10 Things You Need To Know About Fuji Xerox

A New Power Emerges

Late last month, Fujifilm Holdings Corporation and Xerox officially announced Fuji Xerox, a joint venture that creates an $18 billion print industry juggernaut.

The definitive agreement, which involves Xerox ceding a 50.1-percent ownership stake to Tokyo-based Fujifilm, could potentially alter the balance of power in a competitive and evolving market. At the least, the deal marks another significant step on the Norwalk, Conn.-based Xerox's strategic transformation.

As both companies begin to go through the regulatory approval process, CRN takes a look at the major implications of the transaction as well as a few key financial details made available in Xerox's supplemental filing with the U.S. Securities and Exchange Commission.

Fundamental Details

Fujifilm's majority-stake purchase of Xerox has a total value of $6.1 billion and leaves Xerox stock owners with 49.9 percent ownership of the company.

Those investors who held Xerox stock prior to the announcement will receive a special $2.5 billion cash dividend – roughly equivalent to $9.80 per share – to be issued prior to the transaction's closing date. The deal is expected to close in the second half of 2018 following regulatory and shareholder approval.

The newly-formed Fuji Xerox, a combination of Xerox and the preexisting Fuji Xerox joint venture, will be traded on the New York Stock Exchange under the ticker symbol "XRX."

Synergies And Savings

Xerox and Fujifilm anticipate an annual cost savings opportunity of at least $1.7 billion, achievable by 2022, and at least $1.2 billion of that is projected to be attained by 2020.

Of those savings, roughly $1.25 billion is attributable to synergies created by pairing Xerox with Fuji Xerox. Another $450 million will come from a cost reduction program that will reportedly result in the elimination of 10,000 jobs at the legacy Fuji Xerox.

Xerox reported net income of $192 million on sales of $10.3 billion in fiscal year 2017..

Cost Synergy Sources

Xerox expects to draw its savings from three areas: cost of goods sold ($650 million), SG&A ($400 million) and research & development ($200 million).

For cost of goods sold, the two sides are planning to consolidate certain manufacturing facilities tasked with "consumables" and A3 mono device production. Xerox plans to adopt best practices from Fuji Xerox's high-efficiency plants, while Fuji Xerox will incorporate Xerox's logistics and technical services tactics into its own operations.

Consolidation of corporate support operations, including HR, internal IT, legal and finance departments, and a consolidated facilities footprint are among the contributing factors driving expected SG&A savings. And combining the R&D efforts of the two companies, Xerox said, will avoid duplicate research efforts.

New Market Opportunities

By tightening its relationship with Fujifilm, Xerox can now tap into a $36 billion Asia-Pacific print market, which is experiencing 6 percent compound annual growth in China and 4 percent in other APAC (Asia Pacific) countries, excluding Japan, according to IDC and Fuji Xerox. The North American and European markets, by contrast, are shrinking by 2 and 3 percent, respectively.

Both sides are looking to take advantage of improved win rates on global accounts, the elimination of "margin stacking" under an existing Fuji- Xerox OEM agreement and the continued pursuit of the SMB space via channel partners. Xerox CEO Jeff Jacobson said previously that he expects Xerox's multi-brand reseller expansion strategy to continue as part of Fuji Xerox, which itself hasn't traditionally focused on the multi-brand dealer space.

Jacobson said penetrating the untapped $100 billion production and industrial print sector would be another potential growth avenue for Xerox.

Leadership

Following deal closure, Jacobson (pictured) will continue to lead Xerox as CEO of the new Fuji Xerox.

Fujifilm Chairman and CEO Shigetaka Komori will serve as chairman of the board. The new board of directors will feature seven Fujifilm appointees and five Xerox-appointed independent directors, reflecting the new ownership structure.

Fuji Xerox will operate out of dual headquarters in Norwalk, Conn., and Tokyo, Japan.

