The 5 Best-Selling Wireless Access Point Brands Of Q3 2017

Access Granted

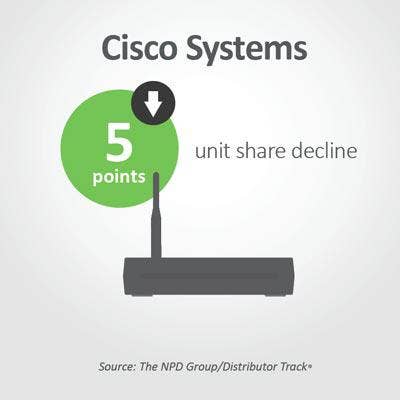

Cisco Systems continued its dominance of the wireless access point market in the third quarter, controlling nearly half of all sales and selling six of the top 10 products through technology distributors and resellers during the period, according to the latest data from The NPD Group, Port Washington, N.Y.

But while Cisco dominated the market in the quarter, its share declined as competitors Aruba Networks, Ubiquiti Networks, Ruckus Wireless, and Aerohive made gains.

The NPD Group tracks monthly technology sales-out information from the largest IT distributors and resellers in North America, down to the item level and with overlap removed.

5. Aerohive Networks

Aerohive sold 22,482 access points during the quarter, according to The NPD Group, a nearly 75 percent increase over its total for the same period a year ago. The total gave Aerohive a 3.7 percent share of the market compared with 2.5 percent a year ago, according to The NPD Group.

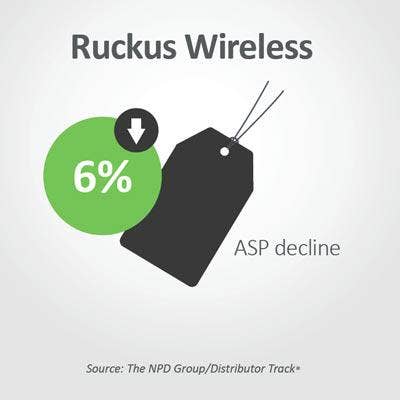

4. Ruckus Wireless

Ruckus made a strong showing in the third quarter, selling 38,911 units, a 17.5 percent increase from the same period a year ago, according to The NPD Group's data. The increase was enough to push the Sunnyvale, Calif., company's market share to 6.5 percent from 6.4 percent a year ago. Ruckus did not have any wireless access point models among the top 10 selling units, according to The NPD Group.

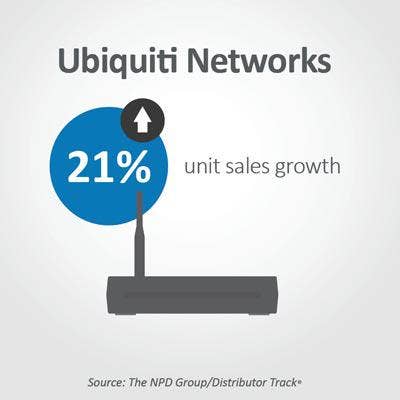

3. Ubiquiti Networks

Ubiquiti put up solid totals in the third quarter, boosting sales nearly 21 percent to 51,368 units from 42,565 units a year earlier, according to The NPD Group. Ubiquiti's third-quarter performance came on the shoulders of strong sales of its UAPACPRO model, which was the seventh-biggest selling model of the quarter, NPD said. New York-based Ubiquity finished the quarter with 8.5 percent market share, up from 8.2 percent a year ago.

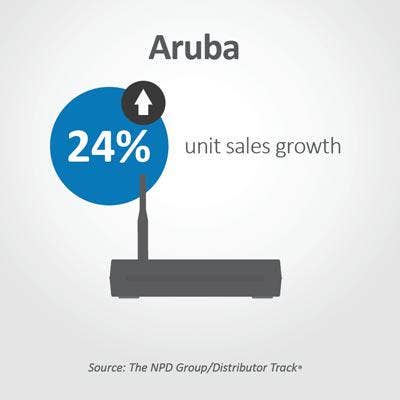

2. HPE-Aruba Networks

Aruba, a Hewlett-Packard Enterprise company, saw the number of units it sold jump to 139,295 from 112,613 in the same period a year ago, according to NPD. The increase was good for a 1.4 percent boost in market share, which ended the quarter at 23.1 percent, NPD said. The strong showing came as the company JW797A, AP325 and JW813A models sold well, finishing the period as the sixth, eighth and tenth-best-selling units overall, NPD said.

1. Cisco Systems

Cisco was in a similar situation to Aruba, but Cisco saw its market share dip even as the number of units it shipped increased, indicating the networking giant is losing share to competitors. Cisco shipped 278,548 units in the quarter, up 4.2 percent from 267,280 a year prior, The NPD Group said. Cisco access points dominated the best-sellers list, claiming the top five positions, as well as the No. 9 spot. Cisco's Meraki MR33HW was the best-selling access point in the quarter. Cisco's market share dipped to 46.2 percent from 51.4 percent a year ago.