The $35B AMD-Xilinx Acquisition: 7 Big Things To Know

AMD gets a mega chip deal of its own, which could mean greater competition with Intel on 5G network infrastructure and with Nvidia on SmartNICs. CRN dives into the details of the Xilinx deal and what it could mean for the data center and telecom markets, among other things.

‘It’s Not M&A For M&A’s Sake’

In a little over a month after Nvidia announced a $40 billion deal to acquire Arm, its GPU rival, AMD, announced its own mega chip deal with its plan to acquire FPGA maker Xilinx for $35 billion.

AMD, based in Santa Clara, Calif., announced the deal Tuesday morning at the same time the chipmaker released its third-quarter earnings results, where the company reported a $2.8 billion in quarterly revenue that quarter, marking a 56 percent year-over-year increase.

[Related: Intel Enterprise Server Sales Nosedive As Ice Lake Slips, 10nm Ramps]

In AMD’s earnings call, AMD CEO Lisa Su (pictured) was joined by Xilinx CEO Victor Peng to discuss the deal and how it will make the combined entity “the industry’s high-performance computing leader.”

“We’re not doing M&A for M&A’s sake,” Su said on the call. “I mean, this is such a unique opportunity. There actually is no better match in the industry for us than Xilinx.”

What follows are highlights from the earnings call as well as several other important things you should know about the $35 billion AMD-Xilinx deal as well as what’s been happening at both companies.

Details Of The Deal

AMD plans to acquire Xilinx in a $35 billion all-stock deal. That represents approximately $143 per share of Xilinx common stock, which is a premium of nearly 25 percent over the company’s current value.

The deal has been approved by the boards of directors of both AMD and Xilinx, and it’s expected to close in late 2021 if it gets approved by regulators and meets other closing conditions. AMD said the deal will qualify as a tax-free reorganization with respect to U.S. federal income taxes.

The deal means AMD shareholders will own approximately 74 percent of the combined company while Xilinx shareholders will own roughly 26 percent.

Once the transaction closes, AMD CEO Lisa Su will serve as CEO of the combined company while Xilinx President and CEO Victor Peng will be responsible for the Xilinx business and strategic growth initiatives. AMD will also add two Xilinx directors to its board of directors.

Within 18 months of the transaction closing, AMD said, it will make $300 million in spending cuts on an annualized basis, which will largely consist of “synergies in costs of goods sold, shared infrastructure and through streamlining common areas.”

In the earnings call, Su said the company plans to continue growing its investments in research and development, but it will cut costs in some overlapping areas, such as some technology IP that both companies use to develop chips. She added that those cost-savings measures will allow the company to invest more in AI and software.

“We‘re not you know counting on any major changes at all to either business from the running of the business,” she said. “I think the emphasis here is that both companies are executing extremely well, and we’re going to continue to keep it that way.”

How Xilinx Will Complement And Expand AMD’s Product Portfolio

AMD is primarily in the business of selling CPUs and GPUs for client computers, servers and embedded systems while also making custom system-on-chip solutions for devices like Sony’s PlayStation 5.

With the Xilinx acquisition, AMD will expand its product portfolio to include reprogrammable chips called field-programmable gate arrays, or FPGAs. These chips made by Xilinx serve as the basis for a variety of products that target several markets, including ones in which AMD has a small footprint in, like telecom, edge, industrial and networking.

Xilinx has been pursuing the data center market more aggressively in the past couple years through a new “data center first” initiative. The main products its pushing in this area is a lineup of Alveo accelerator cards, which launched in 2018 to provide “adaptable” high performance for applications ranging from storage and data analytics to machine learning and streaming video.

Xilinx is also in the SmartNIC market, thanks to its 2019 acquisition of network interface card Solarflare Communications. The company’s current SmartNIC offering is part of its Alveo card lineup, the Alveo U25, which the company says provides “ultra-high throughput, small packet performance and low-latency,” with the ability to improve cloud-based applications by up to 400 percent.

With this expansion in the portfolio, AMD will have new ways to compete against Intel, which has its own portfolio of FPGAs, FPGA-based accelerator cards and FPGA-based SmartNICs, thanks to the semiconductor giant’s 2015 acquisition of Altera. AMD will also increase its competition against Nvidia, which recently announced plans to sell SmartNIC products it refers to as data processing units, or DPUs.

