Weisler On HP Inc.'s Internet of Things Bet, Beating Apple, Windows 10 And The 'Agitation' In The Marketplace

Opportunity Knocks

HP Inc. CEO Dion Weisler spoke with CRN Tuesday about the company's Internet of Things technology bet, share gains HP is making in the premium market segment against Apple, the end of the Microsoft Windows 10 free upgrade offer, and volatility in the market.

The conversation came after Weisler told analysts at HP's Industry Analyst Summit that he is aiming to increase the percentage of channel sales at the $50 billion company from 80 percent to 87 percent of total sales by the end of the year. "We are investing more of our business in increased R&D across core growth and our future," said Weisler. "We are investing in our partners and our go-to-market motions."

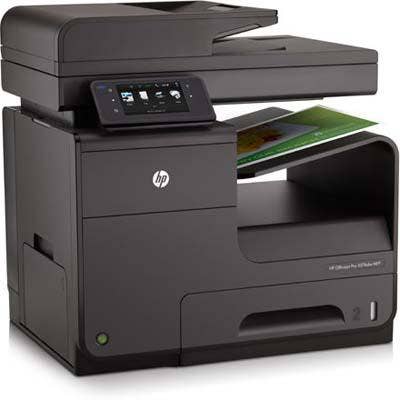

HP executives, in fact, outlined an aggressive move to deliver more services through partners, including an expanded device-as-a-service effort and additional focus on managed print.

The move to boost channel sales comes as several of HP's largest competitors are mired in uncertainty. Dell is in the midst of the largest acquisition in the history of IT as it works to close its deal with EMC, Xerox is splitting in two, and Lexmark agreed to a merger with a group of investors led by Chinese manufacturer Apex Technology for $3.6 billion.

What technology is HP Inc. working on that focuses on the Internet of Things market?

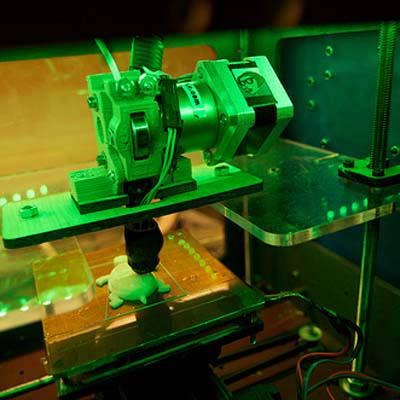

At the voxel [the 3-D printer equivalent of a pixel] level, we're able to in the future embed electrical conductivity. People don't really get what that means. Then I say, 'OK, well here's a chain link that we showed you a year and a half ago,' and then I bring on stage a chain link that has got embedded electronics. Now that can send information to your application that lives up in the cloud and can tell you how much load is on that link. Then people's imaginations start running. Another example is a prosthetic knee. Almost anything where you are trying to get information that can come from anywhere embedded in parts.

Then you start thinking, 'Wow, there are completely different ways to monetize this.' There are completely different ways to build smart machines -- really smart machines -- and you start to think about how you collapse supply chains, how you democratize manufacturing. It is all enabled by this super HP voxel that we have created. That is the differentiation that we have.

What is the partner opportunity in Internet of Things with HP and how can channel partners take advantage of it?

We talked about this obviously in the context of our 3-D printing future. In the future we will have that voxel-level control, and we'll be able to have different-colored voxels. We'll be able to change translucency of the voxel. We'll have connectivity, etc.

We're already beginning to see some channel partners here that have begun to invest very heavily, a lot of the system integrators. Accenture is building a 3-D printing practice. They walk into the biggest organizations in the world where they are hired by a company to look end to end at how to optimize a supply chain, make better parts, reduce costs. Now they have a new arsenal in their toolset. They can relook at this in an entirely different way -- changing paradigms from where products have to be built, how much capital is tied up, spare parts, all of those things. This is a new channel that we haven't traditionally worked with in the past that is investing heavily in this space.

How are you moving to leverage the current 3-D printing channel?

This is a new channel that we are picking up that is already doing 3-D printer parts today, but because we have built a better mouse trap that is really the only device that will do short-run production, they are saying I have all this demand and never had a technology solution like this. So they are coming to us. So that is another new channel.

Then we have some of our traditional channel partners who are saying, 'I don't know a lot about this, but we trust HP. We have been with you for many years, and you told us to chase down printing and look at this franchise we have built.'

So we have got some of our biggest partners that are actually going off and buying some of the traditional [3-D] channels to generate that know-how. There is opportunity here. It is a tiny industry today. It is only $5 billion. We didn't get into it to be a $5 billion industry. We got into it to tap into a $12 trillion industry. That is a huge opportunity for the channel -- probably the single biggest opportunity they have had in their lifetimes.

Talk about the HP Inc. R&D effort and how that stacks up against competitors.

All I would say is that our R&D is 100 percent spent on printing and personal systems. So if you look at what other people are spending, they have huge portfolios, just as we were spending a lot of money inside the old HP that didn't necessarily go to printing and personal systems. We wake up every day and we think about printing and personal systems.

