5 Bidders Besides Apple Who Have Their Eyes And Wallets On Toshiba's Chip Business

Chip Business Champions

Toshiba's computer chip business is up for sale – and a slew of vendors have their eyes on the group as a potential expansion of their portfolios.

The company in January said it would sell a majority stake in its memory chip business as it digs for funds to offset a multi-billion dollar writedown.

The sale comes in an industry continually rocked by acquisitions – in October, Qualcomm announced it would acquire NXP Semiconductor for $47 billion, while earlier in the year Avago Technologies acquired Broadcom Corp. for $37 billion.

Most recently, reports from NHK revealed that Apple is teaming up with its supplier, Foxconn, to bid "at least several billion dollars" for Toshiba's semiconductor business. Following are five other vendors who could be interested in the company's chip segment.

Foxconn

Taiwanese Apple partner Foxconn has signaled that it could bid up to $27 billion for Toshiba's chip business, according to reports.

This preliminary bid is higher than analysts' $18 billion valuation for the business, according to the Wall Street Journal. The electronics company doesn't own a major flash memory maker – so it could avoid the antitrust hurdles that other bidders may face.

If Foxconn is the successful bidder, the company's manufacturing customer, Apple, could potentially move forward in bringing NAND flash needs in-house.

Silver Lake

U.S. private equity firm Silver Lake Partners, in partnership with chipmaker Broadcom, is interested in Toshiba's chip unit, according to the Nikkei Asian Review.

The Menlo Park-based firm teamed up with Broadcom, which was acquired in 2015 by Avago for $37 million, to offer $17.9 billion for the chip business.

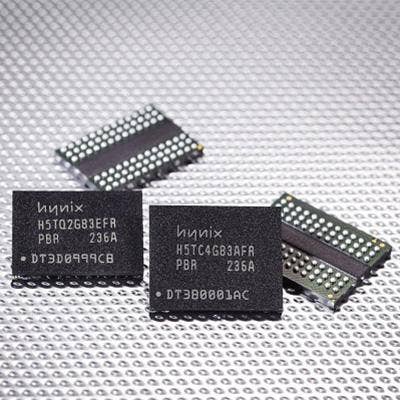

SK Hynix

According to the Maeiul Business Newspaper, a consortium led by South Korea-based SK Hynix has offered to pay for a majority stake in Toshiba's memory chip business.

According to reports, SK Hynix, which has a broad NAND flash memory chip portfolio, has partnered with various Japanese financial institutions to offer to pay more than $9 billion for the chip business.

In February, SK Hynix's CEO Park Sung-wook said the company would consider a fresh bid if Toshiba should make another offer.

Micron Technology

U.S. chip firm Micron Technology is another company reportedly vying for Toshiba's chip business.

Toshiba's chip business is appealing to Micron Technology because the company could gain share in the DRAM market by becoming the only DRAM supplier for Toshiba.

The company has gained share through previous acquisitions, including companies like Inotera and Elpida.

Western Digital

Western Digital, a smaller player in the memory chip market, is another potential bidder for Toshiba's chip business, according to a report by the Wall Street Journal. Western Digital has a memory partnership arrangement with Toshiba, further bolstering speculation that the company could be a likely buyer of the stake.

The company, which is a large provider of disk drives, could expand its chip-base flash storage portfolio with Toshiba's chip business. However, Western Digital faces challenges because it has anti-trust concerns as both a rival and a business partner of Toshiba.