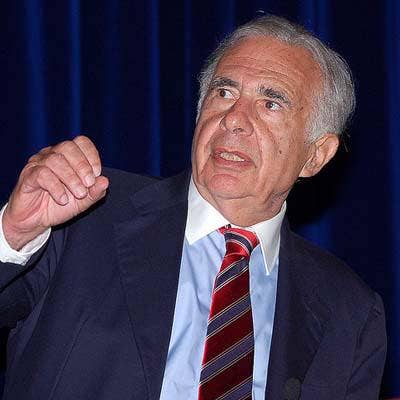

Carl Icahn's Response

Ichan and Darwin Deason, who together own 15 percent of Xerox, argued in a letter written to fellow investors on Monday that a Fujifilm takeover would be "the company's final death knell" if ultimately approved. The pair also criticized Xerox's channel model for creating "conflict with competing sellers, thereby diluting their differentiation, incurring duplicative operating expenses and sacrificing margin."

Icahn has previously advocated that Jacobson should step down, and Deason has echoed many of Icahn's frustrations. On Tuesday, Deason filed a suit to block the Xerox-Fujifilm transaction from being finalized, claiming fraud and breach of fiduciary duties led to the agreement

A Long History

Fujifilm and Xerox have been working together since 1962, when the original Fuji Xerox joint venture was first launched. Fujifilm had owned 75 percent of the business, while Xerox had the remaining 25 percent.

For decades, the entity has developed, manufactured and distributes document processing products in the APAC region. More than half of its $9.5 billion revenue derives from office product and print devices, while another 25 percent comes from solutions and services sales.

Fuji Xerox currently employs around 46,000 workers, meaning the upcoming cost restructuring cuts would eliminate more than 20 percent of its existing staff. It's just the latest upheaval at the business, which restructured its Australian and New Zealand subsidiaries last year in the wake of an accounting scandal that produced overstated revenue of $450 million over five years.

Key Fuji Xerox Financials

While Xerox has suffered from a shrinking top line, Fuji Xerox saw revenue growth every year from 2010 to 2015. Sales declined seven percent year-over-year in 2017, but the business is performing well in the APAC region..

According to IDC and Fuji Xerox data, the joint venture is APAC market-leader in A3 multi-function printers, color production devices and the number one provider of managed print services in Japan. The company's MPS business in Japan grew 15.3 percent between 2012 and 2016, while its color production sales increased 6.8 percent during that same period.

Xerox, for its part, is experiencing the most growth around workflow automation (10 percent), SMB-focused managed print services (6 percent) and color production (4 percent).

An Enhanced Agreement

Xerox said that by doubling down on the joint venture with Fujifilm the combined Fuji Xerox will create new paths to growth and improve upon what it characterizes as a limited existing joint venture agreement.

Under the old terms, Xerox was prohibited from selling print and copier devices in Asia, because Fuji Xerox maintained those rights. If a named competitor ever acquired more than 30 percent of Xerox, Fujifilm had the option to terminate the agreement entirely.

The new structure allows Fujifilm to acquire no more than two-thirds of Xerox unless it chooses to conduct a complete buyout of the company.

Partner Reaction

Partners say they see the Fuji Xerox combination as a game changer that will benefit channel partners.They were upbeat about about early rumors of the Fujifilm-Xerox deal and, later, the official announcement.

Josh Justice, president of La Plata, Md.-based Just·Tech, said he was excited by the prospect of working with Fuji Xerox in Asia. "[We're] now partnered with an $18 billion company that has committed to future growth investments and the elimination of costs, which will make Xerox products even more competitive in this marketplace," Justice said.

Troy Tafoya, president of Fort Collins, Colo.-based Professional Document Solutions, said the combination of Xerox's ConnectKey software with Fuji's strong A3 and A4 product lines is appealing, adding that it could help Xerox from a competitive perspective.

Likewise, they have viewed Xerox's overall direction under Jacobson in a positive light. Icahn's criticisms of his leadership and strategic initiatives are "short-sighted," said Patrick Leone, founder and CEO of Bloomington, Ind.-based MidAmerica Technology.