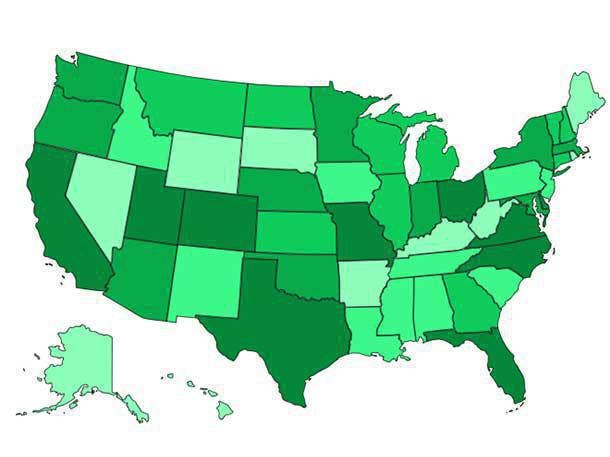

Best (And Worst) States For Taxes In 2019 For Solution Provider Startups

High taxes can hinder a startup's growth by sucking up capital that could be used for expansion. Entrepreneurs starting a solution provider business should consider states with low corporate income, sales, property and unemployment insurance taxes whenever possible.

Tax Preparation

For startups, money is a scare resource. As a young company hires its staff, develops its products and plots its strategy, there's more money going out than coming in. Having to pay taxes – corporate income taxes, sales taxes, unemployment insurance taxes and more – can be tough for a company in startup mode.

As part of the 2019 Best (And Worst) States For Starting A Solution Provider Business, CRN looked at corporate income tax rates, state and local sales taxes, property taxes and unemployment insurance taxes (as of Jan. 1, 2018) levied in each state. (Individual income tax rates were considered as part of the "personal cost of living/quality of life" criteria.) Most of the tax data was obtained from the Tax Foundation (taxfoundation.org).

In addition to specific tax rates, we considered the overall rankings on the Tax Foundation's 2019 State Business Climate Index and the Small Business & Entrepreneurship Council's Small Business Tax Index rank. We also included each state’s fiscal stability rank from the U.S. News and World Reports’ Best States Rankings.

For criteria that's ranked, the lower the number, the lower the tax burden.

Best States No. 10: Louisiana

Top Corporate Income Tax Rate: 8 Percent

Combined State and Average Local Sales Tax Rates: 9.45 Percent

Top Individual Income Tax Rate: 6 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 44

Small Business Tax Index Rank: 20

Fiscal Stability Rank: 43

Best States No. 9: Nebraska

Top Corporate Income Tax Rate: 7.81 Percent

Combined State and Average Local Sales Tax Rates: 6.85 Percent

Top Individual Income Tax Rate: 6.84 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 24

Small Business Tax Index Rank: 39

Fiscal Stability Rank: 7

Best States No. 8: Ohio

Top Corporate Income Tax Rate: None

Combined State and Average Local Sales Tax Rates: 7.17 Percent

Top Individual Income Tax Rate: 4.997 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 42

Small Business Tax Index Rank: 8

Fiscal Stability Rank: 41

Best States No. 7: Mississippi

Top Corporate Income Tax Rate: 5 Percent

Combined State and Average Local Sales Tax Rates: 7.07 Percent

Top Individual Income Tax Rate: 5 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 31

Small Business Tax Index Rank: 17

Fiscal Stability Rank: 44

Best States No. 6: Indiana

Top Corporate Income Tax Rate: 5.75 Percent

Combined State and Average Local Sales Tax Rates: 7 Percent

Top Individual Income Tax Rate: 3.23 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 10

Small Business Tax Index Rank: 14

Fiscal Stability Rank: 6

Best States No. 5: Missouri

Top Corporate Income Tax Rate: 6.25 Percent

Combined State and Average Local Sales Tax Rates: 8.13 Percent

Top Individual Income Tax Rate: 5.4 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 14

Small Business Tax Index Rank: 21

Fiscal Stability Rank: 16

Best States No. 4: North Carolina

Top Corporate Income Tax Rate: 2.5 Percent

Combined State and Average Local Sales Tax Rates: 6.97 Percent

Top Individual Income Tax Rate: 5.25 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 12

