HPE, Pure Storage, NetApp Can’t Beat PowerStore: Dell SVP

Dell Technologies channel chief Scott Millard talks to CRN about why storage competitors like Hewlett Packard Enterprise, Huawei, Pure Storage and NetApp can’t compete with Dell’s new PowerStore all-flash storage array.

‘Highly Differentiated’ PowerStore Storage

As Dell Technologies doubles down on driving PowerStore sales through new 20 percent channel margins and a partner support service, Dell’s Scott Millard says storage competitors can’t compete with the innovation PowerStore is bringing to the market.

“We’re highly differentiated, priced to win and we’re making it very profitable for our partners to go win with PowerStore,” said Millard, senior vice president, global channel, alliances and OEM specialty sales, in an interview with CRN. “[PowerStore’s] any scale [capabilities] – that’s scale up and scale out – not everybody can do that. In particular, Pure Storage can’t do that, Hitachi can’t do that, Huawei can’t do that.”

PowerStore is Dell’s new midrange all-flash storage line which is a scale-up, scale-out container-based architecture. With built-in machine learning and automation, PowerStore is a programmable infrastructure that aims to streamline application development and reduce deployment time from days to seconds with VMware integration and support for orchestration frameworks including Ansible, VMware vRealize Orchestrator and Kubernetes. The storage solution has a machine-learning engine to optimize performance and reduce cost by automating labor-intensive processes. PowerStore also contains Dell’s container-based software architecture, PowerStoreOS, as well as CloudIQ, which provides proactive monitoring and predictive analytics.

Dell’s Millard talks to CRN about PowerStore’s market differentiation versus the competition as well as new channel margins and partner support for selling PowerStore.

How does PowerStore stack up against your storage market competitors?

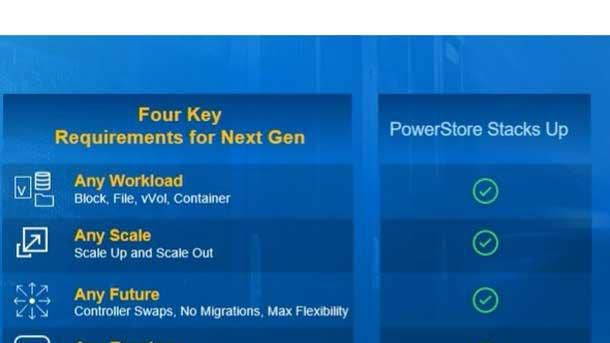

When we look at PowerStore versus the competition, we’re differentiated. The four things are: any scale, any workload, any future and any topology.

Under any scale, that’s scale up and scale out. Not everybody can do that. In particular Pure Storage can’t do that, Hitachi can’t do that, Huawei can’t do that. If we look at any workload -- block, files, vVols [virtual volumes] containers – HPE can’t do that. If we look at any future or any time upgrades, NetApp can’t do that. And if we look at any topology, what where talking about there is the ability to run apps natively on the array as well as use it as a traditional storage array – none of our competitions can do that.

When you look at those four things, we can do all of that with PowerStore. None of our competitors can do all those four things.

Why are customers picking PowerStore over the competition?

It’s differentiated versus any other storage array in the market. No one else can deliver advanced replication like PowerStore metro node. … Feedback from partners is our performance is differentiated. In particular, our data reduction at 4 to 1 is differentiated. We’re highly differentiated, priced to win and we’re making it very profitable for our partners to go win with PowerStore.

With just six months since launch, how much momentum has PowerStore witnessed?

Since May, we’ve shipped over 300 units to over 40 countries. We’ve got over 28 petabytes deployed and we’ve got over 200,000 run hours now where we are reporting six nines of availability. … PowerStore is out of the gate strong. Business is off to the races.

Talk about Dell now increasing partner margins to 20% when selling PowerStore?

We are now targeting an average margin for our partners at 20 points with PowerStore. It’s really just part of the continued evolution of the Dell Technologies Partner Program. The tenants are simple, predictable and profitable. This really lands in the predictable and profitable tenants. Through a couple different levers, we are providing a deeper discount to a deal registered partner. What that means is it’s a greater halo for the deal registered partner between a non-deal registered partner or a Dell direct deal. This should enable them to make that 20 points of margin on average.

Is that 20% in upfront or backend incentives?

It’s a combination of point of sale margin or upfront margin at the time of transaction, and their backend rebates. So it’s a total average margin of 20-points.

Are there any changes you’ve made with Dell’s direct sales team to help push PowerStore deals via the channel?

We made some changes to our end user sales compensation plan to make it comp neutral when working with a partner and allowing them to make that margin to really facilitate partner engagement. So we’re trying to drive more engagement with our end user sales teams and our partners specifically here. Dell end user sales teams will make the same quota and commission if they do a deal with a partner at the lower discounted price as if they were to do a direct deal. So we are really making it comp neutral for direct versus a channel deal at a deeper discount. In the past, the deeper discount or transfer price for the partner, that can impact quota and commission -- we’re making that comp neutral now. That should help facilitate partner engagement. The price to the customer remains the same. We’re providing partners a low discount or transfer price, and we’re protecting our sales team to facilitate that.

What exactly is Dell’s new Deal Desk for partners around PowerStore?

Consider this a help desk. If the partners are having trouble getting to that winning price and making that target margin, we’ve created a Deal Desk to help them quickly get to a resolution. It’s a team of partner support specialists that know where to go to get the answers quick for the partners. They know how to coordinate across our end user sales teams, our finance and pricing decision teams, our technical teams maybe just to validate that the configuration was billed correctly depending on who we are competing with. So they very quickly just assess the escalation and help determine what path we need to go down to help the partner get to that winning price and make that 20 point target margin.

Why did Dell launch all these new channel investments around PowerStore?

The partners have spoken to us and said, ‘Hey, we’d really like to see a more predictable and profitable margin.’ We know how critical it is that we work with partners to continue to grow our share and market leadership. The partners have told us these are investments we need to make, so we’re listening. This is another example of a step we’re taking to deliver that. … Partners are driving the majority of [PowerStore’s] business. So this is a big ‘thank you’ to the partners.