10 Companies Analysts Say Cisco Could Buy Next

Who's Next?

Cisco Systems spent billions acquiring seven companies in 2016, right after it made 11 acquisitions in 2015. This month, Cisco unveiled its plan to buy artificial intelligence and machine learning specialist MindMeld for $125 million, as well as software-defined WAN vendor Viptela for $610 million.

The networking giant is on pace to acquire several more firms before the end of 2017, according to analysts, even after spending $3.7 billion on AppDynamics earlier this year. CRN breaks down the 10 company's that analysts are predicting that Cisco might acquire next and why it makes sense in the various markets the vendor plays in.

Cylance

CEO: Stuart McClure

Founded: 2012

Headquarters: Irvine, Calif.

One of the fastest-growing private cybersecurity companies, Cylance would highly compliment Cisco Tetration – the company's breakthrough analytics data center solution, according to Zeus Kerravala, principal analyst at ZK Research.

"Their [artificial intelligence] driven security, all software, compliments Tetration and Cisco's overall security strategy," said Kerravala. "Tetration makes a ton of data in the data center, and you could easily see how Cylance could leverage that data and how Cisco could leverage Cylance machine learning algorithms to create a one-plus-one equals three."

Cisco's latest acquisition, MindMeld, revolved around AI targeting the unified communications and collaboration space.

Puppet

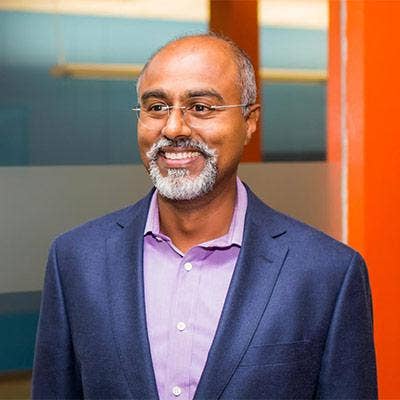

CEO: Sanjay Mirchandani

Founded: 2006

Headquarters: Portland, Oregon

Analysts said one of the most interesting acquisitions Cisco could make in 2017 would be of open source software specialist Puppet. However, the only way Cisco could afford the vendor is if President Donald Trump's tax repatriation plan actually happens, said analysts, which would allow Cisco to repatriate its more than $60 billion overseas capital back into the U.S. Cisco CEO Chuck Robbins said this year that if President Trump follows through with his proposed repatriation plan, it would spur "a combination of dividends, buybacks as well as M&A activity."

"Cisco has become more of a developer-influenced company, and Puppet's got a huge developer-base. It could role very nicely into the whole [Cisco] DevNet program. In many ways, it becomes the thing people care about and then you can use it to pull through other equipment and maybe minimize the impact of VMware presence in the data center or Docker down the road," said Kerravala.

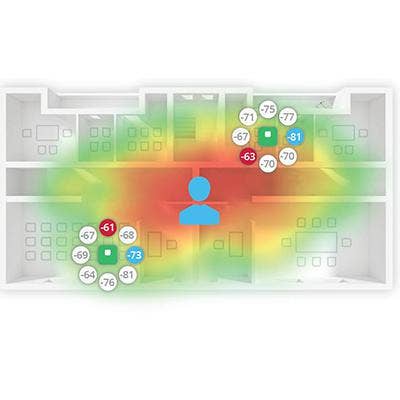

Mist Systems

CEO: Sujai Hajela

Founded: 2014

Headquarters: Mountain View, Calif.

A more traditional selection from analysts was networking startup Mist Systems, which was founded by former Cisco executives. The network leader has also invested in the startup.

"Cisco definitely needs to look for innovation in the Wi-Fi space, they're losing market share and really flattening out in terms of growth," said one analyst from a global IT research firm, who did not wish to be identified. "For the non-Meraki side of the house, customers are maybe starting to see Cisco as stale in wireless and not able to keep up with the younger, cooler innovators in the space. Mist does have a really cool virtual BLE technology. They're really good with location-services, which is something Cisco has been trying to make a big part of their value proposition with mixed results."

Five9

CEO: Mike Burkland

Founded: 2001

Headquarters: San Ramon, Calif.

Cloud-based contact center specialist Five9 who could enhance Cisco's more traditional contact center business.

"This is a no-brainer for Cisco," said Kerravala. "The one area that is still lagging is their contact center. They have a very traditional contact center business, but that market is moving to the cloud. Cisco isn't very far down that journey."

