Phil Mottram On HPE’s New GreenLake Aruba NaaS Offers: ‘We Think The Demand Is Going To Be Pretty High’

HPE Intelligent Edge Business Executive Vice President Phil Mottram expects to demand to be high right out of the gate for the first standardized off the shelf Aruba network-as-a-service (NaaS) offers for the HPE GreenLake pay-per-use cloud service.

‘Great Opportunities’ For Partners To Drive Services Growth With HPE Aruba

The eight new Aruba NaaS offers for GreenLake -- which provide flex up and flex down options for customers -- are poised to power big new services opportunities for partners, said Hewlett Packard Enterprise Intelligent Edge Business Executive Vice President Phil Mottram.

“In order to kind of get these models up and running you need someone who is going to go out and actually deploy the network on the customer’s premises, so we think there is great opportunities for partners to offer deployment services,” said Mottram, discussing the new offerings in an exclusive interview with CRN. “There’s obviously quite a lot of skill associated with those sorts of deployments in terms of working out what should go where, etc. So there is quite a lot of design professional services type offers they can add into the mix. On top of that there will be opportunities to provide additional management services. They can also plug into their own applications that they may decide to offer.”

The eight new HPE GreenLake enterprise NaaS offerings from Aruba are: Indoor Wireless as a Service; Outdoor wireless as a Service; Remote Wireless as a Service; Wired Access as a Service; Wired Aggregation as a Service; Wired Core as a Service; SD-Branch as a Service; and Aruba UXI (User Experience Insight which provides network application and performance management).

Aruba is offering partners four primary channel models: a partner assessment and design model with standardized and modular service packs that can be configured by partners in three to five year subscription models; a fulfillment model that gives the partner the ability to sell the service but have Aruba fulfill it; a model for the customer to contract service levels with a partner and finally and a model where partners and Aruba team together with partners providing monthly billing and day one services for the customer.

Mottram said as far as he knows there is no other vendor that is offering a similar NaaS opportunity for partners. “I am not familiar with any other networking company similar to us with a partner friendly offer in the market today,” he said. “So I think we’ll probably be the first.”

Up until now, Aruba has been offering bespoke NaaS offers rather than standardized NaaS offers, said Mottram. “The bigger opportunity here - and we are very partner led as an organization – is to generate some offers that are more kind of standardized and repeatable but more importantly can be sold through the partner channel,” he said.

How does the new Aruba GreenLake offers fit into the HPE GreenLake strategy?

At a company level HPE is trying to move all of its products and services to as a service. We think that is where the market is heading and that is what customers want, etc.

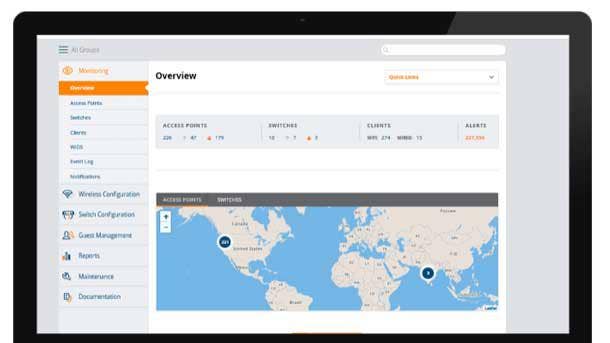

About two years ago Aruba kind of led the way for the company. It led the way in two aspects: the first one was the Aruba Central platform which is our cloud based management platform that allows customers to manage the network. It’s got some great functionality in it with AI type capabilities,etc. It makes it very easy for customers to kind of deploy and manage the network but it also has a lot of intelligence in the platform to prevenut faults. That is the Aruba Central platform. That now has 120,000 customers and two million devices connected to the platform. And every year we do a number of different releases and add more and more functionality into that cloud central platform.

What the company has done is taken elements of that platform and developed the GreenLake platform. At a corporate level the idea is we will be able to say to HPE partners and customers – ‘Look you can buy the full range of the company’s portfolio- be that compute, storage, data or connectivity- all through one single unified platform. That’s where the company is heading from a strategic perspective.

Aruba has led the way in two aspects: one would be the platform. The first one is we were the first part of the organization- but also one of the first companies from a network perspective to be signing as a service contracts.

The initial ones we did were typically quite chunky large contracts for very big customers. Off the back of that they were pretty bespoke to be honest. What we saw was some customers historically saw their network requirements being best handled by some of the major networking companies. We saw a bit of a change- if I am honest – in that regard. Historically you had big organizations buying global MPLS networks. Now you have this move to sell more SD-WAN. Then you see situations where enterprises are sort of buying their own underlying networks.

Off of the back of that, there was a bit of a change we saw in the market where (customers) started to look to other players network management services.

So we signed some initial large bespoke NaaS deals. Those were well received by customers. But we thought you know what the bigger opportunity here - and we are very partner led as an organization – is to generate some offers that are more kind of standardized and repeatable but more importantly can be sold through the partner channel.

My kind of definition of NaaS is historically you had customers buying things and devices and the model under which they were buying them would be kind of capex up front investment and then they would pay maintenance and support fees after that. What we are doing is we are shifting away from that (in order to provide standardized network as a service offers). What we mean by that is we are delivering and deploying the equipment – in conjunction with partners- for customers and providing the software that sits on top of that, quite often in the cloud, being Aruba Central software and we are providing lifecycle management as well. We are doing all of that in a predictable x per month type fee for customers and we give customers the ability to be able to flex up and flex down.

