8 Things To Know About The $6.9B Nvidia-Mellanox Acquisition

What We Know About Mellanox, Its Market, The Deal And More

Nvidia put an end to the question of Mellanox's fate when the chipmaker announced that it would acquire the company for $6.9 billion.

Mellanox, an Israeli provider of networking components for data centers, had reportedly been on the market for several months following a fight with an activist investor, and multiple buyers had lined up before Nvidia sealed the offer Monday.

Once the deal closes, which is expected by the end of the year, Nvidia is set to become a larger player in the data center market than ever before.

Mellanox had 2,330 full-time employees and 116 part-time employees as of the end of last year, according to a filing with the U.S. Securities and Exchange Commission.

What follows are eight important things to know about the $6.8 billion Nvidia-Mellanox acquisition, including the market for Mellanox's products, what they're used for and the history of Mellanox's journey from activist investor spat to acquisition by Nvidia.

Mellanox Provides Critical Components For HPC

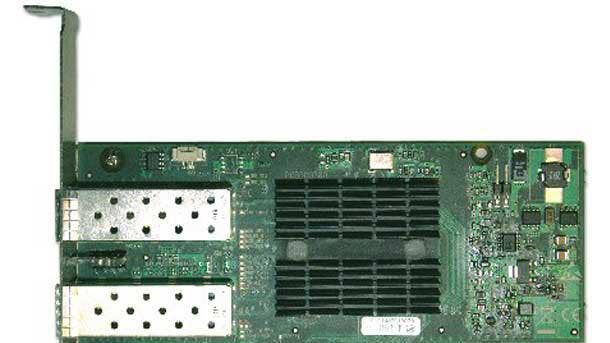

Mellanox provides a slew of data center products from Ethernet switches, chips and InfiniBand intelligent interconnect solutions to servers, storage and hyper-converged infrastructure. These products are used in more than half of the world's fastest supercomputers and in many leading hyperscale data centers, according to Nvidia.

At the center of Mellanox's offering, however, is the InfiniBand interconnect, which is becoming critical for high-performance computing workloads that interact with each other, according to Dominic Daninger, vice president of engineering at Nor-Tech, a Burnsville, Minn.-based system builder.

Daninger said the InfiniBand interconnect is a low-latency fabric that decreases the amount of time it takes for compute nodes to communicate each other. An HPC application that requires such low-latency is computational fluid dynamics, where multiple nodes each compute a different section of a mesh in a simulation, meaning that changes in one node will affect other nodes. Without a low-latency interconnect like InfiniBand, it would take longer for those nodes to communicate changes.

Daninger said many of his HPC customers use Mellanox's InfiniBand interconnect.

"The bandwidth on those things is unbelievable," he said.

Mellanox's Products Target An $11 Billion Market

Nvidia said in the future, data centers "will be architected as giant compute engines with tens of thousands of compute nodes, designed holistically with their interconnects for optimal performance." With Nvidia's GPUs and Mellanox's interconnects combined, data center workloads will be optimized "across the entire computing, networking and storage stack to achieve higher performance, greater utilization and lower operating cost for customers," according to Nvidia.

The total addressable market for Mellanox's products is $11 billion, Nvidia said, adding to the $50 billion market for computing that the chipmaker is already pursuing.

In a January presentation, Mellanox said five of the top six global banks, nine of the top 10 oil and gas companies, three of the top five pharmaceutical companies and the top 10 auto manufacturers use Mellanox solutions. The company said its products help reduce latency and database recovery time while also improving performance and throughput in data center workloads.

Intel Competes With Mellanox In The Interconnect Space

Intel is both a customer and competitor of Mellanox, offering its own line of interconnect products based on its Intel Omni-Path Architecture. The company's portfolio of interconnect products include host fabric interfaces, switches, director class switches and cables.

Dominic Daninger, vice president of engineering at Nor-Tech, said Nvidia's plan to acquire Mellanox signals a potential misstep for Intel, which had reportedly offered up to $6 billion to buy the company.

"I think that was a mistake on Intel's part because Mellanox is so dominant in this low-latency fabric area," Daninger said.

Intel declined to comment on the deal.

On the same morning the Nvidia-Mellanox deal was announced, Intel said it was developing a new open interconnect technology called Compute Express Link that aims to improve performance and reduce bottlenecks in computation-intensive workloads for CPUs and purpose-built accelerators.

