CRN Exclusive: Cisco Channel Leader Outlines New Apple And AWS Opportunities For Partners, Touts Cisco's Intuitive Network As A 'Market Disruptor'

Channel Chief Bahr On Major Partner Opportunities With Cisco

"We are at a crossroads of being able to take what we built over the last 20 years together and take it to the next level," said Cisco Channel Chief Wendy Bahr, in an interview with CRN. "With our new Catalyst 9000 -- we haven't done something like this in a long time."

Cisco Live 2017 in Las Vegas was centered around the San Jose, Calif.-based networking giant's new Intuitive Network architecture, which Bahr says offers a plethora of new opportunities for the channel. The event also saw Apple CEO Tim Cook make a surprise appearance on stage alongside Cisco CEO Chuck Robbins.

Bahr talks to CRN about the new partner opportunities with Apple, Amazon Web Services, and its new networking system as well as how Cisco views its market share declines.

"It's a world of many clouds, and AWS is a key player in that market -- as is Azure, as is Google, as are many others. We have an opportunity with our partners to connect Cisco technology to public clouds," said Bahr.

Talk about the new partner opportunities around your new Intuitive Network platform and how partners should sell it?

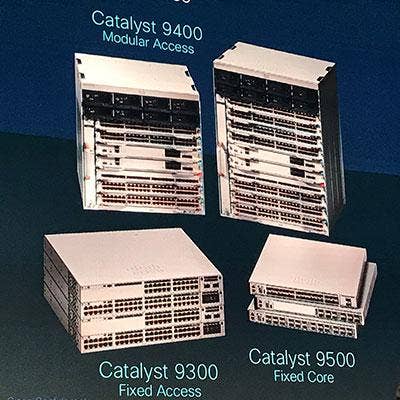

The opportunities are incredibly huge. With our new Catalyst 9000 -- we haven't done something like this in a long time. Partners that are ready can jump right in with our DNA (Digital Networks Architecture) or Cisco ONE, and you can start transforming how we operate networks in this new and different way. We're going to have a subset of partners, those that have deep technical capabilities and expertise, that are going to want to go right to the software-defined access, right to the fabric and that's DNA.

But partners can also go and sell the Catalyst 9K just like how we've already sold the Catalyst line – it's got faster, better feature functionality capabilities. So I don’t want partners to be afraid that they have to somehow reinvent their business to go out and continue to sell the Catalyst 9300, 9400 and the 9500. They can position customer's networks for the future by enabling them the way they are already enabling them today. I love the fact that there's choice for the partners and choice for the customers.

Is the Catalyst 9K and the whole Intuitive Network part of Cisco's VIP program?

Absolutely. One thing I've learned from my partners is when you have a program that works well for them, and they know how to operate it, you evolve what's in the program. You don’t create a new program because that just causes more learning and more expense for them to have to understand it. Partners love VIP. It's a great value exchange between the company and the partners. So we're going to evolve what's inside VIP, so they continue to get incentives and rewarded for selling the things that are most critical to our customers.

What are the best incentives and money making opportunities inside VIP that partners should be selling?

Software, security and now the new products will be enhanced and robustly positioned, and in areas like lifecycle management. We’re going to be offering our lifecycle advisor partners incentives for activations, for adoption, for expansion … we're going to be very focused on lifecycle management, software, and security.

Market numbers show that Cisco's networking share is dropping. Do you expect to regain that share?

This is a wildly competitive market, and competition makes us all better because it makes us innovate faster. We have always focused on the innovation first and let the competition kind of take care of itself. This is a landscape that is rapidly transforming. The launch of the new Catalyst 9000 is a proof point that Cisco is not just dealing with the transformation; we're leading in the innovation.

For us, it's about focusing on that innovation and re-designing the next era of networking. Counting things the way we use to count them and using that as a benchmark, may not be the most relevant way to measure success. Maybe measuring success is about taking our customers and our partners with us on this journey to reinvent the industry that we've been a part of since the very beginning.

How should Cisco partners view Tim Cook's appearance on stage with Robbins at Cisco Live?

It really symbolized the strength and the credibility of that partnership when you see Apple and Cisco, Tim and Chuck, on stage together telling 28,000 here and many thousands watching online that this is a partnership built to last and we're going to co-innovate together moving forward.

First and foremost, the most near-term opportunities are in wireless. We have some amazing technology with our fast lane and Apple with making wireless a better, faster experience for both the customer and the opportunity for the partners. So that's here and now, and we're having tremendous success in the retail space as an example.

With a tighter Apple partnership around security, what's it in for partners?

So we're now expanding this into greater security attached to that innovation and in collaboration with Cisco Spark. If I'm a partner and I've got an enterprise who is using a lot of Apple products, I have a massive opportunity to add more value, be more relevant and expand the TAM because you have certain divisions – like the CMO or the head of sales or head of HR – who may want to use those Apple devices in a way that helps improve their employer work experience. There's a lot of synergies when you start thinking about the number of Apple devices and how they can be better secured and innovated with the Cisco network that so much of our enterprise customer-base has installed.

Should Cisco partners look at the Apple partnership as a new money-making opportunity?

It takes them into new businesses, targeted addressable markets, into new conversations, and it opens up the door to have more of that workforce or customer user experience. I think that's where the value is versus the more transactional, traditional, "If I sell an iPAD you're going to give me a rebate or some sort of commission." When we partner together Apple's brand and Cisco's brand, that co-innovating gives partners a unique opportunity to go in and have a conversation with a customer that's very differentiated. Since [Apple] is really looking at our partner base, because it's built on capability, not volume, they're looking for us to help lead that discussion with our partners so that they can sell outside of IT, sell into the line of business which is where much of the budget is now being allocated.