We might say to a customer it is going to be x per branch per month and then as customers want to add or delete branches we can flex the model to accommodate that. That is what we are offering.

The initial contracts we did where kind of large, bespoke contracts. What we are launching next week are eight different offers that really help partners take that offer out to customers. We think the reason it will be interesting to partners will be the fact that clearly that is way the market is heading.

IDC suggests that by 2025 60 percent of networks will be bought on an as a service basis. So we believe there is definite demand from the market for these sorts of services. We are seeing that for sure. We think there is a great opportunity for the partners to overlay their services on top of the offer.

How critical are partners in the GreenLake for Aruba NaaS Offers?

The reason this is really important is if you think about the other products and services that the company is offering to its customers such as compute and storage – those sorts of offers. For the most part those offers don’t necessarily have to touch a customer’s site. They can sit in a data center somewhere or wherever it may be. Whereas with networks, you obviously need to deploy a network on a customer’s site. Off the back of that that is where the partner really gets an opportunity to step in.

In order to kind of get these models up and running you need someone who is going to go out and actually deploy the network on the customer’s premises, so we think there is great opportunities for partners to offer deployment services. There’s obviously quite a lot of skill associated with those sorts of deployments in terms of working out what should go where,etc. So there is quite a lot of design professional services type offers they can add into the mix. On top of that there will be opportunities to provide additional management services. They can also plug into their own applications that they may decide to offer.

How does this compare to what Cisco offers on network-as-a-service?

Cisco is clearly a great company. I don’t want to be negative about them as an organization. They have got a great heritage in the industry.

But where I think we would be different versus a Cisco is the Aruba Central platform is one platform that manages all of our products and services. So when we talk to customers and ask what is the difference between ourselves and Cisco they like the fact that we have a single cloud platform to manage all of our products and services. So we get big kind of check in the box there. We also get a check in the box around the capabilities of the management platform

I had one customer which is a large global bank that when they used to make changes to their Cisco networking environments on the WiFi side it used to take them 600 man hours of effort to do a network upgrade whereas with our technology it takes five man hours. So we get very positive feedback on that.

Some of the feedback I get is the fact that we actually have a live customer base up and running because we have been doing this now for a number of years. We have 120,000 customers connected into the platform and also getting close to 2 million devices. I think that is where we are different than Cisco.

How big a step forward is this in the networking market?

I think it’s pretty big. I am not familiar with any other networking company similar to us with a partner friendly offer in the market today. So I think we’ll probably be the first.

What are you seeing from customers and how much money can be made here with these new offers?

When we kind of launched early on I thought the main draw for customers would be around the opex model versus the capex model but interestingly when you talk to customers about it they are interested in more than that (pricing model).

They are very interested in the fact that we as an organization are responsible for the upgrades, the lifecycle management and ourselves and the partner are taking more of a managed services approach.

It’s kind of interesting- some of the customers we have signed are financial institutions.You would have thought if it was just a financial thing obviously banks have very cheap access to money. If it was just a financial proposition alone then you would have thought a bank that has got endless access to cheap money would not be interested in the proposition. They are drawn to the fact that we as an organization – with our partners – are taking responsibility for the end to end management of the offer, the lifecycle management, and the fact that it is plugged into this great Aruba Central platform. So we think the demand is going to be pretty high.

Partners can play in this offer in a number of ways from partner assessment and design to partner to Aruba for fulfillment or partner and Aruba to the customer. What is the call to action for partners?

The call to action for partners is to understand the offers in terms of how they work commercially, who is doing what, understand the role that they can play in the deployment and the on going management of the services. We think it is going to be a great opportunity for partners. If they see or hear customers interested in this model and they think this is relevant for their customers then start to push it. Certainly what we see in the market is there is a pull for customers for these sorts of models and these sorts of end to end managed services.

Will these Aruba offers get priority in the supply chain given the fact that it is tough to get some Aruba gear?

From a supply chain perspective like many industries there are supply constraints right now. What we do is when we get supply we look at customers, the backlog of orders that we have got and typically what we do is push our supply to the customers who are kind of first in the que.

I am not necessarily saying these offers are going to change anyone’s position in a que. That is a separate process in terms of how we manage this que.

How important that Aruba Central is now an integral part of the GreenLake model?

We’re proud of the work that we have did on the platform establishing customers on a global basis has been leveraged by the company for the wider platform. We are excited about that.

We are making loads of investments in the platform in terms of adding new features and functionality. There is another release coming out in June that has some really great functions and features on it. One that I particularly like that I saw a demonstration of a week or so ago is something called Time Travel. If you have a problem you can literally log on to the Aruba Central platform and let’s say the problem happened 53 minutes ago you literally have a time bar at the top so you can push the time bar back 53 minutes and see what happened on the network 53 minutes ago. Maybe someone did a release upgrade.

Then you can identify very quickly what happened 53 minutes ago,. Hopefully that helps you work out what the problem was on the network.

We make lots of investments in additional features and functionality on the network in the Aruba Central platform and we think that’s going to be a real differentiator over time.

There have been a number of public cloud outages. How big an opportunity is there for partners to sell Aruba as the edge platform instead of public cloud?

Most companies have their platforms on a range private cloud and multiple public cloud to make sure they get the right level of resilience. As I say the platform we have – Aruba Central- has been up and running now for two years. It is a robust platform. We get great feedback from customers. So we are happy with the feedback and the investments we are making.