CRN Exclusive: Tech Visionary Melkote On Aruba's Upcoming SD-WAN Breakthrough, 'Autonomous' Networks, And Why He Is Not Worried About Cisco Catching Up

Unleashing The Next Wave Of Aruba Innovation

Keerti Melkote, senior vice president, general manager and co-founder of Aruba Networks, the Hewlett Packard Enterprise subsidiary driving the intelligent edge Internet of Things revolution, spoke with CRN about the next wave of innovation coming from the wireless market leader, including an upcoming SD-WAN offering, a new era of autonomous networks, and why he is no longer worried about Cisco catching up.

Melkote's technology vision has propelled Aruba to the top of the wireless networking world and now into the core of the network with the new Aruba 8400 switch and OS-CX operating system. Now, Melkote is planning the next wave of innovation including an SD-WAN offering that is aimed at bringing wireless networks and wide area networks together.

"In the past, the enterprise used to be campus, branch and data center and you connected them together," said Melkote. "Today that data center is no longer just a data center. It is a VPC [virtual private cloud] sitting in AWS somewhere. It is Azure. It is SaaS. Your applications are all over the place. And if you look at how you connect to those applications, you have campuses, branches, telecommuters, remote workers, mobile workers. So you have to bring the distributed nature of everything together over private networks and the internet. That is the piece that is not yet solved. That is what we are going to bring to bear. We are going to bring the whole thing together."

As you push the vision forward for intelligent edge, what is the next big software innovation you are thinking about?

The next big software innovation is going to be around creating a software-defined end-to-end enterprise network that includes the wide area. Today we are inside the local-area network. We are doing Wi-Fi and LAN. Even with the Aruba OS-CX and 8400 [switch], we are completing the LAN story.

The one piece we are going to add in the next few months is to integrate the wide-area network. You might have heard of the term 'SD-WAN.' SD-WAN to me is a feature of a broader architecture. We are going to embed SD-WAN capabilities and make the whole thing sing. So you make the LAN and the WAN all come together in one architecture.

What does the SD-WAN product launch mean to customers and partners?

It is going to be a product. It is going to be added to the architecture from a software perspective. It will be multiple things.We are going to talk about how do you build a whole network.

Think about the enterprise. In the past, the enterprise used to be campus, branch and data center and you connected them together. Today that data center is no longer just a data center. It is a VPC [virtual private cloud] sitting in AWS somewhere. It is Azure. It is SaaS. Your applications are all over the place. And if you look at how you connect to those applications, you have campuses, branches, telecommuters, remote workers, mobile workers. So you have to bring the distributed nature of everything together over private networks and the internet. That is the piece that is not yet solved. That is what we are going to bring to bear. We are going to bring the whole thing together.

What is the differentiation with the Aruba SD-WAN versus the rest of the market?

Customers don't like silos. You go buy an SD-WAN from a startup and you are building an operational silo. You may have an operational silo for wireless. You may have an operational silo for edge LAN. And you may have an operational silo for core LAN. Customers are tired of silos. They want one architecture that spans everything -- that embraces the future, which is about mobile and cloud. How do you bring that together? That is the new world. To me there is nobody that has a [complete] unified architecture that is mobile-first and cloud-first. That is what we are going to do.

When you look at software-defined networking, how does the Aruba approach compare to VMware NSX or Cisco ACI?

Most SDN technologies today are aimed at virtualizing data centers, which is why it is VMware and Cisco. Nobody is thinking of what it means to the edge. We are coming at it from the intelligent edge side, asking how do you take users, devices and IoT and bring it to the core. It is a very different approach. And it is, frankly, a much bigger problem and a much harder problem that we are trying to solve. I believe with the innovation path that we are on we have put a lot of distance between us and Cisco. You will see us continue to innovate and expand the distance. What we aim to do is to give our customers that mobile-first, cloud-first, secure IoT architecture they can take into the future.

What is at stake for customers as they make this decision on how to architect their networks for the mobile-first cloud-first era?

Fundamentally, Aruba has differentiated itself as an organization from the beginning as a customer-first, customer-last organization. We have to listen to what customers want to do and deliver what they need and then the business follows. We are hearing very clearly from them: They are embracing mobile and cloud. They want an architecture that embraces the two. For us we can innovate as a greenfield vendor in a pure-play manner. If we had a lot of legacy behind us it would be hard to give it all up and say we see the future and are going to give it up and go there.

Very few organizations are able to put the past behind them and look at the future. That is the innovator's dilemma that every large organization goes through. We are frankly taking advantage of that. We have to keep that customer-first, customer-last spirit alive. As long as we keep listening to what they want and delivering value to them, the business is going to follow.

What is the Aruba secret software sauce?

