The 10 Biggest Cisco News Stories Of 2021

From making massive moves to accommodate new ways of buying IT, including rolling out as-a-service offerings and a brand-new enterprise agreement, to seismic channel program changes, leadership changes and some M&A activity along the way, tech behemoth Cisco had a busy 2021.

Not Your Father’s Cisco

Cisco Systems is in the midst of a major transformation. The tech giant is making big moves that don’t necessarily involve new technologies or product launches.

Instead, Cisco is making headlines by pursuing a major business model transformation in favor of software and services, while shedding its legacy as primarily a hardware provider. Under the direction of Chairman and CEO Chuck Robbins, the company vowed to transition the majority of its portfolio to an Everything-as-a-Service model. Robbins made it clear that every Cisco product would be evaluated, and nothing would be off the table. To that end, Cisco in April unveiled Cisco Plus, a new sales motion that is delivering networking, security, compute, storage, applications and observability offerings as a service to customers through channel partners. Cisco partners are currently in trial with the first of those offerings, which is getting rave reviews from both the channel and end customers transforming their own IT infrastructures. At the same time, Cisco realized it had to make it easier to buy IT. With that in mind, the Cisco Enterprise Agreement (EA) 3.0 was introduced with great fanfare in November as a new way for customers to buy from Cisco’s five portfolios with one set of terms and conditions.

On the channel front, Cisco made good on its promise for big changes to its partner program structure and in April rolled out the most significant changes in more than a decade. The newly simplified partner program honors the distinct roles that partners are playing with their customers.

San Jose, Calif.-based Cisco made some leadership changes, too. Its executive leadership team saw promotions of two Cisco veterans, Fran Katsoudas and Liz Centoni. Maria Martinez was also raised up to the chief operating officer seat. The security business got a new leader, too: Shaila Shankar, who replaces Gee Rittenhouse as senior vice president and general manager of Cisco’s Security Business Group.

As if that wasn’t enough news, then came the acquisitions—five deals closed in 2021, in fact. To name a few, Cisco landed Contact-Center-as-a-Service provider IMImobile for $730 million to boost its flagship Webex platform and app monitoring specialist Epsagon for a reported $500 million.

Here are the 10 biggest Cisco news stories of the year.

10. Cisco Commits To Net Zero Greenhouse Gas Emissions By 2040

In a move that pleased channel partners, Cisco pledged to reach net zero greenhouse gas emissions by 2040, including its own operations, product use and supply chain, the company said in September. Cisco also pledged to reveal more near-term emissions-reduction targets for its most material emissions.

The tech giant also is investing millions through its Country Digital Acceleration (CDA) program to help its partners and end customers lower their own carbon footprints and meet sustainability goals. The Sustainability Partner Innovation Challenge will challenge Cisco’s partner ecosystem to develop proofs of concept aimed at solving sustainability issues. Cisco’s CDA has more than 1,000 active or completed projects across 43 countries, according to the company.

Cisco’s sustainability announcement follows a busy year for the tech giant, which also has been focused on its “Inclusive Future“ strategy, which includes social justice and global health initiatives, and closing the digital divide.

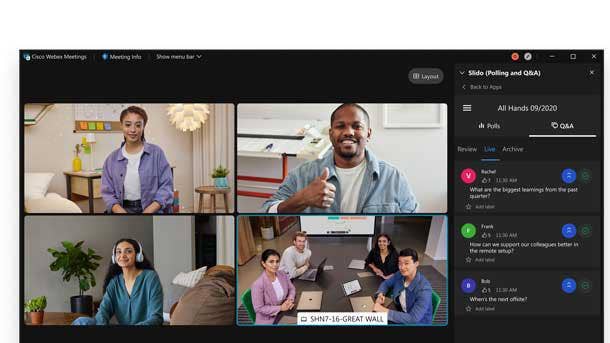

9. Cisco Webex Gains More Than 1,000 New Features

Cisco’s Webex platform has reached new heights over the last nearly two years as the COVID-19 pandemic shined a much brighter light on the importance of collaboration tools as a way to keep people working together, despite being separated by physical distance.

The company has been busy upgrading and furiously adding features to its flagship collaboration platform to the tune of more than 1,000 new Webex features and capabilities over the course of the year. In October at its second annual WebexOne event, Cisco launched a slew of new features and updates, including a Voice Equalizer feature and third-party interoperability with Microsoft Teams and Zoom, and even a Hologram offering, which is still in preview. The company also introduced a new desk camera option for home workers, Webex Desk Mini, and a new headset made in collaboration with sound company Bang & Olufsen.

