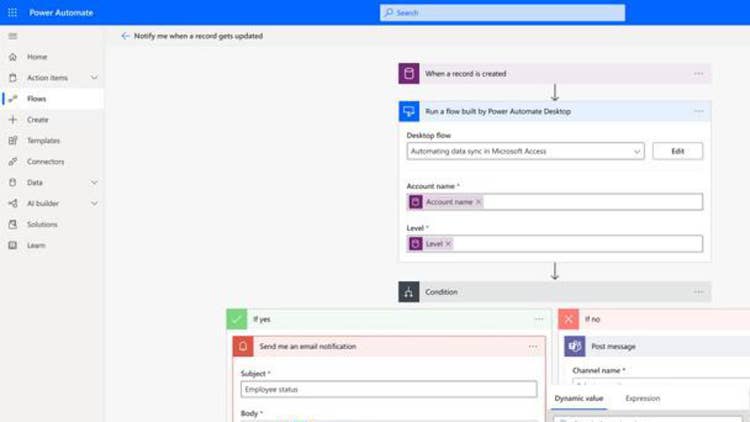

This makes it actually unique for Microsoft because, obviously, they’ve entered the space with their Power Automate. But Power Automate is a starter pack, if you want to call it that, for getting into the market.

But at the same time, we’re a big partner with them. So we welcome them because not only does it validate the space, but it also wakes everybody up to the actual addressable market that’s here and the opportunity for everybody.

Is there as much opportunity with midmarket customers as there is with the largest enterprises?

I don’t want to confuse anyone. We’re absolutely a large-scale-enterprise-focused company to begin with. That’s absolutely where the bulk of the business is today.

But we’re gearing up with the move to Ingram Micro and building that breadth channel to be able to serve the rest of the channel where we are seeing a significant appetite.

We’re not even recruiting partners in this breadth space. They’re literally just signing up. And that’s a very good sign.

We haven’t even started our recruitment engine out of Ingram Micro yet. So ultimately we want to identify, recruit and enable partners that will transact more often and aren’t just putting a toe in the water. But we are seeing significant demand, especially around midmarket.

We also have a velocity sales engine. We have sold seven-digit deals over the phone with customers in the midmarket space to our velocity sales engine. I mean, that’s incredible. I wasn’t seeing anything like that prior to this so early. You’ve got to remember we shipped our first software five years ago.

It’s an incredible growth machine, really. The velocity and the breadth appetite we’re seeing says there’s definitely an opportunity.

Our focus is definitely top of the pyramid down, in that order. We are dividing up our sales force and how we manage the partner ecosystem to address large strategic companies, the Fortune 1000, our enterprise, midmarket and SMB. The opportunities are definitely there.

SMBs, they run everything in the cloud. So being able to automate stuff for them without adding head count or outsourcing more activities would be a huge plus for them.

When I said ‘head count,’ I want to underline, the goal here is not to replace head count. Because you can’t replace human beings. A bot’s not going to do that. But what it does is it emulates the work that a human does. Taking all of that automatable, vanilla execution work out of the workflow so they can really focus on value-added work.

The ROI we’re seeing is off the charts in terms of man-hours. Not that we want to save head count or lay people off or anything like that. But the human hours that we’re saving is incredible.

What workloads have been in high demand for automation lately? What’s the future hold?

Everything’s open for business. It’s insane. I did ask somebody what were the leading verticals the other day. I got back, manufacturing, banking, financial services and health care.

But really, what happened, to put my own spin on it, is the pandemic made everybody rethink digital transformation.

We saw continued growth during the pandemic. There was no slowdown. I moved companies right in the middle of the pandemic. I had seen slowdown in other areas. But not in UiPath.

I think the two workloads or areas that are very automatable out of the gate are HR and finance. Having CFOs, chief accounting officers, chief people officers as key decision-makers is really important. All of the workloads associated with billing, processing, ordering procurement, HR processes. They’re table stakes when you digitally transform a place to begin with and drive a lot of volume. Everything else is kind of gravy.

Let me give you an example that shows the scale of this. Take health care, for example. There’s health-care partners who serve all the health-care companies, thousands of them, small, medium and large. And they’re looking at how they can embed things like UiPath into their offerings so that they can provide that automation right out of the gate.

We’ve all probably seen the transition in health care of a doctor coming in with a notepad and a pen or a medical practitioner, or the nursing assistant, and now they come in with their computer and they’re typing away. The next wave of that will be attended and unattended automation.

