Extreme Networks CEO: ‘We Are The Little Guy’ That’s Moving Ahead Of Cisco

The networking specialist is smashing records and beating out the ‘largest player’ with its simple licensing structure for its entire cloud networking portfolio that is turning heads of partners, customers and, even, Gartner, Extreme Networks CEO Ed Meyercord tells CRN.

Joining The Giants

Extreme Networks bought Aerohive Networks in 2019 and has since become the second-largest cloud networking player in the industry. But for the first time, Extreme came out ahead of the “big company,” aka, Cisco, in the most recent Gartner Magic Quadrant for Enterprise Wired and Wireless LAN Infrastructure report because of its cloud-native roots and simplified licensing structure, Ed Meyercord, Extreme Networks president and CEO, told CRN.

The San Jose, Calif.-based networking specialist is taking market share and gaining new customers who never considered Extreme before, Meyercord said. During the company’s most recent fiscal quarter—first-quarter 2022—the company reported revenue of $267.7 million, up 14 percent year over year. SaaS subscription bookings grew 71 percent during the quarter, with SaaS annual recurring revenue totaling $78 million, up 54 percent year over year. A record number of customers—43—booked more than $1 million in business with Extreme during first-quarter 2022, a 40 percent increase over fourth-quarter 2021, according to the company. All of this growth, Meyercord said, was driven primarily by the company’s channel base.

From the company’s new SD-WAN offering, to the addition of automation into the partner process, to its simplified approach to licensing for partners and end customers, here’s what Meyercord had to say.

How has Extreme’s recent cloud growth catapulted the company into a leadership position?

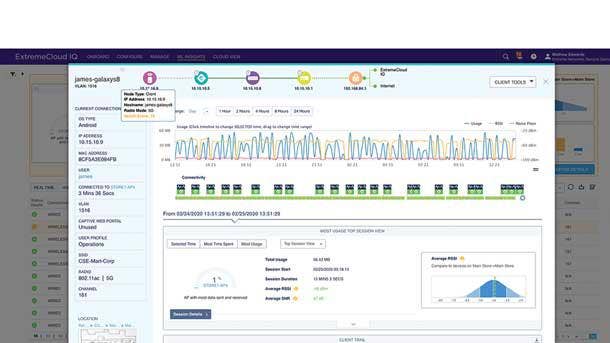

The momentum continues at Extreme. [First-quarter 2022] was unprecedented in my seven years as CEO and then 12 years as a board member. We had an incredibly strong quarter led by cloud [and] subscription, and that’s really top of mind for our enterprise customers. Cloud in the networking space is the fastest-growing segment of our industry. In the distributed world that we live in now, this idea of enterprises supporting their workers, their patients, their students, wherever they are, has really taken hold. We’ve never been in a better position to support our customers and partners in a leadership role that we are in now. What played out in the quarter is more interest in Extreme as a leader in cloud. The market-share data that came out showed that Extreme is the second-largest cloud provider that has a cloud-native infrastructure. It’s different than [Cisco] Meraki. Our AI, machine learning and all the data required to drive the intelligence from a network puts us in a really good position because it’s all about the data. Our cloud is the No. 2, but we’re bigger than No. 3 and No. 4 combined. So, we’ve got real differentiation in terms of scale of our cloud and the scope of our software solutions, and then all the goodies, if you will—the services that we’re delivering with our [cloud management platform] ExtremeCloud IQ. Cloud has become an essential ingredient in terms of the formula of how we’re going solve for [distributed environments]. People are coming to Extreme and they want to hear from us, and we’re converting more and more of these conversations into business and into new customer relationships—all of that just played out in spades this quarter.

So, from our standpoint, despite a constrained supply chain, we hit our numbers and beat the street. From an earnings perspective, we’ve posted year-over-year revenue growth of 14 percent, which makes us the fastest-growing player in the enterprise space, driven by 54 percent growth in our cloud recurring revenue, and that really just showcased this phenomenon of people finding out about Extreme. Enterprise customers that haven’t been in touch with Extreme for a while are being, I would say, surprised and really impressed about where we are today. Our batting average is going up and we are winning more and more business. Behind the curve is this backlog. At the end of Q4 earnings, we had built up a backlog of $100 million, which was an all-time record. And then just during the September quarter, we added another $100 million of backlog. And, by the way, we’ll add yet more backlog this quarter just because of the strength of the demand.

Extreme now has an SD-WAN offering. Why is this important?

In the enterprise, customers are going to be taking more ownership over the end-user experience outside of the office. And that dovetails into the investment that we just made. We acquired Ipanema SD-WAN [a subsidiary of network management and performance player Infovista], a cloud-driven SD-WAN solution. What we’re building is the capability to provide the application performance, visibility and insight at the edge of the network [or] wherever the user may be. It’s not necessarily a traditional branch solution, but we can actually follow the individual, and in order to do that, it has to come from the cloud, again, reinforcing why the cloud is so important in the future of the enterprise network. The idea that the next-generation SD-WAN solution also now incorporates security elements and then supports this more distributed enterprise, that’s another contributing factor to the heightened interest in Extreme.

