The 10 Biggest Cisco Stories Of 2010

Cisco Highs And Lows

Cisco continued to grow throughout 2010, and also had a number of major product debuts, channel updates and notable milestones, including astonishing customer growth for its Unified Computing System (UCS), the arrival of a collaboration architecture called Cisco Quad, and, in October, the shipment of its 30 millionth IP phone.

But to say Cisco had it easy this year would be to miss the mark. Several earnings reports brought some less-than-invigorating surprises, and the biggest Cisco story of 2010 -- Cisco's supply chain woes -- was surely one that tested the patience of even the most devoted Cisco solution provider.

Here's a look at the year in Cisco, one that was as eventful as ever for the San Jose-based networking and data center powerhouse.

1. Cisco's Supply Chain In Crisis

It started out innocently with some protracted lead times for Cisco product lines, and then mushroomed into a full-scale calamity: months-long delays for Cisco security, data center, switching and other products, a lack of communication by Cisco on the scope of the problem that frustrated and infuriated VARs and distributors, competitive wins by some of Cisco's key networking rivals taking advantage of the vendor at a weak moment and an influx of Cisco business into the gray market.

Cisco's supply chain shortfalls, which began about July 2009 and continued until they were nearly eradicated this fall, were not a problem of its own making. As Cisco's Executive Vice President Randy Pond told VARs at Cisco's Partner Summit in April, the unexpected pickup in demand for Cisco product following last year's economic slowdown caught the vendor -- and many like it -- by surprise. Coupled with a shift in economic and labor conditions in China, where many of the component factories Cisco relies on are located, and the problem was that much more magnified.

2. Cisco's Video Vindication

Cisco's video strategy continued to expand this year, with the launch of several consumer-oriented video products and, on the enterprise business side, the April closing of its $3.3 billion acquisition of Tandberg, 95 percent of whose business went through the channel.

On the consumer front, Cisco continued to update the Flip video camera line it acquired with Pure Digital in 2009, and in October, took the wraps off of Umi, its long-rumored home telepresence system.

It's Tandberg, however, that's been a source of excitement and more than a little concern for Cisco VARs. At the time of the acquisition's close, Cisco executives promised a combined partner program in nine months' time. In mid-November came more details, including new product releases and specifics on Cisco's new TelePresence Video Authorized Technology Provider (ATP) program. Solution providers still have plenty of concerns, especially as the deadline for mapping Tandberg VARs into Cisco's channel program -- January 31, 2011 -- inches closer.

3. Cius It Now

Perhaps Cisco's most intriguing single product announcement of 2010, the Cius is an Android-based tablet that the company is positioning as a UC and collaboration endpoint. Not many details -- including pricing -- have been revealed since the Cius' late June debut, and the tablet itself won't be available until March 2011 at the earliest. But the unveiling of the Cius was enough to get -- and keep -- the Cisco channel abuzz, first because it's Cisco with a snazzy-looking new device, second because it appears to be a strong UC (and desktop virtualization) play, third because it's a tablet in a year where tablet computers are being judged on their enterprise business and channel sales potential, and fourth because it's an Android-based device announced in a year when Android growth took off like a rocket.

4. Questionable Bellwether?

During its fiscal fourth quarter report, Cisco reported strong, but not blockbuster, results, and some of CEO Chambers' comments were enough to unsettle some observers that the macroeconomic recovery was not going as briskly as planned.

Most recently, with its report for the first quarter of its fiscal 2011, Cisco again raised red flags. Sure, profits and revenues were up 8 and 19 percent respectively, year on year, but Cisco also missed its order forecast for the quarter by more than $500 million, causing it to slash projections for the second quarter and its stock to drop like an anvil. One of the big causes? Public sector spending declines, particularly in state and local governments in the U.S.

5. UCS = Undeniable Cisco Success

Cisco's Unified Computing System (UCS) was a major salvo by Cisco in the battle for the enterprise data center. Nearly two years following its March 2009 unveiling, it's a success story. Tales of UCS implementations have begun to appear, especially following the UCS' release to distributors late last year, and Cisco's UCS customer pipeline has been growing by leaps and bounds. According to the vendor, sales of UCS grew 550 percent year-over-year during the first quarter of fiscal 2011, and the UCS has an annualized run rate of $500 million. Customer-wise, UCS now numbers 2,800 for Cisco, up from 1,700 the quarter before, and 900 the quarter before that. According to VARs, Cisco's UCS is scaring the hell out of all of Cisco's data center rivals, even if they put on a good face in public and scoff at UCS' viability.