“AMD will offer the strongest portfolio of high performance and adaptive computing products in the industry, spanning leadership CPUs, GPUs, FPGAs, and Adaptive SOCs,” AMD CEO Lisa Su said on the earnings call. “This will enable us to take a leadership position accelerating a diverse set of emerging workloads, from AI to smart networking and software-defined infrastructure.”

Su said Xilinx’s underlying technology will also be a boon for AMD.

“Beyond their core innovation in FPGAs and associated software design environments, they have industry-leading capabilities in SOC design, SerDes and high-speed I/O, mixed signal RF, advanced 2.5 and 3D silicon integration and packaging as well as targeted software stacks for key verticals,” she said.

Why AMD Thinks The Xilinx Deal Is Different From Intel-Altera

One major question AMD will face with the Xilinx acquisition is how it will differ from Intel’s 2015 acquisition of Xilinx’s former FPGA rival, Altera.

An analyst asked AMD CEO Lisa Su this question on Tuesday’s earnings call and opined that Intel’s Altera deal was “not terribly successful.”

Su said the Xilinx deal is a “very different situation” from Intel’s Altera deal, in part because Xilinx is the market leader for FPGAs but also because both AMD and Xilinx are both “executing really well.”

“They are very complementary from a product and market standpoint, but we have sort of important intersections around the data center focus, and then also around the technology strategy,” she said.

Su also noted how both companies have been investing into 2.5D and 3D silicon integration as well as software, open-source or otherwise. In addition, both companies use TSMC to manufacture chips.

“There are a lot of synergies that are under the covers that that we see, and we see very strongly, and I think you‘ll see as the roadmaps execute,” she said.

The CEO said AMD and Xilinx are also aligned when it comes to company culture.

“[Xilinx CEO] Victor [Peng] and I are both engineers at heart,” Su said. “We love the technology. We have a common vision. I‘m really, really happy that he’s joining me on this journey. I think we have a bold vision of what we think we can do for the industry and for our joint companies.”

The Deal Means Intel Will Face Fiercer Competition In 5G

While Intel has given up on its ambition to sell 5G modems for smartphones, the semiconductor giant is going all in on 5G network infrastructure, and it will likely face greater competition from AMD in this area if the acquisition of Xilinx goes through.

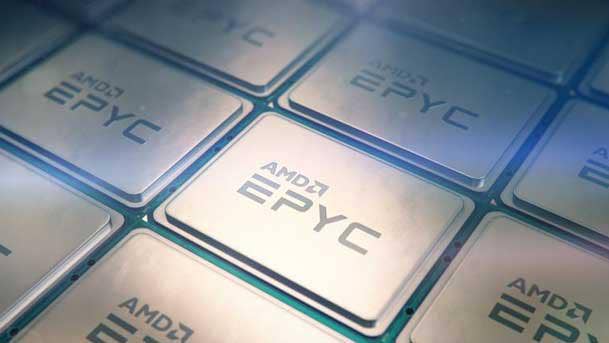

AMD has already made some progress in the 5G network space. Last fall, the company touted the high performance its second-generation EPYC processors can provide 5G networks and said that Nokia had tested the processors for delivering broadband, IoT and machine-type communications services over 5G.

But with the Xilinx acquisition, AMD will gain a greater assortment of technologies to compete for 5G network infrastructure deals, and the company believes that will help it sell more EPYC processors into the telecom industry overall.

“In telecom for instance, where Xilinx has solutions capabilities and relationships with industry leaders including Samsung and Ericsson, we will now have an accelerated path to market to better address the largely untapped $5 billion market opportunity for our EPYC processors,” AMD CEO Lisa Su said on the company’s third-quarter earnings call Tuesday.

In Xilinx’s most recent earnings call, Xilinx CEO Victor Peng said the company’s RF system-on-chip products stand to benefit from expanding 5G footprints across multiple geographies. The company’s most recent product in that area is the Zynq RFSoC DFE, which was announced Tuesday and is designed to provide high performance, low-power solutions for massive 5G radio deployments.

Peng also cited “great progress in the OpenRAN space,” where the company is working with “key stakeholders to drive O-RAN initiatives to ensure 5G and future networks be openly developed.”