The new technology — which has the backing of Cisco, Hewlett Packard Enterprise, Dell EMC and other data center giants — creates a "high-speed, low-latency interconnect between the CPU and workload accelerators, such as GPUs, FPGAs and networking," according to Intel.

Mellanox Put Itself On Market Following Spat With Activist Investor

Mellanox reportedly put itself up for sale last fall after the company reached a settlement with activist investment firm Starboard Value that resulted in the appointment of three new board members.

The settlement, which was announced last June, came after Starboard threatened to oust all sitting directors. The activist investor had acquired a more than 10 percent stake in Mellanox in November 2017 and urged the company to explore a sale and improve its margins. Starboard said at the time that Mellanox had rebuffed a deal to be acquired by chipmaker Marvell Technology Group.

After the company put itself on the market, multiple firms lined up as potential bidders. Data center chip specialist Xilinx first emerged last November with a reported $5.5 billion bid. Microsoft was then reported to have hired Goldman Sachs to negotiate an offer last December. Then in January, it was reported that Intel was offering up to $6 billion to buy Mellanox.

Mellanox Will Be Nvidia's Largest Acquisition Yet

With a deal worth $6.9 billion, Mellanox will be Nvidia's largest acquisition yet. Up until this point, the company's spending for acquisitions never exceeded $400 million in any prior year, according to FactSet data cited by MarketWatch.

According to Crunchbase, Nvidia previously made 13 acquisitions between 2000 and 2015. Its largest acquisition before Mellanox was Icera, a British maker of soft modem technology for mobile broadband phones and data devices that Nvidia paid $367 million to acquire in 2011. Four years later, Nvidia announced that it was shutting down Icera's operations.

Nvidia's most recent acquisition was TransGaming, a provider of cross-platform portability technology that was acquired for $3.75 million. Other acquisitions include 3dfx Interactive, MediaQ, PortalPlayer, AGEIA Technologies, RayScale and PGI.

The Data Center Is Nvidia's Fastest-Growing Business

Nvidia's data center division is the company's fastest-growing and second largest business. The company recently closed its 2019 fiscal year with $2.9 billion in data center sales, representing roughly 25 percent of the company's total revenue for that year. That was a 52 percent increase in sales from 2018.

In comparison, Nvidia's professional visualization business grew 21 percent annually to $1.1 billion in 2019 while automotive solution sales increased 15 percent to $641 million. Gaming, the company's largest business, grew 13 percent to $6.2 billion.

Nvidia uses GPUs as hardware accelerators for data center workloads, including deep learning and high-performance computing workloads. The company's data center products include the Nvidia Tesla GPU, Nvidia DGX AI server system and Nvidia HGX-2 server platform.

Nvidia And Mellanox Have A 'History Of Collaboration'

When it announced the Mellanox deal, Nvidia said the two companies have had a "longstanding history of collaboration" and cited Nvidia's DGX-2 AI server system as an example.

The DGX-2, which has been called the "worlds first two-petaflop deep learning system," combines 16 Nvidia GPUs and eight Mellanox ConnectX adapters that support both InfiniBand and 100 gigabit Ethernet connectivity, which enable 1600 gigabits per second of bi-directional data throughput.

Dominic Daninger, vice president of engineering at Nor-Tech, said he expects future Nvidia products will find more ways to benefit from Mellanox's products.

Nvidia And Mellanox Power Half The World's Supercomputers

In a presentation made Monday morning, Nvidia boasted that 127 of the world's top 500 super computers use Nvidia GPUs while 265 rely on Mellanox's interconnect products. Combined, that makes for more than half of the world's supercomputers on the TOP500 supercomputer list.

Nvidia's GPU accelerators are used in the world's two fastest supercomputers, the U.S. Department of Energy's Summit at Oak Ridge National Laboratory and Sierra at Lawrence Livermore National Lab, which combined feature more than 40,000 Nvidia V100 Tensor Core GPUs.

Dominic Daninger, vice president of engineering at Nor-Tech, told CRN last fall that he has seen an uptick in interest for Nvidia's GPU accelerators with his HPC computing customers because of the abundant number of computing cores they contain. He said Ansys, a provider of engineering simulation software, allows customers to offload computing to GPUs in exchange for a "very modest licensing fee."