I think [the portfolio] is a true testament to what we have been spending on R&D, whether it is the [Elite] x2 [2-in-1] or the [Elite] x3 [smartphone], and the Spectre 13 [laptop] in the personal systems group or the 3-D printing systems that we released, Jetintelligence [printer cartridges], Multi JetFusion and PageWide array in the printer group.

And it doesn't stop there. We are doubling down on R&D. You only see what is released today. We have got a really exciting road map out into the future, and, as we have become a separate company, all of our money goes into our businesses.

You're making a bet to continue to invest in R&D even as you take other costs out of the business?

At the end of Q4 we said we expect the [PC and printer] world is going to be challenged for some time, and we have got to take costs out of the system. Now we have got a lot of opportunity to take costs out, and what we tried to do here is ring-fence both R&D on one end and sales and marketing on the other. So we went after all the non-revenue-generating costs. How do we streamline our finances? How do we streamline our legal department? How do we streamline our supply chain operations so that we could defend that R&D investment and the sales and marketing investment that supports the channe?.

What level of turmoil do you see among competitors, many of which are facing mergers, acquisitions and divestitures?

Anytime you have mature categories it creates this situation where natural consolidation happens. And there is a lot of agitation in the marketplace.

What we focus on every day is ensuring that all we do is printing and personal systems, how do we engineer experiences that amaze, how we add sprinkles of magic to our product.

We are the pillar of stability right now. People trust our brand. And we are very protective of our brand, and it needs to be worthy of experiences that amaze our customers. And when we do that, all the other things that happen in the market will ultimately be beneficial for our customers and our channel partners.

How has HP Inc. performed in the premium space versus the competition?

I have said for many years in the personal systems space that I wasn't after share for share's sake. We have been very deliberate in our execution there. We have segmented the market. We segmented again and we determined where we can really add value to our customers. And if we feel we can't add value, then we just don't do it. And the art of strategy is as much about choosing what not to do as to what to do.

We recognize there will be some competitors that will go chase the bottom of [the] tablet market. We don't want to be there. We want to create commercial mobility solutions where we can help change workflows, help customers change the way their business operates. That is where we can add value. That is where our channel partners can add value. As a result of that we get a share of that value, as do our customers and the channel. We are really focused on that space.

How have you performed against Apple in the premier segment?

In the premier segment, some of the products we are doing here are just gorgeous – to have the world's thinnest laptop and to take share points away from others that have really occupied that space for a long time is really rewarding for the team. They have done a first-class job here making gorgeous products, not only in personal systems but in print as well – adding design to a printing device that sits inside a teenager's room at home is important to us in a market where we are looking to make printing more relevant. Right across the portfolio there is the premium segment and the gaming segment. These are more profitable markets where we can add more value and more engineering. That is great for our company, great for our customers, great for our partners.

The Windows 10 free upgrade offer ends July 29. What does that mean for HP?

Clearly, we think there has been double-digit movement from people that would have purchased a new device had it not been for the free operating system.

I understand the logic of what Microsoft did here – they are trying to up the number of licenses that they have – that is great because then the app developers come and develop for their platforms. The Windows ecosystem is really important to us and to the industry at large.

Now it is time for us to start upgrading those more than 500 million devices out there that are more than four to five years old, deliver a better customer experience. We are looking to do that, and we have Microsoft's full support to do it.

What is the message to partners looking at upgrading those 500 million older devices?

I think we have the best portfolio we have had in more than a decade – perhaps ever. And so we have all the tools in our arsenal. I think the market is ready with these devices that are fairly aged, and there is a great way and reason for our partners to knock on the door of our customers – whether they be big or small – and talk to them about how we can add value to their portfolio, how we can talk about commercial mobility, how we can deliver a complete range of products from smartphones all the way up to high-end industrial printing. It's a terrific opportunity for the channel.

Talk about the move to grow the percentage of sales going through partners from 80 percent to 87 percent of total sales.

We think we are going in the right direction. I am a firm believer in the channel and always have been. I grew up in the channel. I am not moving from 80 [percent] to 87 percent because I want to give a gift to the channel. I am doing it because I think it makes the most sense for them to amplify the hard work of our engineers. The channel adds value. They add things on top of our products that we can't do. It doesn't mean that we don't want to have relationships with our end customers. But it doesn't mean we have to exclude the channel when we do that. So we are moving from 80 percent to 87 percent because they are more efficient, and it is going to amplify our efforts.

How important is it for partners to invest in the future with HP in areas like 3-D printing and the Elite x3?

I think all businesses need to keep their eyes open every single day. What has worked in the past doesn't guarantee success in the future. The markets move at lightning speed. In the same way that many of our partners had to react to the internet and had to build an online business and an online presence a decade ago, they have to look at the trends that are happening in the market today whether it is commercial mobility, security, Millennials, the blended reality moving from the physical world to the digital world.

