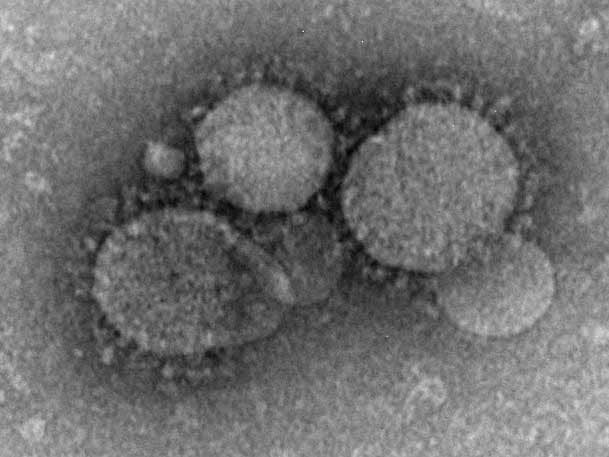

5 Tech Execs On How COVID-19 Has Impacted The IoT Market

CRN talks to executives at Intel, Microsoft, GE Digital, PTC and FogHorn Systems about how the coronavirus pandemic has affected the IoT market.

Some Verticals Take A Hit While New Opportunities Emerge

The coronavirus pandemic has thrown a bit of a curveball for the IoT market, which has seen a slowdown in areas like retail and manufacturing while new initiatives to reduce human contact and improve automation have come to the forefront.

"The last three and a half months have been us — as a company and my team and division from an IoT perspective — really focused on helping companies apply the right technologies to solve some real immediate needs that have emerged [due to] COVID," Rodney Clark, vice president of IoT and mixed reality sales at Microsoft, told CRN in a recent interview. "And so where I'd like to say, it's been business as usual from an IoT front, It's been anything but."

[Related: 5 Processors Powering The Future Of IoT Applications]

The pandemic-induced slowdown in demand for IoT solutions was demonstrated in the most recently earnings for Intel, which reported a 3 percent year-over-year decline in first-quarter sales for the company's division that produces computer chips for IoT devices.

But Clark and other IoT executives who recently spoke to CRN as part of IoT Week said they believe the new requirements and realities brought upon by the coronavirus has underlined the importance of IoT technologies as governments and businesses seek to adjust to a "new normal."

What follows are remarks made by IoT executives at Microsoft, Intel, GE Digital, PTC and FogHorn Systems in interviews with CRN on how the pandemic has impacted the IoT market, including what areas have seen a slowdown and where they have identified new opportunities.

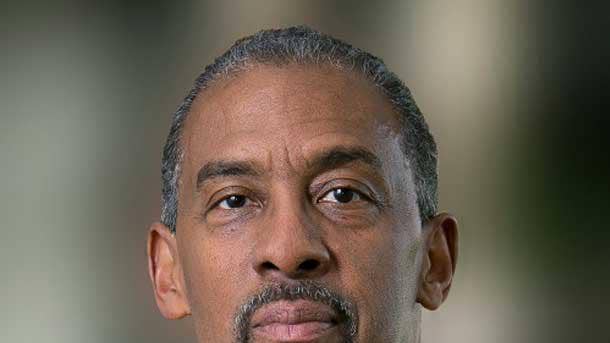

Rodney Clark, Vice President Of IoT And Mixed Reality Sales, Microsoft

The last three and a half months have been us — as a company and my team and division from an IoT perspective — really focused on helping companies apply the right technologies to solve some real immediate needs that have emerged [due to] COVID. And so where I'd like to say, it's been business as usual from an IoT front, It's been anything but.

The time that I spend right now is in implementations for COVID-initiated things like monitoring and detection, things like business automation, social and workplace engagement interaction projects that probably would have taken 18 months to do formal [proof of concepts], test and deploy — we've deployed in a matter of two or three weeks. That's new for us.

And then at the same time, there are solutions that we have been working on in industries like manufacturing and retail and automotive as well that have been put on hold because of the current situation. You don't have the ability to sit and architect and build a solution with the partner or customer. It's been an interesting ebb and flow of our business and what's happened and transpired over the last several months.

[For the solutions that became more relevant because of the pandemic,] we started a conversation internally around the solutions that we've built with partners, most of them that were either built or architected already, or were in the process, to solve solutions to solve customer problems. A great example of that is the [U.K. National Health Service's] ventilator challenge, where we got together with the likes of PTC, Avnet, Arrow and a number of other large technology companies along with the U.K. Government and accelerated the production of ventilator to help out with the initial COVID response.

We've had solutions from companies like PCL and Insight, which is a citizen care pod or a portable care unit [that is a] mobile building — think of a shipping container that's pre-configured with thermal sensors. They're places for people to come in, to get screened and checked, and these sensors are managing and monitoring temperature of people in line and there are also some AI algorithms that are detecting spatial considerations. That's a solution that that literally popped up overnight, and, in essence, what it is is a pop-up testing center. So think of businesses going back into work today and wanting to have a way to test employees before they come into a facility. Think of in the future when you go to a sporting event, this portable unit could be something that sits outside of a traditional stadium entrance to test people to minimize concern of people participating or not.

