Intel’s $9B NAND SSD, Memory Sale To SK Hynix: 6 Big Things To Know

CRN dives deep into the details of Intel’s NAND SSD divestiture, how it will help SK Hynix, which Intel products it will impact and what it means for Intel’s Optane business.

A Major Game-Changer In The SSD Market

Intel is getting out of the NAND SSD market with a $9 billion deal to sell its NAND memory and storage business to South Korean chipmaker SK Hynix.

The two companies announced the transaction Monday night stateside, which was at the beginning of the Tuesday workday in Korea, and it answered a question that had been lingering about Intel’s ability to make NAND products a long-term profitable business that provided strong returns.

[Related: Intel Unveils Next-Gen SmartNICs As Nvidia Plots DPU Takeover]

The deal, which was announced several hours after two news reports said it was imminent, is the second major merger and acquisition deal in the semiconductor industry to be announced in the last two months that is of major consequence to the IT landscape. But besides the Nvidia-Arm acquisition, another large deal could be coming with AMD’s potential acquisition of Xilinx.

What follows are six big things you should know about the planned sale of Intel’s NAND memory and storage business to SK Hynix, including how the deal will happen, what will happen to Intel’s Optane products and how the deal will impact SK Hynix’s standing in the SSD market.

The Details Of The Deal

Under the deal, Intel will sell SK Hynix its NAND SSD business, NAND component and wafer business and NAND memory manufacturing plant in Dalian, China, but the transfer of assets and employees won’t happen all at once.

Instead, the first transfer and closing is expected to happen in late 2021, though it can’t happen prior to Nov. 1, 2021, according to the master purchase agreement that Intel filed with the U.S. Securities Exchange Commission on Tuesday.

The first transfer to SK Hynix will include Intel’s NAND SSD business, along with associated technology IP and employees in addition to the Dalian plant, for which Intel will receive $7 billion. But this can only happen if both companies secure approvals from regulators, among other customary conditions.

The second transfer and closing is expected to happen in March 2025, which is when Intel is expected to receive $2 billion from SK Hynix in exchange for the remaining assets, which will include technology IP related to the manufacture and design of NAND flash wafers as well R&D employees and the Dalian factory workforce. Until then, Intel will continue to manufacture NAND wafers at the Dalian plant.

Among the bodies Intel and SK Hynix will require approval from are the Committee on Foreign Investment in the U.S., the Federal Trade Commission and the U.S. Department of Justice as well as regulators in the People’s Republic of China and certain other foreign jurisdictions.

If the deal falls apart, Intel or SK Hynix may be required to pay a multi-million-dollar termination fee depending on the circumstances. For SK Hynix, if the deal terminates due to specific circumstances related to government approvals or SK Hynix fails to close, it will have to pay Intel a $350 million termination fee if it happens before the first closing or $100 million after the first closing. For Intel, if the deal is terminated due to legal challenges or Intel fails to close on the deal, Intel will have to pay SK Hynix a $140 million termination fee before the first closing or $40 million after the first closing.

What Intel, SK Hynix Hope To Get Out Of The Deal

SK Hynix said the acquisition of Intel’s NAND business will make it more competitive in the storage market, particularly in the realm of enterprise SSDs.

The company highlighted Intel’s “industry-leading” NAND SSD technology and quadruple level cell NAND flash products and how Intel’s NAND businesses generated $2.8 billion in revenue and contributed roughly $600 million in operating income for the first six months of 2020.

“I am pleased to see SK Hynix and Intel’s NAND division, which have led the NAND flash technology innovation, work to build the new future together,” said Seok-Hee Lee, CEO of SK Hynix, in a statement. “By taking each other’s strengths and technologies, SK Hynix will proactively respond to various needs from customers and optimize our business structure, expanding our innovative portfolio in the NAND flash market segment, which will be comparable with what we achieved in DRAM.”