How should Cisco partners view AWS?

They should view them as an opportunity. Chuck [Robbins] articulated in his keynote that it's not just one cloud – a public cloud, a private cloud. It's a world of many clouds and AWS is a key player in that market -- as is Azure, as is Google, as are many others. We have an opportunity with our partners to connect Cisco technology to public clouds [through] cloud services routers, virtual ASA, our Umbrella Security capabilities. When a customer has a need to put a workload in a public cloud, we hope the partner will choose the right cloud, and we'll connect as much Cisco capability as possible to that customer's particular need.

So what's a good partner go-to-market strategy with AWS?

If they're working with AWS, or Azure, or with the marketplace like an Ingram Micro or a Tech Data and picking a cloud provider – whether it's Salseforce.com or any others – we want them to look at our portfolio and know that they could attach our Cisco virtualized capabilities and make that solution even more integrated with what we are sure is still some private cloud capabilities. It's an integrated model. So when you're using Cisco in private and Cisco tied to public, you have the ability to have a more seamless network experience. I'm encouraging partners that are using AWS to ensure that they're attaching Cisco whenever possible to that solution set.

Competitors are still saying that Cisco is a closed networking vendor. Do you see your new Intuitive Network as proof that Cisco has shifted from its proprietary past?

Frankly, we've always had an open and non-proprietary way of doing business. I know some of our competitors like to say differently. I can understand why they would say that's our position, but we've got the broadest portfolio in the industry. It's important that it works end-to-end because that unlocks our value proposition, it unleashes the power of the network.

It is a big step to say we're now having those both northbound and southbound API's so that developers – whether that be partners or customers who want to write their own applications or software integrators who want to make our platforms and networks more robust – I do think that's a shift. I don’t think it necessarily [means] we were closed, and now we're open. It's about taking what was an end-to-end network and value proposition, a very powerful value proposition, and making it even more powerful because we opened up the API's.

How big of an investment should partners be making around APIs?

I can't tell you the number of my partners that are either teaming with or acquiring application development companies for this very reason. You have World Wide Technologies that bought Asynchrony. Insight bought BlueMetal.

But what if I'm a channel partner who can't acquire an application development company?

So some of the smaller partners come to me and say, 'Does this mean if I can't buy someone, I can't participate?' Absolutely not. That's why we promote our ecosystem so strongly. We look at ISV's who have great applications.

I just met with TurnStyle yesterday, which was acquired by Yelp 90 days ago, and now they're going to be Yelp Wi-Fi. TurnSystle was a data marketing cloud applications, and they teamed with Cisco Meraki -- we were seeing a lot of success there. When they were bought by Yelp, at first thought I didn't understand that, but Yelp has tremendous data -- customer data, customer insights. Now they're going to marry the Yelp data with their cloud-based marketing data platform all operating off Meraki with GPS and location management, and I could see it all coming together … It's really exciting we have this kind of opportunity whether you’re a small partner, a ISV partner, a large global system integrator, a service provider – everybody has an opportunity to participate.

What's Cisco's strategy to combat this changing and highly competitive network landscape?

At the very heart of Cisco, at the very core of what makes us who we are, it's about disruption and innovation. It's always been that way. When I came to Cisco 17 years ago, I was previously in the telephony industry and I watched what was happening with voice-over-IP and said, 'I need to work for [Cisco]. They're going to disrupt that market.' And sure enough they did and now we're the world leader in collaboration. When we got into the server business, people thought we were crazy. We had tremendous success with UCS. Our history as a company is about being a market disruptor and innovator. We're doing that again with the network intuitive with the Catalyst 9000. It is an important evolution in the new era of networking. We're at the very core of what powers Cisco when we talk about switching. So yes, it's a very important [time], but it isn't something we haven't tried to do before. In fact, we've been repeatedly successful at it.

How do you measure success in today's market?

It's about how we can help our customers move quickly and with speed, to take advantage of what the network can unleash in terms of the value for their digitization strategies. Those are more our metrics today, but obviously running a business you have to pay attention to the [market] numbers as well. We're focused on making the transformation happen as fast as possible.

As Robbins approaches his two-year mark as CEO, what has stood out to you the most?

What I love is there's so much about the history of Cisco and our culture that is embedded in Chuck. There was such a smooth transition between John Chambers as a CEO to Chuck Robbins as a CEO, which is because they have so many similar qualities and the cultural values are both similar. But what we see from Chuck is his willingness to move fast. His willingness to be agile in our execution. His willingness to know that we're going to fail on a few things and when we do, we'll fail fast.

How should channel partners view Robbins as a leader?

The fact that Chuck had seven years in the channel – I worked for him when he ran US and Canada channels – he knows as much if not more than John about how critical the partners are to our continued success. They are truly one of our biggest competitor assets. He knows that we need to take them with us as we make this journey into the new era of networking. For me as a global partner leader, to know that your CEO not only has walked a mile in my shoes, but understands the criticality of partners to Cisco success, it certainly makes my job a lot easier.

Why should partners be pumped about Cisco in the second half of 2017?

We are at a crossroads of being able to take what we built over the last 20 years together and take it to the next level. When you're in sales, you want killer innovation. You want a compelling value proposition and a credible company who is going to stand behind you and ensure that your successful together. We have all of those things with our partners.

They are so excited about this new Catalyst 9K. Our partners are our harshest, toughest critics … partners see this elevating their position in their discussion. This is going to give them an opportunity to really show the value they can bring as [customers] digitize and move into this next, new era of networking.