One of Xilinx’s latest products targeting O-RAN initiatives is the T1 Telco Accelerator Card, which was announced in September and is designed for O-RAN distributed units and virtual baseband units in 5G networks. On the recent earnings call, Peng said customer interest has been “solid” for the product, which has received positive feedback from Nokia and 5G network software provider Mavenir.

The Acquisition Means A Reunion For Xilinx’s CEO

With Xilinx CEO Victor Peng (pictured) expected to join AMD as the head of the company’s Xilinx business and strategic growth initiatives, it will mark a reunion of sorts for the semiconductor veteran.

That’s because Peng previously worked at AMD back in the aughts. Peng had joined AMD by way of the company’s 2006 acquisition of ATI, which hired him the year before. During his three-year tenure at AMD, Peng had served as corporate vice president of silicon engineering for the graphics product group and led the silicon engineering team’s efforts for things like graphics and game console products.

“This is my second time joining AMD, and to do that with the Xilinx team just couldn’t be more thrilling for me,” he said on AMD’s earnings call Tuesday morning.

The acquisition also means that AMD executive Dan McNamara will work with a company he previously competed with for roughly 15 years. Prior to becoming senior vice president and general manager of AMD’s server business unit, McNamara was the head of the company’s Programmable Solutions Group, which he joined through Intel’s 2015 acquisition of Altera, Xilinx’s top competitor. McNamara had worked at Altera in the 11 years leading up to its sale to Intel.

Xilinx’s Relationship With AMD To Date

Prior to the acquisition announcement, Xilinx had been a strategic technology partner for AMD’s data center efforts, namely the chipmaker’s EPYC server processors, in recent years.

For the launch of AMD’s first- and second-generation EPYC processors, the chipmaker named Xilinx as a key server hardware ecosystem partner whose products are featured in EPYC-based servers.

“The launch of the AMD EPYC processor signifies an important milestone in the industry,” said Victor Peng, who was Xilinx’s COO and is now CEO, in a statement for the 2017 first-generation EPYC launch. “Together with Xilinx’s All Programmable devices, the EPYC platform provides outstanding performance when accelerating data center applications. We are also delighted to be working with AMD in furthering open data center standards, such as the CCIX interconnect, to provide the necessary heterogeneous computing solutions for next generation workloads.”

When AMD released second-generation EPYC processors, the company was first to market with CPUs that support PCIe 4.0 connectivity, which allows Xilinx’s PCIe 4.0-compatible Alveo accelerator cards to take advantage of the technology’s higher throughput.

In a white paper published by AMD in March 2019, the company detailed a Xilinx Deep Learning solution that had been optimized on and EPYC-based server. The chipmaker pitched Xilinx’s FPGA products as capable of delivering tenfold acceleration of a “broad set of applications,” with the ability to reconfigure the FPGAs, making them “an ideal fit for the changing workloads for the modern data center.”

Xilinx Has Started Making Forays Into The IT Channel

Xilinx has recently started to work more closely with IT solution provider companies that have traditionally worked with Intel and AMD on server deployments.

Earlier this year, Sam Bellamy, partner business director at Xilinx, told CRN that the company has been “building out the base foundation layers of our distribution and channel strategy at Xilinx [and] the data center group for the last two years.”

With the company’s Alveo accelerator cards, Xilinx has started to operate at a “much higher level of integration” — L6 barebone servers and beyond — than it previously has, according to Bellamy. Prior to its Alveo cards, Xilinx had been more focused on levels L1 through L6 of integration, providing the base FPGA technology that board manufacturers would then integrate into their products.

“Xilinx has a long and proud history of working in its simplest form, indirectly,” he said. “We rely upon distribution and these partnerships for our silicon product. And so it‘s obviously been keen for us to replicate that in our new Alveo board world, to create and build the same channel partnerships.”

As of June, Bellamy said Xilinx had around 17 value-added reseller partners around the world, which included high-performance computing integrator Microway and Colfax International as well as IT services provider Groupware and HPC distributor Exxact. The company also has a new distribution partnership with IT shop Ingram Micro.

Xilinx’s partner resources include in-depth training, the availability of demonstration units, lead generation, reference architectures as well as branding, marketing and support tools.

“We felt that we can give that technology channel a real leg up with some of our expertise,” Bellamy said. “[We’ll] still have them implicitly building and servicing those end customer needs, but really shorten the time to market and the time to revenue for all of us involved, if we can establish a strong, strong set of reference products and appliances.”

Advertisement