VMware-Avi Networks Deal: 5 Important Things You Need To Know

Avi Networks’ ties to Cisco and VMware’s Virtual Cloud Network plans are just a few of the things you need to know about the VMware-Avi Networks deal.

A Blockbuster Buy

From Avi Networks’ close ties with Cisco to VMware’s bullish Virtual Cloud Network strategy, the virtualization star’s planned acquisition of the multi-cloud application delivery startup is big news for the IT world.

Palo Alto, Calif.-based VMware hopes to leverage Avi Networks’ technology to boost NSX and the company’s software-defined networking innovation. “VMware is committed to making the data center operate as simply and easily as it does in the public cloud, and the addition of Avi Networks to the growing VMware networking and security portfolio will bring us one step closer to this goal,” said Tom Gillis, senior vice president and general manager, Networking and Security, VMware in a statement.

Financial terms of the VMware-Avi Networks deal were not disclosed. VMware expects to close the Avi acquisition in its current second fiscal quarter 2020.

Here are five things you need to know about the VMware-Avi Networks deal.

Avi Networks Was Founded By Cisco Execs

Avi Networks launched out of stealth mode in December 2014 after raising $33 million from venture capitalists. The company was founded 2012 by former top Cisco executives, including Umesh Mahajan, previously vice president and general manager of Cisco's Data Center Switching business; Ranga Rajagopalan, former senior director of engineering at Cisco; and Murali Basavaiah, Cisco's former vice president of software engineering for the Data Center Group.

In a blog post from Rajagopalan and Basavaiah, the two co-founders said the acquisition is great news for Avi customers, employees and partners.

“We founded Avi Networks more than six years ago, with the goal of transforming application services in the new world of multi-cloud, containers, and DevOps,” said the co-founders. “We have changed how load balancers are deployed and consumed in the world's largest enterprises ranging from financial services firms to eCommerce, technology, manufacturing, and retail companies. … Together, VMware and Avi will build on our common architectural foundation to create the industry’s only complete L2-L7 software-defined stack.”

Avi Has Close Ties With Cisco

Not only was Avi Networks founded by former Cisco executives, but the startup has been a strategic partner for Cisco since 2016. The two companies created a strategic reseller agreement in 2017 where the Avi Vantage Platform became available for Cisco partners to sell. The Avi software license SKUs became available as an annual or three-year subscription from Cisco while also being available as a joint solution with Cisco’s CSP NFV platform.

In June 2018, Avi raised $60 million in series D funding, which included an investment from Cisco. San Jose, Calif.-based network giant Cisco allows its channel partners to resell Avi’s platform around the world. Avi’s load balancing, web application, firewall and network analytics software integrates closely with Cisco’s application centric infrastructure (ACI), which is the company’s flagship software-defined networking solution. Avi also integrates with Cisco’s Tetration security analytics platform.

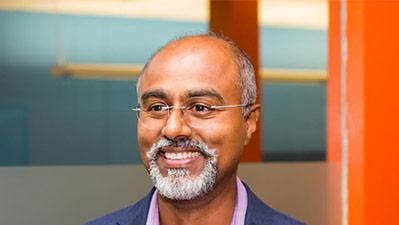

Avi Networks CEO Amit Pandey (pictured) told CRN last year that his company and Cisco “create end-to-end network automation all the way to the application. It really makes the ACI fabric more powerful from the customer’s perspective.”

Avi Already Integrates With VMware

Avi Networks already integrates with VMware technologies including VMware NSX and VMware vCenter. The startup’s integration with VMware NSX delivers an application services fabric that synchronizes with the NSX controller to provide automated, elastic load balancing including real-time analytics for applications deployed in a software-defined networking environment.

Avi Networks’ mission is to make it easy to apply load balancing, web application firewall and service mesh to any application in any data center and cloud. The Avi Vantage platform delivers multi-cloud application services including Intelligent Web Application Firewall (iWAF) and an Elastic Service Mesh.

VMware NSX and the Avi Vantage platform enables enterprises to deliver flexibility, speed, automation and cost effectiveness for layer 2 to layer 7 for application networking. Avi also monitors, scales and reconfigures application services in real time in response to changing performance requirements. Avi executives said joining VMware will enable further innovation and new solutions to address customers’ needs in the modern cloud era.

VMware’s Plan For Avi Networks

VMware’s broad goal is to implement Avi Networks technology into VMware’s Virtual Cloud Network strategy unveiled last year. The Virtual Cloud Network seeks to enable organizations to create a digital business fabric for connecting and securing applications, data and users across the entire network in a multi-cloud, multi-hypervisor world.

The Virtual Cloud Network is based around VMware’s NSX technology, which included the launch in 2018 of NSX Cloud, NSX Data Center, NSX SD-WAN and NSX Hybrid Connect. With the Virtual Cloud Network, channel partners can create an end-to-end software-based network architecture that delivers services to applications and data wherever they are located.

“This acquisition will further advance our Virtual Cloud Network vision, where a software-defined distributed network architecture spans all infrastructure and ties all pieces together with the automation and programmability found in the public cloud,” said VMware’s Gillis. “Avi Networks will enable VMware to bring the public cloud experience to the entire data center – automated, software-defined, highly scalable distributed architecture, and intrinsically more secure – and deliver the industry’s most complete software-defined networking stack from L2-7 built for the modern multi-cloud era.”

VMware-Dell Technologies Momentum And Channel Opportunity

The Avi Networks acquisition comes on the heels of a strong first fiscal quarter earnings results, with VMware revenue hitting $2.27 billion, up 13 percent year over year. VMware NSX was included in all 10 of the company’s largest deals of the quarter.

VMware falls under the family umbrella of Dell Technologies, as the $91 billion infrastructure giant owns more than an 80 percent stake in VMware stemming from its acquisition of EMC in 2016. Round Rock, Texas-based Dell extended its worldwide market share leadership position in servers in the first quarter of 2019, with sales of nearly $4 billion to capture 20.2 percent total market share, up from 19.3 percent share year over year, according to research firm IDC. Dell is also the global leader in storage and hyper-converged infrastructure (HCI), which Dell jointly creates and sells alongside VMware.

VMware plans to leverage Avi Networks’ customer base that includes Fortune 500 companies representing the world’s largest financial services, media and technology companies. Channel partners of Dell Technologies, which include partners of Boomi, Dell EMC, Pivotal Software, RSA, SecureWorks, Virtustream and VMware, will be able to sell Avi Networks through Dell’s new Dell Technologies Partner Program once the acquisition closes.