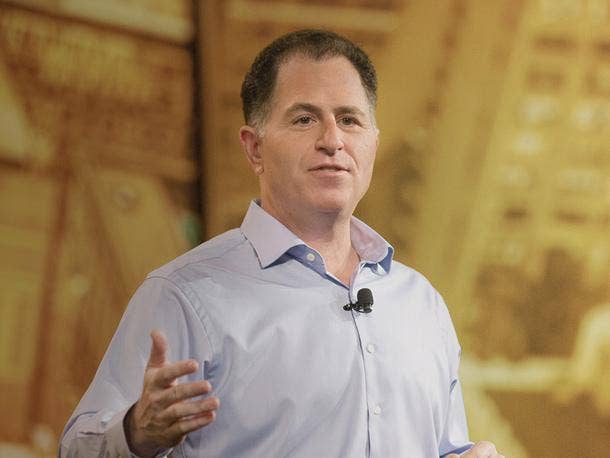

Michael Dell On Dell Going Public And Its 'Best Year Ever'

‘We think the demand is going to continue to be very strong in 2019. The momentum we have in the channel is quite strong. It's a very different company than it was five or 10 years ago,’ Dell founder and CEO Michael Dell tells CRN in an exclusive interview.

'Best Year Ever'

With its servers and networking business growing this year at 35 percent, storage at 10 percent and PCs at 12 percent, Dell Technologies founder and CEO Michael Dell is extremely bullish about his company's return to its former status as a publicly held company on Dec. 28.

"If you look at our data center business, we are the largest and we're bigger than Cisco, bigger than IBM, bigger than [Hewlett Packard Enterprise]," said Dell in an exclusive interview Thursday with CRN. "If you look at the growth in the first nine months through the end of October, our data center business grew plus- 22 percent. So we’re the biggest and growing at 22 percent. … So now you've got the essential infrastructure company. It all looks like a beautiful picture."

Dell's data center business, or the Infrastructure Solutions Group—which combines servers and networking, storage and the hot-selling VxRail hyper-converged system—brought in sales of $26.83 billion for the nine months ended Nov. 1, 2018, compared with $21.96 billion in the year-ago period.

After nearly a year of planning for a return to the public market, including a battle with activist investor Carl Icahn, Round Rock, Texas-based Dell Technologies is set to officially start trading on the New York Stock Exchange on Dec. 28, 2018, under the symbol DELL. Michael Dell spoke with CRN about the return to the public market, his 2019 outlook, Amazon Web Services' entry into the on-premises infrastructure market with Dell Technologies company VMware, and the rapidly changing technology landscape—including the impact of 5G networks on businesses of all sizes.

What does a public Dell Technologies look like and what's the strategy heading into 2019?

For our partners, for our customers and for our team members, there's really no change. We're operating with the same approach we have been for the last five, six years. We've been very clear that we're focused on the medium and long term, and we're investing for growth. We think the demand is going to continue to be very strong in 2019. The momentum we have in the channel is quite strong. It's a very different company than it was five or 10 years ago. Obviously, we have almost 90 percent of our engineers and developers focused on software now. We have a whole different set of capabilities with Dell EMC, VMware and Pivotal and the rest of the family. We're in a very good spot. The demand for technology infrastructure is going to remain very robust. We have a leading position that we don't take for granted. We have to work hard every day to earn the trust of partners and customers, but momentum is very good. When you look at the [third-quarter 2018] storage numbers that just came out, we're bigger than No.2, bigger than No.3, bigger than No. 4—all combined together, and we're growing faster.

Why are businesses going to buy Dell Technologies in 2019?

The end customers and many of the partners are saying, 'Why would I want to work with 20 little companies that are less capable when I can work with one company that is the leader? And, by the way, the problem I'm trying to solve is above all of this. So you guys just make all this stuff work, I'm going to do something else.' That's the way IT should work. Customers shouldn't have to worry about it.

What we refer to as revenue synergies, those have been way bigger than we thought. It's not that hard to think through it. It's like, 'I have EMC storage. Should I have Dell servers? Well, now it's Dell EMC storage and Dell EMC servers. So of course, let's do that.' We also now work with VMware. We created VxRail, which is more than a $1 billion business. We had another quarter of triple-digit growth in VxRail. It's been a total rocket ship and keeps going and going. vSAN from VMware is super strong, and we continue to drive that. So we're leading in every form of storage that you can think of, every form of servers you can think of, our client business continues to be very strong, and you have a robust demand environment.

What are your thoughts on Amazon Web Services coming out with hardware next year with AWS Outposts alongside VMware?

Look, we've been talking about the multi-cloud, hybrid cloud for a long, long time. What this just validates is that cloud is not a place, it's an operating model. The private clouds are going to the public clouds, the public clouds are going to the private clouds—it's really a workload-dependent discussion. The VMware-AWS partnership is quite strong. There's nice growth in that partnership. We're also expressing our value with all the other public clouds as well. Customers want a two-way street there. They want to be able to move things back and forth. Sometimes it will be on our infrastructure and sometimes it will be on someone else's infrastructure—hopefully always with our software. This just shows that it is not a public cloud or private cloud, it's both.

How much public cloud repatriation are you seeing and how important is the software-defined stack Dell offers in terms of total cost of ownership versus public cloud?