There's another solution for Microshare, which is occupancy and asset monitoring using LoRa sensors and gateways in hospitals to monitor beds and occupancy and other assets, different medicines and location of certain devices and machines. That is something that was developed in a short amount of time to address a specific need.

We have over 170 of these solutions. I won't go into detail on all 170, but the point is that based on the need, we even saw [the U.S. Food and Drug Administration] ease some requirements in things like ventilator production. When I say ease in requirement, it's more [about the] timeline and application than requirements. And we saw that in GE: they put out a software solution allows them to monitor patient data across ventilators so that doctors can check on them remotely. And that was an approval process that was accelerated as a result.

Mandy Mock, Vice President, General Manager, IoT Platform Management And Marketing, Intel

We think there's a lot of opportunity in front of us. It's kind of interesting with the COVID-19 stuff that's happening right now. We're seeing a surge in customer inquiries around automation and solutions that reduce dependence on human presence and interaction. And so we're thinking that we're going to see an acceleration across the industries of implementation of these sorts of solutions, where people have been more risk adverse in the past. We think this really is going to drive that that shift faster.

We're seeing it multiple places. Retail and industrial manufacturing, specifically, are big ones, but health care also, especially right now, I think people are thinking a lot about how do they make the environment safer with less human contact needed. So we're seeing that there too.

[One use case for industrial environments] that jumps to mind first is just visual detection of anomalies, being able to remove people from the line who are doing manual detection of errors right now, is a quick way to reduce your social interaction.

[Automation has] been trending this way. People know this is coming. But at the same time, there's a lot of aversion to risk. If you have an established system, it all works. Let's use the factory example. Your lines are running well. It's both an expense and a risk to implement completely new systems. You've got to set up a copy potentially of one of your lines in order to implement the new things, then you've got to invest in the infrastructure and then do the transition. And so that definitely makes people cautious in their transition, I would say. What this [COVID-19] environment is doing is really making them conscious of the cost of not moving, and so it's accelerating the interest and the desire to make the transition.

We're always trying to anticipate what use cases are going to be needed. And we're, of course, talking with our customers and Industry analysts all the time about what do we anticipate for future needs. It's tough, obviously, for us to predict what sort of impacts that will have on workforces and so forth. The only thing I would offer is that we've been going down the road of automation for a long time, and the U.S. at least until COVID, has seen some of the lowest unemployment levels we've seen, so we've been fairly successful at dynamically adapting to the environment, and I personally have great confidence in our ability to continue as a human species.

Colin Parris, Senior Vice President, Chief Technology Officer, GE Digital

The impact has been — and I hate to ever use this word in light of the pandemic itself — but it's been actually favorable, and in very different ways. So let me give you some examples.

The two things we always think about with any digital transformation is people go about it for productivity, right? So that has always been a focus, and then for the other fact that there's a lot of dynamics in the market. So whenever there are dynamics, people worry about that and want to do things. So now what you have is that because of the pandemic, this productivity got attached to this notion of remoteness. Case in point: POSOCO [Power System Operation Corporation].

POSOCO is India's energy utility. They do the energy for all of India. With POSOCO right now, what you had was because of COVID, the Prime Minister of India said, "as a way of solidarity, I want everyone" — 1 billion people in India — "to turn off their lights for nine minutes." So now they're going to turn off their lights. That has a massive effect on the grid. A grid is built to be stable, an electric grid. You don't have any fluctuations in power. It doesn't handle [flu cations] well, because when you [have a massive drop in electricity] and try and bring it back up, that causes a whole lot of problems.

So imagine that's what he's asked them to do, and he gives POSOCO 60 hours notice. They call us immediately. We have a system called AEMS, Advanced Energy Management System. We work with them on the system, but we also have something we call remote connectivity, so we could remotely look at it. How do we prepare for that to happen? Now what you have to do is to quickly understand the entire grid, lay it out in such a way that when this drop in electricity happens, and it comes back up, you got to stabilize the grid. Because initially, all of this electrical current needs to be at one level, and then when you stabilize that, you've got to make sure everything comes back up in the right way.

That requires a different level of coordination. So two things there. One is that we have to do this remotely, because nobody was allowed to fly into India, so we had to have remote connectivity. We had to make sure the software was intelligent enough so that it could respond. And so initially, they thought, well, their grid is 130 gigawatts. Right now, because of COVID, it was only running at 50 gigawatts — already a problem. Now they thought it will drop by 12 because of what the Prime Minister said — it dropped by 30. We didn't plan for that. The algorithms kicked him. They stabilized the grid. Nine minutes later, it came back up. It dropped by 30, came back up, no problems whatsoever.

So right away, you could see the effect of remote capability as well as the effect of smart software that could make things happen. Immediately after that, they call us and said, "you know what? We got to invest more in this, because now we actually know it works." And it works in extreme cases, because nobody would have thought about that.