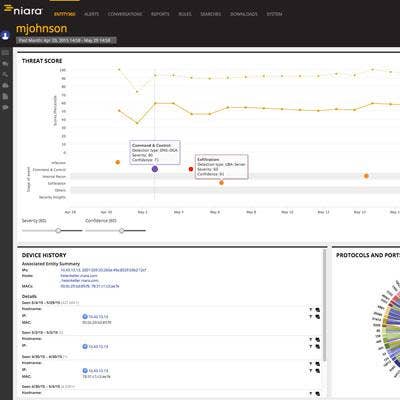

The secret sauce comes from analytics and security. People look at applications and the long files that the applications generate to figure out what security issues are: Nobody is looking at the traffic and seeing what are the security issues inside the network. We have a lens into the traffic, which basically feeds the traffic to a Niara processor and we have built sufficient compute inside the switch to reprocess the data, feed it to Niara and then Niara makes sense of the data and tells you if there is an anomaly with a user or device behaving badly. By doing that you can now use the network as a security tool, not just as a tool for moving packets. We had to rethink everything to do that. The network had to be instrumented to give the data to an analytics engine like Niara.

In the past, we never built networks for that. We built networks for moving packets. So we had to design it from the ground up to look at every packet rather than just pass the packet through. That required a different approach.

Why is Niara a critical piece of the Aruba network core story?

Niara is part of the solution. Aruba OS-CX is a sensor. Niara is a sense maker. Those two come together. There are two pieces that come together: Niara for security and Rasa, which we acquired as well for performance analysis. It is not simply software. It is learning software. Everything has to learn. That is the new mantra for us. We used to build smart software. We are going to build learning software now.

How is adding learning software to the core of the network going to make networks better?

To me, the entire world has to start learning. If you look at Google search, it is a smart search now. It knows what you looked for in the past and based on that its recommendations are based on what it knows about you. It is proactive. It is thinking. Cognitive, AI [artificial intelligence] and machine learning are all the buzzwords. But, fundamentally, it is about figuring out from your history what you are going to do in the future. That is what learning is about. Networks don't learn. Networks just pass packets.That is it. That is where we felt we needed to change the network. Passing packets is a fundamental duty of the network, but it also needs to learn so that we can proactively tell you when the network capacity is declining or there is a security anomaly – letting you know what is going on so you can take care of it.

If you look at the future, learning leads to autonomy. To me, learning is the first step. Smart was the past. Learning is the present. Autonomous is the future. That is where we go.

Can Cisco move the network forward at the mobile campus network edge?

The edge is where the action is, and they are ignoring it. And AppDynamics is not going to do it either. Meraki is probably the only edge thing they have. The one area we do compete with them at the edge is Meraki. That is about it. But Meraki is in the branch office -- not in the campus. In the campus, it is still large-scale networks. I think the innovations that we have brought to the table successively over the last three years starting with Aruba OS 8.0 fundamentally changed how wireless LANs are built. Then we added Rasa to create the predictive analytics aspect of it. Then we added Niara to create the security piece and then Aruba OS-CX to continue to drive intelligence at the core. So you can see the pattern of how we took what was in the past and transformed it to learning software.

How do you make sure the Aruba engineers keep innovating?

We have a fairly simple contract with our engineers. It is a four-part contract: have fun, make money, make an impact, learn and grow. That is it. We empower them to go do that. We don't get in the middle. You talk to any Aruba employee. They are empowered to go make a difference with this customer-first, customer-last message in mind. For them individually they grow as the business grows, their careers grow. As the business grows, the rewards grow. As the business grows, their impact grows. And we all have fun doing it. It is great to be part of a system like that.

What do you think of Cisco buying AppDynamics?

I did not know how it fits, to be honest with you. AppDynamics is a good company. It is going to be a part of Cisco. I don't know how it fits into the strategy. I just cannot explain it. Cisco should do the explaining to the customer base as to how it fits into the overall portfolio. They are certainly a very large company and looking to diversify. I am not sure if that is part of the strategy. But it is not a networking play, that much I know.

Does the AppDynamics deal signal a fundamentally different market for them?

That is a piece that I don't understand. AppDynamics is an application-orchestration-type play. Maybe it is an expansion strategy going into that direction. I certainly know it is nothing to do with networking. Networking is about mobility, cloud and security.

Are you recruiting Cisco partners to bring the new Aruba 8400 switch with the OS-CX operating system to market?

They are coming to us. When you see somebody winning, you start to move in that direction. Our partners that have been with us for a long time have been at the forefront of the journey with us. They are going to get the most of it because they have been on the journey. They know how to get the most out of it. They know how the game is played and how to win. HPE partners are the next sort of big bucket for us. That is why we came to [HPE] Discover to educate the broader population of HPE partners. Those partners sell Cisco gear as well. They are all multivendor.

Why would they want to pick HPE Aruba over Cisco? It is ultimately the ability to build a profitable business for themselves. To me, the only way to do that is by showing value every day.

