8 Reasons To Not Be Bullish About Juniper Networks After 'Disappointing' Quarter: Wall Street Report

Tough Road Ahead

Financial firm UBS isn't bullish about Juniper Networks' financial outlook after what Juniper CEO Rami Rahim said were "disappointing" first-quarter earnings.

"Before we downgraded [Juniper] recently, we had been willing to hang in given product introductions across segments," said Steven Milunovich, the lead UBS analyst in a report about Juniper. "Now it appears that much of the upside this year may have evaporated."

Milunovich and channel partners weighed in on eight difficulties Juniper is facing that could prevent the Sunnyvale, Calif.-based networking vendor from growing, including softer refresh cycle demands, more pressure in the switching and security market as well as lacking a "strong channel."

Enterprise Woes

Juniper's service provider growth in its recent earnings was offset by a more than 10 percent drop in enterprise revenue, from $350 million to $313 million year over year for the first quarter of fiscal year 2016, which ended March 31.

There are many reasons for Juniper's enterprise slide, according to UBS, including increased competition, in which Juniper is at a disadvantage because it does not have a wireless LAN portfolio of its own, as well as its own cutback in security.

"The company has pulled back on more expansive security plans, which is a key spending area for the enterprise. As a result, we don't see Juniper growing revenue meaningfully in the enterprise," said Milunovich.

The vendor's service provider business has grown from about $2.6 billion in annual revenues in 2010 to $3.3 billion in 2015, although its enterprise business growth has been stagnant. In 2015, Juniper enterprise sales were $1.6 billion, the same as in 2011.

'Lack Of A Strong Channel'

UBS said it believes the main reason for enterprise sales stagnation over the past five years is because of "the lack of a strong channel."

"Cisco has strong enterprise channels and a broad product portfolio that can change sales conversations to being more architecture-focused," said Milunovich. In 2015, Juniper reported to CRN that it had 11,650 total North American channel partners, while Cisco reported 20,500 partners in North America.

One executive from a solution provider that is a longtime Juniper partner said Juniper isn't lacking in channel expertise, but rather in go-to-market strategy and marketing efforts with its channels.

"It's about getting out to the marketplace with the channel better," said the executive, who declined to be named. "There needs to be some market extension and market planning with the channel. … Because we are winning more in the enterprise when we go against a Cisco shop. I say we have a 50-50 chance. Where a few years ago, that was not the case."

New Product Refreshes Won't Be Too Meaningful

Although Juniper has been undergoing several product refreshes recently, UBS doesn't believe it will make Juniper a "meaningful player" in the switching and security landscape.

The bulk of recent switching growth for Juniper has come from data center switching; however, campus switching accounts for 44 percent of switching revenue. UBS says customers are increasingly buying campus wireless and wired products together, putting Juniper at a disadvantage despite wireless partnerships, according to UBS.

"We see growth in data center switching being offset by losses in campus switching. On the security front, Juniper has pulled back from more expansive ambitions and now focuses on network security. The security segment should return to growth this year but Juniper likely remains a small player in both markets," said Milunovich.

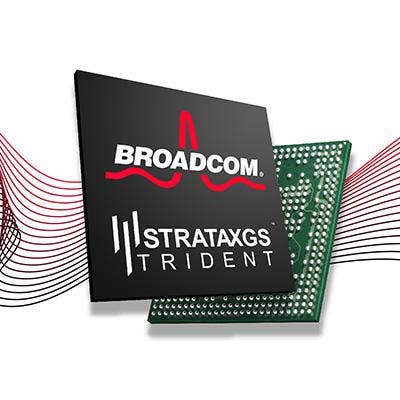

Jericho-Based Platforms Impacting Juniper

Advances in merchant silicon are continuing with semiconductor vendor Broadcom's fabric-based Jericho chip, which is now targeting edge routing. Jericho chips have Layer 3 features that allow some routing functionality to be incorporated by cheaper switches, according to UBS.

"We see it gradually impacting Juniper starting in 2017," said Milunovich. UBS says 80 percent of what Juniper sells to hyperscalers is routers, which means up to $600 million of revenue is at risk of TAM compression from Jericho in the long term.

Soft Demand For Older SRX Products

Although Juniper has been revamping and reinventing its SRX series, there is soft demand for older SRX products in the low and midrange market, according to UBS, which caused security revenues to drop 37 percent, to $73 million. in its first quarter year over year.

During the earnings call last week, CEO Rahim said Juniper is taking "a bit of an aggressive stance towards end-of-lifeing some of our older SRX products with the goal of ensuring that we have maximal capacity -- engineering and go-to-market -- to think about the newer products, the next-generation products."

The solution provider executive said Juniper's revamping of the SRX and next generation firewall platform is starting to resonate with customers, although Juniper needs to be clearer on its security message.

"We're looking for some information around specifically talking points on security. What are they going to do moving forward to really support the security technology?" said the executive. "They have to make sure they're supporting the products and their sales people so they can be effective out there in the market.

Security Market Competition

Competition in the security market is heating up, especially from networking rival Cisco, which has made security one of its biggest priorities.

"We see the security industry as highly fragmented, lending itself to security-focused vendors or larger companies like Cisco," said Milunovich.

Juniper's overall security revenue has declined in each of the past five years, losing share to the vendors such as Checkpoint Software Technologies, according to UBS data.

More Routing Pressure

Networking rivals Cisco and fast-growing startup Arista Networks are putting more pressure on the routing market, which accounts for nearly 50 percent of Juniper's overall revenue.

Both Cisco and Arista both announced Jericho-based products, targeting the data center interconnection (DCI) market, in which full-fledged routers are used but not always required. The Jericho chip from Broadcom embeds more routing features than its predecessors. UBS says Arista also has the capabilities to develop a routing stack and attack the broader edge-routing opportunity.

Juniper's core routing revenue has been roughly flat for the past six years, according to UBS data.

Juniper's Outlook

Routing accounts for 46 percent of Juniper's overall revenues, followed by services, at 31 percent, then switching, at 16 percent, and security at 7 percent. For its most recent quarter, Juniper's routing remained flat, at $504 million; security was down 21 percent at $73 million, services were up 14 percent, to $345 million; and switching was up 5 percent, to $176 million.

"We see structural reasons to expect Juniper's switching and security growth to remain under pressure," said Milunovich. "In the long term, we worry about competitors attacking the routing market with Jericho-based switches, compressing TAM.

Juniper's guidance for its upcoming second quarter is revenue of $1.19 million, plus or minus $30 million, compared with first-quarter revenue of $1.1 million. The vendor has a market cap of $8.8 billion