Exclusive Interview: Michael Dell On HP Chaos, Lenovo Shortcomings And Icahn's Lies

Michael Dell On The Record

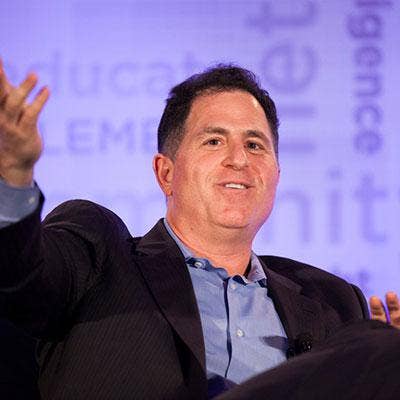

When Michael Dell took to the stage Monday at the 2014 Best of Breed conference in Orlando, Fla., there was no shortage of things to talk about.

The Dell founder and CEO was pressed by Robert Faletra, CEO of The Channel Company, on some of the industry's toughest questions surrounding cloud, the future of the channel and an IT landscape that's morphing at the speed of light. Dell also shared his thoughts -- candidly -- on Hewlett-Packard's recent split, why Carl Icahn is a "bad guy," and his company's newfound channel DNA. Here's a look at the conversation.

What do you think of Hewlett-Packard's split? Is this a big opportunity for you? Why did they do it and does it make sense?

I don't know why they did it. You'll have to ask them. I know that you don't score points when you are on defense, and we are on offense. They are going to go through a period of being distracted. There is chaos in trying to separate two large entities like that … That's [a large] company that operates in a 180 countries and [and in each country they are going to have turn one building into two and separate people into two companies.] So you multiply that by 180 countries [with] all the partners and all the customers -- it's a level of chaos and confusion that one really has to question.

How do you assess Dell's position in the market?

From our standpoint, the leverage and connection between the client business, particularly commercial client and the server, is quite strong and always have … If you look at the IDC data that came out last month, Dell's client PC market share grew 19.7 percent in the U.S. That's significantly faster than all the other big guys. We grew share three times as much share as HP, five times as much share as Apple, and ten times as much share as Lenovo. We are on the attack. We are on the offensive, and we are going to be scoring points, and channel has an even bigger role than it did last year and the year before that.

After HP breaks apart you'll actually be bigger than any one of two of the entities.

That is correct, and more profitable than either one too.

You're more profitable now than you were a year ago?

Yes

Are you going to share any of that with the channel?

We are sharing it with the channel. Our partner incentives are increasing. There are three things we are focused on: the first is stability, the second is comprehensive end-to-end solutions and the third is partner profitability … A number of you are going to be with us at DellWorld in a few weeks and we are going to have a whole serious of announcements centered around those three themes. Our partners have been an enormous part of our growth. It's now a third of our commercial business, 60 percent of our software business and two-thirds of our U.S. federal business, and only going up. There is no upper limit.

You have $60 billion in revenue and roughly $20 billion going through the channel. Can you really be a channel company if you're doing less than half of your business through the channel?

I think you've got to start somewhere, and certainly from 2007 when we formed Partner Direct to today at $20 billion-plus growing at double digits, I think you'd have to say that's a … pretty good start. I think the number will only go up, and it wouldn't surprise me if we're at the halfway mark pretty soon. We are embracing the channel in even more significant ways. Distribution is another example. We didn't initially embrace distribution now we have Ingram [Micro], Tech Data, Synnex … so the whole channel program is growing and it's fully fledged.

Are you surprised at the rate of growth you are getting out of the partners at this point?

At this point it's not surprising because it keeps on happening. I think the great thing is that there have been some other things that have happened that have helped us. In the first part of this year we almost doubled the number of IBM partners that signed up with us as they've been looking at what's going on in the data center in converged infrastructure, server, storage, network and our 13th generation PowerEdge server portfolio. You talked about the HP move … We are the leader in breadth of solutions … the whole range of capabilities.

How do you position Dell today? Is it a hardware company or a total infrastructure company? A software company?

[Over the past few years] we started investing internally and made a series of acquisitions. We acquired roughly 40 companies across a whole spectrum of the IT landscape. Those companies themselves had acquired roughly 150 companies.