What is the enablement plan to have Aruba partners attack the core Cisco network?

Cisco is overdistributed in the market. So as a partner if you are selling Cisco, you are doing nothing different than the guy next door. You may move boxes, but you want to make profits. What our partners are telling us is they want to drive business with protitability and growth.

What we are saying to partners is you can stick with the old architecture or go to the new architecture. It is a different way. It is software-driven. It is not moving boxes. What software allows you to do is not only install the architecture but create a long-term business around it with a sustainable recurring revenue model. That comes from applications, whether it is adding a mobile unfied communications application, location services or asset tracking. That is the future. It is about software.

How is the recurring revenue model played out at the edge and how it will play out in the core?

The business model has to be disruptive to the incumbent. In this case, it is Cisco. Clearly, wireless is disruptive. Cisco simply won't go there because it is very disruptive.

Secondly, it has to be economically beneficial to the customer and add more value at the same time. Going mobile-first you are truly saving money by not pulling more cables or installing as much of a chain. As you migrate to mobile, you are adding more services. That is the business model: You save money and whatever money you save you apply to new services. The money does not go away. The budgets are the budgets. It is what you use it for:Iinstead of 90 percent hardware, 10 percent software, it is 50-50 now.

What are you seeing from customers who are embracing Aruba at the core versus Cisco?

They are used to a networking model that used to be set and forget. Go set it up, don't touch it and then just move on. It was OK for an era where things didn't change. What is happening now is things are changing at a very, very rapid pace. Wi-Fi devices are coming in. IoT is happening. Security is an issue. They are looking at how can they take this old architecture and try to layer Band-Aids on top of it or go to something new that gives them end-to-end control that is programmatic, that allows them to stay on top of the changes that are happening. And if you can do it and save money, that is a huge win-win. They see that their users are already mobile, have security issues, Band-Aiding whatever they have and at some point it is going to break. They want to think new and fresh.

What is the value proposition with the new Aruba 8400 core switch?

With the 8400 what we are doing is saying is you can modernize the whole network starting with the access points, the access switches and the core switch with the same consistent [Aruba] software. That is the biggest win. Customers are used to very siloed models – how they manage wireless is different than from how they managed wired, different from how they manage the core. You may have a [Cisco] Catalyst at the edge, [Cisco] Aeronet as an access point and different operating systems. They are tired of that.

This is a new market for us. It is very measurable. It is a $4 billion TAM [total addressable market]. It is a very profitable, high-margin business that can differentiate our partners.

Why has the core of the network remained stagnant for so long?

It is essentially more of the same. The core is a pretty important part of the network. It is a stabilizing area for the customer so they don't change it often. But I think there is a tipping point that they reach: If their traffic is still wired-centric there is no point in changing the architecture, but if they are going mobile they are changing things anyway. So it is time to really rethink what is happening in the core. To me it is that innovator's dilemma. The innovation was 20 years ago. Once you put it in there it is very difficult to get rid of it and pull it out. This is very classic high-tech disruption that we see going on.

You recently introduced a new asset tracking solution. How big is that total addressable market?

Asset tracking most people don't know is a $5 billion TAM. The reason most people don't know is it is very proprietary and very fragemented. It is very proprietary technology with RFID, passive and active. Companies have tried to play there and customers have rejected most of these solutions because they were not done in a cost-effective manner. Now what we are doing is adding asset tracking as an application on the network. Now apps start to move to the network in a mobile way. This is where we see the value. It is directly tied to the network. Yes, it is an application, but it is an application on the network.

How many more applications will we see coming from Aruba for partners to make money?

That is where the future is. We are going to bring them more apps like asset tracking. Another application idea is creating a brand-new conference room experience. We have partnered with Skype for Business to create that mobile user experience. Analytics is another area where they can differentiate.

To me, the recurring revenue opportunity once you lay the foundation is to keep adding apps. That is how customers get more value out of it. That is how partners make more money out of it.

What is your mood as you look into the future as part of HPE with the innovation you are bringing to market?

The future for us is opening up. It used to be wireless. It is now the edge and with the core the whole thing is opening up for us. We are super excited. Our business is growing. We are the fastest-growing provider of wireless networking in the industry and that is not coming off a small base. It is pretty large already. That speaks to the differentiation in our solutions, the culture and our partners that are able to take it to market with us. To me, as long as we stay true to those three things we will continue to grow.

The TAM is a $70 billion market and we are still a $2.5 billion company as Aruba. I think we can continue to make it grow for a long time to come.

How big could the HPE Aruba intelligent edge business be over time?

