CRN Exclusive: Cisco's New CTO Explains His Technology Road Map And Why Partners Should Focus On Containers

Cisco's New CTO Talks Technology Road Map

Cisco Systems' most successful partners understand that learning what the networking giant's technology road map is will eventually lead to greater profitability. No one knows this road map better than its new chief technology officer, Zorawar Biri Singh.

In an exclusive interview with CRN, Singh explains Cisco's vision for hyper-convergence, how the world will think of Cisco "as a cybersecurity company" and the networking leader's future involving containers in the data center.

"We're going to build a container-friendly stack, leveraging UCS, storage and networking. We're going to add open-source community software on it," he said. "The traditionals -- the HPs, the Dells -- are stuck dealing with server decline on the traditional model. So there's a fantastic opportunity for us and our partners."

Talk about your cybersecurity strategy for Cisco.

Our strategy that we keep executing on is building an overall architecture. Then, our brand [will be] significant enough, large enough, where I think you can start thinking of Cisco as a cybersecurity company -- but that's a long way off and [there is] a lot of work to be done.

Cybersecurity is pervasive everywhere.

The buying function for cybersecurity is very different than network security. In network security, we go in with a very targeted message to the [chief information security officer] and the IT networking security team to say, "Hey, look, these are the things you're buying." But typically in enterprises or across any organization, cybersecurity is a horizontal project. It's at the sponsorship of the CEO or global head of security, and it's a project that spans across the organization. So for Cisco, the opportunity is, it's a whole new buying function. There's a higher degree, a much bigger market.

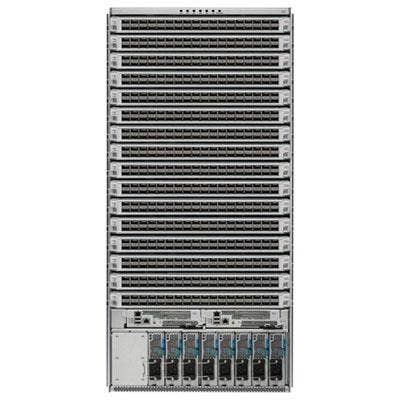

Historically, Cisco has not been known for low-priced hardware. Does the new Nexus hardware signal a shift in the strategy going forward? Are you trying to hit that price conversation a little more?

What we're really doing with merchant silicon -- and we're the largest consumer of merchant silicon -- is we're solving for certain packaging, whether its 10/25/40 Gbps. Then we do our own development and we can achieve price performance sort of metrics that we think are far superior -- which allows us to now mix and match the offerings across speeds and feeds, and also features that are part of it, in a much more sophisticated manner.

To me, it's about providing more choice and us really filling out all the price points. It's about price elasticity and figuring out, "Where is there more room to get price-performance ratios better?"

There [are] also philosophical points here -- merchant silicon versus highly specially designed, well-engineered ASIC. It just depends on what customers want. So our view [is], let's give them the best of choice.

Many of Cisco's top technology leaders have left recently -- you replaced Padmasree Warrior as CTO, Pankaj Patel is leaving. What would you say to partners who might be worried that Cisco lost so many technology leaders?

I'm an IBM/HP guy, but I'm also a startup guy. … I've been here seven months, I'm focused on who's here and the direction forward.

The IT industry and our channel partners in general, the degree of disruption, the pace of disruption, the frequency of disruption, is far more significant than it's ever been.

There's no more frequency of departures or entrees than any other company out there. There's no exception to that. I think [the Cisco departures are] pretty average and normal for the industry.

We haven't really heard much about containers from Cisco before now. How will containers become relevant in regards to the potential data center threat coming from public cloud?

You've got public cloud emergence since 2008. The big three are going to go from about a $10 billion run rate to a $50 billion run rate in the next four or five years. People say, "A big chunk of that is workloads moving off data centers moving onto public cloud." Which it is, but it's not all of that, because there's a bunch of new cloud-native development happening as well.

So you've got dollars shifting from on-premise to public cloud. There's this other market, X-as-a-Service, where you have every next-gen service going to be written on this. At large scale, 40,000 or 100,000 [virtual machines] on public clouds, are actually going to come off. Over the next five years, 30 percent of big, big deployments will actually come off public cloud onto an on-premise, container modern data center stack.

