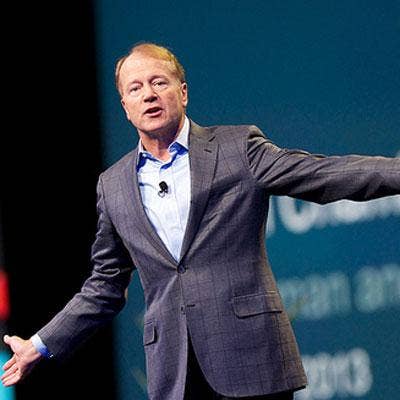

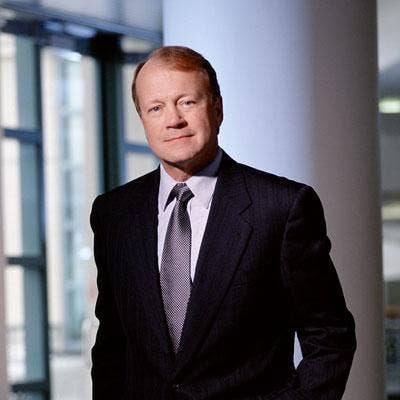

Cisco Partner Summit: Chambers Gets Candid On 5 Pressing Industry Questions

Chambers Speaks Out

Cisco CEO John Chambers has touched on topics ranging from cloud to new partner business models to the Internet of Everything at this year's Cisco Partner Summit in Boston, Mass. On Tuesday, Cisco's top executive sat down with reporters for a deeper dive into software-defined networking, Cisco's commitment to the channel and even its relationship with Huawei.

Here's a glimpse into that conversation, including Chambers' responses to some of the industry's most pressing questions.

Will Cisco Slim Down Its Partner Base In Its Quest To Become The World's No. 1 IT Company?

The answer is no. First of all, we are a family. You need to understand that's what's different about Cisco. We have been the No. 1-rated partner organization in IT and communications for over a decade in almost every periodical review there is.

Secondly, you owe an obligation to your family who brought you where you are to help them transition to the future. Now, that doesn't mean [partners] don't have to earn it ... and that's what we are sharing here today. But, unlike many of our peers in the industry, we aren't going to say 'you either make this cut or you don't survive,' or threaten partners.

They're our family. We will make this transition together.

How Is Cisco Aligned With The Networking World's Growing Emphasis On Software?

First, we will frame [software-defined networking] in terms of how it will be software plus silicon plus hardware plus services, and it's about programmability throughout the network across a $180 billion install base.

Secondly, we are going to set very specific goals, which forces us to think outside of the box in terms of how are you going to get from $6 billion in software revenue today to $12 billion? It will be part of our strategy. And, remember, $12 billion is the third or fourth biggest software company in the world, so we clearly are setting aggressive goals on this. And it means we are going to have to both recruit and develop, both through acquisitions and individual recruits, more software expertise.

What's Cisco Take On Huawei's Retreat From The U.S. Telecom Market?

So, as it relates to competition and, indirectly, to China, I think there is an opportunity to rebuild relationships both at the country level between the U.S. and China and, candidly, at the business level. There are a lot of partners we are going to work with and get closer to in China, ... [but] Huawei is going to be a competitor -- period.

In terms of our overall approach to the market, we speak of our ability to deliver customers our integrity. We've ranked at the very top level for integrity in every survey done for a decade, plus. It's a huge advantage for us.

But the key takeaway: [it] doesn't matter if your competition was HP, who everyone thought was going to beat us two years ago, or Avaya, who was a new challenger, or Huawei or Juniper [Networks], ... we aren't going to be tough with our comments on competitors; we are going to be tough in the market.

Cisco Objects To The Microsoft-Skype Acquisition In Europe. Why?

In regards to the Microsoft and Skype deal, we are not objecting to the combination. We are saying, in this industry, when you have huge proprietary strengths, you ought to have to open up and let other participants [in].

All we are saying is create a level playing field, not just for your large peers like Cisco who really speak up, but for small players who can get locked down very much. So no objection to the issue of the [Microsoft-Skype] combination, just an objection that it damages competition and creates unfair advantages when you lock out players from interoperability. And interoperability does not mean five or six clicks. It's got to be one click, because otherwise nobody is going to get through it.

So we'll see how this one plays out. I think if U.S. regulators had to do it over, they might have done something different.

Cisco Talks A Lot About Attacking The Midmarket. But What About SMB?

The majority of job growth actually around the world is with small companies with under 100 [employees]. So you'll see us focus on midmarket, ... but [we will also focus] on small businesses as well as commercial, which I consider above midmarket. So we will address all segments of that.

The very low-end -- i.e., sub-100 [employees] -- will be serviced entirely through channels, not through any pull-through type of approach. And this goes back ... to smaller resellers and channel partners, who are the best for going after that market. So this is an area we are very much interested in, and it will be entirely channel-driven.