I've described this before, but I think customers often go through a bit of a journey on this topic. They'll often start out saying, 'I'm cloud first. Everything to the public cloud.' And they go off on that journey and find that not everything moves so well to the public cloud. Some things work great, and some things don't work great. Some things are less expensive, and some things are more expensive. Then they realize that [the answer] is actually hybrid cloud.

As we show up with these more modernized, automated systems like VxRail, our converged and hyper-converged systems—which is seeing triple-digit growth—customers move toward, 'Not everything is a public cloud. It's multi-cloud, hybrid cloud and workload-dependent.' Then if you think about the edge, edge computing I think will be bigger than all the clouds combined because there's just going to be way more computing, and you're going to take your compute to where the data is. You're not going to take your data to where the compute is. So if you've got robots whizzing around your factory doing things, you're going to need computing to control them.

What's Dell's opportunity around 5G?

I'm giddy with excitement about 5G. The reason is that it's just going to completely turbocharge everything that is going on because it's not just so you can talk on the phone faster—it's all about data and a thousand times faster and a thousand times less latency. The number of smart, intelligent and connected things is exploding, and with it comes way more data and way more need for organizations to reinvent themselves.

When we go and talk to companies in every sector from health care, aerospace, automotive, industrial—they're all putting intelligence in their 'things.' Think about it yourself, you're walking around with a little data center and you have all these little connected things.

For example, I have this ring on that has a couple of microprocessors in there that's tracking my heart rate, temperature and gyroscope. That's just one small example. There are lots of examples in this across every sector. The last several decades have been quite amazing in terms of microprocessors, the internet and all these things, but the foundation that we're building on now with [artificial intelligence], blockchain, 5G and the cost of making something intelligent, it's a super-exciting time.

How is Dell driving 5G innovation and solutions around your infrastructure edge-to-core-to-cloud strategy?

With 5G, there is a big movement to NFV [Network Functions Virtualization]. This is basically virtualization of the network functions in the 5G network, and VMware has an incredible position and capability with NSX around NFV and is working with a large number of the leading telcos in the world. The other thing that's happening with 5G and NFV is it's moving towards what you would think of as commercial x86 architecture. So the server business, where we've had six quarters in a row of double-digit growth—30 percent-type growth—this is a big demand driver for the server business. With the amount of data being created, just think about the autonomous car, for example, it's going to be generating tons and tons of data. You're not going to have all that data going back to the center somewhere. You're going to have the 'things' talking to each other. You can see it across many, many industries. 5G is not here yet, but it's coming in the next year or two.

What's the opportunity for moving Dell servers to the edge with 5G?

5G will be a big driver for the whole industry because it will drive the demand for IT infrastructure, the number of connected things and the amount of data being created. Certainly, the number of 5G base stations that have to be created is significant. Many of those will use our technologies—both software and hardware—and while that's really interesting and important, the things that it enables are even more significant. Again, this is where companies have to reimagine themselves and say, 'What does it mean to be in the food delivery business when you have 5G? What does it mean to be in the automotive, or aerospace business or health-care business or education business?' The available market is getting much, much larger. That doesn’t mean we can just sit back and watch the orders come in. We have to go create solutions. We have to have fantastic partners. We have to continue to invest heavily in the technologies and build lots of partnerships to make it all happen. But it is happening.

How was 2018 for Dell?

It's been a fantastic year. Best year ever. The momentum in the business is quite strong. If you look at our data center business, we are the largest and we're bigger than Cisco. Bigger than IBM. Bigger than HPE. If you look at the growth in the first nine months through the end of October, our data center business grew plus- 22 percent. So we’re the biggest and growing at 22 percent. Then you say, 'Well what did Cisco grow?' Cisco grew like 5 [percent] or 6 percent. HPE grew 4 percent and IBM was negative. So we're larger and growing a lot faster. So if you step back and think about it in hindsight, what we've done is we combined the leading storage company with the leading server company, which created the leading hardware infrastructure company, and we combined that with the leading software infrastructure company. So now you've got the essential infrastructure company. It all looks like a beautiful picture. If you go back to October 2015, when we announced this little idea [of acquiring EMC], people were like, 'What are you doing? How's that going to work?' Well, it's worked out quite well.

Talk about Dell's channel growth in 2018 and strategy for 2019.

[Channel revenue] grew 21 percent in the third quarter [year over year]. It's right in line with the business. We have $49 billion in orders through our channel partners, so lots of success. What's happening in the technology world is technology is no longer just in the IT department because companies are having to reimagine themselves in the world of AI, everything becoming intelligent and digitally connected, and massive increases in the amount of data. So that becomes the priority for the business line executives and for the chief executive of the company. It's not the IT department that has to run the general ledger or the MRP [materials requirements planning] system. It's, 'How do you actually make your products and services better with technology?' If you don't do that, your competitors may do it, or some new company will come along and you'll be [taken over by] an Uber or Airbnb. So customers are all in on the digital transformation that requires all kinds of new capabilities. Partners are jumping into this. They're having to evolve their capabilities. We've all been doing this for a long time. The successful companies are the ones that evolve. It's change or die. It's quick or dead. It's no different than it was, it's just now going faster and faster.

Advertisement