Small Business Tax Index Rank: 9

Fiscal Stability Rank: 4

Best States No. 3: Oklahoma

Top Corporate Income Tax Rate: 6 Percent

Combined State and Average Local Sales Tax Rates: 8.92 Percent

Top Individual Income Tax Rate: 5 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 26

Small Business Tax Index Rank: 19

Fiscal Stability Rank: 32

Best States No. 2: Delaware

Top Corporate Income Tax Rate: 8.7 Percent

Combined State and Average Local Sales Tax Rates: None

Top Individual Income Tax Rate: 6.6 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 11

Small Business Tax Index Rank: 36

Fiscal Stability Rank: 18

Best States No. 1: Florida

Top Corporate Income Tax Rate: None

Combined State and Average Local Sales Tax Rates: 7.05 Percent

Top Individual Income Tax Rate: None

Tax Foundation's 2018 State Business Climate Index Rank: 4

Small Business Tax Index Rank: 6

Fiscal Stability Rank: 2

Worst States No. 41: Wisconsin

Top Corporate Income Tax Rate: 7.9 Percent

Combined State and Average Local Sales Tax Rates: 5.44 Percent

Top Individual Income Tax Rate: 7.65 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 32

Small Business Tax Index Rank: 33

Fiscal Stability Rank: 14

Worst States No. 42: Virginia

Top Corporate Income Tax Rate: 6 Percent

Combined State and Average Local Sales Tax Rates: 5.65 Percent

Top Individual Income Tax Rate: 5.75 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 22

Small Business Tax Index Rank: 22

Fiscal Stability Rank: 8

Worst States No. 43: New Hampshire

Top Corporate Income Tax Rate: 7.7 Percent

Combined State and Average Local Sales Tax Rates: None

Top Individual Income Tax Rate: 5 Percent (Interest and dividend income only)

Tax Foundation's 2018 State Business Climate Index Rank: 6

Small Business Tax Index Rank: 32

Fiscal Stability Rank: 10

Worst States No. 44: Nevada

Top Corporate Income Tax Rate: None

Combined State and Average Local Sales Tax Rates: 8.14 Percent

Top Individual Income Tax Rate: None

Tax Foundation's 2018 State Business Climate Index Rank: 9

Small Business Tax Index Rank: 1

Fiscal Stability Rank: 37

Worst States No. 45: Michigan

Top Corporate Income Tax Rate: 6 Percent

Combined State and Average Local Sales Tax Rates: 6 Percent

Top Individual Income Tax Rate: 4.25 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 13

Small Business Tax Index Rank: 13

Fiscal Stability Rank: 27

Worst States No. 46: Illinois

Top Corporate Income Tax Rate: 9.5 Percent

Combined State and Average Local Sales Tax Rates: 8.74 Percent

Top Individual Income Tax Rate: 4.95 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 36

Small Business Tax Index Rank: 25

Fiscal Stability Rank: 50

Worst States No. 47: Idaho

Top Corporate Income Tax Rate: 6.925 Percent

Combined State and Average Local Sales Tax Rates: 6.03 Percent

Top Individual Income Tax Rate: 6.925 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 21

Small Business Tax Index Rank: 35

Fiscal Stability Rank: 11

Worst States No. 48: Pennsylvania

Top Corporate Income Tax Rate: 9.99 Percent

Combined State and Average Local Sales Tax Rates: 6.34 Percent

Top Individual Income Tax Rate: 3.07 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 34

Small Business Tax Index Rank: 29

Fiscal Stability Rank: 38

Worst States No. 49: Kentucky

Top Corporate Income Tax Rate: 5 Percent

Combined State and Average Local Sales Tax Rates: 6 Percent

Top Individual Income Tax Rate: 5 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 23

Small Business Tax Index Rank: 40

Fiscal Stability Rank: 45

Worst State No. 50: Massachusetts

Top Corporate Income Tax Rate: 8.00

Combined State and Average Local Sales Tax Rates: 6.25 Percent

Top Individual Income Tax Rate: 5.1 Percent

Tax Foundation's 2018 State Business Climate Index Rank: 29

Small Business Tax Index Rank: 31

Fiscal Stability Rank: 30