As [HPE CEO] Meg [Whitman] said, it is the future. It is going to drive a lot of value. It is going to pull through data center infrastructure to. It is very humbling and grafitfying to be a part of that because when we got acquired two years ago we were coming into HPE and Meg said, 'We are going to keep the Aruba brand alive, the innovation DNA alive and keep the culture alive.' HPE has held true to that. You can see that HPE is elevating our importance as part of the broader HPE. It is not just Meg and [HPE President] Antonio [Neri] -- all of HPE is embracing Aruba. It is across the board. The partners are embracing us. So we are very humbled and gratified. What we need to do is just stay true to our culture and serve them the best we can and life will be good.

What is your biggest worry going forward with the battle against Cisco?

I actually used to worry about it five years ago. I don't anymore. If you look at who is growing in networking, it is Aruba. It is Arista. It is not Cisco. The CCIEs [Cisco Certified Internetwork Experts] are smart people. They obviously are very intelligent. They got the CCIE in the first place. They are looking at where the world is headed and who is going to give them the next 10 years of their career. That is really where are going with the community we built with Airheads and the mobility certifications. I really don't worry anymore about the head-to-head battle that we are going to take on with Cisco. It is something we are prepared for. For 15 years we have prepared for this battle. We are going to take the gloves off and go after the market.

What is the biggest competitive weapon you have as you go forward against Cisco?

It is the architecture which allows you to integrate your software, hardware and analytics, creating this mobile-first architecture. It is as simple as that. We have been telling that story and it is silence from the other side. We know why that is: It is the innovator's dilemma. We are just going to stay true to our roots and go mobile-first and cloud-first and keep innovating. Software, big data and machine learning are the future. To me, for partners the biggest opportunity is to take what we offer and turn it around into a managed service and deliver it as a service to their customers. That is where they can differentiate themselves and build that recurring revenue stream that every partner I talk to wants to go build.

What is your advice to partners as they look at the market opportunity ahead?

The plunge partners have to make is fundamentally embracing the software-first approach. It is making the shift in the engineering community from a CLI [command line interface] perspective to writing code that adds value. Once they write code and they make the transformation, it is their code and the partner differentiates themselves.

What kind of recurring revenue can partners make by writing applications on top of Aruba with products like the 8400?

The way you integrate into the network is all APIs. You don’t have set and forget and hope nothing breaks. It is integrated into the architecture with code.

AT&T, a partner of ours, took our products and built a managed service around it. What they did was write a bunch of code that simplified their customer experience. So AT&T customers with a few simple clicks can subscribe to the service. They ship a few boxes and the customer turns it on and off the customer goes to the races. They built an auto-management system on top of our core mobile-first platform. Now they can evolve and feed more code on how to change the infrastructure as opposed to making manual changes to the infrastructure.

Home Depot has 50,000 access points and 50,000 switches. There is no way you can do it manually. You have to automate. Automation is where all this is going.

How do you get customers like Home Depot that have committed to Aruba to move their core network to Aruba?

The core is a logical extension. There is an operational managed service model and you can insert boxes into that model. It can be an edge swtich, access point or a core switch. The key is the software layer on top of it. It could be a future SD-WAN architecture or IoT edge computing. We can keep adding categories that allows you to embrace innovation in an easy, fast manner because if you are not fast in this world you are going to be left behind. That is very clear.

How does it feel as someone who worked on Cisco Catalyst to bring a modern architecture to the core network?

We didn't start out thinking about the core. We started at the edge, seeing that is where the action was. It is very gratifying to hear customers tell us that they no longer think of their wide network as their primary network. They tell us wireless is their primary network, Aruba is their primary vendor. They now ask us, 'Tell me how to build networks.' They don't want to go to Cisco.

That is new. It used to be they had a Cisco network and wanted to add wireless on top of it with Cisco still teaching them how to build a network. When wireless becomes the primary network, the equation changes. That is very humbling and gratifying and we take that responsibility very seriously.

What is your biggest worry as you move into the future?

To me, it is really about execution. I don't worry about competition so much anymore. I don't worry about technology innovation. It is about execution in the market and internal execution. It is making sure I keep the best employees as part of the culture and keeping the culture alive. Ultimately, that is what is going to sustain us in the long term.

Talk about starting your career at Cisco and how that led to Aruba.

I started in the [Cisco] Catalyst group in 1995 helping build out their initial switching products. I was there for four years. It was a great ride. At that time, networks weren't common and we were building out networks to the edge with the Catalyst products. The inspiration for Aruba came from the growth that we experienced there. The LAN was a great place to be at that time. But when we started Aruba we asked, 'What's next? Is it more LAN with higher speeds or something else?'

To me, the answer was not about providing higher speeds-- it was providing connectivity in other places, not just at your desk. Mobility was the vision that we had. That could only happen with wireless. The long-term bet was, 'Man, if wireless becomes de facto you don't need the wires.' So wireless becomes the primary means of connection. That was a dream. Fifteen years later customers are voting and basically saying they are going mobile-first.