So today, Dell is a company that extends across the entire IT landscape. It is very focused on the fastest growing areas like cloud and converged infrastructure … As you move to software-defined, that means it runs on the server, like software-defined storage and networking. Layers 3 to 7 essentially become applications that get virtualized and run in a compute node. That's been very good for us.

You don't feel like you have to have that software? If not, won't the customer just go to the lowest-cost hardware supplier?

I don't think you can actually have it all. You can't actually buy every company on the planet … In many cases we do own the software. Certainly we have our own solutions for converged infrastructure, storage, and networking but I think when you look at big trends in the industry, if things happen that are good for customers and we get in the way of them, that's just not the way you succeed. When VMware comes along or open stack comes along, you see Microsoft moving in this space moving aggressively and those companies are successful and help customers accomplish what they want to accomplish … we want to help them do that.

Are you investing more in research and development now as a private company?

We are, and the robustness of the product line shows it. Look at the storage product line: we have a number of new announcements coming, and just released the SC 4020,taking our SC 8000 Compellent down to mainstream price points. The thirteenth-generation PowerEdge is just awesome … On the client side, [we've got] the broadest range of offerings and it shows in our share growth. We've got double-digit growth in our software business, managed security services. So yes we are absolutely investing and gaining share across the board.

Are you seeing larger companies transition out of public cloud into private cloud?

I think we are seeing a couple things. One is you have VMware, Microsoft, Red Hat and a whole host of other companies ... that are really looking to recreate the economics of a public cloud but on-premise, as a private cloud. And, quite frankly, that is generally what we hear customers want more than public cloud.

At the same time, when you look at public cloud, it's enormously competitive. You've got Google, Amazon, all the telcos [with] unique ways of subsidizing their participation in the market. We sell a significant amount of gear into those providers and are happy to do that. But what I find interesting is that these converged infrastructure appliances are approaching the efficiency of the public cloud and allowing your clients to get that efficiency.

Last year, Dell said it would move 200,000 accounts to partners, but it didn't happen. Was it not a good idea?

Our channel business has grown double digits, so channel partners' business with Dell has also grown quite significantly, if not more than that ... As we look across all the accounts that are out there, the vast majority of accounts, call it 70 [percent] or 80 percent, where we are not covered at all. So those are great opportunities for the channel.

In addition, there are a large number of accounts where we might have historically had one product area where we have done well with that customer -- where they have self-selected to work with Dell, historically -- but they aren't working with us in other areas of our offerings. Those are great channel opportunities, as well.

Has the DNA of Dell actually changed to do more business through the channel?

I think absolutely so. I think it's an omni-channel approach. When we started it was a program. Now it is a $20-plus billion business and a substantial part of our revenue and even more substantial part of our growth. We are completely integrating the channel into everything we do.

Do you think it will ever get to a point where we consume compute services like electricity? A pure public cloud model?

If you go back and say, 'what is causing somebody to go to a public cloud?' Well, the operating theory of the public cloud provider is that they can sweat the asset more efficiently than any individual company. Now, there could be some areas where that is the case. … However, if you look at companies over time, they are usually not all fitting to that kind of profile. …We are just starting to see this new wave of software like VMware's EVO:RAIL announcement, and like other upcoming announcements from other large software partners that you can probably guess, along with these hyper-efficient, converged appliances that we learned how to build from the big public cloud guys, and now partners can go install those into a customer's [environment].

Carl Icahn gave you a hard time. Now he's chasing the guys at Apple. Any advice for Tim Cook on dealing with Ichan?

[Long pause.]

You're among friends, Michael.

[Ichan's] a bad guy. He lies. He has no ethical boundaries. He will say anything, do anything. I have no time for him.

Is Dell well-positioned to fight Lenovo? Is it a top competitor?

If you look here in the U.S., last quarter, we gained 310 basis points of share, so 3.1 percent share increase year-over-year. … [Lenovo] gained 30 basis points. So we grew share ten times faster … They have got their own issue to deal with now in terms of integrating the IBM x86 server business. We have seen a large influx of IBM partners coming to us, [some adding us, some replacing them with us.]

