10 Tablet Market Trends Partners Need To Keep An Eye On

The Tablet Market Is Declining, But Not For Long

The tablet market may continue to see declining sales for the second straight year in 2016, but research firm IDC says it sees a glimmer of light at the end of the tunnel.

According to a new report IDC released Thursday, tablets will see a slight rebound in 2018, driven in part by the growth of detachable tablets (which are tablets that are attached to and can also disconnect from keyboards) as opposed to the more traditional slate tablet.

Following are 10 key insights into the tablet market from the IDC report that are important for solution providers specializing in Windows, Android and iOS tablets.

Tablets Will Decline In 2016 -- Again

IDC forecasts that the tablet market will decline for the second straight year in 2016, with sales dropping almost 10 percent compared with 2015.

According to IDC, the tablet market overall has reached its peak, and will face declines in 2016 and 2017. The market is facing issues in part because of long tablet life cycles, similar to those of the PC market, as well as increased competition over the past few years from large-screened phones, or "phablets."

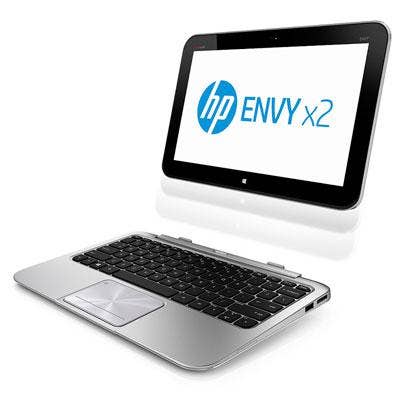

Detachables Are Increasing In Popularity

IDC said detachable tablets -- which can attach to and disconnect from keyboards -- account for 16 percent of the overall market. In 2020, the detachable category is expected to reach 31 percent.

The detachable tablet segment is also considered by some manufacturers, like Apple, as a way to spur replacement cycles of the existing slate tablet installed base, according to Jean Philippe Bouchard, research director of tablets at IDC. "One reason why the slate tablet market is experiencing a decline is because end users don't have a good enough reason to replace them, and that's why productivity-centric devices like detachable tablets are considered replacement devices for high-end larger slate tablets," Bouchard said.

The Tablet Market Will See A Slight Resurgence Starting In 2018

According to IDC, the tablet market is expected to see a slight rebound in 2018 and beyond, driven in part by steady growth in popularity from detachable tablets, which analysts say are popular in part because of their productivity-centric features.

While the tablet market is projected to hit a low this year, with an expected 9.6 percent decline, IDC expects the market to grow 2.1 percent in 2018.

Slate Price Point

According to IDC, lower-cost, small-screen slate devices, particularly those running on Android, will attract emerging markets.

"In many emerging markets, the only computing device for many will be a mobile device, whether that is a small-screen tablet, smartphone or both. This is the main reason why, despite all the hype that the detachable category receives, we believe cheaper slate tablets fill an important void," said Ryan Reith, program vice president with IDC's Worldwide Quarterly Mobile Device Trackers.

Consumer Versus Enterprise Demand

While detachable tablets have important productivity features, IDC's Reith said he expects consumers to still be the biggest driving force for the tablet market, as opposed to the enterprise market.

"I think a lot of [the demand] will be consumer," he said. "The complexity of the device always adds some overhead to IT for small and medium[-size] businesses."