Why will they leave the public cloud?

Three reasons.

One, at scale, 40,000 to 100,000 machines is very expensive. Running that kind of scale of an application is actually prohibitively expensive on public cloud.

Two, the IT administrators will now see a modern stack that has evolved that they can now build and run a lot clearer and simpler than they could five years ago. DevOps skills have come along, and the ability to deploy container infrastructure has come a long way. So it's a lot easier to deploy a modern architecture today than it was 24 months ago.

Three, once they figure this out, they actually realize they run it at a better efficiency, because you can optimize their workloads and things like that.

I'm a huge believer that the hybrid cloud market, on-premise infrastructure, modern container stacks, [is] going to be massive in this next generation world of massive processing. Data centers won't be big, goliath data centers, or they won't be like Facebook, or Amazon, or Google, because those workloads are massively scalable. … You'll see much more smaller, modular data center models emerge.

So why is Cisco making a big deal about containers now?

Containers are much more efficient and simpler and cheaper to use. … There's enough companies innovating on containers and enough open source out there where the modern view is, "We're no longer going to develop on VMs. We're just going to develop on containers."

This is also changing the programming paradigm, so now a container on a bare-metal server can run and it can be wound down without needing the software.

Why should Cisco partners care? What is Cisco going to come out with?

What we're going to do at Cisco is we're going to take Cisco UCS, we're going to take storage and we're going to take our networking model -- which is ACI, which our partners know really well -- and we're going to package that together tightly coupled with an orchestration layer on top. It's going to basically leverage ACI, SDN modeling.

So we're getting compute, storage and networking to work together, rather than separate.

So for Cisco, we're going to build a container-friendly stack, leveraging UCS, storage and networking. We're going to add open-source community software on it. CliQr will go in on top, because it adds a higher level of management. Then we're going to burn the whole thing in and Cisco-certify it.

What does it mean for Cisco customers?

They're now getting what we think is a very modern container stack -- future-proof for how Web-scale production will be built. And they're going to get Cisco backing it with our channel and our full force behind that.

Very few companies and vendors are set up to actually take care of that opportunity. The traditionals -- the HPs, the Dells -- are stuck dealing with server decline on the traditional model. So there's a fantastic opportunity for us and our partners. It allows channel partners to keep building a set of data infrastructure business with Cisco.

When will that stuff be ready?

I can't give specific dates, but I think you'll see us previewing some version of the stack here this year. Stay tuned. I'm super excited.

Cisco has a long list of recent acquisitions. Is there one you're most excited about as far as having the biggest impact technology-wise?

I'm excited about all of them. Seriously, there's a lot of thought and design points to each one. I'm passionate about each one because I think they have significant upside for the company. It would be very unfair to everyone else if I were to name one.

[For our acquisitions], it's not like we go, "Oh yeah, we just did that. We don't know why." No. Since I've been here, the decision science behind each acquisition has been pretty thorough.

How does Cisco's new HyperFlex offering stack up to Nutanix and SimpliVity?

I'm not one that talks about competitors in general. I sort of respect everyone in the industry. I'm an old school Michael Dell fan, which is, the best way to measure it is customer count. I can't speak for SimpliVity or Nutanix, where they are and how they're doing. They've clearly done well. They've innovated. I know both teams and they have fabulous people.

For us, the argument is pretty simple: We have a pretty large install base that was super interested in having a hyper-converged piece. We went through and evaluated our options and we landed on the team at SpringPath.

S o what is Cisco's approach to hyper-converged?

Our approach is, we have 50,000 UCS customers that have bought the UCS vision, the UCS blade story. They're looking at us saying, "Hey, we have invested in the UCS design point. Where can you grow us from there?" What they're looking for is the [total cost of ownership] argument.

We're trying to frame the story in hyper-converged as, it's one of our offerings of the traditional, through container stack pieces, that we're doing that is storage-specific. It's going to do really, really well. Especially when you couple it with the fact that we have an understanding for UCS where you're going to see us expand the UCS sort of Web-scale object-storage use cases, especially in big data and streaming analytics.