Kerravala also said Five9 is a high-value business. "If you look at the revenue that they get per contact center, per seat – they're at the very high end of $200 per-seat on average. For Cisco who drives high value, high margin, it's a natural fit," he said.

FireEye

CEO: Kevin Mandia

Founded: 2004

Headquarters: Milpitas, Calif.

Although rumors of Cisco acquiring FireEye have sprouted up in the past, 2017 is the year the network leader should make its move.

"At $85 bucks a share, Cisco's not buying them. At $50 bucks a share, they're not buying them. Even at $14 per share, they're not buying a year ago. But since Mandiant came in, that Helix database they put together, I've spoken to customers, and they love the thing," said Kerravala. "It's one of the richest data sets out there for threat information around the globe and Cisco is a global company with big customers … If Cisco ever wanted that technology – not the sandboxing, but the stuff they got from Mandiant – now would be the time to acquire them."

FireEye's stock hit a high of $85.64 per share in February 2014 but has been steadily declining since – hitting a low of $10.40 per share in March.

Avi Networks

CEO: Amit Pandey

Founded: 2012

Headquarters: Santa Clara, Calif.

Founded by former top Cisco executives, analysts said application deliver controller (ADC) specialist Avi Networks would be a great match with Cisco in container networking.

"Citrix, for example, took their virtual product and shoved it into a container, but I don’t believe that's what the world needs. You need to build a product where your ADC services become individual containerized services that you can spin up and down," said the global research firm analyst. "Avi created a distributed platform that uses containers to be able to spin up and down ADC services really quickly. In this multi-cloud world – and the hybrid cloud Cisco promotes all the time – the ability to apply those application services where and when the customer needs them in a lightweight, fast way, Avi does that better than maybe anyone."

The startup is aiming to become a 100 percent channel company, launching its first ever global channel partner program in July.

Radware

CEO: Roy Zisapel

Founded: 1996

Headquarters: Tel Aviv, Isreal.

Security data center vendor Radware already has an OEM agreement with Cisco around distributed denial of service (DDoS) and firewalls. Acquiring Radware would give Cisco more firepower against competitors in the space such as Palo Alto Networks and Fortinet, according to analysts.

"Buying Radware would bring Cisco more into the next generation firewall fold," said Kerravala. "If Cisco really wants to be that end-to-end security vendor, you could argue they need an NG firewall. And I think pound-for-pound, the Radware product is as good as your going to get and their evaluation is probably a quarter of Palo Alto Networks."

NS1

CEO: Kris Beevers

Founded: 2013

Headquarters: New York, NY

The DNS-focused and traffic management startup NS1 would fit well inside Cisco's OpenDNS technology as well as its Digital Network Architecture (DNA). The networking giant is striving to boost DNA's capabilities, which is a key reason why it's acquiring Viptela.

"Customers are recognizing that DNS management is a important part of network infrastructure to guard against things like DDoS attacks and make sure resources are efficiently allocated because with so many more IP endpoints being critical to the business, you have to have efficient management of DNS resources on all sides," said the global research firm analyst. "I've seen Cisco with DNA. They've mentioned causally some DNS [and] DHCP integration, so I could see building out that story through an NS1 acquisition."

SpringPath

CEO: Terry Cunningham

Founded: 2012

Headquarters: Sunnyvale, Calif.

The hyper-convergence software startup formed a strategic partnership with Cisco to build its hyper-converged infrastructure solution HyperFlex. Analysts said Cisco should turn up the heat in the market by acquiring SpringPath this year after Hewlett Packard Enterprise purchased hyper-converged rival SimpliVity in February.

"Cisco will eventually buy them. The reason they haven't yet is because that market is still evolving," said Kerravala. "You could argue that Cisco is the only major data center vendor – maybe besides Lenovo – that doesn't have their own HCI technology."

Cloud4Wi

CEO: Andrea Calcagno

Founded: 2013

Headquarters: San Francisco, Calif.

Named on CRN's 10 Coolest Networking Startups Of 2016, Wi-Fi specialist Cloud4Wi owns a cloud-based services platform.

"Customer-engagement over Wi-Fi is a compelling part of today's Wi-Fi story. So how do you turn a network from a cost center to a profit center, and how do you use that underlying network infrastructure to bring about new revenues, new products and services," said the global research firm analyst. "One of the best Wi-Fi monetization platforms out there is Cloud4Wi."

In April, the startup joined Cisco's Solution Partner Program, which unites third-party independent vendors with Cisco to deliver integrated solutions to joint customers.