We didn’t have a SD-WAN capability previously, and the exciting thing for us is the quality of the technology and the quality of the platform that they’ve built. We have leadership in cloud and networking solutions, and so the combination here, and then the ability for us to leverage a base cloud license to use our cloud platform as an orchestration platform for more services—that’s really what this is about. The first service coming out, which is a software subscription service, is ExtremeCloud SD-WAN. We’re packaging what Ipanema built as a pure subscription service that comes out in our third fiscal 2022 quarter. There’s a lot of interest, enthusiasm and excitement around that. We are ahead of schedule with the service integration, the business integration, and then opening up SD-WAN solutions for our field globally. It’s the cloud-driven capability. In other words, instead of having the traditional hardware and a branch office, [it’s] the ability to deliver services from the cloud in a more distributed environment. There’s a lot of excitement there, as well as the new branch solution that we’ll bring to market. It’s opening up the door for us because of the cloud and the core ExtremeCloud IQ license to sell more services over the top.

How does Extreme’s simplified licensing structure help you stand apart from the competition?

We have the most deployed fabric for the core of the network, and there’s a lot of security benefits for a campus network and deploying Extreme’s fabric that extends out to the edge. We are also offering analytics, [mobile access control] capabilities in terms of security, access control, policy management—all of these are coming with the [ExtremeCloud] IQ license. We have the simplest licensing structure in the industry and there’s a lot of confusion today in the market around licensing. There’s a lot of complexity in tiered licensing structures. Interestingly, a lot of our customers—and we’re hearing this in real time—are talking about how they are actually paying for software and licenses that they might not be using. All of this equates to a lot of interest in Extreme and the simplicity of our licensing platform. It’s one license for all devices. Customers [are saying], ‘Wow, this is refreshing.’ Extreme is showing up in more and more competitive situations.

All of our licenses now are in a subscription model, and when we were designing our subscription offer, we spent a lot of time looking out in the industry. And yes, we have to look at the largest player, [Cisco]. One of the things that we heard back from partners and customers is a lot of frustration with the complexity of licensing models and then the way that services were sort of packaged into a group license, and then the way it was priced. There is a lot of frustration because people were looking at their bills and realizing that they weren’t even using the services of the software that they were buying but didn’t even realize it because of the complexity of the licensing structure. So, when we set out, we said, ‘OK, let’s do this. Let’s come up with the most simple licensing scheme in the industry, period.’ For all you people out there dealing with licensing complexity, check out Extreme. You’re going to be happy. Why? Because we have a single license that works with ExtremeCloud IQ, our [wireless] access points, or for an edge switch or core switch, and it’s one simple licensing structure you can manage within our cloud platform. It just makes it easier for our customers and our partners to manage. I think that saves a lot of time, energy and money.

How has the addition of more automation into the process of working with partners helping the company grow faster?

We reorganized about a year ago to better support our partners. We’ve invested a lot in automation and tools to make it easier to do business. For commercial run-rate businesses where partners are supporting existing customers with smaller transaction sizes, all this has been automated and we’re supporting this with dedicated teams very focused on higher-volume-type transactions. And then our direct sellers in the field are better equipped and more focused on supporting customers’ big projects. One of the things that happened this past [quarter] is we had over 43 customers that transacted over $1 million with Extreme, which was another record. I think that just highlights how our field is working well, partnering with the channel on these bigger projects. At the same time, this run-rate business—the business that we saw through our automated tools—also grew significantly. It’s just easier to work with Extreme, partnering on the bigger projects, and then also on this run-rate business, and all that has contributed to that growth.

Are you seeing pressure from smaller, cloud networking startups?

No. We are the little guy in our market. And it’s pretty clear we’re taking share. The Gartner report just came out [for Magic Quadrant for Enterprise Wired and Wireless LAN Infrastructure] and we moved ahead of that ‘big company,’ [Cisco]. We’re four years in a row in the Leadership quadrant, but we just moved ahead of that big company for the first time. And that’s a big deal—it’s a big deal for people out there. If you’re a channel partner out there noticing: ‘Wait a minute, Extreme just passed the big player and oh, by the way, I’m hearing [about] a lot of issues with the complexity of licensing, and there’s a lot of issues, interoperability between the cloud-based and Catalyst-based [offering]. Maybe I should consider an alternative.’ So, we’re getting these looks and these [turns] at bat. Gartner is always a real exclamation point. I think the old adage: ‘Nobody gets fired for working with the big company,” I think people are realizing that you can be a lot more competitive, and you can win with Extreme Networks. So, why wouldn’t you consider partnering with Extreme and positioning Extreme given the superiority of our solutions for the enterprise and the simplicity of working with us?