Webex is also holding its own against the competition. In particular, it continues to compete strongly with Zoom. In September, Cisco said that its Webex Calling portfolio hit a record 8 billion monthly calls as the company expands the offering into more countries. By comparison, Zoom Communications’ cloud-based phone service, Zoom Phone, sold 2 million seats as of August 2021, which climbed up from 1.5 million three months earlier, Zoom said at the time.

Customers are in the “third wave” of transformation since the start of the pandemic, which involves a mix of employees who will always be remote and those who are a blend of working in the office and at home. As such, businesses are thinking about how to properly address the new needs of their employees. Cisco sees this wave as a tremendous opportunity it plans to keep riding with the help of its partners, Jeetu Patel, Cisco’s executive vice president and general manager, security and collaboration business units, told CRN in October.

8. Cisco To Buy App Monitoring Specialist Epsagon For A Reported $500M

All in all, Cisco unveiled its intent to acquire six companies and closed five of those deals during the year. For the majority of those deals, the price tags were not disclosed.

Cisco in August said it was buying Israeli application monitoring company Epsagon to add to its growing observability platform. Specifically, privately held Epsagon’s technology will be added to Cisco’s full-stack observability platform that today consists of the company’s other acquired assets from AppDynamics and ThousandEyes, as well as its own Intersight management platform.

While the two companies did not reveal financial terms of the upcoming transaction, Cisco was reported to have spent $500 million to buy the observability company, according to a report from Tel Aviv, Israel-based news site Globes. Cisco closed the deal in October.

Epsagon wasn’t Cisco’s only purchase related to its AppDynamics observability platform during the year. In October, the company unveiled its intent to buy Replex, a privately held enterprise software company based in Germany, in a deal that will help AppDynamics grow its product and engineering talent with a view toward accelerating and expanding product capabilities that observe enterprise-scale, cloud-native environments, according to the two companies.

7. Shaila Shankar Promoted To Cisco Security Boss

Cisco in September said that effective immediately, the company would have a new leader of its more than $3.3 billion security business.

Shaila Shankar, Cisco’s then senior vice president and general manager of cloud and network security, took the reins as senior vice president and general manager of Cisco’s Security Business Group, becoming the first woman to lead the company’s security business. Shankar replaced Gee Rittenhouse, Cisco’s security senior vice president, who had led the business for five years. He spent a collective eight years at Cisco.

Shankar joined Cisco in June and prior to her promotion, which came three months into the job, she was a longtime security leader who had spent a collective eight years at McAfee. Before that, she spent more than six years as Intel’s vice president of consumer and mobile engineering for the company’s security business.

Shankar will report to Jeetu Patel, Cisco’s executive vice president and general manager, security and collaboration business units.

6. Cisco Buys IMImobile for $730M

In February, Cisco became the owner of center-as-a-service provider IMImobile PLC to bring more omnichannel engagement into its customer experience solutions. Cisco, via the terms of the deal, paid 595 pence per share in exchange for each share of IMImobile, or an aggregate purchase price of approximately $730 million assuming fully diluted shares, net of cash and including debt as publicly reported, based on the prevailing exchange rate at the time of the agreement, according to the two companies.

Since then, Cisco has been at work combining IMImobile’s offering with Webex Contact Center. Now together, Cisco is creating an enhanced Cisco Contact Center platform that will bring together cloud contact center, artificial intelligence, experience management, collaboration and Communications Platform as a Service (CPaaS) to create a single offering for customers and channel partners, Cisco said of the deal.

5. Cisco Unveils Three Leadership Changes

Cisco in May honored the work of three of its female leaders with promotions. Fran Katsoudas, a 25-year Cisco veteran, was named chief people, policy and purpose officer. Katsoudas got her start with Cisco 25 years ago as a contact center agent. Since then, she has moved up the ranks with the company’s HR team and has spent the past five years running Cisco’s People and Communities organization, most recently as executive vice president and chief people officer. In her newly expanded role, Katsoudas will also oversee Cisco’s Global Government Affairs and Country Digital Acceleration team.

Liz Centoni, who has spent more than 21 years at the tech giant, is now leading Cisco’s applications business as its chief strategy officer and general manager, applications. Centoni began as senior director of engineering for the tech company in 2000. She’s held a number of vice president-level engineering and strategy roles, including most recently being named to lead Cisco’s Emerging Technologies and Incubation group that was formed last March. Centoni served as senior vice president and general manager of IoT for Cisco for nearly two years before she was named as the leader of the Cloud Strategy and Compute business unit that was formed in 2019. In her latest promotion, Centoni is leading the company’s applications business, which will include alignment with Cisco’s cloud application monitoring business, AppDynamics.