These are all new megatrends that ground our strategy. So we encourage our channel partners to think about the big macro trends that are taking place and not invest everything but take a portion of what they would invest in the business, continue to invest in their core just as we do, but start to have an eye on which capabilities, which sub-segments, and which verticals they want to participate in in the future.

They won't be able to do them all. Some of the bigger ones will. But if you are a smaller reseller today, think about where the markets are going and what is the bet that you want to lay down and put some money aside to invest in that.

Talk about what surprised you most now 226 days into HP as a separate independent company.

What has surprised me is how quickly the industry is changing around us, whether it is complex acquisitions or divestitures or sales or spinoffs. The market out there at the moment is incredibly volatile, and I think our team has really risen to the challenge here – the pillar of stability in the industry. We know what we are. We understand what our strategy is, we understand what our value is. We are going to bring that to the market, and we are going to bring it standing tall, standing proud. That has been really remarkable to watch -- everybody up-leveling themselves, everyone stepping up to the challenge. That is what HP does really well. We operate great in down markets – equally as well in up markets.

What do you see as the biggest challenge going forward for you and the team?

I think we have great opportunity. We have articulated a strategy that is grounded in reality. We understand were the markets are today, and we have a core business that represents the vast majority of our $50 billion in revenue. We have to be excellent in printing and personal systems in our core. But we also understand where our growth will come from over the next one to three years, whether it is the A3 copier space, commercial mobility or our graphics space. We are focused in on making sure we put more wood behind fewer arrows. And then well out into the future when I am bouncing my grandkids on my knee I want to be able to look back and say, 'This is how HP changed the world.' What we are doing in blended reality, whether it be on the on-ramp with immersive computing or the off-ramp with 3-D printing, I think is just transformational. As a citizen of Western economies that have seen manufacturing move to far-away places over the years, this is great to be able to democratize manufacturing and bring it back. To give the blacksmiths back their tools I just think is fantastic for America. It is great for Western Europe. It is great for Australia. Everyone gets to participate in Industry 4.0.

What was the reception to 3-D printing from the HP JetFusion 3D printing solutions launch?

It has been phenomenal, whether it is the industry analysts that follow it closely who understand the breakthrough we have made with Multi JetFusion and the voxel, just how differently we are doing this, being the world's first commercial production 3-D printing system and what that means to be able to change traditional supply chains to the channels involved in the business today and the new channels that are going to be involved in the business tomorrow to the sales that we have made. People put down hard cash to reserve these systems. They have put down thousands of dollars to say when [the printers] come off the [manufacturing] line, we want to be in the queue. That is awesome. I love that.

Talk about the move from transactional product sales to contractual services sales. How fast you are seeing that happen?

Globally, we are seeing that move at about six points. In mature markets, it's probably moving double that, and in emerging markets a little slower. So it varies country by country. We saw it first with managed print services, and as we built that asset base and that know-how – the distribution centers, the trucks -- we are taking that incredible infrastructure and now applying it to personal systems so we can deliver everything as a service. I expect graphics in the future will be delivered as a service as will 3-D printing. It is a natural course of action. You are always going to need a device – your personal device you are working with and a printing device to get the thoughts on your mind onto a printed page. Managing those devices is not strategic. What is strategic for you is how do you develop your cloud strategy from an IT perspective, how you are going to manage your data centers. What they want is for a company like HP together with our channel partners to take all that over for them. So delivering everything as a service in a partner-led model, which is our fastest-growing pipeline. Partner-led managed services is really where the industry is going.

How much of your time was freed up from focusing internally to externally with the HP Inc. split?

I have always been very externally focused. I don't believe you learn anything sitting behind a desk in Palo Alto. Being a CEO of a Fortune 100 corporation requires you to spend some time together with your board, and I love spending time with our board. We hand-picked this board that is focused entirely on this business. I get tremendous value out of that. I get new ideas. I think about the business differently. We have a lot more interaction with industry analysts, with financial analysts, which all gives me perspective as well. But I spend the vast majority of my time either with my business units designing and creating products and pipeline and portfolio or their customers and partners that give me the input in order to bring that into our business units so that we continue to up the game. Competition doesn't sleep.

What is your 'third wave' innovation vision for creating new markets like 3-D printing?

We are reinventing our business. Within our DNA we are an engineering-centric organization. But for many years I think we went a little dormant there. So what we did is we created this innovation framework where we refer to the three waves of innovation: talking about the here and now, capitalizing on the future, and creating new categories. And we are living that. It doesn't matter whether you speak to engineers in Shanghai or Dalian or whether you go to our R&D centers in Singapore or here in the United States, every one of our engineers has to think about Wave One, Wave Two, and Wave Three innovations. I don't want to get into exclusive details and give a heads up to our competition on exactly where we are going to play. Let's just say the money is apportioned between Wave One, Wave Two and Wave Three. So you can't just take all the R&D dollars and assign it all to Wave One. You have to have a case behind all three waves because that is how you keep innovation moving.