Intel plans to use the proceeds to the $9 billion NAND deal to invest in products and long-term growth priorities, including AI, 5G networking and the “intelligent, autonomous edge,” according to the joint announcement from the two companies.

“I am proud of the NAND memory business we have built and believe this combination with SK Hynix will grow the memory ecosystem for the benefit of customers, partners and employees,” Intel CEO Bob Swan said in a statement. “For Intel, this transaction will allow us to further prioritize our investments in differentiated technology where we can play a bigger role in the success of our customers and deliver attractive returns to our stockholders.”

Which Intel Products Are Impacted And What Happens To Intel Optane

While the deal clearly signals that Intel is getting out of the NAND SSD business, the joint announcement noted that the semiconductor giant will retain its Optane products and technology.

In a Tuesday filing with the U.S. Securities and Exchange Commission, Intel said it will begin presenting non-GAAP financial information that excludes the results of its NAND businesses in the first quarter of 2021. At the same time, it will roll the results of its Optane products into the Data Center group.

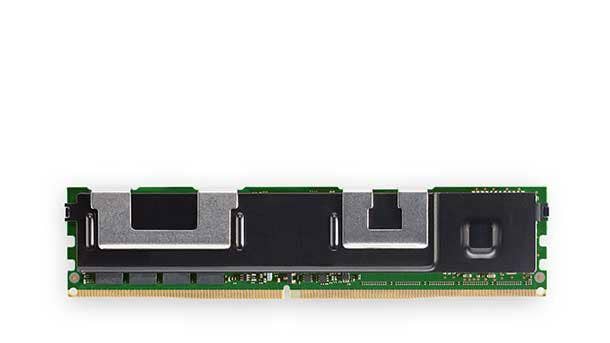

The distinction between Intel’s NAND SSD products and its Optane products is important because the former group of products is made with NAND technology that Intel is selling to SK Hynix and the latter group is made with 3D XPoint technology that Intel is keeping.

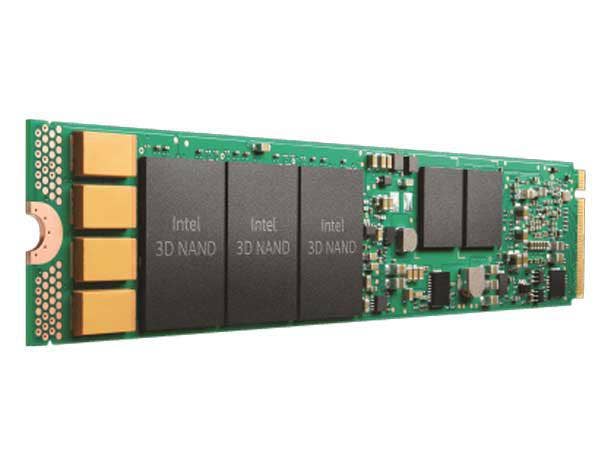

Intel’s latest NAND SSD products include the Intel SSD D7-P5500 and Intel SSD D7-P5600 Series for data centers. Unveiled alongside Intel’s new Cooper Lake server processors, the new PCIe 4.0 SSDs are built with Intel’s 96-layer triple-layer cell (TLC) 3D NAND technology, which the company said would optimize performance and capacity for all-TLC arrays.

At Intel Architecture Day, the company revealed that it was on track to begin production on 144-layer quad-layer cell (QLC) 3D NAND technology by the end of the year, which Intel executive Raja Koduri said was ahead of the industry target of 128 layers and would have big implications for the storage market.

“Our four-bit-per-cell QLC technology helps us change the economics of storage and will help us fill the cost-performance gap within storage, allowing for SSDs to continue to displace HDD for high capacity needs,” he said in the presentation. “Our 3D NAND journey has been remarkable. This technology has an incredible future as a storage technology.”

Intel’s current stable of NAND SSD products includes Intel SSD 7 Series on the client side and the Intel SSD D7 Series for the data center.