But look, I think our x86 server business has had great momentum and continues to have great momentum, so I would put it up against anybody's in terms of the ability to compete and the breadth of product line.

But, here's the thing: the game has sort of all already changed. It’s converged infrastructure. It’s not server, storage and networking. It’s converged infrastructure. So just having x86 servers is not really the game anymore.

So how does a partner make money with Dell in mobility?

Clearly, there is the notebook and tablet and then there is how do you securely manage all of the mobile devices, whether they are iOS or Android, and how do you secure the data running across all the devices. We have great solutions for that. But in terms of being in the device business, or smartphones ... [Dell is] not going there. It is a truly tough business.

What kind of phone do you carry?

I have a couple different ones.

What's the next big opportunity for solution providers?

The big opportunity we see is what we call the data economy. This is also referred to by other names: big data, machine-to-machine communications, [or] data analytics.

Back 30 years ago, we had this really big expensive machine that didn’t generate much data. Now we have an enormous number of machines, we have small mobile devices, we have semiconductor costs coming down, so we have tons and tons of data out there.

How do you take that data and turn it into insights, better outcomes, better results? It's a huge opportunity.

When is it more beneficial to forge an alliance with another vendor than to try to go at it alone?

I think alliances have played a very big role. This goes back to the idea that you certainly can't [buy everything]. You look at Oracle, SAP, Cloudera as good examples. We are creating appliances. It's beyond the idea of we have an alliance, here's some whitepapers, good luck. We are creating appliances. Think of it as small, medium and large at the workload level, where if you are customer that wants to use Cloudera or they want Cloudera Hadoop or they want to use SAP HANA, or they want to use Oracle, we have tested to optimize our converged infrastructure solution for that software platform. We deliver that to our partners and they are ready to go.

What's the next big thing after hyper-converged?

I don’t think there is one next thing. I think there are many next things ... I do think this data economy will be a massive driver of growth, particularly as we all figure out technically how to unleash that power for smaller-sized organizations. If you think about education, healthcare -- these are sectors that are really crying out to be able to use data more efficiently to create better outcomes, and I think technology is a big part of that solution. I think it's a very optimistic future for our industry.

[IT] used to be kind of stuck in the backrooms of only big companies, but now every company has IT. In fact, you can't be a company unless you are able to use IT. It's all the customer-facing functions, and it will be interesting to expand all around the world to next billion users coming online.

Should solution providers really be targeting a specific type of customer, instead of selling more broadly?

As the business moves from, sort of, a more basic level to a more advanced level, certainly vertical understanding and vertical knowledge and expertise is going to be highly valued. Even within an organization, if you look at the IT people that are succeeding, they are there to align with the organization's strategy and to understand how they can actually solve problems. It's not just running the infrastructure or keeping everything operating. It's how do you create business value from this access to information and the speed and agility that comes from using data and information to gain new customers, develop new products, build new solutions and transform the business faster.

I know you're a private person and a family guy, but who do you hang out with? What do you do on the weekends? I know a lot of guys in Texas like to shoot things. Do you shoot armadillos on the ranch? Do you fish?

We have a lot of people on our team who like to shoot the animals. I prefer to just look at them. I don’t actually have any desire to kill them. Fishing I like.

Look, you know, I've got a fantastic wife --we will be married 25 years later this month. I have four great kids, two of them are still at home. I have two brothers that both live in Austin, so they've got their kids, so we spend time with them. I love what Im doing so I've got a pretty close group of family in the Texas area, and it's not 'let's go hang out with famous people,' as you might be thinking of. We're just having a good time, doing what we love doing, and life is good.

Is the job 24-7? Can you shut it out?

When you are having fun and it's working and you're growing and you're expanding and you're winning, I've never worked a day in my life. It's all fun.

Any CEO succession plans in place?

I think we have a very strong team inside the company and certainly our other investor knows what the succession plan is. We have one. Fortunately, I am staying away from buses and am not engaged in high risk activities.

You're not going anywhere any time soon? You did try to semi-retire once, stayed on as chairman, and came back.

I was there every day. So, I was very involved in the business between 2005 and 2007. Then, when I came back, we launched our channel program. Took me a couple years to think about that.

For more coverage of the BoB Conference, visit ITbestofbreed.com