Many examples in COVID where completing all of the COVID forms—when you take all the information when the COVID tests were done—and then automate that. We have a product now, which is basically document understanding, and it can read unstructured data, and structure it so it can be automatable. And that advances the whole RPA concept and gets the data ready before you even apply RPA to it. I think health care will be a huge area of growth for us in the future.

As a former Microsoft guy, what are your thoughts on Power Platform? Is it competitive with UiPath?

I had an amazing 15 years there [at Microsoft]. I had the pleasure of managing Dynamics operations globally. And [CEO] Satya [Nadella] on his way up the ranks got to run Dynamics.

Yes, for sure we see them as a competitor. In fact, we keep an eye on Microsoft more than the ones we’ve left behind. We don’t really lose deals to many companies nowadays. But we are seeing Microsoft’s name come up, because they’ll always have the power of saying, ‘Hey, buy us, it’s free.’ It’s not really free. It’s already in there, along with the other 50 products to their enterprise agreement.

So our positioning around that is ‘best-in-breed’ versus ‘good enough.’ And one day they’ll get Power Automate to a point where it could be ‘good enough.’ But there’s a lot of opportunity for best-of-breed. I think a perfect example is Zoom versus Teams. And Slack was alive and well leading up to the Salesforce acquisition.

So yes, we see them as a competitor. They are also a partner, though, with Azure. And we look at that very positively as we grow our cloud business. Our cloud business has totally taken off. What we’re trying to do is make available in the cloud everything that’s available on-prem. We feel like we’ve already passed the competition from a cloud perspective. AA [Automation Anywhere] does a good job talking about their cloud positioning. But the reality is, functionality-wise, we feel like we’ve passed them. And we’re close to making everything available on cloud that’s on-prem. And we’re seeing our cloud business increase dramatically, and we’re very excited about that.

That makes us important partners with AWS and Microsoft and how we think about their infrastructures. They’re the two main ones that we’re in with today. So they‘re both a partner and a competitor. Blue Prism and Automation Anywhere are the two others of the top three. We just don’t see them in many deals now.

Everyone will always say competition is good for the market. There’s definitely room. If you actually do the math on the 80 percent not automated, it’s in the trillions [of dollars]. But reality check on bringing it into a number that is maybe achievable, you’re into $60 billion. So we’re both excited and watching closely.

What will help automation continue to grow in enterprise technology?

Firstly, we have to absolutely continue to innovate. And we have to keep developing the platform. So that’s definitely a high goal of the engineering team.

The price point is interesting because you can enter the market, honestly, with a fairly small configuration. We have a starter pack for $37,500. And if you go a la carte, you get $8,000 to $11,000.

And you can subscribe to our citizen development model, which basically means you can start doing automations for free. So there’s definitely a path at the low end.

We have an approach saleswise because you want to do what’s right for every customer. But our initial target tends to be a five-bot minimum. Depending on where you are in the world, we can get you into a price point of anywhere from $10,000 to $25,000, depending on the configuration. But for SMB, you can get in under $10,000.

Do you want more partners in your ecosystem?

There’s one school of thought which says, look, we only need four or five partners. That’s all we need. Once we do a lot with a few, we’re golden.

But let me quote Microsoft: 400,000 partners. I ran the OEM channel when I was there. I know what it’s like to have a world-class channel and the importance of it if you really want to be a global, corner-to-corner software and enterprise software company like we do and we are already.

So I’m a big fan of big partner ecosystems. It’s going to take us years to build it. But I have recently presented a plan in order for us to leapfrog, to some extent. And, it got very well received by leadership, I would say.

Without saying anything too confidential, I can’t wait 35 to 40 years to have a 400,000-partner ecosystem. I’ve got to find a way of getting there faster.

For channel partners who want to wait before exploring a partnership with UiPath, why is now the time to join?

I would always say, the sooner they’re in the better because customer ecosystems surround partner ecosystems. So if you’re a partner and you’re choosing not to participate, you’re now choosing to take automation off your offering for your customer ecosystem. And you’re opening up the door to your competition to fulfill that need. And if they fulfill that need, then the chances are they’ll fulfill other needs that you might be fulfilling today. So I would say every partner that’s involved in implementation and deployment of a platform like an ERP or a CRM or a Workday needs to be involved in building an automation practice, 100 percent.