Cisco also said that Maria Martinez, a Cisco leader for the past nearly four years, is now in the chief operating officer seat. Martinez was Cisco’s executive vice president and chief customer experience officer since 2018. In her new role as COO, Martinez is leading both operations and customer experience, which is a brand-new role for Cisco, the company told CRN.

4. Cisco Makes Biggest Changes To Partner Program In More Than A Decade

Cisco revealed its simplified partner program in June that is now recognizing and rewarding the four different roles that partners want to play with customers.

Under the new program, Cisco partners will be able to select the role or roles that best describe their business. The Integrator role is Cisco’s “bread-and-butter” partner, which includes many longtime solution provider partners. The Provider role, which was built with the MSP partner in mind, will now better identify and rcognize partners based on their investment in managed services and as-a-service solutions.

The Advisor role launched in November, which intends to bring Advisor partners more deeply into the Cisco partner ecosystem and is scaling up the rewards for these partners, who used to be part of Cisco’s Consultant partner program. Cisco is also providing technical and strategic development resources, cooperative business development, co-sales and access to Cisco events for Advisor partners.

The Developer role also went live in November and already includes more than 1,000 partners with DevNet certifications and 1,600 approved partner solutions that Cisco is co-selling with its early Developer partners today, Cisco said.

In addition, Cisco is evolving its Specialization portfolio by offering five cross-architectural solution-based specialization areas—analogous to Cisco’s Advanced Specializations—for partners that excel in more than one Cisco offering: Secure, Agile Networks, Hybrid Work, End-to-End Security, Internet for the Future and Optimized Application Experiences.

3. CFO Says Cisco Is ‘One Of The Biggest Software Companies In The World’

During the company’s third-quarter 2021 earnings call in May, Cisco revealed it has one of the largest software businesses in the industry with an annual run rate of north of $14 billion in software revenue. Robbins at the time shared that in the company’s third quarter, which ended May 1, the tech giant achieved $3.8 billion in software revenue. Software subscriptions accounted for 81 percent of its total software revenue, up sequentially from second-quarter 2021’s result of 76 percent, as interest in subscription-based solutions grow.

The company has working diligently for the past three years to transform its historically hardware-first approach to one that favors more software and subscriptions. Scott Herren (pictured), Cisco’s CFO, in September shared with CRN that Cisco exceeded its goal of generating 30 percent of its revenue from software and is on track for subscriptions to make up half of its revenue by fiscal year 2025. “Cisco is one of the biggest software companies in the world, and I don’t think anyone thinks of Cisco in those terms,” he said.

When Robbins took the helm at Cisco in 2015, the company pulled in $3.4 billion in subscription software revenue. In fiscal year 2021, which ended on July 31, 2021, Cisco had nearly $12 billion in subscription software revenue, marking a 23 percent compound annual growth rate.

2. Cisco Reveals Radically Revamped Enterprise Agreement Licensing Model

Cisco in November unveiled its highly anticipated, simplified enterprise agreement (EA) licensing model, Cisco EA 3.0.

The idea behind the revamped EA is to “radically simplify” Cisco’s various product categories and offerings into one agreement that customers can use to expand and evolve from one generation of IT to the next, the company said at the time. The new EA will address new customer demand and changing buying behaviors. Cisco told CRN that partners have been asking for a simpler way to transact across Cisco’s vast portfolio, and solution providers said that the new payment structure will help them drive premium experiences for their end customers, who will also have more choices around IT spending.

The brand-new EA offers one set of terms and conditions for whatever a customer buys from Cisco’s five portfolios: Applications Infrastructure, Networking Infrastructure, Collaboration, Security and Services.

1. Cisco Unveils As-A-Service Strategy: Cisco Plus

In its biggest move of the year, Cisco unveiled Cisco Plus in April, the company’s commitment to deliver the majority of its portfolio as a service over time. Robbins called Cisco Plus and the company’s software transformation the “most significant business model transition.”

Cisco Plus is the company’s as-a-service strategy that allows customers to purchase Cisco IT in a flexible, consumption-based manner. Cisco in April formally introduced its first two new flexible consumption models for networking and hybrid cloud, the latter of which is currently in beta trials with a limited group of partners.

The Cisco Plus Hybrid Cloud solution as a service includes Cisco’s entire data center compute, networking and storage portfolio, as well as third-party storage and software, which is bringing together on-premises, edge and public cloud environments in a flexible consumption model.

The Cisco Plus Networking-as-a-Service (NaaS) model, on the other hand, will let customers and partners operate and maintain their network, without owning, building and maintaining their own infrastructure.

More offerings are slated to roll out in 2022, according to Cisco.