6. Channel Chief Changes

Cisco in October completed a three-month-long makeover of its channel executive team that according to the vendor, better positions it to lead and manage its expansive channel over the next five years.

The changes were in part structural, with the creation of the Worldwide Partner Organization (WWPO) in February out of the previously separate channel and strategic alliance organizations. They also meant new roles for some of Cisco's best-known faces: Edison Peres became senior vice president, worldwide channel organization, taking over day-to-day channel-facing duties from Keith Goodwin. Wendy Bahr, formerly the U.S. and Canada channel chief, became senior vice president of global and transformational partnerships. Jim Sheriff, formerly CEO of Cisco China, returned to the U.S. to take over Bahr's role, and then some. Dave O'Callaghan, formerly Cisco's distribution chief, assumed a new role as vice president, worldwide commercial sales. And Scott Brown, most recently vice president for worldwide sales enablement, became the new vice president of worldwide distribution.

7. Bates Bolts For Skype

Executives jump ship all the time in the frenzied realm of IT, but some departures are naturally much more significant than others. In early October, Cisco confirmed a big one: Tony Bates would leave to become CEO of Skype. Bates, a 15-year veteran, reported directly to Chambers and was a key architect of Cisco's Borderless Networks, data center, UC and collaboration strategies. He was also a past general manager of Cisco's Service Provider unit, overseeing the group when Cisco's milestone CRS-1 carrier core router debuted in 2004.

Bates was hardly the only notable departure -- or arrival -- at Cisco in 2010. Joe Burton, formerly the top technologist in Cisco's UC group, became chief strategy and technology officer at Cisco's video and UC archrival Polycom. And Mark Papermaster, a headline-maker thanks to his controversial departures from IBM and Apple, is now vice president of Cisco's Silicon Switching Group.

8. Commercial Gets Close Attention

Cisco defines its commercial sales segment as midmarket and small business, and both are areas where it spent quite a bit of time and energy throughout 2010, and will next year.

On the small business side, the seeds Cisco planted two years ago -- with a $100 million investment in dedicated SMB resources -- are starting to flower, and Cisco's small business-focused releases continued to come throughout the year, from new products and services to the launch of Cisco Small Business University and a well-received 3-year, zero-percent-financing program for sub-$250,000 small business sales.

It's the midmarket, however, that's now receiving just as much play. Not long after Dave O'Callaghan took over Cisco's commercial sales unit following a long stint as its distribution chief, Cisco announced a new program, Fast Track 2, an update of its original Fast Track program designed to simplify midmarket product sales to customers between 100 and 1,000 employees.

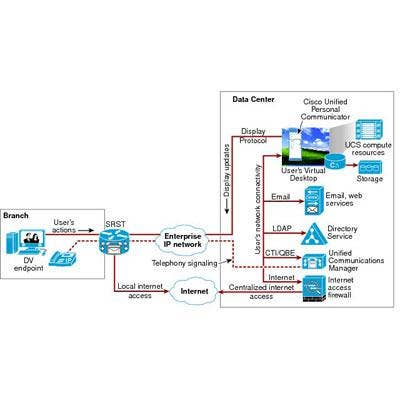

9. Virtually Cisco

Cisco used the busy November stretch for several substantial product updates, and one that really intrigued solution providers was the launch of the Virtualization Experience Infrastructure (VXI), Cisco's desktop virtualization system. VXI, according to Cisco, is designed as an enhancement to traditional desktop virtualization -- it utilizes Citrix's XenDesktop 5 and VMware View 4.5 software -- and validated within it are everything from Cisco UC products optimized for virtualized environments to the UCS.

During a mid-November press conference, Cisco executives cited the growth of video and the demands of mobility as things IT professionals can no longer ignore, and that makes "any device, anytime"-style desktop virtualization compelling. And if Cisco's proven anything in the last two years, it's that it's hardly afraid of charting new territory where many current and prospective competitors already thrive.

10. Good TIP

Cisco puts a lot of stock in the structure and facility of its channel programs, so any time it adds another incentive program --- which rewards partners extra points of margin based on deals they bring to Cisco's attention and also the types of deals they are -- it qualifies as a major event for the Cisco channel.

To the VIP (Value Incentive Program), OIP (Opportunity Incentive Program) and SIP (Solution Incentive Program), Cisco this year added TIP (Teaming Incentive Program), designed to reward partners 5 extra points if they've been qualified early in the sales process of a deal.

Check out the other biggest IT vendor stories of 2010.