How CenturyLink Shook Up The 2015 Infonetics SIP Trunking Scorecard

Started From The Bottom

The annual Infonetics Session Initiation Protocol (SIP) Trunking Scorecard ranks the top 10 SIP service providers in North America. While the bottom half of the rankings usually change slightly from year to year with a provider or two dropping off, or a new contender breaking into the top 10, the mainstays -- providers like Verizon, AT&T and XO Communications -- typically hold down the top of the list.

This year, however, Monroe, La.-based telecommunications provider CenturyLink made an unprecedented jump up in the rankings. The service provider scored a second-place finish this year -- a departure from its last-place finish in 2014.

CRN caught up with report author Diane Myers, research director of VoIP, UC and IMS for Infonetics Research, to learn more about this year's report. We also talked with CenturyLink and a CenturyLink partner to hear about how the service provider's new SIP strategy is helping to grow the install base of business customers. Here's what they had to say.

The Leaders Of The Pack

Verizon was once again the first-place finisher, topping the SIP scorecard for the seventh straight year.

"[Verizon] has a really good install base and clearly, they are really stable," Myers said. Verizon has been paving the way in the SIP space, and doing things that other service providers weren't doing. But now, other providers are catching up, she said.

Joining Verizon, CenturyLink, AT&T and XO Communications closed out the top four spots on the scorecard. These four providers are leading the SIP marketplace in the U.S. and Canada. According to Myers, rankings are based on specific criteria, including the number of IP connectivity lines, or trunks, the financial stability of the provider, and the service capabilities and support options.

CenturyLink's Ranking Explained

CenturyLink's silver medal finish was the biggest highlight on this year's SIP scorecard. Its unexpected jump in the rankings is thanks to the improvement of its financial stability and the growth in its install base, Myers said. The provider also placed more strategic importance on VoIP services this year, she added.

"CenturyLink has really made some strong improvements," Myers said. "These [improvements] really pushed CenturyLink to the forefront this year. Overall, the education of their sales force and working with partners has absolutely really helped them expand."

CenturyLink's New Take On SIP

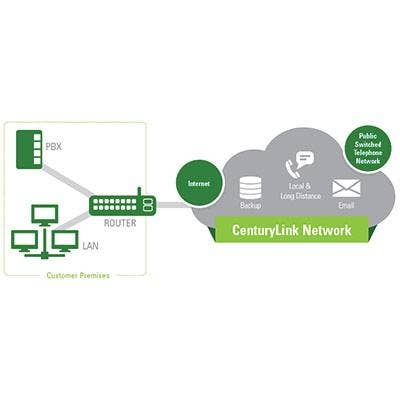

CenturyLink rolled out a new SIP offering, CenturyLink IQ SIP Trunk, in January 2015.

CenturyLink used to provide SIP trunking using technology from Sonus, a service provider. But the Sonus-based platform didn't allow for any feature-rich capabilities, like cloud-based voicemail or fixed line to mobile call answering, said Ted Fitzgerald, manager, strategic voice products for CenturyLink.

CenturyLink's latest SIP platform is based on service provider BroadSoft's technology, BroadWorks. CenturyLink IQ SIP Trunk can work with any hosted VoIP product, whether it's from CenturyLink, Avaya, Cisco or Microsoft.

"It's a way for customers to save a lot of money, and get a lot of new, cloud-based features, even if they are using an older PBX," Fitzgerald said.

BroadSoft Versus Sonus

Many SIP providers were using the BroadSoft platform before CenturyLink, according to J.R. Vernick, president of Clinton, N.J.-based RDS Solutions, a telecom services, consulting and management provider and CenturyLink partner.

The move to BroadSoft was most likely instrumental in helping CenturyLink's ranking improve, Vernick said.

"There were some features they couldn’t deliver, like the ability to fail off their network to another provider if [the CenturyLink] network went down," he said. "Every time we would tell a customer that, they'd want to go with another provider because that's a big deal."

Selling SIP

RDS Solutions helps business customers navigate the differences among several SIP providers, including Verizon, Level 3 and CenturyLink. RDS Solutions offers MPLS and SIP solutions, and SIP sales account for about 20 percent to 25 percent of RDS' business, Vernick said.

Demand for SIP has been growing at a steady clip for the past two years. CenturyLink's strong network, coupled with its new SIP strategy, is allowing partners like RDS to sell more of the provider's services. It also puts CenturyLink on par with providers like Verizon and Level 3 from a technology standpoint, he said.

"We wanted to be able to do more with [CenturyLink], and now that they changed their platform, we can," Vernick said. "There's no question that this puts [CenturyLink] on an even playing field, where I didn't think they were before," he said.

CenturyLink's Soaring SIP Sales

CenturyLink is seeing rising sales for its IQ SIP Trunk solution, especially as businesses move from TDM to VoIP, Fitzgerald said.

CenturyLink initially announced IQ SIP Trunk to its channel partners two months before it was made generally available, he said.

"We invested a lot of energy into this product … [and] we got a lot of preorders before we were ready to go to market," Fitzgerald said. "The channel was involved from Day 1."

Partners Are Propelling SIP Sales

Myers agrees that the channel is starting to get involved with SIP sales by bundling SIP trunking services with unified communications systems and traditional PBX solutions.

"Partners are definitely helping a number of companies grow the SIP market, and build awareness or educate customers on SIP trunking," she said.

The Infonetics SIP scorecard can help partners determine which providers they might want to work with in order to resell the most in-demand SIP services, she said.

The Closers

Fusion, IntelePeer, Level 3, Sprint and Windstream finished out the bottom of the top 10 list. Cox Communications also joined the rankings this year, while service provider Bandwidth dropped off the scorecard. While the larger vendors will most likely hold tight to their spots at the top of the list thanks to their install bases, there is always room for change toward the second half of the list, Myers said.

"There's a lot of small companies getting into this space and doing interesting things, so we could always see some more shakeup at the bottom," Myers said. "SIP isn't commodity yet, but it's not far away," she said.