One thing that partners have uniquely that the companies themselves won’t do, honestly, is what I call the ‘one plus one equals three.’ Which means if you’re a partner and you’re bringing automation—call it ‘the one’—to a customer, and then you’re bringing Workday to the customer —call it another ‘one’—but automate the implementation process of Workday, and therefore reduced this time it takes to implement Workday because you’ve automated some of it, now you have a one plus one equals three. And you’re a really attractive partner to that particular customer because you’ve saved them money on implementation, you still brought them the product they wanted and now you’ve introduced digital transformation by automating. That’s a big part of our pitch with the integration into things like Oracle, Workday, SAP. And the Accentures of the world are cracking that as we speak. We would like them to move faster, honestly, because I know big GSI partners have multibillion-dollar practices on Salesforce. And I don’t want to wait 35 years to get one of those.

Things like security, infrastructure, productivity, if you look at the big areas of the enterprise software stack, automation is becoming one of them.

What are some recent investments UiPath has made to improve the partner program?

We’ve done a few things that I think are interesting in the last year or so. One of the things we did is we’ve started measuring the business incrementally, to partner-attached to what we call partner-sourced.

Partner-sourced, it’s an internal measure. We’re not going out with a banner saying we’re a partner-sourced company. But what we’re trying to do is measure the teams to see how much business the partners are themselves generating. And if partners themselves are generating automation business, then it means we’re doing something right for them.

And the thing we’re measuring ourselves on to enable them in order to be able to generate more business is two things. One is enablement. So in addition to all the usual partner enablement stuff, we created a UiPath Services Network [USN].

And what we did is we developed the absolute best-in-breed examinations. If you’re a certified public accountant, and you need to take the professional exams, these are them for automation. They’re hard. I would fail these all day long.

We’re getting big names now to be USN-certified. We’re enabling them to take that leap into the digital transformation automation space and start creating demand in their own customer ecosystem. And they do that a few different ways. One is identifying processes that need to be automated. We have 99 USN-certified partners with 303 currently in the pipeline. We have 1,200 people certified under our new certification and 20,000 under a previous certification.

That was a big mindshift from when I came on board first, where we were more about, ‘Hey, mister direct sales guy, what deals are you working on? Let’s bring a partner in and share the love.’

We‘re still doing all of that. But we’ve added this new dimension, which I’m particularly happy about, and we’ll see how it goes.

I’m not just saying this because it’s SMB, but a major achievement this year was the global program with Ingram Micro. All the signs now are we’re absolutely flying, and we’re over the moon with the results so far.

You could say that was our first step into midmarket and SMB through that. Now, it’s super early days, nascent. I’m not declaring victory. But the signs are very positive.

I think the other big ones are everything we’re doing with the GSIs. The conversation, the demand, the engagement with all our GSIs has rocketed. The growth trajectory there is very, very positive. Deloitte became USN-certified.

Looking forward, I go segment by segment. GSIs can look forward to a different investment model from us. So we want to do more than certification. We want to invest in joint solutions. And we’ve already been sending signals we’re willing to invest and here’s what it looks like.

And that investment has kind of a few different categories to it. One is increasing the number of resources we have dedicated to enabling the GSIs and helping them to build out their practices. Also increasing the number of resources we have selling with them. So presales, technical resources, getting them to do a thing. We have a thing called automation consulting. It’s our own professional services team that goes into customers and identifies what can be automated and starts developing that digital transformation plan. The first step toward the fully automated enterprise.

And now we’ve started bringing that automation consulting expertise to the GSIs. That’s in motion. That’s going to be a big advancement for next year. Because now they’re going to be creating demand with a lot of these customers who put their toe in the water and haven’t scaled their RPA.

Another big thing to look forward to is more targeted joint business development with the strategic partners in certain verticals. So we’re going to pick you Ashling, you Accilerate, and let’s go crack this market together. Post the IPO, we obviously have some cash, so it is a good time to invest. And I’ve been very aggressive in asking for incremental investment. And [CEO] Daniel [Dines] has been super supportive.

If you interview me in a year’s time, I’d love to have a full SMB story where we’ve really developed the SMB community, we’ve landed it, it’s incremental business over and above our expansion, and new logo growth with existing customers and new logo growth in enterprise.

The other thing for partners to look forward to is that they’re becoming a bigger and bigger source, especially in this breadth space of new logos. So they’re bringing a higher percentage of our total new logos. Each quarter, more comes from partners now than from our direct sales team. And we want to see that significantly grow.

We are really looking at our partner program. Our partner program is pretty standard. We’ve got our Diamond or Gold or Silver or Registered partners. We’re really putting some thought into what partner program 3.0 looks like. I’d like to try some innovative things. We’d like to break away from the pack, to be honest, with just a state-of-the-art, fully automated enterprise partner program. We have a partner program for you, wherever you are in your automation journey. And that’s how we’re positioning this.