With Intel planning to retain the Intel Optane business, that means the company keep and continue to sell its Intel Optane Persistent Memory modules for the data center and the Intel Optane Memory M10 Series for client computers. This also means Intel will likely also keep its Optane SSD products for the data center and client markets since they are also based on 3D XPoint and not NAND.

One question is what this means for the future of products that combine Intel Optane and Intel NAND storage technologies, like the Intel Optane Memory H10 with Solid State Drive, as Intel has yet to respond to a request for comment on how the NAND deal will impact certain products.

Intel Had Been Trying To Figure Out Its Long-Term NAND Plans

Intel had been exploring whether to get out of the NAND memory and storage business for some time, according to The Wall Street Journal. And the company has publicly admitted that the return on investment for NAND memory hasn’t been meeting expectations.

At a Morgan Stanley Analyst Conference in March, Intel CFO George Davis called NAND memory one of the company’s “big bets” that will give the chipmaker not just “differentiated technology” but a “a product that will play a bigger part in our customer success.

But, Davis said, while NAND memory has been able to return to profitability after a difficult 2019, it hasn’t been at the level the company would like to see.

“NAND in the data center is just becoming a more and more important element, but we haven‘t been able to generate the profits out of that to get the returns we would like to see,” he said.

One of the ways Intel could have improved profitability, he said, was through partnerships, which would likely mean the company would outsource at least some NAND manufacturing to external foundries. It’s something that company had previously said it was exploring, with Intel CEO Bob Swan saying in April 2019 that it was making evaluations to bring down costs.

In the second quarter, Intel reported that its Non-Volatile Solutions Group, which consists of NAND-based SSD products and 3D XPoint-based Intel Optane memory modules, grew 76 percent to $1.7 billion, an all-time high for the business unit. And while the business wasn’t profitable last year — with an operating loss of $600 million in the 2019 fiscal year — Intel has since turned things around this year, reporting a $300 million operating profit in the second quarter.

What’s Been Driving Sales

In May, Laura Crone, vice president of sales for Intel’s Non-Volatile Memory Solutions Group, told CRN that channel partners have played a key role in driving growth for the company’s memory and storage products, both in the data center and for PCs.

On the data center side, virtualized desktop infrastructure and virtualized storage solutions have driven demand for Intel’s storage and memory products.

“We‘re spending more time helping people understand how Optane can help their data center infrastructure or on the client side where Optane can help accelerate and improve their infrastructure,” she said. ”So from a partner perspective, I think that the opportunity is all around this exploding data, and the need for memory and storage is greater than it’s ever been.”

In January, Intel data center executive Lisa Spelman told CRN that the company has done more than 200 proofs of concept for Intel Optane Persistent Memory for data center workloads ranging from in-memory databases to virtualization, and many of those end up turning into commercial deployments.

“One of the things that we‘re just getting into now is the conversion rate, so we’re getting high 80 [percent to] 90-plus percent conversion of proof of concept into deployment, which is insane,” she said in an interview.

Intel’s Standing In The SSD Market And What The Deal Means For SK Hynix

The share of revenue for Intel and SK Hynix in the NAND flash market in the second quarter of this year was 11.5 percent and 11.7 percent, respectively, putting them behind larger players like Micron, Western Digital, Kioxia and memory juggernaut Samsung, according to research firm TrendForce.

However, with Intel’s plan to sell its NAND memory and storage business to SK Hynix, the research firm projects that the South Korean chipmaker’s NAND flash market share will grow to more than 20 percent, putting it in second place ahead of Kioxia and right behind Samsung.

TrendForce, in a research note issued Tuesday, said Intel “has been performing superbly in the enterprise SSD market,” putting it on par with Samsung, which means good news for SK Hynix.

“The acquisition of Intel’s 3D NAND Flash capacity will massively elevate SK Hynix’s competitiveness in the enterprise SSD market,” the firm said. “Going forward, it remains to be seen how the two companies will optimize their product portfolios following the acquisition in order to maximize profits.”