Mobile Payment Head-To-Head: LoopPay Vs. Apple Pay

LoopPay Joining Crammed Mobile Payment Space

In an effort to move into the mobile commerce space, Samsung on Wednesday said it plans to acquire Burlington, Mass.-based mobile payment system LoopPay.

The South Korean company will now compete against platforms like Google's Google Wallet and eBay's PayPal in the mobile commerce market. But the most significant hurdle that Samsung and LoopPay will jointly face is Apple's Apple Pay.

Apple Pay, released in September, has seen tremendous success, as the service makes up $2 out of $3 spent on purchases using contactless payment across the three major U.S. card networks, according to Apple. But LoopPay has a few unique features differentiating it from Apple's popular payment system. CRN puts the two platforms head-to-head to size up their different aspects.

Consumer Base

A large part of a payment system's success comes from consumer trust, which directly relates to the client's relationship with the smartphone vendor and mobile brand. And, according to analysts, Apple has a dedicated base of followers. Samsung may have a refreshing, new payment platform, but Apple's consumer base will lead the success of its mobile payment product.

"Apple has the advantage of having the most loyal and strongest brand in the mobile device market," said Jack Narcotta, devices analyst at Technology Business Research. "The iPhone is so important for Apple Pay being a success because it hinges on the user base's loyalty."

Retail Compatibility

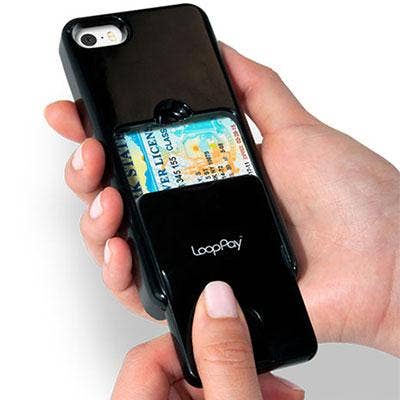

LoopPay touts Magnetic Secure Transmission technology, which offers advanced contactless payments that turn magnetic-stripe card readers into mobile contactless receivers without changes or costs for the merchant or client. Unlike other mobile systems, this technology allows consumers to tap their smartphones against the magnetic-stripe-reader machines that are available in most stores, according to LoopPay.

Other mobile payment systems, like Apple Pay, have required retail merchants to upgrade their checkout devices to be compatible with NFC (near field communications) technology, which allows two devices to communicate when they are in close distance.

Apple Pay works at less than 5 percent of retail locations, while LoopPay works at 90 percent of retail locations, according to LoopPay.

Track Record

Apple Pay was just released in September, but the mobile payment system has seen widespread success in the past few months. According to Apple CEO Tim Cook, Apple Pay makes up more than $2 out of $3 spent on purchases during contactless payments across the three major U.S. card networks. Apple Pay has also recently formed groundbreaking partnerships with organizations like the federal government and JetBlue, so that these groups can support the mobile payment's technology.

LoopPay was started in 2012, long before Apple Pay. However, the payment system, long an independent company, still has to mesh out how it will operate as a platform within Samsung's mobile division.

Point-Of-Sale Reader Support

While Apple Pay supports 90 point-of-sale issuers, LoopPay supports more than 10,000 issuers, credit cards, debit cards and gift cards, according to LoopPay. The company's technology also works with all types of cards, including Starbucks, Target and Walmart. Apple Pay, on the other hand, does not include loyalty cards, gift cards or other types of cards in its system, according to LoopPay.

EMV Support

Federal regulations are requiring U.S. businesses to update their point-of-sale machines to be EMV-compliant for security reasons. EMV, or EuroPay, MasterCard and Visa are data chips that securely pass along credit-card information, as opposed to cards with magnetic stripes.

As businesses are required to upgrade by October 2015, there has been talk about mobile payments being accepted at these new EMV terminals. Apple Pay uses industry-standard EMV contactless protocols, and EMV's stronger security features include the technology that enables Apple Pay.

If the point-of-sale terminal is configured to accept EMV cards, LoopPay clients will be instructed to use the physical card to make the transaction for the chip and PIN card reader. According to LoopPay, the company will soon be announcing a solution to this.

Additional Security Measures

Apple Pay and LoopPay both offer extra security measures to ensure that their clients' information is protected. Apple Pay offers a slew of extra security measures. Apple does not store the credit-card data on the device or in its servers, and the company’s security processes are strong, according to CEO Tim Cook. Apple hardware and software use encryption, and a security operations team monitors the infrastructure around the clock.

Similarly, LoopPay encrypts account information, which is password- and PIN-protected to prevent access or use by others. LoopPay stores track data from credit, debit, loyalty and gift cards in an encrypted format in secure memory within each device. The LoopPay app also has a Lockbox feature, so users can safely store passwords and other critical information in a password, encrypted and PIN-protected environment.