We have the same thing going on with Sonelgaz, which is an Algerian national gas. The same problem: remote connectivity and productivity. They normally require five to eight people in their control center. Well, because of COVID, they don't have a control center, and they had a lot less people. You have to do it with three people. And then can you do it remotely? So both productivity, going from five to three people, and remotely. And it's been working for three months.

When you see examples like this, right away, people look at it and say, "well, hold on. I didn't know it could work." It was interesting that we had a discussion at one point with the CEO of the New York Power Authority. He said, "we always wanted to go digital and have a lot more remote capability, because that's the wave of the future." And I asked people how long it will take, and they said, "between three to five years." Well, because of COVID, they did it in five days.

What that taught them was that perfection can't become the enemy of this practice. You will give them a chance. You knew you had to do it. And yes, okay, if you fail, you could fail. But in five days, they did what they were projecting would take years. And they're not the only one. Many utilities, many others — manufacturing plants — are seeing the same thing, because they know that now I can get this thing done, I can be more productive because less people were there. And I can actually do it remotely.

The other thing is that they all tell me and they believe, this is not going to recover soon. People aren't going to suddenly go out and buy again. So these [companies] are going to continue to think, how do I maintain this? Because who knows what's going to happen? So, in some sense, [it's] favorable because it's been tested, we see the productivity, we see the remote capability, and then we also see dynamics. Because nobody expected this, this is a huge peak. If I told you as a practice, let's try and shut the grid down just for the hell of it, you'd have said, "no, Colin, go to hell." But because of what occurred, we were able to see that. So in some sense, it's accelerating the digital transformation we see right now, because of the fact it's now better proven, and also, it's going to be needed. It was needed in COVID times. COVID times haven't stopped, and the economic fallout is going to extend even more.

David King, CEO, FogHorn Systems

I think of it as two sides of our business. The predominant side that we've been working so hard on for five years, we call it the industrial edge AI customer base. We talk about these different sectors of manufacturing or oil and gas, whether it's upstream, midstream or downstream, and we talk about transportation systems and even things like elevator management in buildings.

That's what I call smart industry or smart industrial. There's definitely a slowdown. We literally saw it sweep the globe. Asia slowed down. China, Japan, Korea started to slow down first, and then of course, it's brought here to the [U.S.] and Europe. What we've seen is, [many of those companies] didn't lockdown, because many are considered critical infrastructure. But they definitely slowed. A lot of people were kept out of factories or out of facilities for a bit, and they're all starting to pick back up again, so it's been a two- to three-month pause for some of our large industrial customers.

They're not fully back up to previous levels, but they're coming back slowly but surely. We've definitely [seen] progress from the March-April timeframe until now. There's definitely been a lot of factories reopening that went from minimal production back up closer to full production. So we've seen the gradual pickup in the industrial side.

Now we have another side of the business that we haven't talked much about in the past. You'll be hearing more about it from us later this year. We've been doing a lot in the energy management side of things around energy efficiency. Our lead application is for smart infrastructure, and that smart infrastructure solution is a way bigger market than smart elevators and escalators that we've been doing for years because of our work with GE early on.

Building energy management is just a huge market, much bigger — every building, not just industrial buildings, but office buildings, malls, hotels, no matter where you go. And so we won some big projects in the school space around energy management. Those projects took a very short-term hit when people couldn't go into the buildings to deploy. But that was a very temporary hit — that was a matter of a month or two, and people were allowed back in.

What they realized is A) they need more remote monitoring. So having a digitized automated solution makes more sense, but beyond that, you're not dependent on the global economy to justify the business use cases. You're really just saving the money on their energy bill. Especially when you don't have full-time staff there to try to do anything to mitigate your energy consumption, having an edge AI system that can automatically do that is really powerful. That has not really slowed down at all, and it's continued on. In fact, if anything, it's even accelerated through this period.

Joe Biron, Chief Technology Officer Of IoT, PTC

Short-term impact for our customers who have already deployed IoT is they now are in love with IoT even more than they were before. There's this picture in my mind, and actually, it's not just a picture. I've seen them on virtual conferences recently with our customer users who are service technicians that are at home in their pajamas, diagnosing and remediating problems in the field without having to jump in the truck. No, they're used to that because they've been using ThingWorx for a while for that. But wow, they are very glad they made that investment, and our expectation that in the short term, we will have many more product OEMs that wake up to that opportunity because of the recent events.

In the manufacturing sector, of course, plants have been on lockdown and are just starting to open up. We feel that there will be a bit of an elastic bounce as they reopen and are going to be more focused on the efficiency in the manufacturing because they've got a backlog of orders that they need to fill. And so again, we think that we're not glad COVID happened. It certainly is not good for any business. But we think that for IoT, it highlights the importance of efficiency and being able to do things remotely.

Our current customers already have religion about [using IoT to become more efficient and enable remote connectivity], and they invested in IoT in the first place for that reason. They're now able to justify expansion of their footprint because of the very obvious benefits of having an IoT implementation already. Of course, we're going to use those case studies to evangelize to the rest of the market: this is this is real stuff that solves real problems.