IDC: Top 5 Global Smartphone Vendors For The 4Q 2014

Smartphone Wars

Market research firm IDC released its outlook on fourth-quarter 2014 smartphone shipment levels in 2014 on Thursday, Jan. 29.

Overall, the global smartphone shipment level grew 28.2 percent at 375.2 million units during the fourth quarter of 2014, compared to the 292.7 million units shipped in the fourth quarter of 2013.

"Most of the industry expected an extremely strong holiday quarter from Apple, especially with regards to the iPhone. However, worldwide shipments of 74.5 million units beat everyone's expectations," said Ryan Reith, program director with IDC's Worldwide Quarterly Mobile Phone Tracker, in a release, referring to Apple's shipments.

Following are IDC's top five smartphone vendors with the highest shipments in the fourth quarter of 2014.

5. Xiaomi

Chinese-based manufacturer Xiaomi was the fifth-place smartphone vendor, taking 4.42 percent of the fourth-quarter market share and shipping 16.6 million smartphones. Xiaomi's levels reflected the largest amount of growth from the fourth quarter of 2013 with a 178.6 percent change over last year's market share of 2.03 percent and 5.9 million global shipments.

The company's rapid growth is attributed to a solid demand in the smartphone's home country, China, and a steady release of new devices, including the Mi4 LTE. Xiaomi has been reaching beyond its home base in China to release devices in other markets, such as the Mi4 in India.

4. Huawei

Huawei Technologies, a Chinese telecommunications equipment and services company, was fourth place in the smartphone shipment market.

Hauwei took 6.25 percent of the fourth-quarter market share, with 23.5 million shipments. This was a 41.7 percent growth over the fourth-quarter shipments of 2013, where the company had 16.6 million shipment volumes and took 5.66 percent of the market share.

During the holiday quarter, the company was driven by success from its Honor line, and continued to emphasize its midrange and high-end smartphones, such as the P Series and Mate Series. According to IDC, Huawei made strides in 2014 by improving its brand awareness and overall client experience.

3. Lenovo

Lenovo barely topped Huawei in its global smartphone shipments, taking 6.59 percent of the market share and shipping 24.7 million units. The company faced widespread growth, up 77.9 percent from last year's fourth-quarter shipment volumes of 13.9 million units and market share of 4.75 percent.

The Chinese tech company was driven by its cheap handset markets in China, as well as its "vast portfolio" of devices, including the Golden Warriors S8 and Vibe Z2 pro, according to IDC.

In the next month, Lenovo also will bring the Motorola brand back to its home market in China, beginning with the Moto X. Despite being the third-highest market share vendor, Lenovo still fell in the distance behind the top two vendors by a long run.

2. Apple

After a record-breaking earnings call Tuesday evening, the Cupertino, Calif.-based company faced 46 percent growth to fall behind the first-place smartphone vendor by a hair.

In the fourth quarter of 2014, Apple took 19.85 percent market share, with 74.5 million unit shipments, up from last year's fourth-quarter 17.43 percent share and 51 million shipments.

Apple's release of the iPhone 6 and iPhone 6 Plus, coupled with a heightened customer desire for big-screen devices and Apple's push into China and other countries, helped the company accomplish widescale growth.

Apple CEO Tim Cook applauded the strong unit sales during Apple's earnings call, emphasizing that the current iPhone lineup experienced the highest Android switchover rate over the last three launches in the previous three years.

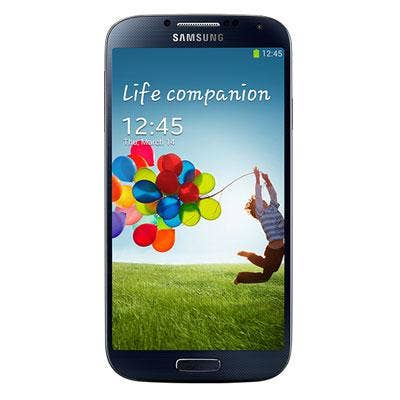

1. Samsung

While Samsung took first place as the global smartphone vendor, it only just surpassed Apple in shipment volumes, and its market share slipped 11 percent from last year's fourth quarter.

Samsung took 20 percent of the market, with 75.1 million units shipped, down from last year's fourth-quarter market shares of 28.8 percent and shipment volume levels of 84.4 million.

The South-Korea based company crumbled under increased pressure on one end from Apple's iPhone 6 and iPhone 6 Plus smartphone popularity, and on the other end from low-end and midrange Chinese manufacturers like Xiaomi and Huawei.

Looking forward, Mobility Communications Business Vice President Park JinYoung said during Samsung's earnings call that the company expects its smartphone and tablet demand to continue to fall, but announced the release of devices Galaxy A5 and Galaxy A3 as possible profit-strengthening factors.